Tabreed Returns to the International Sukuk Market after Absence of 7 Years with Landmark USD700mn Murabaha/Ijara Green Sukuk as Demand for Cooling Services Rises in UAE and Beyond

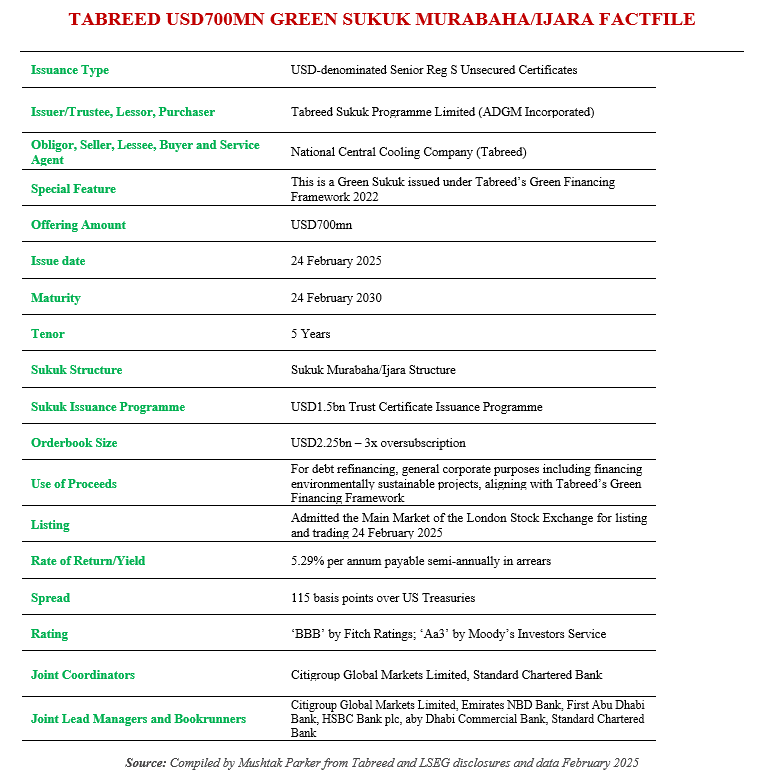

Dubai-based The National Central Cooling Company (Tabreed), one of the leading suppliers of district cooling services in the Gulf Cooperation Council region and majority-owned by Abu Dhabi’s Mubadala Investment Company, returned to the international debt market with a USD700mn Senior Reg S Unsecured Benchmark Green Sukuk Murabaha/Ijara on 25 February 2025.

The company designs, finances, constructs and operates district cooling facilities that supply chilled water for air conditioning to military, residential, commercial and government customers.

The company is the largest such operator in the UAE, but it has also ventured abroad in international markets such as India and Egypt and has expanded capacity at its existing plants to meet the growing demand from customers.

The Sukuk were issued by Tabreed Sukuk Programme Limited (incorporated in the Abu Dhabi Global Market (ADGM)) under the company’s USD1.5bn Trust Certificate Issuance Programme, which was launched in February this year, and under the provisions of the Tabreed Green Financing Framework established in 2022. Prior to this offering the company last issued a USD500m Sukuk in October 2018.

The company mandated Citigroup Global Markets Limited and Standard Chartered Bank as global coordinators of the offering and together with Emirates NBD Bank, First Abu Dhabi Bank, HSBC Bank plc, Abu Dhabi Commercial Bank as joint lead managers and bookrunners to the transaction, and to arrange a series of investor calls and meetings in the UK, Europe, the GCC and Asia, as well as with Offshore US Accounts.

The Initial Price Thoughts were set at a spread of 155 basis points (bps) over US Treasuries but the robust demand for the certificates, with the order books exceeding $2.25 billion, excluding joint lead manager interest, enabled Tabreed to tighten the pricing to 115bps + US Treasuries with a profit rate of 5.29% per annum payable semi-annually in arrears, which Tabreed said “reflected strong market confidence in the company’s financial health and strategic direction, and in its commitment to sustainable financing within the rapidly expanding green finance sector.”

The proceeds from the issuance will be used to refinance existing debt and for financing environmentally sustainable projects, aligning with Tabreed’s Green Financing Framework (GFF) and the global transition towards a low-carbon economy.

The eligible categories for the use of proceeds include Energy Efficiency, Sustainable Water and Wastewater Management, Green Buildings and Renewable Energy, which according to Sustainalytics, which provided the Second Party Opinion on the GFF, are aligned with those recognized by the Green Bond Principles and the Green Loan Principles. Sustainalytics considers that investments in the eligible categories will lead to positive environmental impacts and advance the UN Sustainable Development Goals, specifically SDG 6, 7, 9 and 12. The certificates are rated “BBB” by Fitch Ratings in line with Tabreed’s Long-Term Issuer Default Rating (IDR) and senior unsecured rating of ‘BBB’.

In a rating action commentary, Fitch expected Tabreed to maintain a tangible Ijara asset ratio above 50%. “The obligor has a large base of unencumbered tangible assets amounting to USD619 million, part of which will be allocated to the upcoming green Sukuk issuance. As such, the asset base of Tabreed is sufficiently strong to support the trust certificate programme and subsequent Sukuk issuance,” said Fitch.

The Sukuk certificates have been admitted to the Main Market of the London Stock Exchange for listing and trading on 24 February 2025.

Earlier this month, Tabreed released its consolidated financial results for the year 2024, reporting a revenue of AED2.bn (USD653.4mn) and a net profit before tax of AED624mn (USD169.9 mn), representing a 4% increase over 2023 (excluding one-offs). EBITDA increased by 5% year-on-year to AED1.1bn (USD300mn), with an improved margin of 51%, while net profit after tax stands at AED 570mn (USD155.2mn), up 32% compared to AED431mn (USD117.35mn) in 2023. Increased revenue, said Tabreed, was mainly driven by growth in consumption volumes, which increased by 5% to 2.66 billion refrigeration ton hours (RTH). Connected capacity increased by 23,756 Refrigeration Tons (RT), bringing Tabreed’s total connected capacity to 1.325 million RT.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Tabreed, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.