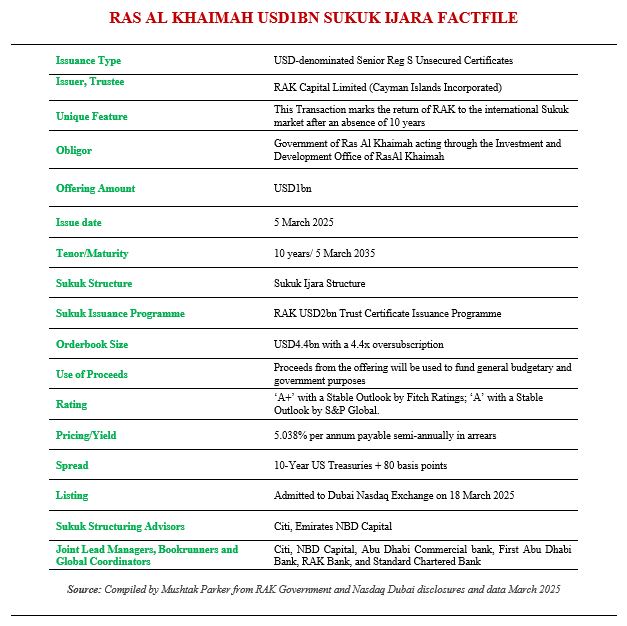

Government of Ras Al Khaimah Returns to the Global Sukuk Market After an Absence of 10 Years with a USD1bn Sukuk Issue

The Government of Ras Al Khaimah (RAK) returned to the international Sukuk market after an absence of 10 years when it successfully priced a USD1bn Sukuk Ijara on 5 March 2025. The Sukuk certificates were issued by Trustee RAK Capital (Cayman Islands Incorporated), on behalf of the Government of Ras Al Khaimah acting through its Investment and Development Office (IDO).

The USD-denominated Senior Reg S Unsecured Certificates were issued under RAK Capital’s USD2bn Trust Certificate Issuance Programme which was set up on 25 February 2025 to support the emirate’s economic growth and infrastructure plans.

The RAK Investment and Development Office had mandated Citi and Emirates NBD Capital to acting as Sukuk Structuring Agents and together with Abu Dhabi Commercial Bank, First Abu Dhabi Bank, RAKBANK and Standard Chartered Bank, to act as Joint Lead Managers and Bookrunners to the transaction and to arrange a series of investor calls and roadshows in London, Europe, the GCC, the Middle East, Asia and with Offshore US Accounts for the issuance of a 10-Year USD1bn Senior Unsecured Benchmark Sukuk offering under the Reg S format.

After the issuance of the Sukuk on 3 March 2025, and a series of subsequent investor virtual meetings, the transaction was launched at initial price thoughts (IPTs) of 10-year US Treasury plus 120 basis points (bps). The strong investor response allowed the issuer to achieve a negative New Issue Concession of -10 basis points, which, according to the RAK IDO underlines the Emirate’s strong credit position. The order book exceeded USD2bn initially but with demand for the certificates increasing, with the orderbook reaching over USD4.4bn, the RAK IDO managed to tighten the price by 40 basis points to reach a final spread of 10-year US Treasury plus 80 basis points. This translates into a profit rate of 5.038% per annum payable semi-annually in arrears which the RAK IDO stressed reflected market confidence in the Emirate’s economic stability.

The subscriptions were led by investors in the MENA region with 57.8% of the allocation, followed by the UK and Continental Europe with 35%, while Asia and other regions accounted for the remaining 7.2% of the allocation.

The issuance follows S&P Global Ratings’ affirmation of its ‘A’ rating and Fitch Ratings’ affirmation of its ‘A+’ rating on RAK Capital’s Sukuk programme, both with a stable outlook, which is in line with the credit agencies’ ratings for the RAK government and the Sukuk certificates. The Sukuk based on an Ijara (leasing) structure and according to the issuer is in compliance with the fatwas of the UAE Central Bank Higher Shari’a Authority, which “supports the sale of Ijara assets to ensure the sale of real estate Ijara assets can be enforced.”

The proceeds from the issuance will be used to support general government and budgetary requirements. The RAK Sukuk certificates were admitted for listing and trading on the Nasdaq Exchange on 18 March 2025. With this latest RAK listing, the total value of Sukuk listed on Nasdaq Dubai, said the bourse, now exceeded USD92.7bn, making it a leading global hub for Islamic capital markets products.