Entry of Türkiye Wealth Fund into International Financial Market with Debut USD750mn Sukuk Al Ijarah Set to Boost Istanbul Financial Centre as a Major Regional Issuance Hub

The entry of sovereign wealth funds (SWFs) into the Islamic finance and investment space, especially in the Islamic debt origination market, is a sure sign of the growing attractiveness, reach and maturity of fund-raising instruments such as Sukuk. This has important implications for the global Sukuk market especially as it tries to expand beyond the traditional markets of Malaysia, Indonesia, Saudi Arabia and the rest of the Gulf Cooperation Council (GCC) countries.

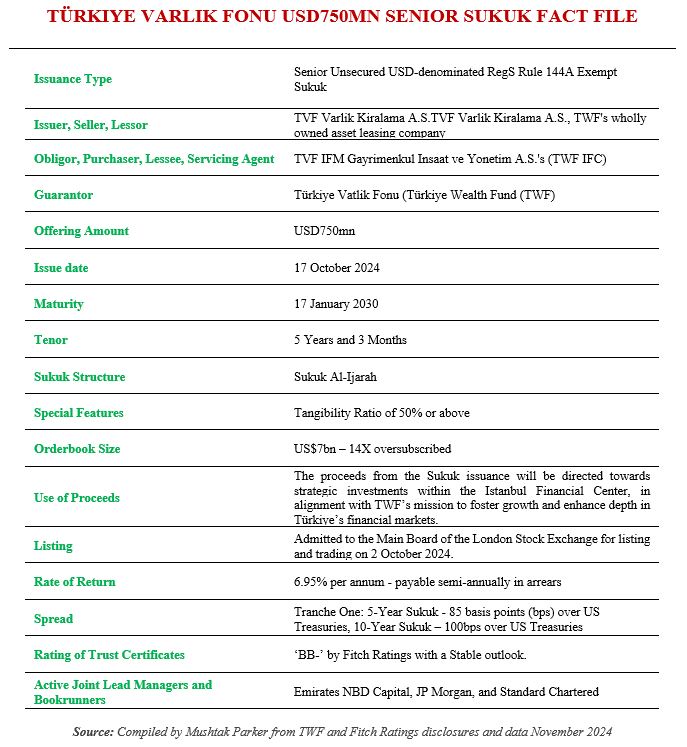

The latest entrant to foray into the market is Türkiye Varlık Fonu Yönetimi A.Ş. (Türkiye Wealth Fund (TWF), the state-owned sovereign wealth fund which successfully completed its maiden Sukuk offering – a benchmark USD750mn Sukuk Al Ijarah on 18 October 2024. TWF follows in the footsteps of Khazanah Nasional Berhad of Malaysia, the Public Investment Fund (PIF) of Saudi Arabia, Mubadala Investment Company of Abu Dhabi, Investment Corporation of Dubai, and Mumtalakat Holding of Bahrain, all of whom have issued Sukuk and some in addition to raising funds through Big Ticket Murabaha syndications.

Indeed, the TWF Sukuk is the second Islamic finance transaction the SWF has completed in 2024. In March TWF signed a USD100mn Murabaha financing agreement with Sharjah Islamic Bank. The 3-year term facility marked the first ever Islamic finance transaction for TWF. The Fund’s debut Sukuk transaction, says the issuer, solidifies the confidence of international markets in the Turkish economy following the successful Eurobond issuance which was completed with a record-breaking demand in February.

It is no secret that Türkiye President Recep Tayyip Erdoğan is keen to develop the Istanbul Financial Centre (IFC) into the premier regional financial hub, including with a strong Islamic finance proposition and ecosystem. The proceeds from this inaugural Sukuk issuance not surprisingly, says Arda Ermut, CEO and Board Member of Türkiye Wealth Fund, will be directed towards strategic investments within the IFC in alignment with TWF’s mission to foster growth and enhance depth and diversification in Türkiye’s financial and capital markets, to boost its sustainability approach, and its Islamic finance activities and architecture. As such, TWF signed a Memorandum of Understanding recently with Albaraka Forum “to develop Islamic finance instruments and to enhance Türkiye’s goal of becoming an important player in this field.”

TWF, a relatively new SWF founded in 2016, according to the latest data from the SWF Institute has current assets under management totalling USD279.3bn at end October 2024. Within this context, these are exciting times for the Sukuk market globally and in Türkiye, albeit it remains to be seen whether these aspirations are translated into a commitment to regular issuances by TWF, the various participation (Islamic) banks and perhaps most importantly Turkish state and private corporates to contribute towards building up a yield curve for such issuances.

While the Türkiye Treasury has been a proactive issuer of domestic Lease Certificates (10 consecutive monthly issuances in 2024 to date) and the occasional offerings in the USD and EUR0 markets, and some participation banks issuing Sukuk over the past few years, the institutional, corporate and social sectors have been conspicuous with their absence from the Sukuk market. This is ironic given that the G20 summit in Antalya in 2015 specifically highlighted the suitability of Sukuk as an instrument to finance urban regeneration and infrastructure. It was the first and probably the last time that Sukuk and Islamic finance was mentioned in an official G20 communique.

If the (IFC is to thrive as an international financial hub – and there is no reason why it should not – then it is imperative that Ankara boosts its architecture beyond the mere functionalities of the legal, technical and basic regulatory and prudential frameworks. Bankers point out that any serious international financial hub must offer both conventional and Islamic finance propositions, especially if they’re located in the core area of the MENAT (Middle East, North Africa and Türkiye) region, where Islamic finance, according to the World Bank, is of systemic importance.

The entry of TWF, in tandem with the Türkiye Treasury’s activities, into a Sukuk market could be a major gamechanger if the strategy is fit for purpose. A commitment to a regular Sukuk issuance calendar and programme by the Türkiye Treasury, the TWF, other state agencies and participation banks, and a concerted market education strategy, could open the market to other potential issuers – the wider banking sector, corporates and even social institutions, thus adding market depth and greater differentiation. Türkiye for instance probably has the most extensive waqf network and assets, thanks to their pivotal position in Ottoman social history, which could be monetised for the benefit of beneficiary communities as is currently the practice in Singapore and Malaysia.

There is a precedent – the monetisation of “idle gold and jewellery’ by the Türkiye Treasury’s through the issuance of Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days. Thus far, the Treasury has held seven such auctions in 2024. The latest was in October 2024 maturing on 12 June 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 12,829,530 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 12,829,530 gold lease certificates (at a nominal value). All these developments would enhance Turkiye’s reputation as a serious issuer and would add value to the global sovereign Sukuk market.

This contrasts with the Türkiye Treasury which is a proactive issuer of lease certificates (Sukuk Al Ijarah) as part of a wider universe of government fund-raising instruments which includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond Sukuk markets – all aimed “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments.”

The Fixed Rate Lease Certificate market is the mainstay of the Treasury’s fund-raising in the Sukuk market, with auctions in consecutive months since January 2024. The Türkiye Treasury in fact raised TRY120,994.22mn (USD4,174.22mn) from the domestic market through the issuance of Fixed Rate Lease Certificate in nine auctions in FY2023. The Türkiye Treasury in the first ten months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY69,723.45mn (US$2,041.84mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

TWF becomes the first Turkish institution outside of the Treasury and Turkish participation banks to issue Sukuk in the international market. TWF’s inaugural issuance was substantial – a USD750mn benchmark senior unsecured transaction with a tenor of 5 years and 3 months, maturing on 18 January 2025. The sovereign wealth fund had mandated Emirates NBD Capital, JPMorgan, and Standard Chartered, to act as joint coordinators, lead managers and bookrunners to the transaction and to arrange a series of investor calls and an investor roadshow in London between 14-16 October.

The Sukuk certificates were issued by TVF Varlik Kiralama A.S., TWF’s wholly owned asset leasing company, on behalf of the Obligor, TVF IFM Gayrimenkul Insaat ve Yonetim A.S.’s (TWF IFC), which are guaranteed by the parent, TWF. The senior unsecured lease certificates have been assigned a “BBB-” rating by Fitch Ratings with a Stable Outlook. According to the rating report, the Sukuk documentation includes an obligation for TWF IFC to always ensure, the tangibility ratio (calculated as the value of the lease assets to the aggregate of the value of the lease assets and each deferred sale price outstanding at the relevant time) is more than 50%, which is in line with market practice following the introduction of this requirement pursuant to AAOIFI Standard 59.

According to Arda Ermut, CEO of TWF, the transaction “garnered unprecedented demand from international investors” with the order book reaching more than USD7bn – an oversubscription of 14 times the initial offering. This remarkable level of interest, he added, set a record in the history of Sukuk issuances, which led to a tightening of the pricing. “Amid a period of mixed global risk perceptions, the success of this Sukuk issuance highlights the strength of investor confidence in Türkiye’s economic policies.

It represents the second-largest price (IPT) reduction of 2024 among all bond and Sukuk issuances from Türkiye-based institutions, second only to the TWF’s own Eurobond transaction in February,” he added in a disclosure on social media.

The Sukuk transaction follows TWF’s highly successful USD500m Eurobond issuance earlier this year, which similarly saw a 14-fold oversubscription. This consistent investor enthusiasm says TWF underscores the high level of confidence in both Türkiye’s economy and the TWF’s strategic initiatives. The final rental rate pricing of the Sukuk at 6.95% per annum secured a 17.5 basis point (bp) advantage compared to the equivalent interest rate pricing of 8.375% per annum for the Eurobond transactionafter two consecutive tightening, which was 75 bps below the initially offered price.

“In February, our Eurobond transaction saw record demand of USD7bn. Following a carefully planned preparation process, the team met with investors in London. During the Sukuk issuance, demand exceeded expectations, with over USD7bn in interest for the USD750mn offering, marking a new record in Sukuk issuance history. This issuance marks the Türkiye Wealth Fund’s second issuance this year, both of which achieved record demand. The significant interest shown by international investors in both the Eurobond and Sukuk issuances reflects the confidence in the national economy and the Türkiye Wealth Fund. This success is backed by a strategic framework and extensive progress, including the stable growth of the companies within the TWF portfolio, increased profitability, and the strong interest from international investors in TWF’s projects,” explained Mr Ermut.

“I extend my appreciation to all stakeholders involved in the issuance process and to the investors for their strong participation, as well as my dear colleagues at the Türkiye Wealth Fund for their diligent efforts during this process,” he added.

The proceeds from the Sukuk issuance will be directed towards strategic investments within the Istanbul Financial Centre, in alignment with TWF’s mission to foster growth and enhance depth in Türkiye’s financial markets. The Centre, stressed TWF, “is poised to become a major regional—and eventually global—financial hub, attracting top-tier financial institutions and companies. This multifaceted ecosystem of financial services, international trade, and energy will create significant value, driving further growth.”