Türkiye Consolidates its Position as a Serious Issuer of International Sukuk with Three Transactions in October and November 2024 Totalling USD3.46bn

Sovereign Türkiye returned to the international financial market with a USD2.5bn Sukuk Al-Ijarah offering on 26th November 2024 – its third US dollar Sukuk transaction in October/November 2024 alone, bringing the aggregate raised to USD3.458mn.

These comprised the USD2.5bn Sukuk Al-Ijarah on 26 November; the benchmark USD750mn Sukuk Al-Ijarah issued by Türkiye Varlık Fonu Yönetimi A.Ş. (Türkiye Wealth Fund (TWF), the state-owned sovereign wealth fund, on 18 October 2024; and the USD208.37mn Lease Certificates issuance by the Türkiye Treasury under its FX-denominated Lase Certificates Issuance Programme on 12 November 2024.

All the signs are that Sukuk issuance – both in the domestic and international markets – are now becoming established features of the Türkiye Treasury’s public debt raising strategy, on the back of rapidly improving economic fundamentals and upgrading of Türkiye’s international credit ratings.

“A turnaround in economic policies since mid-2023 tightened Türkiye’s overall policy mix, sharply reducing crisis risks and raising confidence,” stressed the IMF in a precursor press release to its 2024 Article IV Consultations on Türkiye in August 2024.

“The current account deficit fell to 2.7% of GDP in Q1 2024, market sentiment improved, international reserves (net of swaps and other liabilities) increased by USD91bn since April, international credit agencies upgraded Türkiye’s sovereign risk rating, and CDS spreads have declined nearly 440 basis points since mid-2023. Headline inflation has started easing in the summer, but it remains high. The financial and corporate sectors have so far weathered liberalization and policy tightening without visible stress,” maintained Mr. James P. Walsh, Head of the IMF mission which is compiling the 2024 Article IV Consultations report.

The IMF noted that tight monetary and incomes policies will weigh on domestic demand, bringing 2024 growth to around 3.4%. However, “despite favourable base effects, still-strong inertia would keep inflation at around 43% (y/y) at end-December. On the external front, the current account deficit would continue to fall to around 2.2% of GDP. In 2025, with fiscal policy expected to turn contractionary and real policy rates remaining positive, growth would further moderate to 2.7%, and inflation fall to around 24%. In the medium term, a further drop in inflation would boost confidence, and growth would rise back toward potential of 3.5-4%. Export growth would keep the current account deficit around 2%, and international reserves would stay above 100 percent of the IMF’s reserve adequacy metric,” added the Fund.

Sukuk origination is an established part of the Türkiye Treasury’s active but diversified public funding and debt strategy which includes Sukuk and bond issuances in the domestic and international market; and in the Islamic finance space the issuance of fixed and CPI-linked lease certificates, FX-linked lease certificates, and gold-backed lease certificates.

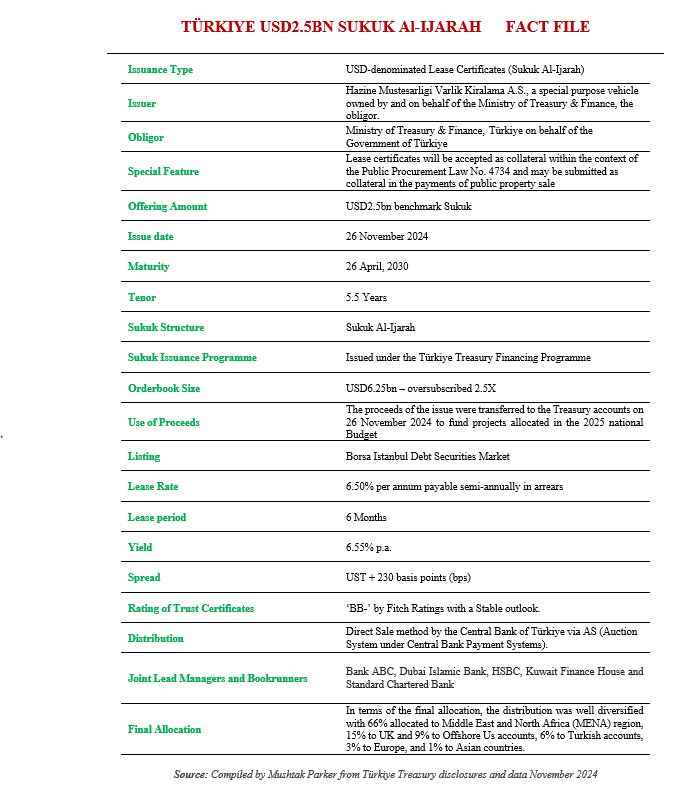

In this latest offering, the Türkiye Treasury issued lease certificates (Sukuk Ijarah) on 26 November 2024 in the international capital markets raising USD2.5bn in the process.

The Ministry of Treasury and Finance mandated Bank ABC, Dubai Islamic Bank, HSBC, Kuwait Finance House and Standard Chartered for a dollar denominated lease certificate issuance in the international capital markets.

According to the Ministry, the Sukuk Ijarah certificates, rated ‘BB-’ by Fitch Ratings with a Stable outlook, were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor on behalf of the Government of Türkiye, under the Türkiye Treasury’s Public Debt Financing Programme. The Sukuk have a tenor of 5.5 years maturing 26 April 2030.

The transaction was priced at a lease rental rate of 6.50% per annum payable semi-annually in arrears on a lease period of 6 months and a yield of 6.55% which translates into a spread of UST + 230 basis points. The proceeds of the issue were transferred to the Treasury accounts on 26 November 2024 to fund projects allocated in the 2025 National Budget.

According to the Türkiye Treasury, the offering received robust demand with the order book exceeding USD6.25bn from 135 accounts, and thus oversubscribed 2.5 times. In terms of the final allocation, the distribution was well diversified with 66% allocated to Middle East and North Africa (MENA) region, 15% to UK and 9% to Offshore US accounts, 6% to Turkish accounts, 3% to Europe, and 1% to Asian countries.

The Sukuk certificates were admitted for listing and trading on the Borsa Istanbul Debt Securities Market on 28 November 2024. With this latest Sukuk transaction, a total of USD13bn of debt instruments (conventional bonds/Sukuk) were issued in the international capital markets in 2024, including approximately USD11.1bn in cash financing. Potentially there could be another transaction before year end 2024.

“It had been stated in the Treasury Financing Programme that financing opportunities in the conventional bond or Sukuk market could be evaluated for a potential financing transaction in the remainder of the year. The recent improvement in investor sentiment and the sovereign risk premium has been effective in raising pre-financing,” advised the Türkiye Treasury.