South African Treasury Returns to Sovereign Sukuk Market after 9-year Absence with 4-tranche Domestic Fixed rate ZAR20.4bn (US$1.085bn) Sukuk Ijarah Offering

South Africa, which was the first sovereign in continental Africa to issue a Sukuk in the international financial market in 2014, returned to the Sukuk market after an absence of 9 years, with a 4-tranche ZAR20.386 billion (US$1,084.99 million) sovereign domestic Sukuk issuance in November 2023.

A promise that was first made by President Cyril Ramaphosa’s Finance Ministers since 2018 starting from Nhlanhla Nene, Tito Mboweni and now Enoch Godongwana, has finally come to market when the National Treasury of the South African Ministry of Finance South issued the country’s inaugural Rand denominated Sukuk which was formally issued on Wednesday, 29th November. It has taken 5 years for the transaction to materialise from mark to market to the frustration of both domestic and international investors who simply could not understand the vacillation.

The Treasury’s journey down this alternative socially responsible value-for-money public debt raising route is nascent although it resonates in markets all over Africa, the Middle East and Asia, where Sukuk issuance is now firmly part of the debt raising landscape whether to finance shortfalls in national budgets and infrastructure, or for corporates to raise working capital, boost Tier I and II capital under the Basle III capital adequacy regime, and to refinance existing more expensive conventional debt.

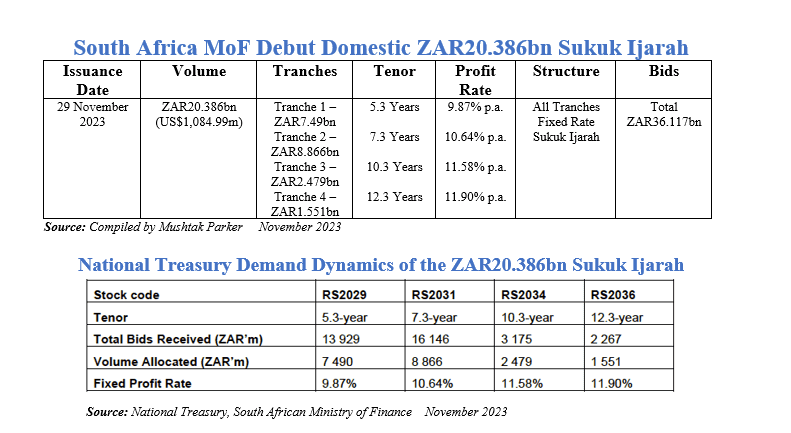

South Africa is the pioneer of sovereign global Sukuk issuance in Africa, having issued its debut US$500 million (ZAR9,394.55 million at today’s exchange rate) benchmark Sukuk Ijarah in 2014 with a tenor of 5.5 years which was over-subscribed more than 4 times. But it has taken 9 years for its second foray into the sovereign Sukuk market albeit a Rand issuance. It raised ZAR20.386 billion (US$1,084.99 million) through a four-tranche transaction varying in tenors, volume and profit rates to be paid to Sukuk holders. They include:

i) A ZAR7,490 million first tranche with a tenor of 5.3 years and priced at a profit rate of 9.87% per annum.

ii) A ZAR8,866 million second tranche with a tenor of 7.3 years and priced at a profit rate of 10.64% per annum.

iii) A ZAR2,479 million third tranche with a tenor of 10.3 years and priced at a profit rate of 11.58% per annum.

iv) A ZAR1,551 million fourth tranche with a tenor of 12.3 years and priced at a profit rate of 11.90% per annum.

The demand from investors for the certificates was robust with bids coming in at ZAR36,117 million. This against the final allocation in the orderbook of ZAR20.386 billion. This means that the transaction was oversubscribed 1.77 time giving a bid-to-cover ratio of 177%, which enabled the issuance to be completed in a single day.

The National Treasury mandated Rand Merchant Bank (RMB), BNP Paribas and Standard Bank to act as Joint Lead Managers and Bookrunners to the transaction. “The launch of this landmark Sukuk,” says the Treasury, “is a key step in broadening South Africa’s investor base and enhancing our funding strategy which has been traditionally reliant on Fixed Rate Bonds, Inflation Linked Bonds and Floating Rate Notes. This initiative is a testament to the depth and liquidity of South Africa’s domestic capital markets, demonstrating National Treasury’s constitutional mandate and ongoing commitment to financial innovation and market expansion.”

The context of this latest Sukuk, issued through the RSA Domestic Sukuk Trustee (RF) Proprietary Limited, on behalf of the Obligor, the South African government, is important. Several milestones were achieved:

- This is the first Rand-denominated Sukuk Al Ijarah in Africa.

- The certificates will be listed on the JSE for secondary trading thus unleashing further liquidity in the domestic capital market.

- The investors comprised a “diverse base” of “thirteen unique bidders” including first time subscribers – “large Islamic funds and Islamic banks” in South African country credit risk.

- The Sukuk issuance has a unique social inclusion element – the only one in the world – which requires mandated banks to have a B-BBEE partner. The aim is for the mandated banks to impart Sukuk structuring technical knowledge to the partners – in this case, THEZA Capital and Africa Rising Capital.

For the Treasury, Sukuk issuance has been a sharp learning curve. In his 2023 Budget speech Finance Minister Godongwana renewed his intention of sourcing public debt financing through alternative instruments such as Sukuk, with the aim of attracting a new investor base and in the process develop the local Islamic capital market by building a Sukuk yield curve.

The local context is vital. In November the National Treasury has been busy adding to the debt metrics of the economy and country. In addition to the ZAR20.386 billion Sukuk raised from the domestic market through a 4-tranche Rand-denominated Sukuk issuance, the Treasury a week earlier raised US$1.3bn in two forex concessional loans – US$1bn from the World Bank and US$300m from the African Development Bank (AfDB), and a €500m loan from Kreditanstalt für Wiederaufbau, the German development bank to support South Africa’s commitment to just transition to a low-carbon and resilient economy and “for general budget expenditure purposes.”

This means that in November alone The National Treasury added ZAR55.25bn (US$2.94bn) to South Africa’s debt burden, of which US$1.54bn (ZAR29.2bn) are in forex loans. The rationale of the Treasury is that “these facilities enable (us) to raise funding at very affordable rates which help to reduce the government public debt.”

Driving issuance levels is the insatiable appetite for funds from the country’s State-owned-Enterprises (SoRs) especially Eskom, the troubled electricity utility, and Transnet, the transport utility – both of which have entrenched historical governance and structural issues. Following on from the R254 billion Eskom bailout through the Eskom Debt Relief Amendment Bill, Finance Minister Godongwana approved a ZAR47 billion guarantee facility to Transnet on 1 December “in support of its recovery plan including meeting its immediate debt obligations.”

Local banking sources stress that this could further deepen the rand Sukuk market should the SoEs decide to raise funds from the market through bond/Sukuk issuances, backed of course by the Treasury guarantee. Both Eskom, Transnet and SANRAL, the road transport utility, have in the past few years contemplated raising funds through the issuance of domestic Sukuk, but to date nothing has been actualised.

The global context too is important. According to Fitch Ratings, global outstanding Sukuk volumes expanded by 10% y-o-y and for the first time crossed US$800 billion in Q3 2023, with sovereigns being the key issuers. Both outstanding and issued Sukuk continued to hold 30% of the total funding mix in core markets.

The momentum is spreading to non-traditional markets including in West Africa especially Nigeria and Senegal. Nigeria in fact issued its sixth Sukuk in October 2023 – a ₦350 billion (US$460 million) Ijarah (Leasing) Sukuk linked to the construction and rehabilitation of 44 arterial roads across the six geopolitical zones of the country.

Between 2017-2023, the Nigeria Ministry of Finance issued six domestic sovereign Sukuk totalling ₦1,092.557 billion (US$1.43 billion). The fact that one South African transaction in volume was matched by almost six Nigerian Sukuk issuances indicates the significance of the South African transaction.