Indonesia Returns to International Market with Second Sukuk Wakala Offering Totalling USD2.75bn in 2024

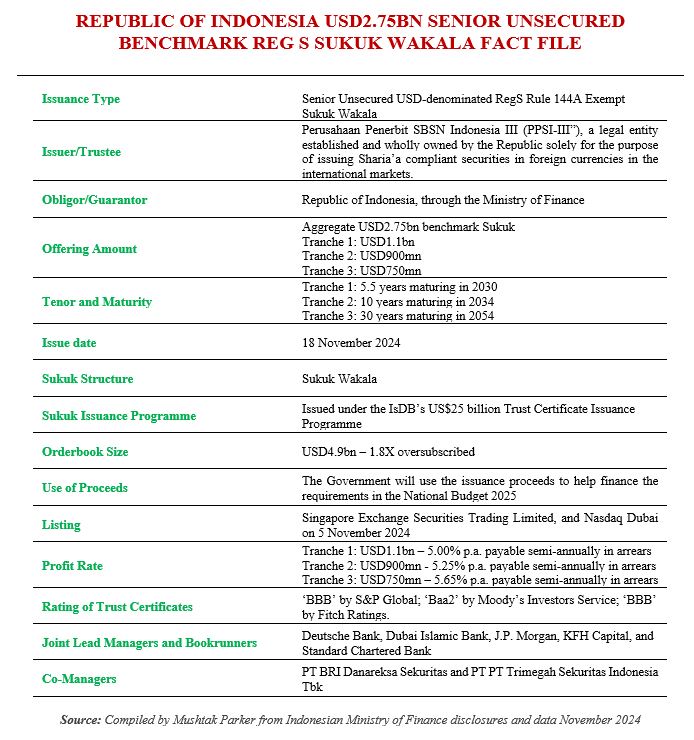

The Republic of Indonesia, one of the most proactive Sukuk issuers in both the international and domestic market, returned to the global market and successfully priced a three-tranche aggregate USD2.75bn Sukuk Wakala on 18 November 2024.

The transaction comprised: i) an USD1.1bn tranche with a 5.5-year tenor maturing in May 2030, ii) an USD900mn tranche with a tenor of 10 years maturing in November 2034, and iii) an USD750mn 30-year tranche maturing in November 2054. The trust certificates were issued through Perusahaan Penerbit SBSN Indonesia III (PPSI-III), a legal entity established and wholly owned by the Directorate General of Budget Financing and Risk Management of the Ministry of Finance on behalf of the Republic of Indonesia solely for the purpose of issuing Sharia’a compliant securities in foreign currencies in the international markets.

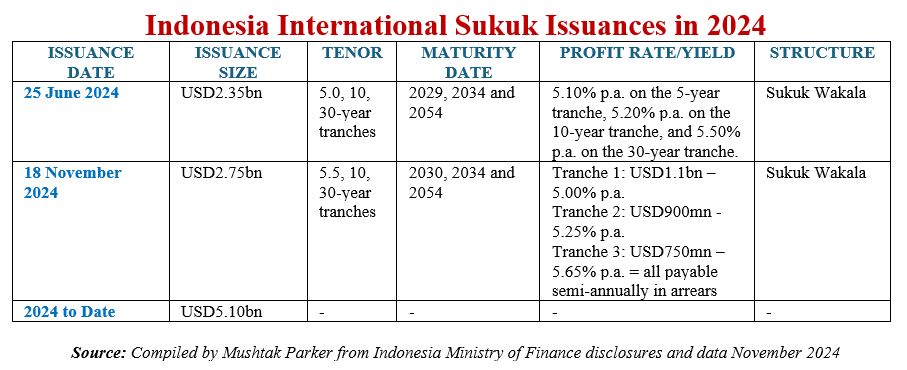

The offering comprised senior unsecured Reg S/144A Trust Certificates priced at par. This is the fourth time that Indonesia has raised funds from the international market through two Sukuk and two bond transactions thus far in 2024. In addition to this USD2.75bn Global Sukuk on 18 November 2024, the Directorate of Islamic Financing at the Directorate General of Budget Financing and Risk Management also raised USD2.35bn through a similar Sukuk Wakala in the international market in June 2024, thus bringing the total funds raised through two international Sukuk offerings in 2024 to USD5.1bn. Indonesia also issued a SEC-registered USD1.8bn Global Bond and an EUR750mn Eurobond on 10 and 4 September 2024 in two separate transactions, raising an aggregate USD3.6bn and EUR1.5bn.

The Directorate General of Budget Financing and Risk Management had mandated Deutsche Bank, Dubai Islamic Bank, J.P. Morgan, KFH Capital, and Standard Chartered Bank to act as Joint Lead Managers and Joint Bookrunners to the transaction, and to arrange a series of investor calls and an investor roadshow with accounts in London, the EU, the Middle East and Asia in mid-November. PT BRI Danareksa Sekuritas and PT PT Trimegah Sekuritas Indonesia Tbk acted as Co-Managers for this transaction.

The Global Sukuk were subsequently priced at par and with a profit rate during final pricing of 5.00% per annum on the 5.5-year tranche, 5.25% per annum on the 10-year tranche, and 5.65% per annum on the 30-year tranche – all payable semi-annually in arrears. This is compared to the Initial Price Guidance of 5.30% p.a. on the 5.5-year tranche, 5.50% p.a. on the 10-year tranche, and 5.85% p.a. on the 30-year tranche.

The final pricing, said the Directorate General of Budget Financing and Risk Management, represents the tightest ever print on a spread basis compared to U.S. Treasuries across the 10-year and 30-year tenors from the Republic of Indonesia for both its Conventional and Sukuk issuances historically.

The Global Sukuk is structured on the Sharia’a principle of Wakala which was approved by the Dewan Syariah Nasional – Majelis Ulama Indonesia as well as by the Sharia’a boards from the participating banks.

The proceeds from the issuance will be used to finance projects allocated in the 2025 National Budget. The transaction, said the Indonesian Ministry of Finance, managed “to attract interest from diverse investor types and geography, showcasing robust investment appetite and market confidence for the Republic given its strong economic fundamentals. The final order size of more than USD4.9bn combined represents an oversubscription rate of more than 1.8x of the issuance, where peak order reached more than USD6.9bn.”

The 5.5-year certificates were distributed 16% to Asia (excl. Indonesia, Middle East, Malaysia, Brunei) investors, 61% to Middle East, Malaysia and Brunei investors, 6% to Indonesia investors, 6% to U.S investors and 11% to Europe-based investors. By investor type, the tranche was allocated 15% to asset managers/fund managers, 63% to banks/financial institutions, 19% to sovereign wealth funds/central banks, 1% to insurance/pension funds and 2% to private banks/others.

The 10-year tranche was distributed 16% to Asia (excl. Indonesia, Middle East, Malaysia, Brunei) investors, 52% to Middle East, Malaysia and Brunei investors, 10% to Indonesia investors, 9% to U.S investors and 13% to Europe investors. By investor type, the tranche was allocated 22% to asset managers/fund managers, 69% to banks/financial institutions, 4% to insurance/pension funds, 3% to sovereign wealth funds/central banks and 2% to private banks/others. The 30-year tranche was distributed 10% to Asia (excl. Indonesia, Middle East, Malaysia, Brunei) investors, 1% to Middle East, Malaysia and Brunei investors, 9% to Indonesia-based investors, 43% to U.S investors and 37% to Europe investors. By investor type, the tranche was allocated 84% to asset managers/fund managers, 11% to banks/financial institutions, 3% to insurance/pension funds, 1% to sovereign wealth funds/central banks and 1% to private banks/others.

The final transaction size, according to the Indonesian Ministry of Finance, represents the largest USD issuance in ASEAN this year and helped the Republic raise a total of US$ 5.1 billion through USD Sukuk issuances in 2024. This also marks the largest total volume that the Republic has managed to raise in a single year via USD Sukuk issuances.

The trust certificates were admitted for listing and trading on the Singapore Exchange Securities Trading Limited and on NASDAQ Dubai on 20 November 2024.