Government of Sharjah Returns to International Sukuk Market with Benchmark US$750m Murabaha/Ijara Sukuk in October 2024 Amid Strong Demand from Investors

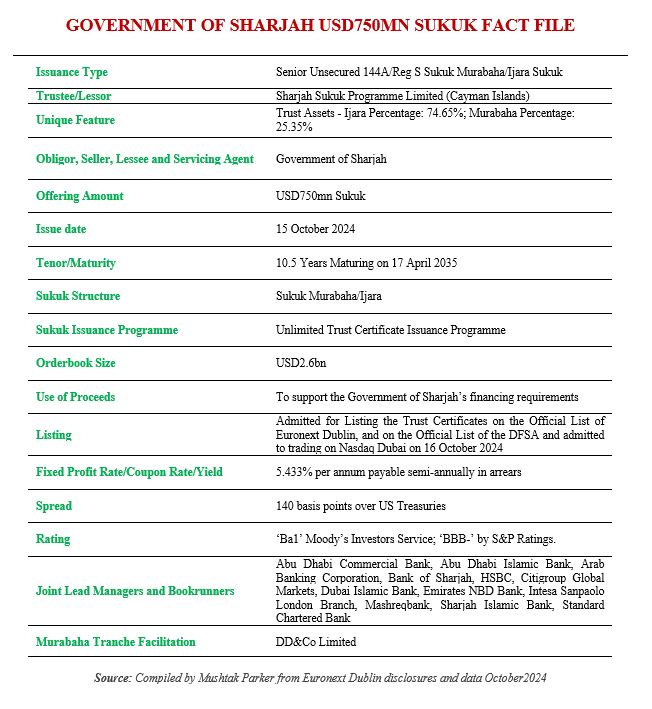

The Government of Sharjah, through its Finance Department, returned to the international Sukuk market with a benchmark senior unsecured 144A/Reg S 10.5-year USD750mn Sukuk Murabaha/Ijara issuance on 15 October 2024 maturing on 17 April 2035. The Sukuk certificates were issued by the Trustee/Lessor Sharjah Sukuk Programme Limited, an exempted limited liability company incorporated in the Cayman Islands, on behalf of the obligor, the Government of Sharjah, under its unlimited Trust Certificate Issuance Programme established in July 2024 and supplemented on 1 October 2024.

The Programme was arranged by HSBC and Standard Chartered Bank, which together with Abu Dhabi Islamic Bank, Dubai Islamic Bank and Sharjah Islamic Bank also acted as Dealers. Sharjah Finance Department had mandated a consortium of banks led by Bank of Sharjah, Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Arab Banking Corporation, HSBC, Citigroup Global Markets, Dubai Islamic Bank, Emirates NBD Bank, Intesa Sanpaolo London Branch, Mashreqbank, Sharjah Islamic Bank, and Standard Chartered Bank, to act as joint lead managers and bookrunners to the transaction, and to arrange a series of investor calls and meetings with accounts in the UK. EU, the Middle East and Asia.

The Government of Sharjah is a regular issuer of Sukuk in the international market. This latest transaction is the fourth consecutive annual fixed rate benchmark USD750mn issuance by the Government of Sharjah since 2021, having issued similar offerings in 2021, 2022, 2023 and 2024. Prior to this offering, the Government of Sharjah executed a similar transaction in September 2023.

Sharjah launched the latest 10.5-year USD750 million offering on 15 October 2024 maturing in April 2035. Sharjah had given initial price guidance of around a spread of 175 basis points (bps) over US Treasuries, but this tightened to 140 bps as the order book topped USD2.6bn due to heavy investor demand for the papers from diverse investor accounts in the Middle East, UK, Europe and Asia. The transaction was over three times oversubscribed. This translated into a profit rate of 5.433% per annum payable semi-annually in arrears on each Periodic Distribution Date.

Mohamed Khadiri, CEO of Bank of Sharjah, maintained that this price tightening demonstrated the strength of demand from investors, with 34% of total orders coming from outside the MENA region. “We are proud to have played a key role in this landmark Sukuk issuance for the Government of Sharjah, reflecting our deep commitment to the Emirate’s financial growth and development. The strong interest from both local and international investors is a testament to the confidence in Sharjah’s economic stability and fiscal discipline. Our collaborative efforts with esteemed partners have enabled us to effectively structure this Sukuk, ensuring it meets the needs of a diverse investor base while reinforcing Sharjah’s position in the global capital markets,” he added.

The Bank of Sharjah, he maintained, “is committed to providing financial solutions that drive economic progress. This Sukuk issuance is an important step in strengthening our support for the Government of Sharjah, and we are excited to continue partnering with them and other key stakeholders to facilitate their growth and development objectives.”

The pricing for the 2024 transaction contrasts with the pricing for the similar 2023 Sukuk offering which had a spread of 180 bps over US Treasuries and a profit rate of 6.092% per annum. The Trust assets, according to the Final Terms, comprises 74.65% Ijara assets and 25.35% Murabaha assets.

The Sukuk certificates were admitted for listing on the Official List and to trading on the regulated market of Euronext Dublin, on the DFSA Official List and to the Nasdaq Dubai on 16 October 2024. Sharjah has been assigned a long- and short-term foreign and local currency sovereign credit rating of BBB- and A-3 by S&P and a long-term issuer rating of Ba1 by Moody’s. They reflected a similar rating for the trust certificates.

The latest USD750mn Sukuk certificates were listed by the Government of Sharjah on Nasdaq Dubai on 16 October 2024. The USD750mn Trust Certificates, due in 2035, brings the total current value of Sukuk under Sharjah Sukuk Programme Ltd. listed on Nasdaq Dubai to USD7.8bn. The total outstanding value of issuances by the Government of Sharjah on Nasdaq Dubai now stands at USD12.6bn.

With this new listing, the total value of Sukuk listed on Nasdaq Dubai currently stood at USD93bn. Nasdaq Dubai continues to be a preferred platform for Sukuk listings, providing issuers with access to a broad investor base and supporting growth within the Islamic finance sector. This growth, said Nasdaq Dubai, underscores the exchange’s pivotal role as the leading platform for Sukuk listings and reaffirms its importance in the global financial market.

“The Sukuk achieved strong demand from investors, with bids reaching USD2.6bn, resulting in the issuance being 3.5 times oversubscribed. Notably, 34% of the investors were from outside the MENA region, highlighting the broad international appeal of the Dubai capital market,” added Nasdaq Dubai.