UAE Government Domestic Treasury T-Sukuk Momentum Continues in 2025 with Second Consecutive Auction on 25 February Raising an Aggregate AED1.1bn (USD300mn)

Abu Dhabi – The dirham-denominated Islamic Treasury Sukuk (T-Sukuk) first introduced by the UAE Ministry of Finance (MoF) in collaboration with the Central Bank of the UAE (CBUAE) in 2023 continued to gain traction in February 2025 as sovereign domestic Sukuk issuances to regulate liquidity management and reserve requirements of Islamic financial institutions and the Islamic banking units of conventional banks authorised in the emirate.

The Ministry of Finance (MoF) as the issuer, in collaboration with the Central Bank of the UAE (CBUAE) as the issuing and paying agent, announced the results of the Islamic Treasury Sukuk (T-Sukuk) auction on 25 January 2025 which are part of the Islamic T-Sukuk issuance programme for Q1 2025.

The MoF, according to the issuance calendar for 2025, plans to have another 7 two-tranche auctions of T-Sukuk in 2025 with the aim of issuing an aggregate AED9,900mn (USD2,695.66mn) in the process. As of 21 January 2025, according to the Ministry, there were AED24,550mn (USD6,684.68mn) of T-Sukuk outstanding.

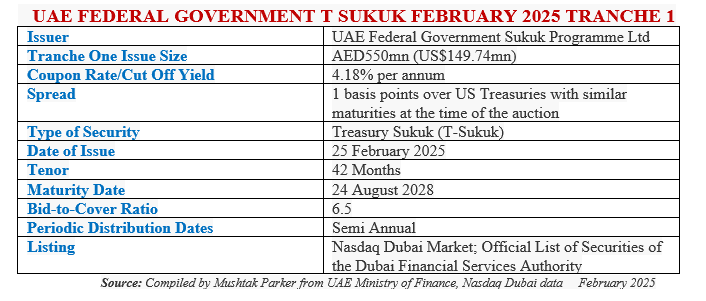

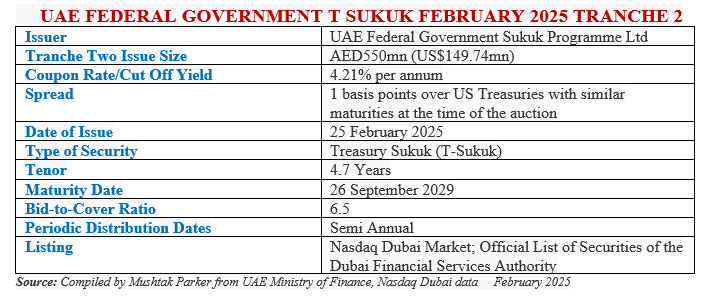

The auction comprised two tranches each of AED550mn (US$149.74mn), thus totalling AED1.1bn (USD299.48mn) per transaction. The auction saw strong demand from the eight primary bank dealers for the tranches maturing on 24 August 2028 and on 26 September 2029. A total of AED7.1bn (USD1.93bn) in bids were received for the two tranches exceeding the subscription volume by 6.5 times.

The success of the auctions is reflected in the competitive market prices achieved, with a yield to maturity (YTM) for the January 2025 transaction of 4.18% for the tranche maturing in August 2028 and 4.21% for the tranche maturing in September 2029, with a spread of 1 basis points over US Treasury bonds of similar maturities at the time of the auction for both tranches.

With the similar January 2025 auction, the aggregate funds raised from the two auctions in January and February totalled AED2,200mn (USD599.03mn).

The Islamic T-Sukuk issuance programme, says the CBUAE will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

The T-Sukuk structure is based on Murabaha/Ijara assets with the asset pool comprising 54% Ijara assets and 46% Murabaha receivables. The UAE Federal Government Sukuk Programme Ltd is the Trustee and Lessor acting on behalf of the Government of the United Arab Emirates, acting through the Ministry of Finance – the Obligor, Seller, Lessee and Servicing Agent to the transaction.

The Sukuk certificates are listed and traded on the Nasdaq Dubai Main Market and on the Official List of Securities of the Dubai Financial Services Authority (DFSA). All the T Sukuk offerings are issued under the unlimited UAE Treasury Sukuk Programme.

The Sukuk are issued via eight primary dealers, with the UAE Central Bank acting as the issuing and payment agent. To facilitate the smooth implementation of the T-Sukuk initiative, the MoF published a robust Primary Dealers code and onboarded eight banks namely Abu Dhabi Islamic Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank, Emirates NBD, First Abu Dhabi Bank, HSBC, Mashreq and Standard Chartered as Primary Dealers to participate in the T-Sukuk primary market auction and to actively develop the secondary market.

According to UAE Minister of State for Financial Affairs, Mohamed Bin Hadi Al Hussaini, the introduction of the T Sukuk “reaffirmed the UAE’s keenness to strengthen the Islamic economy and boosts the size of financial alternatives for investors which contributes to developing the UAE’s investment environment.”