UAE Government Domestic Treasury T-Sukuk Momentum Continues with Auctions in September and October Raising an Aggregate AED2.2bn (USD600mn) as Total Volume of Issuances for January-October 2024 Tops AED10.5bn (US$2.85bn) Due to Steady Demand

Abu Dhabi – The dirham-denominated Islamic Treasury Sukuk (T-Sukuk) first introduced by the UAE Ministry of Finance (MoF) in collaboration with the Central Bank of the UAE (CBUAE) in 2023 continues to gain traction as sovereign domestic Sukuk issuances to regulate liquidity management and reserve requirements of Islamic financial institutions at the central banks gains momentum beyond traditional markets where Islamic finance is deemed of systemic importance in the banking system.

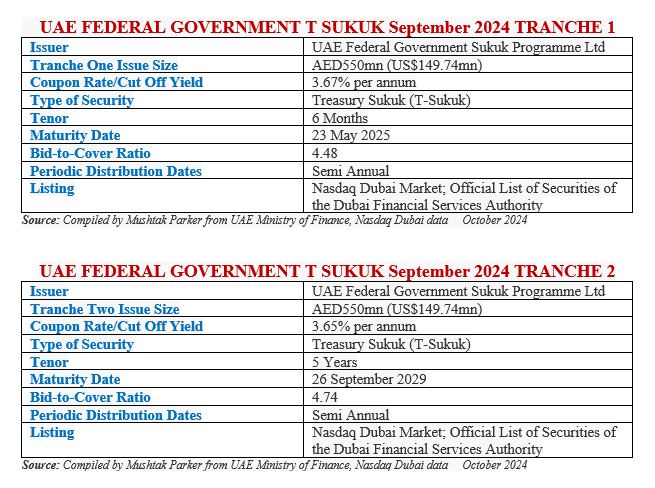

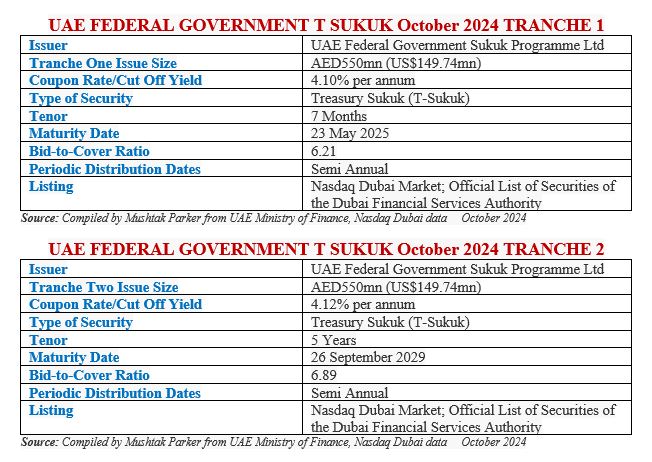

The Ministry of Finance (MoF) as the issuer, in collaboration with the Central Bank of the UAE (CBUAE) as the issuing and paying agent, announced the results of the Islamic Treasury Sukuk (T-Sukuk) auctions on 24 September 2024 and on 22 October 2024, which are part of the Islamic T-Sukuk issuance programme for Q3/Q4 2024.

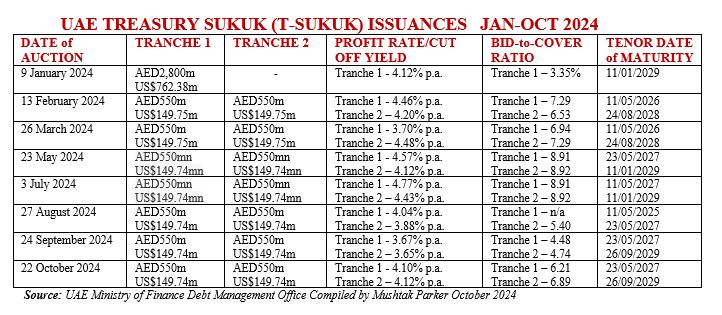

Both auctions comprised two tranches each of AED550mn (US$149.74mn), thus totalling AED1.1bn (USD299.48mn) per transaction. Both auctions saw strong demand from the eight primary bank dealers for the tranches maturing in May 2027 and the new five-year tranches maturing in September 2029. A total of AED5.07 billion in bids were received for both transactions exceeding the subscription volume by about 4.6 times.

The success of the auctions is reflected in the competitive market prices achieved, with a yield to maturity (YTM) for the September 2024 transaction of 3.67% for the tranche maturing in May 2027 and 3.65% for the tranche maturing in September 2029, with a spread of 13 to 15 basis points over US Treasury bonds of similar maturities.

Similarly, the YTM for the October 2024 transaction was 4.10% for the tranche maturing in May 2027 and 4.12% for the tranche maturing in September 2029.

The local currency-denominated Islamic Treasury Sukuk, says the UAE Debt Management Office, supports the development of a UAE dirham-denominated yield curve, offering secure investment alternatives for investors. This contributes to enhancing the competitiveness of the local debt capital market, improving the investment environment, and supporting the sustainability of economic growth.

With this latest transaction in October 2024, the total volume of T-Sukuk issued by the CBUAE on behalf of the Government, the Obligor, amounted to AED10,500mn (US$2,858.69mn) in the January-October period in 2024.

The September auction realised the published target for Q3 of AED9,400mn (US$2,559.22mn) The total T-Sukuk outstanding as on 27 August 2024 stood at AED20,150mn (US$5,485.98mn). There is no doubt that T-Sukuk issuance is gaining momentum, albeit that issuance volumes will have to be increased dramatically to establish that all important yield curve for such issuances and to stimulate secondary trading and unleashing greater liquidity in the market.

The Sukuk certificates are listed and traded on the Nasdaq Dubai Main Market and on the Official List of Securities of the Dubai Financial Services Authority (DFSA). All the T Sukuk offerings are issued under the unlimited UAE Treasury Sukuk Programme.

The T-Sukuk structure is based on Murabaha/Ijara assets with the asset pool comprising 54% Ijara assets and 46% Murabaha receivables. The UAE Federal Government Sukuk Programme Ltd is the Trustee and Lessor acting on behalf of the Government of the United Arab Emirates, acting through the Ministry of Finance – the Obligor, Seller, Lessee and Servicing Agent to the transaction.

According to UAE Minister of State for Financial Affairs, Mohamed Bin Hadi Al Hussaini, the introduction of the T Sukuk “reaffirmed the UAE’s keenness to strengthen the Islamic economy and build a pioneering investment infrastructure to boost it as one of the key pillars of the national economy. The T-Sukuk are Shariah-compliant financial certificates, and they will be traded to reflect the local return on investment, support economic diversification and financial inclusion, as well as contribute to achieving comprehensive and sustainable economic and social development goals.”

The T-Sukuk issuance programme, added Minister Al Hussaini, will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

The Sukuk are issued via eight primary dealers, with the UAE Central Bank acting as the issuing and payment agent. To facilitate the smooth implementation of the T-Sukuk initiative, the MoF published a robust Primary Dealers code and onboarded eight banks namely Abu Dhabi Islamic Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank, Emirates NBD, First Abu Dhabi Bank, HSBC, Mashreq and Standard Chartered as Primary Dealers to participate in the T-Sukuk primary market auction and to actively develop the secondary market.

The launching of the T-Sukuk also incorporates a series of issuances, to attract a new category of investors and support the sustainability of economic growth and is also aimed at enhancing the UAE’s economic competitiveness by providing high-quality Islamic assets at competitive prices. This will support the CBUAE in managing liquidity within the banking sector and boosts the size of financial investments, which will reflect positively on the country’s economy, investment environment, per capita income, and gross national income.

In addition, issuing the T-Sukuk in local currency would contribute to building a local currency bond/Sukuk market, diversifying financing resources, boosting the local financial and banking sector, providing safe investment alternatives for local and foreign investors, as well as helping build a UAE Dirham-denominated yield curve, thereby strengthening the local financial market and developing the investment environment.

The T-Sukuk, according to the MoF, will be issued initially in 2/3/5-year tenures, followed later by a 10-year Sukuk. The T-Sukuk programme, says the MoF, was developed in uniform pricing (the Dutch Auction) for final bid acceptance of bids and final allocation amounts, regardless of the lower-priced bids received, to ensure full transparency in accordance with global best practices for Sukuk structuring. These Sukuk will provide safe investment alternatives for investors which contributes to developing the UAE’s investment environment.