UAE Government Domestic Treasury T-Sukuk Auction in August Raises AED1.1bn (USD300mn) as Total Volume of Issuances for January-August Tops AED8.3bn (USD2.3bn) Due to Strong Demand

Abu Dhabi – The dirham-denominated Islamic Treasury Sukuk (T-Sukuk) first introduced by the UAE Ministry of Finance (MoF) in collaboration with the Central Bank of the UAE (CBUAE) in 2023 continues to gain traction as sovereign domestic Sukuk issuances to regulate liquidity management and reserve requirements of Islamic financial institutions at the central banks gains momentum beyond traditional markets where Islamic finance is deemed of systemic importance in the banking system.

The Ministry of Finance (MoF) as the issuer, in collaboration with the Central Bank of the UAE (CBUAE) as the issuing and paying agent, announced the results of the Islamic Treasury Sukuk (T-Sukuk) auction on 27 August 2024, which is part of the Islamic T-Sukuk issuance programme for Q3 2024 as published on the ministry’s website. A further auction is scheduled on 24 September 2023 for the Q3 period – for a two-tranche issuance of AED500mn each.

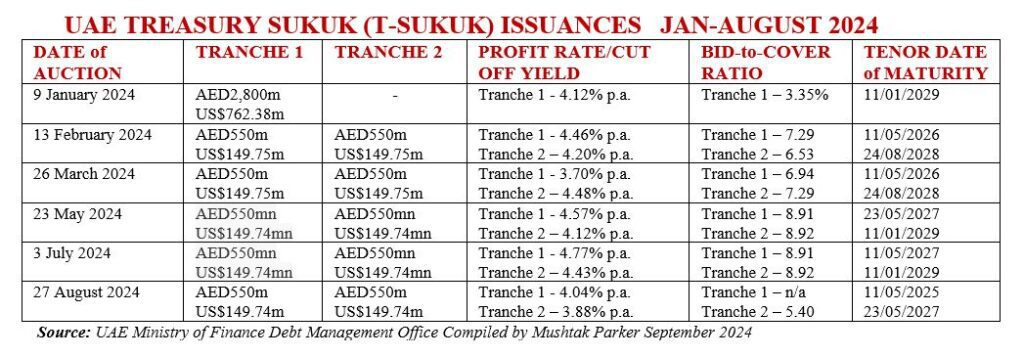

The August auction like the previous one in July 2024, the sixth to date in 2024, witnessed a strong demand through the eight primary dealers for the 9-month and 3-year tranches of the Islamic T-Sukuk, with bids received totalling AED6.32bn (US$1.72bn) and an oversubscription by 5.7 times.

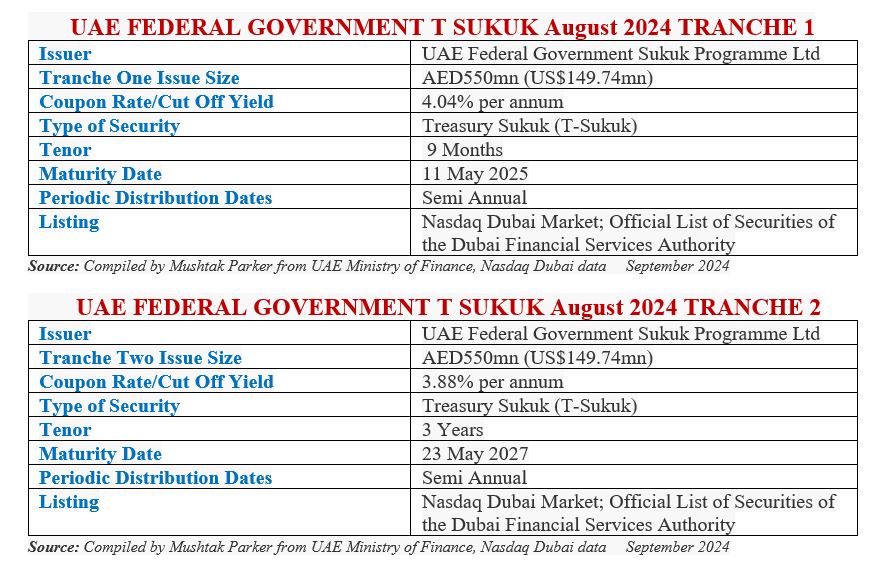

The success of the auction, said the UAE Ministry of Finance Debt Management Office (DMO), is reflected in the attractive market driven prices, with a Yield to Maturity (YTM) of 4.04 % on the 9-month tranche and 3.88 % on the 3-Year tranche, representing a 0 to 9 basis points (bps) above US Treasuries with similar maturities at the time of the auction.

The Islamic T-Sukuk issuance programme, added the DMO, will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

With this latest transaction in August 2024, the total volume of T-Sukuk issued by the CBUAE on behalf of the Government, the Obligor, amounted to AED8,300mn (US$2,259.73mn) in the January-August period in 2024.

The published target for Q3 is AED9,400mn (US$2,559.22mn) The total T-Sukuk outstanding as on 27 August 2024 stood at AED20,150mn (US$5,485.98mn). There is no doubt that T-Sukuk issuance is gaining momentum, albeit that issuance volumes will have to be increased dramatically to establish that all important yield curve for such issuances and to stimulate secondary trading and unleashing greater liquidity in the market. The Sukuk certificates are listed and traded on the Nasdaq Dubai Main Market and on the Official List of Securities of the Dubai Financial Services Authority (DFSA). All the T Sukuk offerings are issued under the unlimited UAE Treasury Sukuk Programme.

The T-Sukuk structure is based on Murabaha/Ijara assets with the asset pool comprising 54% Ijara assets and 46% Murabaha receivables. The UAE Federal Government Sukuk Programme Ltd is the Trustee and Lessor acting on behalf of the Government of the United Arab Emirates, acting through the Ministry of Finance – the Obligor, Seller, Lessee and Servicing Agent to the transaction.

According to UAE Minister of State for Financial Affairs, Mohamed Bin Hadi Al Hussaini, the introduction of the T Sukuk “reaffirmed the UAE’s keenness to strengthen the Islamic economy and build a pioneering investment infrastructure to boost it as one of the key pillars of the national economy. The T-Sukuk are Sharia’a-compliant financial certificates, and they will be traded to reflect the local return on investment, support economic diversification and financial inclusion, as well as contribute to achieving comprehensive and sustainable economic and social development goals.”

The T-Sukuk issuance programme, added Minister Al Hussaini, will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

The Sukuk are issued via eight primary dealers, with the UAE Central Bank acting as the issuing and payment agent. To facilitate the smooth implementation of the T-Sukuk initiative, the MoF published a robust Primary Dealers code and onboarded eight banks namely Abu Dhabi Islamic Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank, Emirates NBD, First Abu Dhabi Bank, HSBC, Mashreq and Standard Chartered as Primary Dealers to participate in the T-Sukuk primary market auction and to actively develop the secondary market.

The launching of the T-Sukuk also incorporates a series of issuances, to attract a new category of investors and support the sustainability of economic growth and is also aimed at enhancing the UAE’s economic competitiveness by providing high-quality Islamic assets at competitive prices. This will support the CBUAE in managing liquidity within the banking sector and boosts the size of financial investments, which will reflect positively on the country’s economy, investment environment, per capita income, and gross national income.

In addition, issuing the T-Sukuk in local currency would contribute to building a local currency bond/Sukuk market, diversifying financing resources, boosting the local financial and banking sector, providing safe investment alternatives for local and foreign investors, as well as helping build a UAE Dirham-denominated yield curve, thereby strengthening the local financial market and developing the investment environment. The T-Sukuk, according to the MoF, will be issued initially in 2/3/5-year tenures, followed later by a 10-year Sukuk.

The T-Sukuk programme, says the MoF, was developed in uniform pricing (the Dutch Auction) for final bid acceptance of bids and final allocation amounts, regardless of the lower-priced bids received, to ensure full transparency in accordance with global best practices for Sukuk structuring. These Sukuk will provide safe investment alternatives for investors which contributes to developing the UAE’s investment environment.