Saudi NDMC Domestic Sovereign Sukuk Momentum Continues with Closure of SAR6.1bn (US$668.5m) of Sukuk Issuances in July and August 2023, as Aggregate Issuance Tops a Staggering US$22.5bn in the January-August 2023 Period

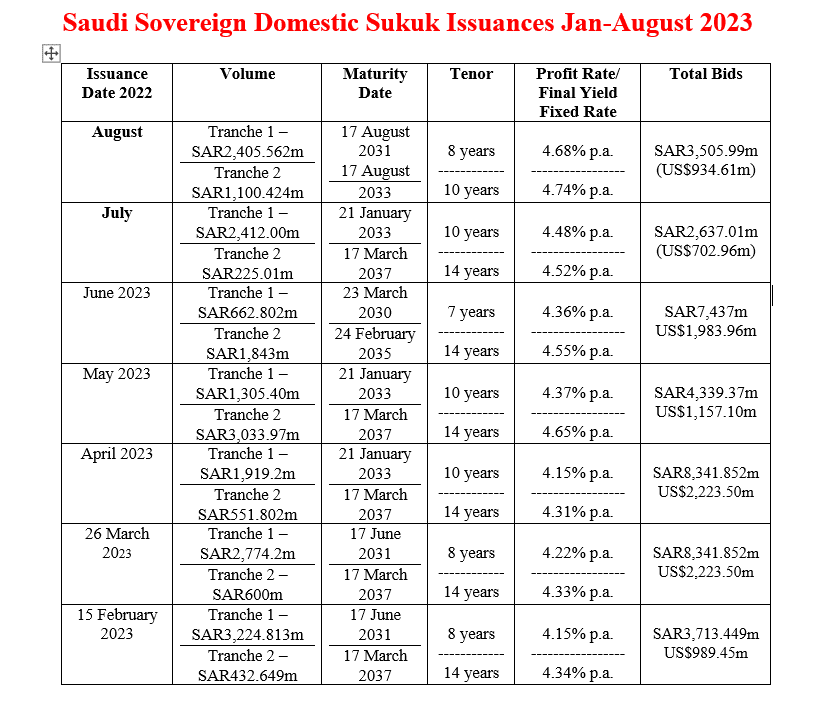

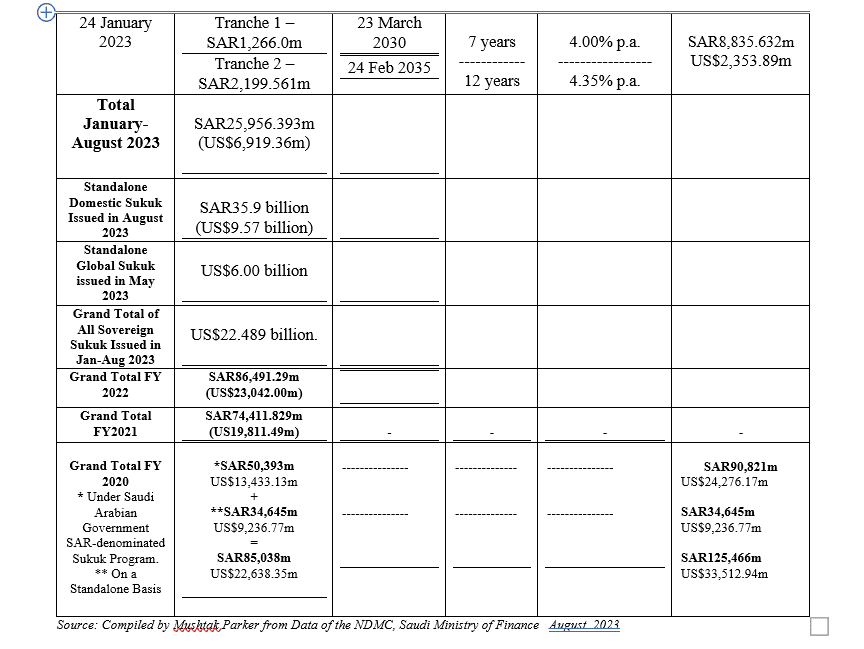

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) successfully closed its seventh and eighth consecutive monthly domestic sovereign Sukuk issuance on 27th July and 24 August 2023 respectively raising an aggregate SAR6,142.996 million (US$1,637.58 million) in the process.

This follows a similar issuance in June 2023 when the NDMC raised an aggregate SAR2,505.802 million (US$668.47 million) through a two-tranche auction conducted by the Saudi Central Bank (SAMA). The total amount of bids received for the two tranches was SAR7,437 million (US$1,983.96 million).

The NDMC kicked off with its first issuance of the year with a two-tranche auction completed on 24 January 2023 for an aggregate SAR3,465.561 million (US$923.25 million), followed by a second two-tranche issuance on 15 February 2023 for an aggregate SAR3,657.462 million (US$974.53 million), a third two-tranche offering in March 2023 for an aggregate SAR3,374.2 million (US$899.39 million), a fourth offering in April 2023 which raised an aggregate SAR2,471.002 million (US$658.93 million), and a fifth issuance in May 2023 which raised SAR4,339.37 million (US$1,157.10 million).

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The two tranches auctioned on 27th July 2023 which raised an aggregate SAR2,637.01 million (US$702.96 million) comprised:

- A first tranche of SAR2,412.00 (US$642.98 million) with a 10-year tenor maturing on 21 January 2033 and priced at a yield of 4.48% per annum and a price of SAR85.220. Bids received totalled SAR2,412.00 (US$642.98 million), the allocated amount.

- A second tranche of SAR225.01 million (US$59.98 million) with a 14-year tenor maturing on 17 March 2037 and priced at a yield of 4.52% per annum and a price of SAR88.1813. Bids received totalled SAR225.01 million (US$59.98 million), the allocated amount.

Similarly, the two tranches auctioned on 24th August 2023 which raised an aggregate SAR3,505.986 million (US$934.61 million) comprised:

- A first tranche of SAR2,405.562 (US$641.27 million) with a 8-year tenor maturing on 17 August 2031 and priced at a yield of 4.68% per annum and a price of SAR98.8117. Bids received totalled SAR2,405.562 (US$641.27 million), the allocated amount.

- A second tranche of SAR1,100.424 million (US$293.35 million) with a 10-year tenor maturing on 17 August 2033 and priced at a yield of 4.74% per annum and a price of SAR98.8959. Bids received totalled SAR1,100.424 million (US$293.35 million), the allocated amount.

In 2022 the Saudi Ministry of Finance issued an aggregate SAR86,491.29 million (US$23,042.00 million) of Saudi-riyal denominated Sukuk for the January-December period through consecutive monthly issuances. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million).

Thus far in 2023, the NDMC has raised a total of SAR25,956.393 million (US$6,919.36 million) in the January-August period.

In a statement, the NDMC stressed that “this issuance confirms the NDMC’s statement on the mid of February 2022, that it will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

This latest transaction also follows the one-off Saudi sovereign Sukuk issuance in the international Sukuk market with a two-tranche Sukuk issuance in mid-May 2023, despite a more-or-less balanced budget, rising oil revenues and pre-funding activities that have been executed to manage refinancing risk of previous bond and Sukuk issuances amid a higher interest rate environment.

The NDMC indeed announced on 14th May 2023 that it had issued a dual tranche Sukuk totalling US$6 billion in response to “receiving investors’ requests for the issuance of international trust certificates (Sukuk).”

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2023 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The Kingdom’s public finance portfolio is very stable flush with liquidity largely due to high oil prices and robust petrochemicals export revenues, but subject to government spending programmes especially under the various pillars of the ambitious Saudi Vision 2030 of which the futuristic megacity project, NEOM is the jewel in the crown. The challenge is to increase the contribution of the non-oil sector to GDP, which is proving to be sticky and slow.

The NDMC in terms of public debt management does resort to regular early repurchasing of public debt obligations. On 13 August 2023, it completed the early purchase of a portion of the Kingdom’s outstanding debt instruments maturing in 2024, 2025 and 2026 with a total value exceeded SAR35.7 billion (US$9.52 billion), which represents the largest early purchase transaction arranged by the NDMC, in addition to an issuance of new Sukuk under the Local Saudi Sukuk Issuance Program in Saudi Riyal with a total value around SAR35.9 billion (US$9.57 billion). HSBC Saudi Arabia, AlRajhi Capital, SNB Capital, and AlJazira Capital were appointed as Joint Lead Managers and Bookrunners to the transaction.

This means that the total funds raised by the NDMC through domestic and international Sukuk issuances thus far in 2023, is a staggering SAR61.856 billion (US$16.489 billion) through domestic Saudi riyal denominated Sukuk in the January to August period and the standalone US$6 billion issuance in the international market in May. In US dollar terms, the grand total raised through Sukuk thus far for the first eight months of 2023 amounts to US$22.489 billion.

“This initiative is a continuation of the NDMC’s efforts to strengthen the domestic market and to keep up with market developments which have been reflected positively on the growing trading volume in the secondary market. Further, this initiative enables the NDMC to exercise its role in managing the government debt obligations and its future maturities. This will also align the NDMC’s efforts with other initiatives to enhance the public finance in the medium and long term,” stressed the NDMC.

The NDMC divided the new Sukuk issuances into four tranches with a total value around SAR35.9 billion. The first tranche amount is around SAR7.5 billion (US$2.00 billion) maturing in 2031, the second tranche amount is around SAR14.5 billion (US$3.87 billion) maturing in 2032, the third tranche amount is around SAR10.8 billion (US$2.88 billion) maturing in 2033, and the fourth tranche amount is around SAR3.2

billion (US$850 million) maturing in 2038.

The NDMC is currently also working on attracting new capital, and more international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. Already, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank have signed up as new primary dealers in the government’s local debt instruments. They join five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.