NDMC Sustains Unwavering Momentum of a Vibrant Saudi Riyal-denominated Market with a 4-Tranche Sovereign Sukuk Issuance Totalling SAR3,070.772mn (USD818.82mn) in February 2025

The signs of a vibrant Sukuk market are its depth, the number of issuers and instruments, the size and volume of issuances, the presence of an established yield curve and listing and secondary trading opportunities especially in the local bourse and beyond. The support of the policymakers, regulators, capital market authorities, rating agencies and a widening investor base is a prerequisite.

When the market embraces a bevy of issuers ranging from sovereign, quasi-sovereign, government-linked companies, to corporates, banks, MDBs based in the jurisdiction, and even social institutions, then it has matured well beyond the initial expectations of adopting Islamic finance and capital market instruments under financial inclusion policies and building up a yield curve.

Saudi Arabia is arguably the only jurisdiction in the world which has achieved all the above market attributes in a relatively short period admittedly driven by the ambitions of the Saudi Vision 2030, the Capital Market Development Programme, the massive infrastructure spending driven by the demands of the NEOM City giga-projects, the policy of diversification of the fund-raising mix of the government and entities, and at the same tine widening the investor base – all in the pursuit of diversifying the economic base of the Kingdom away from hydrocarbons, and thus reducing the dependence on oil and gas.

The future for the Kingdom’s debt capital market (DCM) is bright. In early February 2025, Fitch Ratings published a report which anticipates continuation of robust activity in Saudi Arabia’s DCM in 2025, driven by Vision 2030 initiatives, deficit funding needs, economic diversification, maturing obligations, and ongoing reforms.

Falling oil prices, which Fitch forecasts at USD70/barrel in FY2025 decreasing to USD65.barrel in FY 2026, should increase funding requirements. In 2024, Saudi Arabia became the largest dollar debt issuer in emerging markets outside China, the largest DCM in the GCC, and the largest dollar Sukuk issuer globally.

Almost all Saudi riyal issuance and ESG issuance in 2024 were in Sukuk format. “2025 started strong,” stressed Bashar Al Natoor, Global Head of Islamic Finance at Fitch Ratings, “with a growing pipeline of issuances, as we expect the market to surpass USD500bn even as soon as year-end. This growth will be driven by Vision 2030 initiatives and significant government support, alongside favourable funding conditions”

The composition of the Saudi DCM reflects that of Malaysia’s debt market, which it has overtaken in terms of size and USD transactions. At end 2024, the Saudi DCM had USD432.5bn outstanding – a year-on-year increase of 20%, with Sukuk dominating with 63% market share, and USD accounting for 50% and Saudi riyal for 48.3% of issues.

And yet, even in the Kingdom, the DCM and Sukuk market are still a work in progress. The ESG and Sustainable debt market, for instance, is increasing in importance but the base is low with only USD18.6bn outstanding, accounting for 9% of the US dollar DCM.

According to Fitch, Saudi banks have increased international DCM activities since 2020, aligning with their growth strategies and foreign-currency needs, while corporates encouraged by the government are expected to broaden their funding sources beyond bank loans, which are uncompetitive in the Kingdom.

Just under 85% of Sukuk are rated ‘A+’. Indeed, according to Al Rajhi Capital (quoted by Zawya) most banks in Saudi Arabia expect low double-digit to mid-teens growth in 2025, driven by corporate and mortgage lending.

Despite opening the DCM to foreign investors, who cannot invest directly in the Saudi market, they made up just 4.5% of the investor base of local government issuances in 2024. “Greater inclusion in global indices could bolster demand. The government announced an annual borrowing plan for 2025, with funding needs estimated at SAR139bn (USD37bn),” added Fitch.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world, partly also driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates from both local and international investors. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs.

Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF), buoyed by the positive sentiments of Fitch Ratings affirming Saudi Arabia’s Long-Term Foreign-Currency Issuer Default Rating (IDR) at ‘A+’ with a Stable Outlook in February, continued its monthly Sukuk issuance in February 2025 with a four-tranche aggregate issuance of SAR3,070.772mn (USD818.82mn).

The rating rationale reflects the Kingdom’s strong fiscal and external balance sheets, with government debt/GDP and Sovereign Net Foreign Assets (SNFA) considerably stronger than both the ‘A’ and ‘AA’ medians, and significant fiscal buffers in the form of deposits and other public sector assets.

Fitch also highlighted that the fiscal reforms, which increase the budget’s resilience to oil price volatility could have a positive impact on the rating and expects growth in non-oil exports will be robust and the services balance deficit should continue to narrow given strong growth in the travel account.

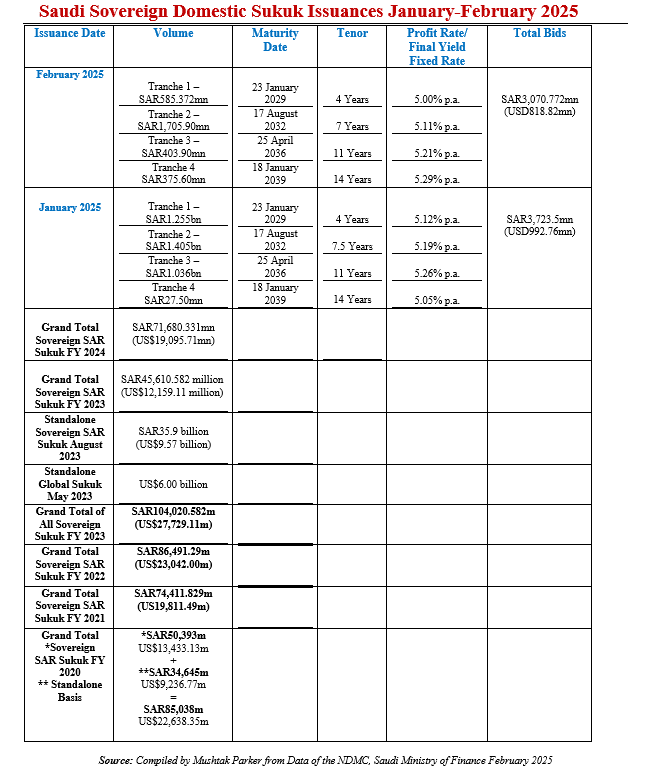

The NDMC started 2025 with a four-tranche auction on 23 January, which raised an aggregated SAR3,723.5mn (USD992.76mn). It continued its proactive sovereign Sukuk issuance momentum in the Saudi riyal-denominated domestic market after finishing 2024 with a flourish of activities resulting in an auction on 24 December 2024 amounting to SAR11,598.081mn (USD3,087.44mn) – its 12th consecutive monthly auctions of the year under its published issuance calendar and the NDMC’s SAR Sukuk Issuance Programme.

The Programme raised a staggering SAR71,680.33mn (USD19,095.71mn) in 2024; SAR45,610.582mn (USD12,159.11mn) in 2023 supplemented by an additional SAR35.9bn (US$9.57bn) through a standalone local currency Sukuk, bringing the total SAR-denominated Sukuk to SAR81.51bn in 2023; and SAR86,491.29m (US$23,042.00m) in 2022. These pertain to local currency Sukuk issuances and do not include the NDMC’s forays into the international Sukuk market and syndicated Murabaha markets.

In the above context, the February 2025 Sukuk issuance of SAR3,070.772mn (USD818.82mn) comprised:

i) A 4 -Year Tranche of 372mn (USD156.09mn) priced at a yield on 5.00% p.a. maturing on 23 January 2029.

ii) A 7.5 -Year Tranche of SAR1,705.90mn (USD454.87mn) priced at a yield of 5.11% p.a. maturing on 17 August 2032.

iii) A 11-Year Tranche of SAR403.90mn (USD107.70mn) priced at a yield of 5.21% p.a. maturing on 25 April 2036.

iv) A 14-Year Tranche of SAR375.60mn (USD100.15mn) priced at a yield of 5.29% p.a. maturing on 18 January 2039.

Total bids for the 4-tranche transaction on 20 February 2025 amounted to SAR3,070.772mn (USD818.82mn) equal to the aggregate allocated amount, and compared with the total SAR3,723.5mn (USD992.76mn) issued and allocated in the January 2025 Auction.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

These issuances confirmed the NDMC will continue, in accordance with the approved 2025 Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally.

This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while considering market movements and the government debt portfolio risk management.

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2025. This diversification will include expanding financing through export credit agencies (ECAs), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

In January 2025, the Saudi Ministry of Investment’s updated investment rules also came into effect, which according to the NDMC will make it easier for foreign investors to invest in the Kingdom to attract more international investment by streamlining the process and creating a more investor-friendly environment. The ministry highlighted that the updated regulations will eliminate the need for many licenses and prior approvals, as well as significantly reduce paperwork and bureaucratic hurdles.