NDMC Continues its Sovereign Domestic Sukuk Issuance Momentum in August/September 2024 with Two Auctions Raising SAR8,621.0mn (USD2,297.33mn) as Total Volume of Issuances in Reaches SAR48.84bn (US$13.015bn)

Buoyed by the award in early September 2024 of the ISO 9001:2015 certification granted by the International Organization for Standardization (ISO), which “recognizes organizations that excel in quality management and operations” aimed at improving governance procedures, and enhancing and transparency of all operations in line with global standards, The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) continued its proactive domestic sovereign Sukuk issuance momentum with an auction in August and early September 2024.

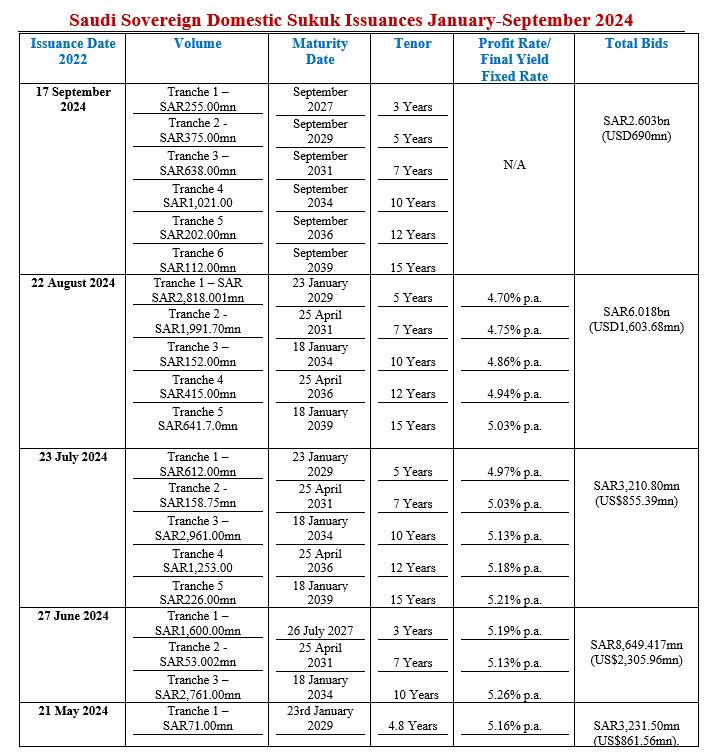

The NDMC continued its issuance in the Saudi riyal-denominated domestic market in August and September. On 17 September 2024 the NDMC held an auction raising SAR2.603bn (USD690mn) in a six-tranche transaction comprising:

i) A 3-Year Tranche of SAR255mn (USD67.95mn) maturing in 2027.

ii) A 5-Year Tranche of SAR375mn (USD99.93mn) maturing in 2029.

iii) A 7-Year Tranche of SAR638mn (USD170.01mn) maturing in 2031.

iv) A 10-Year Tranche of SAR1,021mn (USD272.08mn) maturing in 2034.

v) A 12-Year Tranche of SAR202mn (USD53.83mn) maturing in 2036.

vi) A 15-Year Tranche of SAR112mn (USD29.85mn) maturing in 2039.

A standout feature of this transaction is the list of tenors ranging from 3years to 15 years. It is no secret that the NDMC is keen to extend the tenors of the Sukuk up to 30 years eventually to help build a yield curve for various maturities.

Similarly, the 22 August 2024 auction raised an aggregate SAR6.018bn (USD1,603.68mn) in a five-tranche transaction for tenors ranging from 5, 7, 10, 12 and 15 years comprising:

i) A 5-Year Tranche of SAR2,818.001mn (USD750.94mn) maturing on 23/01/2029.

ii) A 7-Year Tranche of SAR 1,991.7mn (USD530.75mn) maturing on 25/04/2031.

iii) A 10-Year Tranche of SAR 152mn (USD40.51mn) maturing on 18/01/2034.

iv) A 12-Year Tranche of SAR415mn (USD110.59mn) maturing on 25/04/2036.

v) A 15-Year Tranche of SAR641.7mn (USD171.00mn) maturing in 18/01/2039.

The August and September auctions, with an aggregate SAR8,621.00mn (USD2,297.33mn) marked the 8th and 9th issuances of consecutive monthly sovereign domestic Sukuk issuances by the NDMC. These auctions follow the five-tranche auction on 23 July 2024, which raised an aggregate SAR3,210.80mn (US$855.39mn).

The NDMC started 2024 where it had left off in 2023 with a robust issuance of Riyal-denominated Sukuk in the domestic market with seven consecutive monthly multi-tranche transactions in the first seven months to date, which were all fully subscribed by selected local and foreign institutional investors, suggesting a robust sustained trajectory of the issuance and demand for Saudi government securities. It is consistent with the issuance trend of 2023.

The total bids for the August and September 2024 auctions matched those of the aggregate allocated amount. suggesting continued robust market demand from local and international institutional investors for Saudi local currency sovereign papers.

In June 2024, the Ministry of Finance and the NDMC extended the local primary dealer network for the issuances to include Albilad Investment Company, AlJazira Capital Company, Al Rajhi Capital Company, Derayah Financial Company, and Saudi Fransi Capital, appointing them as distribution primary dealers in the government’s local debt instruments. The institutions join the other five local institutions, namely, the Saudi National Bank, the Saudi Awwal Bank (SAB), AlJazira Bank, Alinma Bank, and AlRajhi Bank, as well as the five new international institutions, namely, BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank. The aim is to widen the distribution network for the Sukuk and the reach of the international investor base for local currency Saudi issuances.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

These issuances confirm the NDMC’s earlier statement, that it will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while considering market movements and the government debt portfolio risk management.

Total Volume in First Nine Months 2024 Exceed SAR48bn

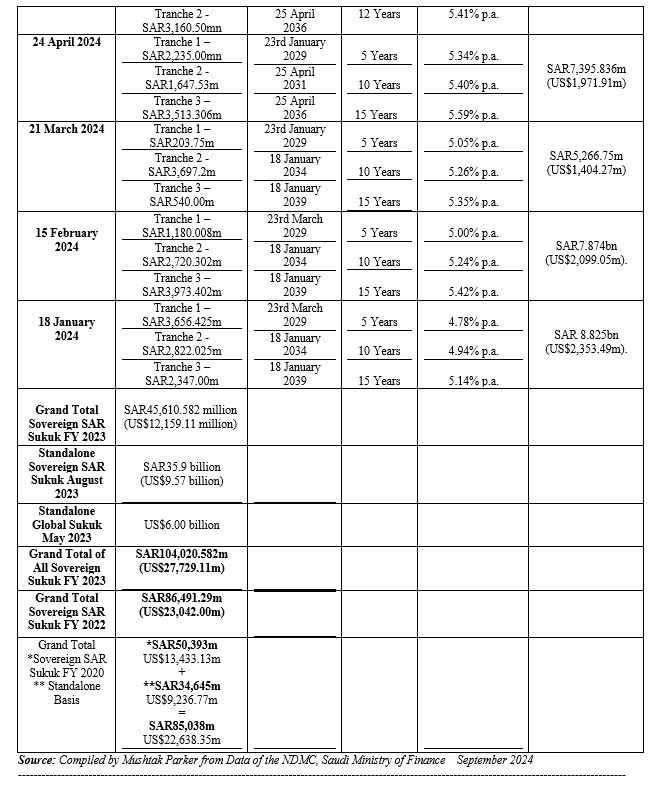

In 2023, the total volume of funds raised by the Saudi Ministry of Finance through all sovereign Sukuk issuances reached a staggering SAR104.02bn (US$27.73bn), of which SAR81.51bn came through domestic Sukuk issuances.

Thus far in the first nine months of 2024, the NDMC has already raised an aggregate SAR48,838.88mn (US$13,014.64mn) through nine consecutive local currency auctions – well on its way to potentially exceed its issuance volume in 2023, given the need to finance the volatility of the 2024 budget deficit and the huge infrastructure funding requirements especially associated with the giga NEOM projects and issuance under its newly-launched Green Financing Framework (GFF) unveiled by the Saudi Ministry of Finance in March 2024.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2024 Calendar of Local Sukuk Issuances, released in January, double downs this issuance momentum and confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates from both local and international investors.

The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The MoF intends to continue borrowing to finance the estimated 2024 budget deficit and refinance debt maturities due in FY 2024. Additionally, the NDMC “will remain vigilant in identifying and pursuing favourable market opportunities to implement additional financing activities to refinance debt maturities in the coming years. The Government remains committed to leveraging market opportunities to execute alternative government financing activities that promote economic growth, such as financing capital projects and infrastructure developments.”

The NDMC says it is committed to ensuring the Kingdom’s sustainable access to various debt markets to issue sovereign debt instruments at fair prices while maintaining prudent risk levels. To achieve this objective, it will continue to diversify financing channels throughout 2024. This diversification will include expanding financing through export credit agencies (ECAs), financing infrastructure projects, and exploring tapping into new markets in new currencies. These initiatives aim to expand the investor base and enhance the Kingdom’s access to global capital markets.

The prospects for the Saudi Sukuk and bond market remain buoyant. In early September the Saudi Ministry of Investment announced updated investment rules will make it easier for foreign investors to invest in the Kingdom to attract more international investment by streamlining the process and creating a more investor-friendly environment.

The ministry highlighted that the updated regulations which come into effect in January 2025 will eliminate the need for many licenses and prior approvals, as well as significantly reduce paperwork and bureaucratic hurdles. The updated investment system, approved by the Saudi Council of Ministers, is a key pillar of the national investment strategy and aligns with Saudi Vision 2030, emphasizing the pivotal role of investment in achieving comprehensive development goals and diversifying the national economy’s resources.

In a report in September 2024, Fitch Ratings stressed that Saudi Arabia’s Sukuk and bond market will likely cross USD500bn outstanding over the next two years, supported by government projects under Vision 2030, deficit funding, diversification, and regulatory reforms. According to Bashar Al Natoor, Global Head of Islamic Finance at Fitch Ratings, the Saudi debt capital market rose 18% year-on-year to USD407.7bn outstanding at end-FH 2024, equally split between US dollars and riyal issues. Nearly two-thirds of the issuances were in Sukuk – both domestic and international transactions.