Saudi Arabia returned to the international Sukuk market with a two-tranche Sukuk issuance in mid-May 2023, despite a more-or-less balanced budget, rising oil revenues and pre-funding activities that have been executed to manage refinancing risk of previous bond and Sukuk issuances amid a higher interest rate environment.

The National Debt Management Center (NDMC) of the Ministry of Finance (MoF) announced on 14th May 2023 that it had issued a dual tranche Sukuk totalling US$6 billion in response to “receiving investors’ requests for the issuance of international trust certificates (Sukuk).”

The NDMC had already given notice to the local and global investor community in February 2023 about its “intention to continue, in accordance with the approved Annual Borrowing Plan of the Ministry of Finance, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

The latest US$6 billion Sukuk was issued under the Kingdom’s unlimited Global Trust Certificate Issuance Programme. The NDMC had mandated a number of local and international banks and financial institutions including Citigroup Global Markets Limited, J.P. Morgan Securities Plc, and Standard Chartered Bank to act as Joint Global Coordinators and Active Bookrunners for the transaction, and to arrange a series of investor calls with accounts in London, Europe, the Middle East, Singapore, Hong Kong and Offshore US. AlJazira Capital, BNP Paribas and Goldman Sachs joined in as Passive Bookrunners to the transaction.

According to the NDMC, the issuance attracted robust demand from a range of diversified investors. The total order book reached over US$27 billion, which equals to a oversubscription of 4.5 times of the US$6 billion (SAR22.5 billion) issuance offer.

The transaction comprised:

i) A first tranche of US$3 billion (SAR11.25 billion) for a 6-year Sukuk offering maturing in May 2029 and priced at a profit rate of 4.274%.

ii) A second tranche US$3 billion (SAR 11.25 billion) for a 10-year Sukuk offering maturing in May 2033 and priced at a profit rate of 4.511%.

“The bid-to-cover ratio,” emphasised the NDMC, “reflects the strong demand of the Kingdom’s issuances, confirming the confidence of international investors’ in the strength of the Saudi Arabian economy and its investment opportunities future. That was shown in this issuance that was heavily oversubscribed with demand coming from a wide array of international investors and was allocated to a global mix of asset managers and financial institutions.”

This transaction is part of NDMC’s strategy to diversify the Kingdom’s funding sources and expand the investor base to meet the Kingdom’s financing needs from international debt capital markets efficiently and effectively, in accordance with the approved Annual Borrowing Plan, considering additional funding activities subject to market conditions and through available funding channels locally or internationally.

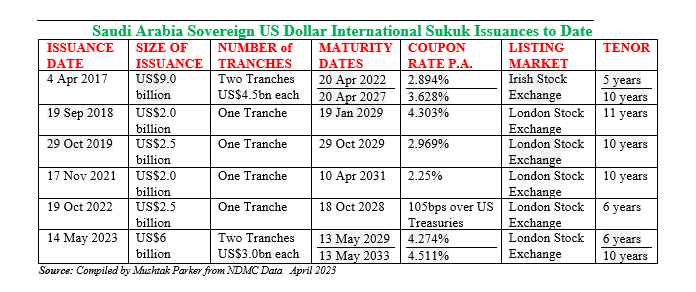

This latest Sukuk issuance is Saudi Arabia’s sixth foray into the international financial market since its debut sovereign Sukuk issuance in 2017 and comes on the back of a successful US$10 billion multi-tranche conventional bond transaction in January 2023.

Thus far Saudi Arabia has raised US$24 billion through six US dollar Sukuk transactions between 2017 and 2023 ranging in tenors from five years to 11 years. Prior to this latest US$6 billion Sukuk transaction, the NDMC last issued a US$2.5 billion Sukuk in October 2022 with a 6-year tenor priced at a yield of 105 basis points over US Treasuries.

According to the NDMC, the Kingdom’s Sukuk issuance strategy centres around the Saudi Government SAR Sukuk Programme and foreign currency Sukuk issuances, as well as conventional bond offerings in the international market.

This year’s plan will continue to be “through diversified funding sources which include domestic and international Sukuk and bond issuances as well as new financing channels, including Government Alternative Financing, [and] Supply Chain Financing, in addition to unifying the domestic Sukuk issuance programmes.”

The proceeds from Saudi sovereign issuances are primarily used to fund budget shortfalls; pre-funding for refinancing and Sukuk redemptions; developing a secondary market for trading on Tadawul (the Saudi Stock Exchange); promoting the development of a thriving Islamic debt capital market and for various policy reasons.

Saudi sovereign Sukuk issuance is partly driven by the robust market demand for such Sukuk certificates in a global market starved of AAA rated papers. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.