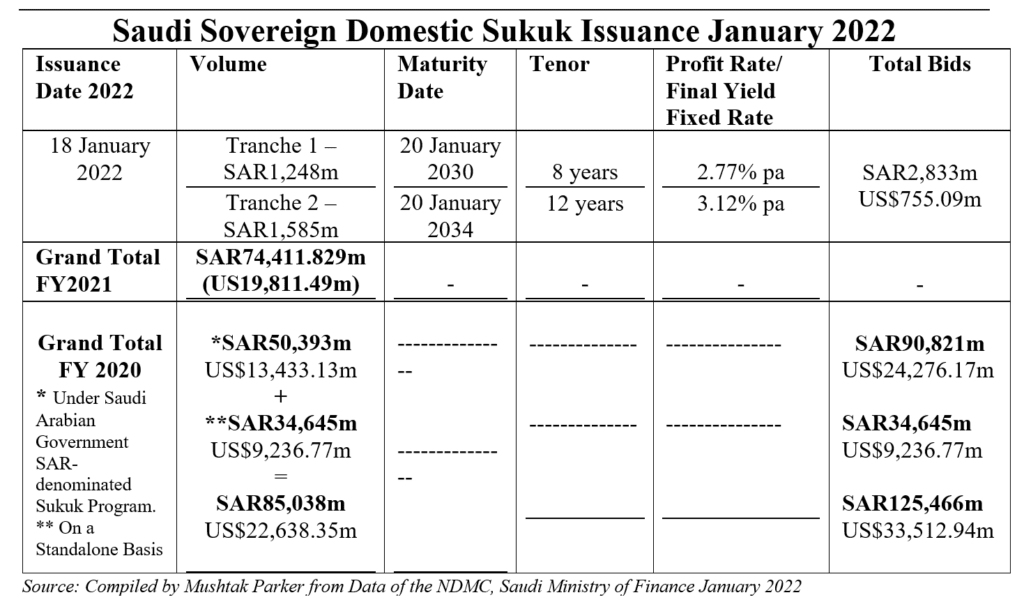

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) Saudi Arabia kicked off its 2022 Saudi Riyal-denominated Sukuk Issuance Programme with a two-tranche offering totalling SAR2.833 billion (US$755.09 million) on 18 January.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world, something for which it has arguably not received due acknowledgment for from the market. The NDMC’s 2022 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The January 2022 Sukuk auction comprised two tranches:

• A first tranche of SAR1,248 million (US$332.64 million) with an 8-year tenor maturing on 20 January 2030 and priced at a profit rate of 2.77% per annum. The bids received for the tranche matched the allocated volume.

• A second tranche of SAR1,585 million (US$422.46 million) with a 12-year tenor maturing on 20 January 2034 and priced at a profit rate of 3.12% per annum. The bids received for the tranche similarly matched the allocated volume.

This transaction follows the December 2021 issuance by the NDMC of its twelfth consecutive monthly issuance of Riyal-denominated sovereign Sukuk on 21 December 2021 with a dual-tranche auction totalling SAR415 million (US$110.55 million).

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The Saudi Arabian Government Annual Borrowing Plan Report for 2022 shows that the Kingdom’s sovereign debt portfolio increased during 2021 by about SAR85 billion (US$22.66 billion) to reach SAR938 billion (US$250.01 billion), representing 29.2% of estimated GDP, against 32.5% in 2020. The debt-to-GDP ratio “is expected to decrease further in 2022 to 25.9% due to the forecasted stabilization of debt levels and the estimated GDP growth.”

As per the 2022 National Budget statement, public debt is estimated to remain at

about SAR938 billion (US$250.01 billion) by 2022 year-end. Therefore, the funding requirement under NDMC’s 2022 Funding Plan will mainly focus on debt refinancing which amounts to about SAR43 billion (US$11.46 billion). In addition, the NDMC “will also explore additional debt raising activities depending on market conditions. Securing the Kingdom’s financing needs in the short, medium, and long term is one of NDMC’s main objectives, along with ensuring the Kingdom’s sustainability in various debt markets to issue sovereign debt instruments at a fair price within prudent risk.”

The main features of the 2022 Plan include:

i) The debt raising split between domestic and international debt will be

largely unchanged from 2021.

ii) The projected form of funding can be a mix of bonds, Sukuk (both in

domestic and international markets), as well as all forms of Government

Alternative Financing (GAF).

iii) The government might consider additional tactical funding activities through available funding channels, either domestically or internationally, including debt capital markets and government alternative financing to fund opportunities that will promote economic growth such as capital expenditure and infrastructure financing.

iv) Diversifying the investor base is a key target for the NDMC in 2022.

v) The emphasis is on fixed over floating rate borrowing activities to maintain the Kingdom’s outstanding debt portfolio exposure to interest rate risk. By end of 2021, 83% of the total debt portfolio had a fixed interest rate exposure while 17% has a floating interest rate exposure.

vi) The NDMC wants to ensure that the domestic debt market is deep enough to absorb contemplated new issuance volumes to preserve the strong liquidity levels of the domestic market.

Refinancing is also an entrenched strategy. In 2022, SAR76 billion (US$20.26 billion) was due to mature domestically and internationally. However, the NDMC successfully executed a Sukuk and bond exchange transaction in 2021 where about SAR33 billion (US$8.8 billion) of 2022 domestic maturities were successfully refinanced by issuing new Sukuk. As a result, 2022 maturities were reduced to about SAR43 billion (US$11.46 billion).

“The NDMC,” according to the Plan, “will carefully calibrate new securities to preserve the average target maturity of the Kingdom’s debt portfolio. In addition, the NDMC will continue its liability management to control the refinancing risk. Furthermore, the debt portfolio average time to maturity (ATM) has increased slightly during 2021 reaching 9.5 years compared to 9.4 years in 2020.”

The 2021 Annual Borrowing Plan totalled SAR125 billion (US$33.32 billion), of which domestic sovereign Sukuk accounted for a staggering SAR74,411.829 million (US19,811.49 million) in 12 consecutive monthly offerings. This compared with total domestic sovereign Sukuk issuance of SAR50,393 million (US$13,433.13 million) in 2020. The NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction in July 2020, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

The NDMC is also keen to further enhance accessibility to the domestic debt markets by developing, expanding, and diversifying the investor base to ensure sustainable access to domestic debt markets. Indeed, the huge appetite for such debt papers from local and increasingly from international institutional investors, follows the gradual opening of the Tadawul stock market over the last year or so to foreign investors who can now directly invest in local stocks and papers. This has been done by expanding the Primary Dealers Programme of the Government Local Debt Instruments to include top global financial institutions.

These demand dynamics, according to local banking sources, will continue in 2022, which augurs well for the Saudi, regional and global Sukuk market. The challenge is not issuance volumes per se, but diversification in terms of structures and use of proceeds. While Malaysia and Indonesia have innovated sovereign Sukuk beyond mere budget requirements – both to meet deficits and finance new policy demands – such as Green Sukuk, Dedicated Retail Sukuk and Infrastructure-linked Sukuk, the Kingdom’s issuances are almost exclusively aimed at financing budget requirements.