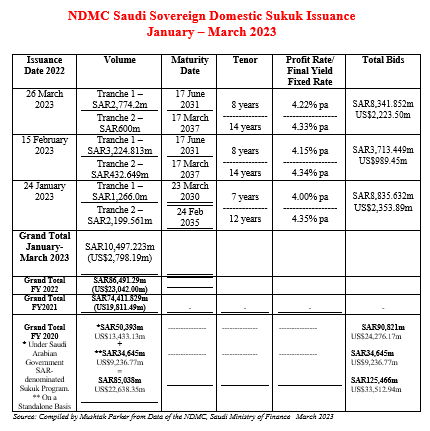

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) successfully closed its third consecutive monthly domestic sovereign Sukuk issuance on 23 March 2023 raising an aggregate SAR3,374.2 million (US$899.39 million) in the process through a two-tranche auction conducted by the Saudi Central Bank (SAMA). The total amount of bids received was SAR8,341.852 million (US$2,223.50 million).

The NDMC kicked off with its first issuance of the year with a two-tranche auction completed on 24 January 2023 for an aggregate SAR3,465.561 million (US$923.25 million), with total bids reaching a robust SAR8,835.632m (US$2,353.89m), followed by a second two-tranche issuance on 15 February 2023 for an SAR3,657.462 million (US$974.53 million), with total bids reaching SAR3,713.449m (US$989.45m).

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The two tranches auctioned in March 2023 comprised:

- A first tranche of 2,774.2 0million (US$739.46 million) with an 8-year tenor maturing on 17 June 2031 and priced at a yield of 4.22% per annum and a price of SAR88.82738. Bids received totalled SAR4,274.3 million (US$1,139.31 million).

- A second tranche of SAR600.00 million (US$159.93 million) with a 14-year tenor maturing on 17 March 2037 and priced at a yield of 4.33% per annum and a price of SAR89.79998. Bids received totalled SAR4,067.552 million (US$1,084.19 million).

In 2022 the Saudi Ministry of Finance issued an aggregate SAR86,491.29 million (US$23,042.00 million) of Saudi-riyal denominated Sukuk for the January-December period through consecutive monthly issuances. In the same period in 2021, according to data compiled by Mushtak Parker from official MoF reports, the NDMC issued an aggregate SAR65,741.315 million (US$17,491.51 million). Thus far in 2023, the NDMC has raised a total of SAR10,497.223m (US$2,798.19m) in the January-March period.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2023 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its ‘Fiscal Balance Programme and Financial Sector Development Programme’, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The NDMC is currently working on attracting new capital, and international financial institutions in addition to selected local banks to take part in the Primary Dealers Program, to capitalize on the debt instruments arranged by the NDMC. In October, the Ministry of Finance and the NDMC signed agreements with BNP Paribas, Citigroup, Goldman Sachs, J.P. Morgan, and Standard Chartered Bank appointing them as primary dealers in the government’s local debt instruments. The cohort of international institutions join the five local institutions, namely Saudi National Bank, Saudi British Bank (SABB), Al Jazira Bank, Alinma Bank, and Al Rajhi Bank, already in the NDMC’s Primary Dealers Programme.

According to Saudi Minister of Finance Muhammed Al Jadaan “these agreements are a continuation of the developmental steps taken towards achieving Vision 2030 objectives under the umbrella of the Financial Sector Development Program. This is primarily achieved through cooperation between relevant entities to develop the infrastructure of the local debt market and increase the liquidity of the government’s local debt instruments by attracting more capital from foreign investors. This is in addition to enabling primary dealers and market participants to play their roles in providing appropriate tools.”

The MoF’s Annual Borrowing Plan Report for 2023 reflects a stable and encouraging scenario. The Sovereign debt portfolio increased during 2022 by about SAR52 billion to reach SAR990 billion, representing 25.0% of GDP, compared to 30.0% in 2021.

The increase, according to the Report, was mainly driven by prefunding activities that have been executed to manage refinancing risk amid a higher interest rate environment. Despite the increase in the debt portfolio in 2022, the debt-to-GDP ratio has decreased due to the fact that debt levels are increasing at a lower pace than the expected increase in GDP.

This March issuance confirmed the NDMC supports the debt management office’s statement in February that “the NDMC will continue, in accordance with the approved Annual Borrowing Plan, to consider additional funding activities subject to market conditions and through available funding channels locally or internationally. This is to ensure the Kingdom’s continuous presence in debt markets and manage the debt repayments for the coming years while taking into account market movements and the government debt portfolio risk management.”

However, two important developments since then may impact on Riyadh’s fund-raising strategy in 2023. Firstly, Moody’s Investors Service changed its outlook on Saudi Arabia in March 2023 to positive from stable and affirmed its long-term issuer and senior unsecured ratings at ‘A1’. The rationale is that Government reforms and investment in non-oil sectors, will over time lead to the diversification of the economy and therefore reliance on hydrocarbons. The affirmation, according to the rating agency, is a recognition of the progress made in the Kingdom’s reform programme, the moderate debt burden of SAR985bn most of which had already been pre-funded in 2022 or 30.7% of GDP at Q3 2022, robust fiscal buffers and Saudi Arabia’s highly competitive and pre-eminent position in the global oil market.