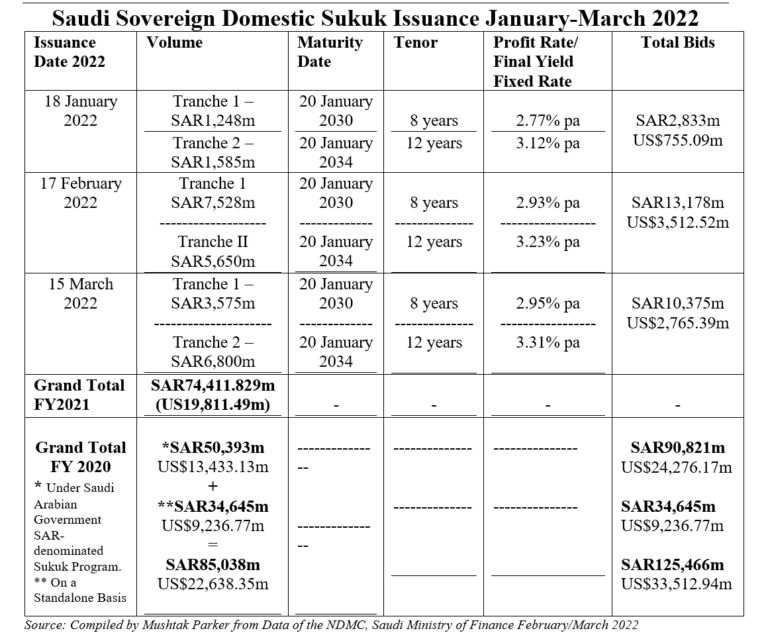

The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) Saudi Arabia issued its second and third consecutive monthly Sukuk issuance under its Saudi Riyal-denominated Sukuk Issuance Programme with a two-tranche offering totalling SAR13,178 million (US$3,512.52 million) in February and a similar two-tranche Sukuk totalling SAR10,375 million (US$2,765.39 million) in March 2022.

This means that in February and March this year the Kingdom issued an aggregate SAR23,553 million (US$6,277.91 million) of Sukuk, and the total figure for the January to March 2022 period rose to a staggering SAR26,386 million (US$7,033 million.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer in the world. The NDMC’s 2022 Calendar of Local Sukuk Issuances, released in January, confirms the intention of issuing domestic sovereign Sukuk consecutively for each month of the year from January to December – the only sovereign issuer to commit to such a calendar in advance.

This commitment is partly driven by the robust market demand for Saudi Arabian sovereign domestic Sukuk certificates. The NDMC’s role is to secure Saudi Arabia’s debt financing needs with the most competitive financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it also has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives are to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.

The February 2022 Sukuk auction comprised two tranches, with bids in each case matching the allocated volume:

• A first tranche of SA7,528 million (US$2,006.54 million) with an 8-year tenor maturing on 20 January 2030 and priced at a profit rate of 2.93% per annum.

• A second tranche of SAR5,650 million (US$1,505.97 million) with a 12-year tenor maturing on 20 January 2034 and priced at a profit rate of 3.23% per annum.

The 15 March 2022 Sukuk auction comprised two tranches, with bids in each case again matching the allocated volume:

• A first tranche of SA3,575 million (US$952.89 million) with an 8-year tenor maturing on 20 January 2030 and priced at a profit rate of 2.95% per annum.

• A second tranche of SAR6,800 million (US$1,812.50 million) with a 12-year tenor maturing on 20 January 2034 and priced at a profit rate of 3.31% per annum.

These transactions follow the January issuance by the NDMC of its first monthly issuance of Riyal-denominated sovereign Sukuk in 2022 through a two-tranche offering totalling SAR2.833 billion (US$755.09 million) on 18 January.

The NDMC Sukuk are all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme, which focuses on fixed-rate instruments “to hedge against risks of potential interest rate fluctuations.”

The NDMC also announced in early March 2022 the completion of an early redemption of a portion of its outstanding bonds and Sukuk maturing in 2023, 2024 and 2026 with a total value exceeding SAR25 billion (US$6.6 billion). In addition the NDMC also issued a standalone “new Sukuk under the Sukuk Issuance Programme in Saudi Riyal with a total value around SAR26.2 billion (US$6.98 billion).|”

This transaction, says the NDMC, is one of its initiatives “to unify the Kingdom’s domestic issuances under the Sukuk Issuance Programme in Saudi Riyal, that represents the third phase of this initiative which was started in 2020 and it will continue until unifying all domestic debt outstanding.

“This initiative is a continuation of NDMC’s efforts to strengthen the domestic market and to carry on with the market developments which have been positively reflected on growing the trading volume in the secondary market. Further, this initiative enables NDMC to exercise its role in managing the government debt obligations and future maturities. This will also align NDMC’s effort with other initiatives to enhance/optimize the public fiscal in the medium & long term.”

The NDMC divided the new Sukuk issuances into four tranches with a total value around SAR26.2 billion. The first tranche amount is SAR2.6 billion maturing in 2027, the second tranche amount is SAR1.9 billion maturing in 2029, the third tranche amount is SAR13.2 billion maturing in 2032 and the fourth tranche amount SAR8.5 billion maturing in 2037. The Saudi Ministry of Finance (the Issuer) and NDMC mandated HSBC Saudi Arabia, AlRajhi Capital and SNB Capital as Joint Lead Managers to the transaction.

This means that in 2022 the NDMC on behalf of the Ministry of Finance has issued a total of SAR52,586 million (US$14,016.48 million) of Sukuk to date.

The Saudi Arabian Government Annual Borrowing Plan Report for 2022 shows that the Kingdom’s sovereign debt portfolio increased during 2021 by about SAR85 billion (US$22.66 billion) to reach SAR938 billion (US$250.01 billion), representing 29.2% of estimated GDP, against 32.5% in 2020. The debt-to-GDP ratio “is expected to decrease further in 2022 to 25.9% due to the forecasted stabilization of debt levels and the estimated GDP growth.”

As per the 2022 National Budget statement, public debt is estimated to remain at about SAR938 billion (US$250.01 billion) by 2022 year-end. Therefore, the funding requirement under NDMC’s 2022 Funding Plan will mainly focus on debt refinancing, which amounts to about SAR43 billion (US$11.46 billion).

The NDMC is also keen to further enhance accessibility to the domestic debt markets by developing, expanding, and diversifying the investor base to ensure sustainable access to domestic debt markets. Indeed, the huge appetite for such debt papers from local and increasingly from international institutional investors follows the gradual opening of the Tadawul stock market over the last year or so to foreign investors who can now directly invest in local stocks and papers. This has been done by expanding the Primary Dealers Programme of the Government Local Debt Instruments to include top global financial institutions.

These demand dynamics, according to local banking sources, will continue in 2022, which augurs well for the Saudi, regional and global Sukuk market. The challenge is not issuance volumes per se, but diversification in terms of structures and use of proceeds.