The National Debt Management Centre (NDMC) of the Saudi Ministry of Finance (MoF) Saudi Arabia completed its 2021 Government Debt Borrowing Programme raising SAR125 billion (US$33.28 billion) in the process.

The Programme, according to the NDMC, was part of the Kingdom’s “public debt strategy to meet the country’s financing needs and seize the opportunities available in local and global financial markets and manage potential risks.” It comprised a mix of sovereign domestic Sukuk on the local market, and US dollar and Euro denominated bond issuances in the international market.

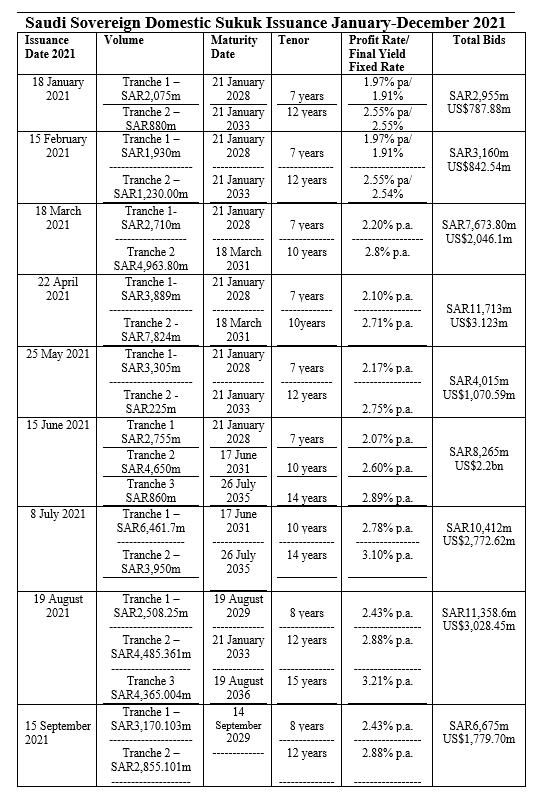

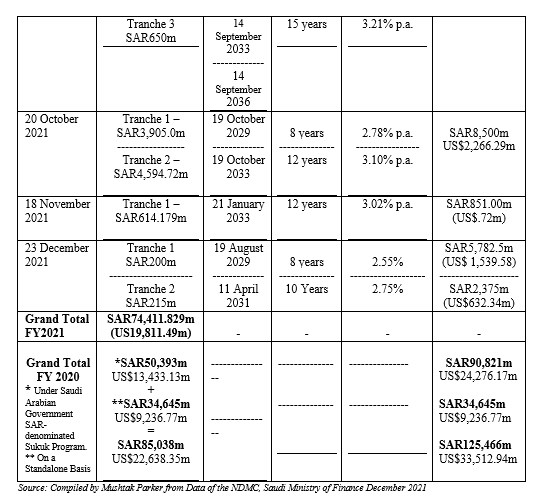

Out of this SAR125 billion, Riyal-denominated sovereign Sukuk accounted for a staggering SAR74,411.829 million (US19,811.49 million) in 12 consecutive monthly offerings, all issued under the unlimited Saudi Arabian Government SAR-denominated Sukuk Programme. NDMC bonds and Sukuk focus on fixed-rate instruments, according to Finance Minister and Chairman if NDMC, Mohammed bin Abdullah Al-Jadaan, “to hedge against risks of potential interest rate fluctuations.”

The NDMC completed its twelfth consecutive monthly issuance of Riyal-denominated sovereign Sukuk on 21 December 2021 with a dual-tranche auction totalling SAR415 million (US$110.55 million). The auction comprised two tranches:

- A first tranche of SAR200 million (US$53.28 million) with an 8-year tenor maturing on 19 August 2029 and priced at a profit rate of 2.55% per annum. The tranche was oversubscribed to the tune of SAR5,782.5 million (US$1,539.58 million).

- A second tranche of SAR215 million (US$57.27 million) with a 10-year tenor maturing on 11 April 2031 and priced at a profit rate of 2.75% per annum. The tranche was oversubscribed by SAR2,375 million (US$632.34 million).

The transaction follows the single tranche SAR614.179 million (US$163.72 million) Sukuk issuance by the NDMC in November 2021. This means that in the twelve months of 2021, the NDMC raised an aggregate SAR74,411.829 million (US19,811.49 million) through domestic sovereign Sukuk issuances. This is by far the highest domestic sovereign Sukuk issuance by any country in the world in 2021.

The fact that the combined SAR415 million offering in December 2021 alone was oversubscribed to the tune of SAR8,157.5 million (US$2,171.92 million) highlights the huge appetite for such debt papers from local and increasingly from international institutional investors following the gradual opening of the Tadawul stock market over the last year or so to foreign investors who can now directly invest in local stocks and papers.

In contrast in 2020, according to data compiled by Mushtak Parker for this newsletter from MoF statistics, the NDMC issued under its Sukuk Issuance Programme domestic Sukuk totalling SAR50,393 million (US$13,433.13 million) with total bids amounting to SAR79,100 million (US$21,085.17 million).

The NDMC also raised SAR34,645 million (US$9,236.77 million) from a four-tranche standalone auction in July 2020, bringing the total Saudi-riyal denominated Sukuk issued by the government in 2020 to SAR85,038 million (US$22,638.35 million), which is almost a 50% increase on the previous year.

These demand dynamics, according to local banking sources, will continue in 2022, which augurs well for the Saudi, regional and global Sukuk market. The challenge is not issuance volumes per se, but diversification in terms of structures and use of proceeds. While Malaysia and Indonesia have innovated sovereign Sukuk beyond mere budget requirements – both to meet deficits and finance new policy demands – such as Green Sukuk, Dedicated Retail Sukuk and Infrastructure-linked Sukuk, the Kingdom’s issuances are almost exclusively aimed at financing budget requirements.

But with the budget deficit virtually wiped out thanks to the spike in crude oil prices, the NDMC has a main chance in diversifying its Sukuk issuance strategy. Higher oil prices do not mean the demand for funding will dissipate. Commodity prices are always subject to the vagaries of geopolitics, supply and demand dynamics and the politics of the oil producers OPEC Plus Group. But the demands of Saudi Vision 2030, the construction of the mega Neom City Project in Tabuk, the transition to carbon zero and the ongoing impact of Covid-19 and any future variants, mean that the Kingdom will continue to borrow from the financial markets, short of resorting to depleting its sovereign wealth assets in the Public Investment Fund (PIF).

As such market demand remains unabated for the NDMC’s Domestic Sukuk Issuance Calendar for 2022, which is expected to comprise consecutive monthly Sukuk issuance strategy from January to December.

According to Hani bin Medaini Al-Medaini, Acting CEO of NDMC, the Centre “is working to broaden the investor base, open communication channels with the investors locally and internationally, and to penetrate to new geographical regions.” The NDMC is also working with international financial institutions for expanding the Primary Dealers Programme of the Government Local Debt Instruments, and “attracting new foreign capital to utilize the opportunities available in debt instruments arranged by NDMC, and seizing opportunities in local and international markets.”

The NDMC’s strategy is to diversify the investor base and meet the Kingdom’s financing needs from the international debt capital markets efficiently and effectively. Domestic Sukuk issuances are also driven by the objectives of the Kingdom’s Fiscal Balance Programme and Financial Sector Development Programme, the robust demand from local institutional investors, and the fact that foreign investors can also invest in local currency Sukuk through Tadawul (the Saudi Stock Exchange), which also has an active secondary trading in government Sukuk.

The Kingdom is by far the single most proactive sovereign domestic Sukuk issuer. NDMC’s role is to secure Saudi Arabia’s debt financing needs with the best financing costs. Saudi Arabia is ahead in tapping the domestic sovereign Sukuk market because it has an established issuance infrastructure complete with a government policy framework under its Fiscal Balance Programme and Financial Sector Development Programme, whose objectives is to add to a diversified public debt fund raising strategy and to the development of the Saudi Sukuk and Islamic Capital Market.