Dubai Luxury Real Estate Developer DAMAC Successfully Closes its Latest Sukuk Issuance in the International Market with a US$750mn 3.5-year Senior Unsecured Sukuk in February 2025

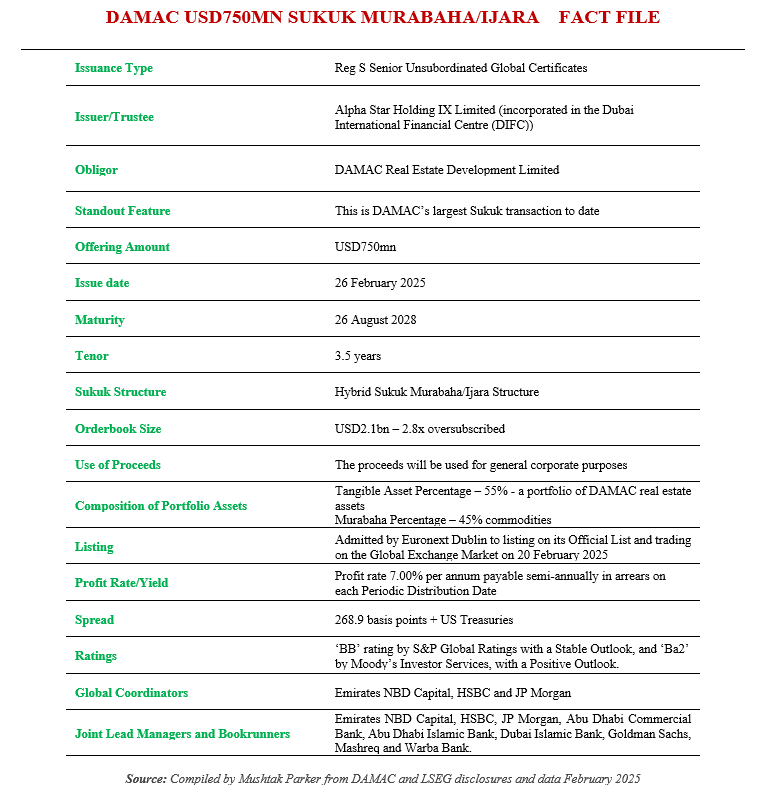

DAMAC Real Estate Development Limited, the Dubai-based luxury apartment and real estate developer returned to the international Sukuk market after an absence of 18 months, successfully pricing its latest Sukuk offering, a 3.5-year USD750mn issuance on 26 February 2025 – easily the company’s largest Sukuk transaction to date.

Prior to this latest transaction, DAMAC issued a 2.25-Year US$200 million Senior Unsecured Sukuk on 15 February 2023.

The Company mandated Emirates NBD Capital, HSBC and JP Morgan to act as global coordinators and together with Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Dubai Islamic Bank, Goldman Sachs, Mashreq and Warba Bank as Joint Lead Managers and Bookrunners to the transaction, and to arrange a series of investor calls and meetings in the UK, Europe, Offshore US Accounts, the GCC and Asia.

The Sukuk certificates were issued by Alpha Star Holding IX Limited (incorporated in the Dubai International Financial Centre (DIFC) on behalf of the Obligor DAMAC Real Estate Development Limited. The Sukuk is based on a Murabaha/Ijara structure with the portfolio assets comprising 55% of Tangible Assets – a portfolio of DAMAC real estate assets, and 45% Murabaha assets.

The Offering, according to DAMAC, received a strong demand from international and local investors, underlining DAMAC’s investment case and its role as one of the key contributors to the development of Dubai’s real estate sector.

The initial price thoughts were set at 7.5% per annum yield. The order book exceeded USD2.1bn, excluding joint lead manager interest, with an oversubscription rate of 2.8x.

Due to the strong demand especially from high quality accounts in the GCC, Europe and Asia, and the Group’s strong distribution capabilities, the size of the issuance originally set at a benchmark USD500mn then rising to USD600mn and finally settling USD150mn higher at USD750mn was priced at a profit rate of 7% per annum payable semi-annually in arrears on each Periodic Distribution Date.

This translates into a spread of 268.9 basis points + US Treasuries. The Sukuk mature on 26 August 2028. This compared with the pricing of the 2023 transaction of the US$200m Sukuk which was priced at a profit rate of 7.5% per annum and matures on 7 May 2025.

DAMAC is rated ‘Ba2’ by Moody’s Investors Service with a positive outlook and ‘BB’ by S&P with a stable outlook. Alpha Star IX, according to a pre-sale report from S&P Global, will use the Sukuk’s proceeds as follows – at least 55% of the aggregate face value of the certificates will fund the purchase of assets pursuant to a sale and purchase agreement from five DAMAC subsidiaries, and a maximum of 45% of the aggregate face value of the certificates will fund the acquisition of commodities (Murabaha assets).

The Sukuk certificates were admitted by Euronext Dublin to listing on its Official List and trading on the Global Exchange Market on 20 February 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by DAMAC, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.