Abu Dhabi Realty Developer Aldar Successfully Closes its Third Green Sustainable Sukuk in as Many Years with a 10-Year USD500mn Benchmark Sukuk Wakala/Murabaha Transaction

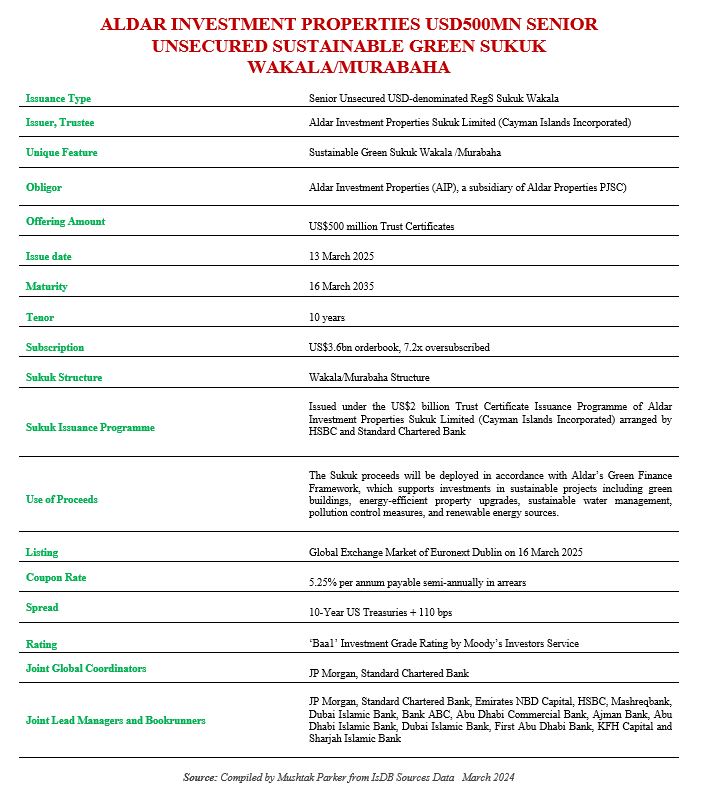

Abu Dhabi-based Aldar Investment Properties, the largest real estate management company in Abu Dhabi and subsidiary of Aldar Properties (Aldar), returned to the international market in March 2025 with the issuance of its third Green Sukuk Wakala/Murabaha – a US$500 million Reg S senior unsecured benchmark Sustainable Green Sukuk offering on 13 March 2025.

The Certificates were issued through Aldar Investment Properties Sukuk Limited (Cayman Islands Incorporated), which also acted as the Trustee on behalf of the Obligor, Aldar Investment Properties LLC (AIP).

The issuance is the latest offering under Aldar Investment Properties Sukuk Limited’s USD2bn Trust Certificates Issuance Programme to support its growth agenda and sustainability commitments, in line with the goals of the 2015 Paris Agreement, the UAE Net Zero by 2050 Strategic Initiative and Aldar’s plan to be a net zero carbon business by 2050. Previously, AIP had issued similar Green Sukuk Wakala/Murabaha USD500mn offerings in May 2023 and May 2024, thus bringing its aggregate Green Sukuk issued to date to USD1.2bn.

Aldar is the leading real estate developer, manager, and investor in Abu Dhabi, with a growing presence across the United Arab Emirates, the Middle East North Africa, and Europe. The company has two core business segments, Aldar Development and Aldar Investment. Aldar Development is a master developer of a 62 million sqm strategic landbank, creating integrated and thriving communities across Abu Dhabi, Dubai, Ras Al Khaimah, the UK and Egypt.

Aldar Investment houses a core asset management business comprising a portfolio of more than AED42bn (USD11.43bn) worth of investment grade and income-generating real estate assets diversified across retail, residential, commercial, logistics, and hospitality segments. AIP is the owner-manager of an AED28bn (USD7.6bn) portfolio of income-generating properties.

Aldar had mandated JP Morgan and Standard Chartered Bank to act as joint Global Coordinators to the transaction, and together with Abu Dhabi Commercial Bank (ADCB), Abu Dhabi Islamic Bank (ADIB), Dubai Islamic Bank (DIB), Emirates NBD Capital, First Abu Dhabi Bank (FAB), Mashreqbank, Bank ABC, KFH Capital, Mashreqbank, Ajman Bank and Sharjah Islamic Bank to act as joint lead managers and joint bookrunners, and to arrange a series of investor calls and roadshows with accounts in the UK, EU, the MENA region, Asia and Offshore US for a benchmark Green Sustainable Sukuk offering.

Aldar subsequently successfully raised USD500mn through a 10-year green sustainable Sukuk. The issuance was 7.2 times oversubscribed, attracting USD3.6bn in orders, with regional and international investors representing 61% and 39% of the total transaction allocation respectively. With a 5.25% coupon rate, the Sukuk was competitively priced at a spread of 110 basis points over 10-year US Treasuries, in line with a green Sukuk issued in May 2024 when Aldar achieved its tightest-ever spread for a public debt issuance.

The strong investor demand, said Aldar, was supported by Moody’s reaffirmation in January of investment-grade ratings of Aldar and AIP of Baa2 and Baa1 respectively, with a stable outlook. The transaction marked the company’s third green sukuk issuance under its USD 2 billion Trust Certificate Issuance Programme launched in May 2023.

Faisal Falaknaz, Chief Financial and Sustainability Officer at Aldar Properties, commented: “Aldar’s ability to consistently achieve a favourable cost of capital, even in the context of global market volatility, underscores the strength of our financial position and disciplined capital management. The strong demand for our latest green Sukuk is a clear sign of investor confidence in our strategy and commitment to sustainable growth that delivers real impact for our stakeholders and communities.”

The Sukuk proceeds will be deployed in accordance with Aldar’s Green Finance Framework, which supports investments in a broad programme of sustainable projects including green buildings, energy-efficient property upgrades, sustainable water management, pollution control measures, and renewable energy sources. Aldar has adopted a green financing framework, which aligns with the United Nations Sustainable Development Goals and is based on principles set out by the International Capital Markets Association (ICMA) and the Loan Market Association. The framework sets out criteria for use of proceeds and is governed by Aldar’s Sustainability Council, which comprises senior management and is chaired by Aldar’s Group Director of Sustainability and CSR.

To date, Aldar has invested over AED150mn (USD40.84mn) in retrofitting 67 properties with new measures designed to optimise energy efficiency and reduce emissions, in line with the company’s Net Zero goals.

The new issuance also supports the early redemption of a Sukuk maturing in September 2025 and the repayment of outstanding bank debt. This issuance, added Aldar, reinforces the company’s commitment to its Net Zero Plan, through which it aims to achieve net zero carbon emissions across its operations by 2050. This green Sukuk is also aligned with Aldar’s broader financial strategy to drive sustainable growth, with the company raising AED16.3bn (USD4.44bn) in new liquidity across its capital structure since the start of the year.

The Sukuk certificates were admitted by Euronext Dublin to listing on its Official List and trading on the Global Exchange Market at end March 2025.

Aldar is 25%-owned by the Abu Dhabi sovereign wealth fund Mubadala and 26% owned by International Holding Company, part of a business empire overseen by Sheikh Tahnoon bin Zayed al- Nahyan, the UAE’s national security adviser and brother to the president.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Aldar, with the Murabaha tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.