Energy Development Oman (EDO) Returns to the Global Sukuk Market with Second Benchmark US$750mn Fixed Rate Sukuk Ijara/Murabaha Issuance in Nine Months

Less than a year after its debut US$1bn Sukuk issuance in 2023, Energy Development Oman (EDO), the sultanate’s state-owned energy development utility, returned to the international Sukuk market with a second benchmark US$750mn Hybrid Sukuk Ijara/Murabaha offering on 28 June 2024.

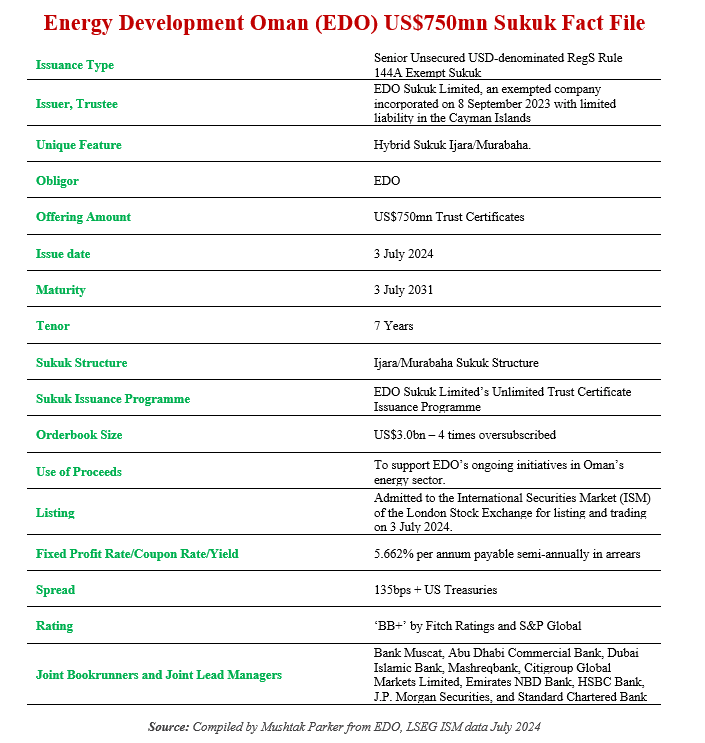

The Sukuk certificates, which have a tenor of 7 years and mature on 3 July 2031, were issued by EDO Sukuk Limited, an exempted company incorporated on 8 September 2023 with limited liability in the Cayman Islands, under its unlimited Trust Certificate Issuance Programme established in February 2024. EDO Sukuk Limited acted as Trustee, Purchaser, Lessor, and Seller in the structure with EDO Gas, incorporated in Oman as the Obligor and EDO as the Guarantor of the Sukuk.

EDO had mandated Bank Muscat, Abu Dhabi Commercial Bank, Dubai Islamic Bank, Mashreqbank, Citigroup Global Markets Limited, Emirates NBD Bank, HSBC Bank, J.P. Morgan Securities, and Standard Chartered Bank to act as joint lead managers and bookrunners for the transaction and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

The Senior Unsecured Sukuk Al Ijara/Murabaha certificates were assigned a BB+ rating by both Standard & Poor’s Global Ratings and Fitch Ratings. The issuance, said EDO, was more than four times oversubscribed, reflecting strong investor confidence in both the Sultanate of Oman and EDO as its national energy champion. EDO launched the fixed rate senior unsecured Sukuk at the initial guidance price of 170 basis points (bps) over US Treasuries.

Due to heavy demand for the certificates with the order book reaching over US$3 billion, EDO finally closed the transaction at a tighter spread of 135 bps over US Treasuries on the same day. The transaction was successfully priced at a fixed profit rate/yield of 5.662% per annum payable semi-annually in arrear, with a term of seven years. This translates into a spread of 1.35% (135 basis points (bps) over US Treasuries. The Trust Assets pool comprised 55.1% Ijara assets and 44.9% Murabaha receivables.

Investor participation was widespread, with over 115 account orders from Europe, the UK, the US, the Middle East, and Asia. This allowed the pricing to be tightened from the initial price guidance.

According to EDO’s Chief Financial Officer, Sultan Al Mamari, “this is a significant milestone, our second issuance in the last nine months. Our latest Sukuk deal is at a significantly lower profit rate, representing savings for EDO and the country. The outcome underscores international investors’ endorsement of our ongoing commitment to bolster Oman’s energy strategy. We deeply appreciate the trust our investors have placed in us, highlighting our robust creditworthiness and our transformation into a fully integrated energy enterprise.”

The proceeds from the Sukuk issuance will support EDO’s ongoing initiatives in Oman’s energy sector, enhancing its capabilities as a fully integrated energy enterprise and contributing to the country’s energy strategy. EDO was established in December 2020 by Royal Decree (2020/128) to pursue new growth opportunities and realise efficiencies in Oman’s energy sector.

The company says it is committed to becoming a world-class partner for growth while driving a sustainable energy future and focused on developing the country’s energy and alternative energy sectors in line with Oman Vision 2040. The company is wholly owned by the Government of the Sultanate of Oman and holds a 60% ownership stake in Block 6 Oil Concession, 100% ownership of Block 6 Non-Associated Gas Concession, and a 100% stake in Hydrogen Oman LLC Block 6 is Oman’s largest and most significant crude oil and gas operation.

Prior to this transaction, EDO issued its maiden Sukuk on 17 September 2023 – a similar benchmark US$1bn hybrid Sukuk Ijarah/Murabaha with a 10-year tenor maturing on 21 September 2033. That issuance was priced at a fixed profit rate of 5.875% per annum payable semi-annually in arrear, and at a spread of 165bps over US Treasuries. The Sukuk certificates were admitted to the International Securities Market (ISM) of the London Stock Exchange for listing and trading on 3 July 2024.