Bahrain’s Bapco Energies Limited Returns to International Sukuk Market with Benchmark US$1bn Hybrid Sukuk Murabaha/Ijara Offering with a 10-Year Tenor in January 2025

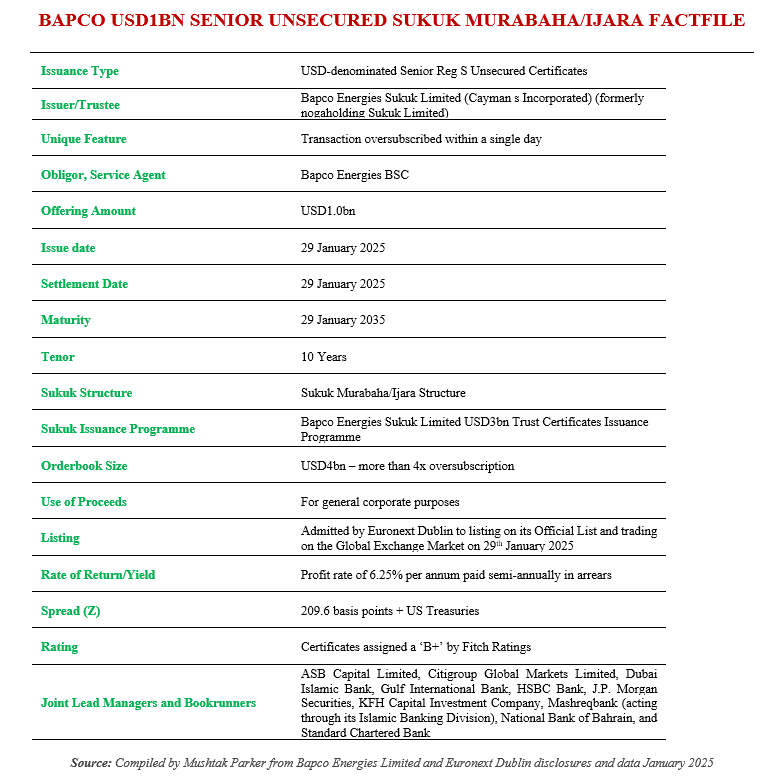

Bapco Energies BSC (formerly The Oil and Gas Holding Company (nogaholding)), the energy investment and development holding entity of the Government of Bahrain, successfully priced its latest Sukuk issuance – a benchmark USD1bn Senior Reg S Unsecured Certificates offering – on 29 January 2025.

The 10-year Senior Hybrid Sukuk Murabaha/Ijara certificates were issued through Bapco Energies Sukuk Limited (Cayman Islands Incorporated), formerly nogaholding Sukuk Limited, on behalf of the Obligor, Bapco Energies BSC, under the company’s USD3bn Trust Certificates Issuance Programme.

Bapco mandated ASB Capital Limited, Citigroup Global Markets Limited, Dubai Islamic Bank, Gulf International Bank, HSBC Bank, J.P. Morgan Securities, KFH Capital Investment Company, Mashreqbank (acting through its Islamic Banking Division), National Bank of Bahrain, and Standard Chartered Bank to act as Joint Lead Managers and Bookrunners to the transaction and to arrange a series of investor calls and roadshows in London, Europe, the GCC, the Middle East, Asia and with Offshore US Accounts.

The offer commenced on 29 January 2025 and the transaction was oversubscribed within a single day. The order book exceeded USD4bn – more than 4x oversubscription.

The initial price thoughts were around the 6.75% area. Due to the heavy oversubscription and demand for the papers, Bapco Energies subsequently issued a US$1bn 10-year Sukuk at a yield/profit rate of 6.25% per annum paid semi-annually in arrears with a scheduled maturity date of 29 January 2035 with a spread of US Treasuries + 209.6 basis points (bps).

This compares with the 10-year Sukuk Murabaha/Ijara in May 2023 with a scheduled maturity date of 25 May 2033 that was priced at a profit rate of 6.625% per annum payable quarterly with a spread of US Treasuries + 306.1 basis points.

The transaction marks Bapco Energies return to the international capital markets after an absence of almost two years. Prior to this offering, Bapco Energies last accessed the Sukuk market on 17 May 2023 through a similar USD750mn Unsecured Hybrid Sukuk Al Ijara/Murabaha offering. The Sukuk certificates, rated ‘B+’ by Fitch Ratings, have been admitted by Euronext Dublin to listing on its Official List and trading on the Global Exchange Market on 29th January 2025.

An interesting aspect of the latest Sukuk issuance is the fact that J.P. Morgan Securities, the stabilisation agent, announced that it had not undertaken any stabilisation action in relation to Bapco Energies Sukuk Limited’s 10-year USD1bn Sukuk offering.

The announcement follows a pre-stabilisation period that commenced on 16 January 2025. The stabilisation activities are measures taken by underwriters to support the price of a security after its initial offering in the market. The lack of such actions suggests that the market naturally supported the price of the Sukuk notes which were at an offer price of 100% at par.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Bapco, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.