NEWS in BRIEF

Murabaha Credit Facilities Continue to Flourish as the Mainstay of Saudi Corporate Funding Primarily to Refinance More Expensive Debt and to Finance Expansion

Riyadh – Big ticket Murabaha credit facilities continue to flourish in the Saudi corporate finance market. Alrajhi Bank arranged two such facilities for local corporates in February 2025.

The first one on 12 February 2025 was for Mobile Telecommunication Company Saudi Arabia (Zain KSA) – a five-year SAR1.934bn (USD515mn) Murabaha credit facility, whose proceeds will be used to repay the current Murabaha facility with the Saudi Ministry of Finance, where the repayments were yearly with the last instalment scheduled for 1 June 2027, thereby, contributing to achieve the company’s strategy and enhancing its cashflow.

This new facility, said ZAIN KSA in a disclosure to Tadawul, the Saudi Exchange, has better commercial terms and will be settled after 5 years in one bullet payment at the maturity date of 17 February 2030. The Facility is guaranteed with a promissory note to the value of the financing.

Alrajhi bank also signed SAR2.5bn (USD670mn) Murabaha Financing Agreement with Tatweer Company to support its expansion plan and development projects. The agreement was signed by Mr. Hussam Basrawi, General Manager of Corporate Banking at Alrajhi Bank, and Mr. Riyadh Al Thaqafi, CEO of Tatweer Company.

Tatweer Company is considered as one of the pioneers of real estate development in the Kingdom, recognized for its distinguished projects such as “Lisen Valley”, “Roshn Facade”, “Economic Gate” and others. With a commitment to delivering impactful value to the community and partners, Tatweer aims to contribute to sustainable growth and enhance the quality of life across the Kingdom.

In another development, Al Moammar Information Systems Co. (MIS), a regular user of Islamic finance facilities, renewed with amendments a 5-Year SAR1.65bn (USD440mn) Murabaha facility with Banque Saudi Fransi on 2 February 2025. The facility is guaranteed secured by promissory notes to the amount of total facilities limit. The proceeds will be used to facilitate invoice payables, projects financing and issuance of letters of credit and guarantees.

In a further transaction, Saudi Awwal Bank arranged a long term Murabaha facility totalling SAR972mn (USD259.15mn) on 3 February 2025 for Arabian Contracting Services Co. whose proceeds will be used to refinance the acquisition loan to Faden Media, in alignment with the company’s strategy to reduce its finance costs and increase its profitability. The 8-year facility is guaranteed by a promissory note to the value of the financing.

Islamic Development Bank Group Pledges USD4.65bn to Finance Expanded Energy Access at to Millions Across the African Continent

Dar es Salaam – The Islamic Development Bank (IsDB) Group has announced a bold pledge of USD4.65bn to support the Africa Energy Mission 300 Initiative, joining forces with the World Bank Group, African Development Bank (AfDB), and other key partners. This commitment, stressed IsDB President Dr Muhammad Al Jasser, underscores IsDB’s dedication to bridging Africa’s energy gap and accelerating socio-economic development.

Mission 300, led by the World Bank and the AfDB, aims to provide electricity access to 300 million people across Africa by 2030. During a high-level panel discussion titled “The Role of International Partners in the Acceleration of Energy Transformation,” held at the Julius Nyerere International Convention Centre at end January 2025, Dr Al Jasser reiterated the Bank’s unwavering dedication to addressing Africa’s energy challenges.

“Energy access,” explained Dr Al Jasser, “is not just a development goal—it is a fundamental human right and a moral imperative. Today, nearly 600 million people in Africa still live without electricity, holding back progress in education, healthcare, and economic growth. The IsDB Group is taking bold action with a commitment of USD2.65bn, backed by USD2bn in insurance coverage for Africa’s electricity sector. This strategic investment will de-risk projects, unlock private capital, and drive transformative energy solutions at scale.

“Building on our cumulative USD33.5bn financing for 622 energy projects across 25 African countries, we are determined to power a new era of opportunity. Together, we can turn ambition into reality and create a fully powered Africa – one that unleashes potential, fuels prosperity, and transforms lives for generations to come.” This multi-pronged approach focuses on renewable energy development, rural electrification, and leveraging Islamic finance instruments to mobilize private sector capital and scale transformative projects.

Africa accounts for 83% of the global unelectrified population, with nearly 600 million people lacking access to electricity. In rural areas, electrification rates remain as low as 40%, underscoring the need for immediate and innovative solutions. Mission 300 aims to bridge this gap by catalyzing investments, deploying renewable energy solutions, and driving critical policy reforms to meet the continent’s growing energy demands. Over the past five decades, the IsDB Group has played a pivotal role in Africa’s energy sector. These investments have supported grid expansion, renewable energy adoption, and innovative off-grid solutions, driving progress toward sustainable development and energy equity.

Dr. Al Jasser also emphasised the importance of leveraging the strengths of development partners to achieve transformative results, and collaboration among multilateral development banks, regulatory reforms to enable private investment, and scalable project designs that are essential to achieving the ambitious goals of Mission 300.

He reaffirmed IsDB’s commitment to creating impactful, sustainable solutions that power progress and unlock opportunities for millions across the Continent, remaining steadfast in its mission to support Africa’s development, leveraging strategic investments, innovative financing solutions, and collaborative partnerships to address energy poverty and drive sustainable progress. Some 27 continental African countries are member states of the IsDB, including 21 from Sub-Saharan Africa.

Africa Finance Corporation Raises USD400mn Syndicated Commodity Murabaha Facility from Consortium of Banks to Finance Accelerated Infrastructure Development and Economic Growth Across the Continent

Dubai – Africa Finance Corporation (AFC), the continent’s leading infrastructure financial solutions provider, successfully closed a USD400mn Shariah-compliant Commodity Murabaha facility on 7 February 2025, marking its strategic return to the Islamic finance market for the first time in eight years. This milestone, said the Corporation, reflects AFC’s commitment to diversifying funding sources while expanding access to ethical and sustainable financing to meet Africa’s infrastructure needs.

Due to strong investor demand, which saw the orderbook oversubscribed by 40%, the AFC upsized the facility to USD400mn from the initial USD300mn at launch. The transaction attracted participation from eleven leading Islamic financial institutions, including new AFC partnerships with Abu Dhabi Islamic Bank, Ajman Bank, Al Rajhi Bank, Emirates Islamic Bank, Sharjah Islamic Bank, and Warba Bank.

“This transaction reaffirms AFC’s role as a bridge between global capital and Africa’s most urgent infrastructure needs,” said Samaila Zubairu, President and CEO of AFC. “The overwhelming demand demonstrates strong confidence in our investment strategy and Africa’s increasing importance in the Islamic finance landscape. By expanding our international funding sources, we continue to create innovative financial solutions to drive impactful and sustainable development across the continent.”

Emirates NBD Capital Limited, First Abu Dhabi Bank, and SMBC Bank International Plc acted as Joint Lead Arrangers and Bookrunners for the transaction, reinforcing AFC’s strong relationships with leading global financial institutions.

The transaction builds on AFC’s proven track record in Islamic finance, including its groundbreaking US$230mn Sukuk—the first-ever by an African supranational entity—issued in 2017.

AFC has consistently broadened its funding portfolio with innovative transactions that open new capital markets to attract global investors to African infrastructure. In January, AFC raised US$500 million from its first perpetual hybrid bond. In the same month, AFC received the highest possible credit ratings from S&P Global (China) Ratings and China Chengxin International Credit Rating Co. Ltd (CCXI) ahead of a potential panda bond issue. This financing facility, stressed AFC, was structured in accordance with standards set by the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), ensuring full compliance with global Islamic finance principles.

Islamic finance, including Murabaha structures, is widely regarded as ethical and sustainable due to its emphasis on asset-backed financing, risk-sharing, and the prohibition of speculative practices. These principles align with AFC’s mission to foster responsible investment that promotes long-term infrastructure development and economic stability in Africa.

“Islamic finance plays a growing role in our funding strategy, helping us tap into a diverse pool of investors who share AFC’s commitment to sustainable and responsible investing,” said Banji Fehintola, Executive Board Member and Head of Financial Services at AFC. “The success of this Murabaha facility highlights the strong appetite for African infrastructure investments and underscores AFC’s ability to structure transactions that meet global investor expectations.”

Proceeds from the 3-year Murabaha financing will support AFC’s mission to accelerate industrialization, infrastructure development, and economic growth across the continent. Several of AFC’s transformative infrastructure projects are based in the Middle East and North Africa region, including Xlinks in Morocco, a pioneering project designed to supply sustainable electricity from the Sahara to the UK. Through the acquisition of Lekela Power, AFC, with its partner, Cairo-based Infinity Power, is Africa’s largest investor in clean energy, targeting 3GW of renewable capacity by 2026.

AFC has 45 member countries and has invested over USD15bn in 36 African countries since its inception in 2007.

SRC Acquires SAR3.4bn (USD910mn) Mortgage Finance Portfolio from SNB in Driving Evolution of Saudi Arabia’s Secondary Mortgage Market

Riyadh – Saudi Real Estate Refinance Company (SRC), a PIF subsidiary company and one of the Kingdom’s largest Shariah compliant mortgage refinance companies, signed a SAR3.4bn (USD910mn) mortgage portfolio acquisition agreement with the Saudi National Bank (SNB), Saudi Arabia’s largest financial institution, on 27 February 2025. The deal marks one of the largest mortgage refinancing transactions in Saudi Arabia.

The agreement was signed by Tareq Al-Sadhan, CEO of SNB, and Majeed Al-Abduljabbar, CEO of SRC, which according to the parties, would reinforce their shared commitment to expanding homeownership opportunities for Saudi citizens by refinancing the mortgage portfolio, thus injecting long-term liquidity into Saudi Arabia’s residential mortgage market. “As the Kingdom’s leading provider of mortgage financing, SNB remains committed to supporting homeownership, enhancing market liquidity, and delivering competitive housing finance solutions. This agreement underscores our dedication to empowering Saudi families with accessible and affordable home financing, in line with Saudi Vision 2030’s housing sector goals to increase homeownership rates to 70%,” maintained Tareq Al-Sadhan.

This partnership, he added, reinforces SNB’s position in the Kingdom’s secondary mortgage market and strengthens its role as a strategic partner in SRC’s Originate-To-Distribute (OTD) model. This collaboration enhances market liquidity, supports financial stability in the housing sector, and marks a key milestone in advancing long-term sustainable securitization efforts.

Majeed Al-Abduljabbar, CEO of SRC, commented: “This strategic agreement with SNB reflects our shared vision to build a resilient and liquid housing finance ecosystem in Saudi Arabia. By providing liquidity and establishing a robust securitization framework, we are laying the foundation for a sustainable mortgage market that supports Saudi citizens in achieving homeownership.”

This transaction is part of SRC’s ongoing mortgage portfolio acquisitions, reinforcing its role as a key liquidity provider in the secondary mortgage market. SNB and SRC further solidify their positions as drivers of innovative financial solutions and economic growth through this collaboration. The agreement also paves the way for developing Residential Mortgage-Backed Securities (RMBS), enhancing market liquidity and activity, while increasing its attractiveness to local and international investors.

By securitizing acquired mortgage portfolios, SRC is driving the evolution of Saudi Arabia’s secondary mortgage market, ensuring long-term financial stability and strengthening Saudi Arabia’s position as a regional leader in housing finance.

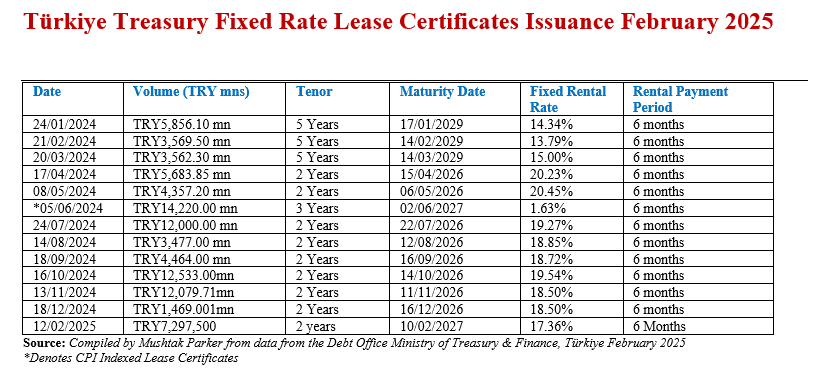

Türkiye Treasury Continues Domestic Sovereign Sukuk Al-Ijarah Issuance in February 2025 Raising TRY7,297.5mn (USD200.21mn) through the Issuance of Fixed Rate Leasing Certificates

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in February 2025 with one auction of fixed rate lease certificates (Sukuk Al-Ijarah) raising TRY7,297,500 (USD200.21mn) as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

The Fixed Rate Lease Certificate market however is the mainstay of the Treasury’s fund-raising in the Sukuk market. The Türkiye Treasury raised TRY7,297,500 (USD200.21mn) in an auction on 12 February 2025 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 10 February 2027 priced at a fixed profit rate of 17.36% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury issued consecutive monthly Sukuk Al Ijarah during 2024, aggregating TRY83,272.161mn (US$2,321.83mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Türkiye Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds.

The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The auction was conducted by the Central Bank of Turkey via its AS (Auction System under Central Bank Payment Systems).

Türkiye Wealth Fund (TWF) Issues USD250mn TAP Issue in January 2025 to Complement its Maiden USD750mn Sukuk Al-Ijarah / Murabaha in October 2024 Upsizing the Total Size to USD1bn

Istanbul – Türkiye Wealth Fund (TWF), the asset-backed development fund of Türkiye, marked its landmark USD750mn Sukuk Al-Ijarah / Murabaha issuance in October 2024 during a Market Open Ceremony at the London Stock Exchange (LSE). This milestone, said TWF, strengthens Türkiye’s role in global financial markets and reflects growing investor confidence in its economic future.

The Sukuk issuance, which received an orderbook exceeding USD7bn and was oversubscribed by 14 times maturing in January 2030, was priced at a return rate of 6.95% per annum payable semi-annually in arrears. According to TWF, the transaction “set a record in the history of Sukuk issuances. Following the success, TWF executed a re-tap Sukuk issuance of USD250mn in January 2025, increasing the total size to USD1bn.” The pricing, tenor and other metrics remain the same as per the original transaction, was rated ‘BB-’ by Fitch Ratings with a Stable outlook.

The event, said TWF, marks its continued efforts to expand Türkiye’s financial influence and support long-term growth.

Arda Ermut, CEO of TWF, commented: “We are pleased to be at the London Stock Exchange on this occasion, as our recent Sukuk issuance was an important milestone in our strategy to deepen our engagement with global financial markets. This achievement underscores the strength of Türkiye’s economic prospects, and the confidence international investors have in our long-term vision. We look forward to continuing to build on these relationships and unlocking new opportunities for sustainable growth. Our collaboration with LSE highlights the global trust in Türkiye’s economic policies. We are committed to leveraging global partnerships to foster economic stability and create lasting value.”

The proceeds from the Sukuk issuance will be directed towards strategic investments within the Istanbul Financial Centre, in alignment with TWF’s mission to foster growth and enhance depth in Türkiye’s financial markets. The Centre, stressed TWF, “is poised to become a major regional—and eventually global—financial hub, attracting top-tier financial institutions and companies. This multifaceted ecosystem of financial services, international trade, and energy will create significant value, driving further growth.”

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by TWF, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.

Saudi SMEs Are Now Turning to Raise Funds Through Small Ticket Saudi Riyal Denominated Sukuk Issuances as an Alternative to More Expensive Bank Credit Facilities

Riyadh – In a potentially important development in Saudi Sukuk origination, small and medium-sized enterprises (SMEs) are now turning to raise funds through small ticket Sukuk issuances. Hitherto, the preferred route to raising funds and credit facilities was through Murabaha credit facilities.

Saudi Arabia’s Rawasi Albina Investment Co. issued a 5-Year SAR50mn (USD13.3mn) in February 2025 which was priced at a profit rate of 10.25% per annum payable semi-annually in arrears, the first in a series of riyal denominated Sukuk programme worth a total SAR500mn.

These Sukuk transactions seem to have traction. According to Rawasi, in a disclosure to Tadawul (The Saudi Exchange) the total number of Sukuk subscriptions was 249,491 Sak, with a Coverage of 499.0%, and 15,991 subscribers.

Saudi multi-sector company Waja similarly issued a SAR10mn (USD2.7mn) Sukuk offering on 13 February 2025 via a private placement. The company appointed Manafea Capital as the financial advisor and sole lead manager for the SAR-denominated transaction.

The minimum subscription amount for both Sukuk transactions open to qualified individual investors, was pegged at SAR1,000, thus making the offering available to a wider universe of qualified retail and individual investors. The Waja Sukuk was issued under the company’s SAR500mn Sukuk Issuance Programme. The 2-year Sukuk have a maturity date of February 2027 but may be subject to early redemption.

The Saudi Ministry of Finance is keen for the Saudi corporate sector and SMEs to increasingly access the Islamic debt market to raise funds on a more favourable basis than traditional bank credit, which is deemed to be more expensive and prohibitive. Sukuk may yet turn out to be a preferred choice for Saudi SMEs to raise funds than even the seasoned Murabaha credit facilities which are dominated by the Kingdom’s Islamic banks and conventional banks’ Islamic banking windows.

ICIEC and ITFC Sign Documentary Credit Insurance Policy to Boost Trade Facilitation and Intra-OIC Trade for the Benefit of Member Countries

Jeddah – In a significant development for IsDB Group synergy and cooperation, the Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), a Shariah-compliant multilateral insurer, and the International Islamic Trade Finance Corporation (ITFC) both members of the Islamic Development Bank (IsDB) Group signed a landmark Documentary Credit Insurance Policy (DCIP) at end February 2025.

This strategic cooperation marks a robust step forward in managing and mitigating risks associated with Letters of Credit (LC) transactions involving Shariah compliant goods and services across OIC member countries and beyond, helping strengthen the economic resilience of these member countries.

The policy will provide critical coverage for ITFC transactions, enhancing trade confidence and facilitating smoother financial operations in global trade involving Shariah compliant products and services, thereby benefiting the broader economic landscape of the member countries. It is designed to provide ITFC with a comprehensive risk management tool to safeguard its LCs Confirmation transactions.

The initiative also seeks to address inherent risks associated with international trade and these robust risk mitigation measures are poised to support increased trade volumes among member countries, thereby contributing to the enhancement of intra-OIC trade as well as international trade. Increased trade strengthens the bonds between these countries, ensuring that risks are managed adeptly and contributing to sustainable development and overall regional prosperity.

Speaking on the occasion, Dr. Khalid Khalafalla, Chief Executive Officer of ICIEC, said: “This policy is a testament to our commitment to fostering secure and robust trade finance solutions, in perfect synergy with our fellow IsDB Group member, ITFC. With the DCIP, we are not only strengthening ITFC’s ability to manage inherent risks in LC transactions but also uniting our efforts to promote smoother and more reliable trade flows among Shariah compliant markets, ultimately benefiting all our member countries.”

ICIEC is unique in that it is the only Shariah-compliant multilateral insurer in the world offering credit and investment Takaful. The Corporation celebrated its 30th Pearl Anniversary in 2024, achieving a historic milestone in cumulative insured business surpassing USD121bn over its 30-year history, significantly contributing to social and economic development across various sectors globally.

Nazeem Noordali, Officer-in-Charge and pending CEO of ITFC, added: “This Documentary Credit Insurance Policy is a crucial step in fortifying trade resilience across our member countries. By mitigating risks associated with Letters of Credit transactions, ITFC is reinforcing its commitment to fostering secure and seamless trade flows that support economic stability and sustainable development. Our collaboration with ICIEC ensures that businesses and financial institutions have the confidence and security needed to expand their trade activities, ultimately driving economic development and greater prosperity for our Member Countries.”

Abu Dhabi-Based Ittihad International Investment Closes USD450mn Senior Unsecured Sustainability-Linked Islamic Revolving Credit Facility, Boosting Liquidity Sources by an Additional USD345mn

Abu Dhabi – Ittihad International Investment LLC, an investment firm based in Abu Dhabi,

successfully completed the arrangement of a USD450mn senior unsecured committed Islamic revolving credit facility (RCF), further strengthening its liquidity position.

In a post on LinkedIn, Ittihad International Investment, said that the facility was arranged by Emirates NBD, Commercial Bank of Dubai, and First Abu Dhabi Bank as Mandated Lead Arrangers and Bookrunners and sustainability joint coordinators, with Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, and Emirates Islamic Bank acting as joint arrangers. Structured at the Holdco level on a pari-passu basis with the outstanding Sukuk certificates while reflecting similar terms and conditions, the facility has a five-year tenure (3+1+1), three years committed with a two-time extension option each for an additional year at the banks’ discretion. It also includes an accordion feature, allowing for an increase in the facility size.

The new RCF is divided into two tranches:

i) Tranche A: USD225mn designated for general corporate purposes, replacing the company’s existing standby RCF of USD105mn which remained undrawn at the time of closing.

ii) Tranche B: USD225mn to replace the company’s existing 90-day subsidiary-level working capital facilities, which were previously financed on an uncommitted basis. Of this, US145mn will be drawn to settle and replace outstanding working capital facilities, while the remaining USD80mn will provide an additional liquidity source on standby for working capital purposes. As a result, the transaction will be leverage-neutral.

This strategic facility, said the company, marks a significant milestone for Ittihad, reinforcing its capital base and supporting future growth through an optimized capital structure. It enhances liquidity, lowers finance costs, and aligns with the company’s commitment to sustainability by integrating environmental and social performance goals into its financing strategy.

Zahi Abu Hamze, Chief Financial Officer of Ittihad International Investment LLC, commented: “We are pleased with the flexibility this transaction provides to support our future financial needs while contributing to our efforts toward an improved credit rating – all at an efficient cost. This is yet another testament to Ittihad’s strong financial outlook. We appreciate the confidence shown by all participating banks in this transaction.”

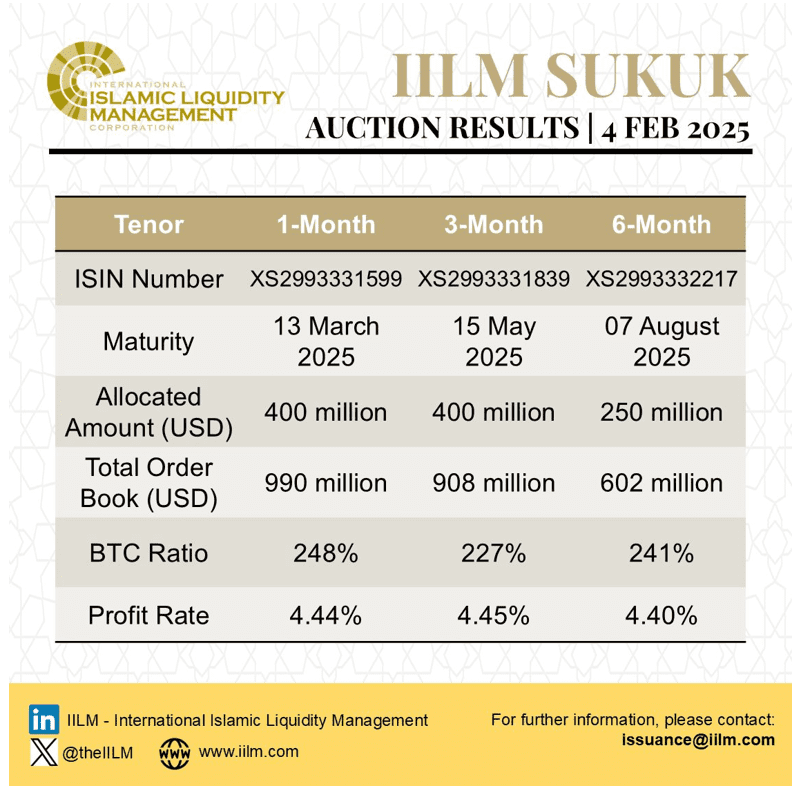

IILM Continues Short Term Sukuk Issuance Momentum with Two Auctions in February 2025 with an Aggregate Reissuance of USD1.76bn

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Shariah-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two transactions in February 2025.

These transactions follow the Corporation’s first auction for 2025 in January with a reissuance of an aggregate USD1.27bn short-term Sukuk across three different tenors of one, three, and six-month respectively.

The first auction on 4 February 2025 saw the successful completion of the reissuance of an aggregate USD1.05bn short-term Sukuk across three different tenors of one, three, and six-month respectively. The three series reissued on 4 February 2025, says the IILM, were priced competitively at: The three series were priced competitively at:

i) 44% for USD400mn for the 1-month tenor

ii) 45% for USD400mn for the 3-month tenor

iii) 40% for USD250mn for the 6-month tenor.

The IILM’s Sukuk reissuance saw a competitive tender amongst the Primary Dealers and Investors globally, with a strong orderbook of USD2.50bn, representing an impressive average bid-to-cover ratio of 238%

Mohamad Safri Shahul Hamid, Chief Executive Officer of IILM, commented: “The outcome of today’s hugely successful auction clearly underscores the unwavering confidence of global Islamic investors in the IILM’s Sukuk as high quality Shariah-compliant liquidity solutions. The impressive demand across all the tenors, despite all the events that are unfolding globally, clearly reaffirms the critical role our instruments play in providing stability and flexibility for Islamic financial institutions globally.

“The heightened global trade tensions have shifted investors’ preference (from riskier assets) towards safer instruments, such as the IILM’s short-term Sukuk, evidenced by the robust bid-to-cover ratio that has allowed us to price today’s offerings within our expectations. We are extremely pleased with the success of today’s auction and hopeful that it will pave the way for us to continue fulfilling our mandate in delivering tailored solutions that will help and facilitate global Islamic financial institutions manage their liquidity positions effectively and proactively.”

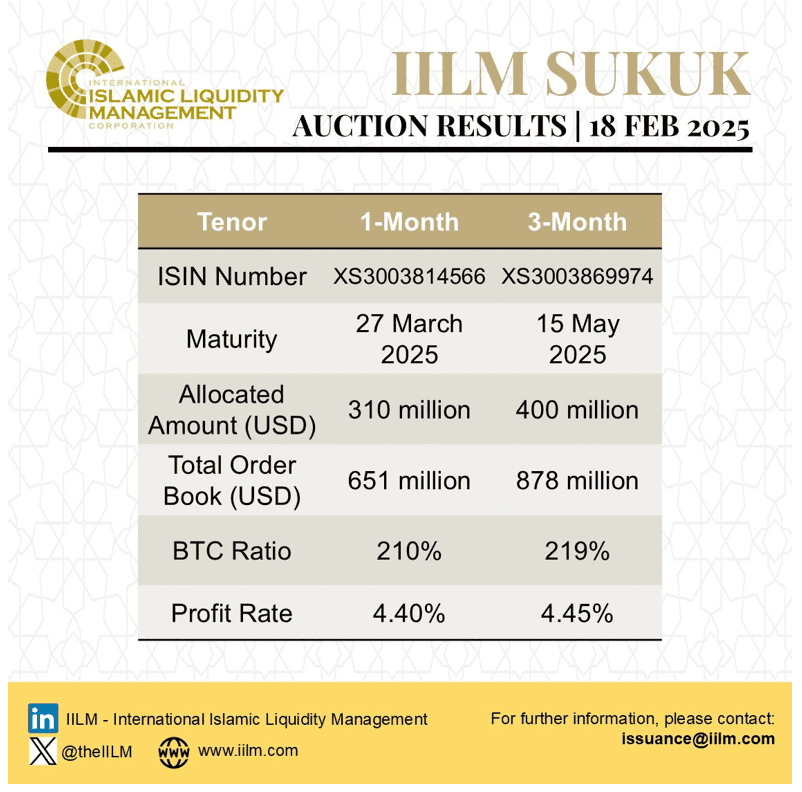

In the second transaction on 18 February 2025, the IILM also successfully completed the reissuance and issuance of an aggregate USD710mn short-term Sukuk across two different tenors of one and three-month respectively. The two series were priced competitively at:

i) 4.40% for USD310mn for the1-month tenor

ii) 4.45% for USD400mn for the 3-month tenor.

This second short-term Sukuk transaction in February today saw a competitive tender amongst the Primary Dealers and Investors globally, with a strong orderbook of USD1.53bn, representing an impressive average bid-to-cover ratio of 215%.

As such the aggregate Sukuk issued in February totalled USD1.76bn, and for the first two months of 2025 to USD3.03bn.

Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, explained that “with today’s auction bringing the total for the month of February to a substantial USD 1.76bn, we are pleased to see continued strong demand for the IILM’s short-term Sukuk. The oversubscription rate reflects deep investor confidence in the IILM’s ability to consistently deliver high-quality, Sharia’a-compliant solutions in dynamic market conditions.”

The second auction of February witnessed an increase in supply of the IILM short-term Sukuk by an additional USD50mn, which further demonstrates the IILM’s dedication to meeting growing demand for high-quality Islamic papers. This demand has been fuelled by the mildly hawkish tone of the Federal Reserve recently, which has led investors to seek safe and reliable investment opportunities.

Additionally, the onboarding of two new Primary Dealers, Golden Global Investment Bank and Kuwait International Bank, brings the total number of Primary Dealers to 14.

This expansion is a strategic move aimed at broadening the IILM’s market footprint, strengthening its service to investors, and advancing the growth of the Islamic finance industry.

“We are encouraged by the competitive pricing and diverse participation in today’s auction, underscoring the IILM’s solid partnerships with an expanding network of Primary Dealers and investors worldwide. As we continue to innovate and enhance our offerings, we remain firmly committed to advancing resilient liquidity solutions for the global Islamic finance industry and are confident of ensuring a robust and meaningful supply of high-quality short-term Sukuk for the benefit of the Islamic financial institutions globally”, added Safri.

The IILM’s short-term Sukuk is distributed by a diversified and growing network of 14 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Affin Islamic Bank, Boubyan Bank, CIMB Islamic Bank Berhad, Dukhan Bank, First Abu Dhabi Bank, Golden Global Investment Bank, Kuwait Finance House, Kuwait International Bank, Maybank Islamic Berhad, Golden Global Investment Bank, Meethaq Islamic Banking from Bank Muscat, Qatar Islamic Bank, and Standard Chartered Bank.

The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation says it will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The issuance forms part of the IILM’s “A-1” (S&P Ratings) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme. The total amount of IILM Sukuk outstanding currently stands at USD4.19bn.

Looking ahead into 2025, the IILM plans to ramp up its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohamed Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Shariah-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM says it will also continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD118.25bn worth of short-term Sukuk across 284 series.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye and the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.