NEWS in BRIEF

Red Sea International Subsidiary Fundamental Installation Obtains Aggregate SAR910m (USD242mn) Murabaha Credit Facility from Local Banks to Fund Guarantees and LC Facilities for Projects

Riyadh – The Fundamental Installation for Electric Work Ltd, a subsidiary of Red Sea International Company, a Saudi-based leading supplier of specialised prefabricated modular buildings for various real estate and industrial sectors, has obtained Murabaha Credit Facilities totalling SAR910.075mn (USD242.25mn in three transactions in November and December 2024.

Fundamental Installation is a local market leader and one of the top standalone MEP contractors delivering world class projects via end-to-end solutions that provide integrated design, engineering and construction services in the field of mechanical, electrical, and plumbing (MEP) works.

The first facility signed on 5 November 2024 was with Saudi National Bank (SNB) for SAR280mn (USD74.53mn) with a tenure from 05/11/2024 to 30/04/2025. The facility, according to a disclosure to Tadawul (the Saudi Exchange) is guaranteed by a Promissory Note to the value of the facility size signed by The Fundamental Installation for Electric Work Co. Ltd. and other guarantors. This includes two corporate guarantees – one for SAR142.8mn given by Red Sea International Company and the second for SAR105.644mn given by MSB Holding Company.

The second facility signed on 13 November 2024 was with Riyad Bank (SNB) is a renewal of an existing facility which expired in August 2024 for SAR237.875mn (USD63.32mn) with a tenure of 3 years. The facility, according to a disclosure to Tadawul (the Saudi Exchange) is guaranteed by a Promissory Note to the value of the facility size signed by The Fundamental Installation for Electric Work Co. Ltd. and by eleven corporate and individual guarantors.

The third facility signed on 17 December 2024 was similarly with Riyad Bank for SAR392.2mn (USD104.40mn) with a tenure of 3 years. The Murabaha credit facility, according to a disclosure to Tadawul (the Saudi Exchange), in this tranche was signed with Red Sea International. This facility is guaranteed by a Promissory Note to the value of SAR397.215mn signed by Red Sea International Company.

The proceeds from the first two facilities, according to Red Sea International, will be used to issue the Bonds (Bid Bond, Advance Payment Bond, Performance Bond, Retention Bond) that may be required in its upcoming projects in addition to LC Facilities and PPF. The proceeds from the third facility is to issue bank guarantees for the project signed with Webuild S.p.A. to build a camp for employees.

Red Sea International is a leading Saudi company in the field of providing model solutions and building high-quality administrative and residential complexes and field hospitals in very short periods of time and creating the necessary infrastructure for various sectors, in addition to operating these complexes and providing all living requirements for guests. This includes electrical power, clean water, food supply, and wastewater treatment. The company uses high-quality local products and manufactures modular units in local, regional, and global manufacturing facilities to meet the housing, catering, and food service requirements of various strategic projects, especially those initiatives that form part of the Kingdom’s Vision 2030.

Arab Coordination Group Allocates USD10bn to Address Critical Issues of Land Degradation, Desertification and Drought in Member States

Riyadh – The Arab Coordination Group (ACG), a strategic alliance of ten leading development finance institutions in the Middle East Region, made a landmark commitment on 3 December 2024 of US$10bn of financing by 2030 to address the critical challenges of land degradation, desertification and drought.

The Group comprises the Islamic Development Bank (IsDB),which serves as its secretariat, Abu Dhabi Fund for Development, the Arab Bank for Economic Development in Africa, the Arab Fund for Economic and Social Development, the Arab Gulf Programme for Development, The Arab Monetary Fund, the Kuwait Fund for Arab Economic Development, the OPEC Fund for International Development, the Qatar Fund for Development, and the Saudi Fund for Development.

The announcement was made during the Ministerial Dialogue on Finance: “Unlocking public and private finance for land restoration and drought resilience”, at the 16th session of the Conference of the Parties (COP16) to the United Nations Convention to Combat Desertification (UNCCD), hosted in Riyadh, Saudi Arabia.

This transformative commitment, made as part of a joint communiqué issued by the Heads of ACG Institutions led by the Islamic Development Bank (IsDB), said the Group, will drive land restoration efforts, enhance climate resilience and promote nature-positive development across vulnerable regions. ACG members will leverage innovative financing instruments, mobilize resources and strengthen partnerships to support sustainable land management, biodiversity conservation and food security, particularly in the Middle East, North Africa and the Sahel.

“The ACG’s US$10bn pledge underscores our shared determination to address some of the most pressing challenges of our time. By restoring degraded lands and combating desertification and drought, we are not just preserving ecosystems but also securing livelihoods and fostering resilience in the world’s most vulnerable communities,” said IsDB Group Chairman, Dr. Muhammad Al Jasser, speaking on behalf of the ACG.

The Group’s new pledge builds on (and will be primarily sourced from) its US$50bn pledge made in Riyadh in November 2023 to help build resilient infrastructure and inclusive societies in the African continent, its US$24bn pledge for climate finance made at COP 27 in November 2022, and its US$10bn for Food Security Action Package announced in June 2022.

The ACG acknowledged Saudi Arabia’s leadership in advancing key global environmental initiatives, including the Saudi and Middle East Green Initiatives, and the G20 Global Land Initiative. These programs serve as benchmarks for global collaboration and underscore the importance of coordinated efforts to enhance land restoration and climate adaptation.

The Group also reaffirmed its commitment to supporting the global agenda for land protection and restoration as well as the Riyadh Global Drought Resilience Partnership in alignment with the UNCCD objectives. It does so by fostering partnerships, mobilizing resources, and calling for the creation of international platforms for knowledge-sharing and capacity-building to support sustainable land management, climate adaptation and ecosystem restoration globally.

Emirates NBD and ADIB Close GBP140mn Sharia’a-compliant Financing Facility with Union Property for Student Accommodation Deal in London

London – Emirates NBD, the second largest lender in the UAE, and the Abu Dhabi Islamic Bank (ADIB) closed a GBP140mn (USD177.6mn Sharia’a-compliant senior financing transaction for a prime purpose-built student accommodation (PBSA) asset in central London in a 50/50 club deal.

The financed asset, Paddington Citi View, comprises 353 bedrooms complemented by a range of top-notch amenities that promote socialisation, wellbeing, and comfort, and is located close to London’s popular Paddington Station. Paddington Citi View was formerly known as Lillian Pension Hall. The property was acquired by Union Property in 2022 from the University of London.

According to Union Property, residents can look forward to access to a bookable kitchen/dining area, games room, gym, individual and group study areas, a laptop bar, laundry facilities, and secure cycle storage. Additionally, the building’s internal fabric will be extensively renovated to feature state-of-the-art VRF heating and cooling systems, smart controls, and building management systems. “At Union Property Services Ltd, we take great pride in delivering exceptional student accommodation that not only meets the needs of our residents but also demonstrates our commitment to sustainability and energy performance,” stressed the company.

The UK’s PBSA market has attracted interest from global investors in recent months. According to property brokers and experts, Knight Frank approximately GBP840mn was invested in the sector during Q3 2024 across 15 deals, with a year-to-date total of GBP3.3bn, surpassing the same period last year by GBP1.3bn. Gulf investors particularly are major players in the UK commercial property market.

SEC Signs USD3.6bn (SAR13.5bn) Hybrid International Syndicated Credit Financing Facility with a Consortium of Nine International Conventional Banks and Four GCC Islamic Banks

Riyadh – The Saudi Electricity Company (SEC), the state-owned utilities firm in which the Kingdom’s sovereign wealth fund Public Investment Fund (PIF) has a 75% equity stake, signed a USD3.6bn (SAR13.5bn) international syndicated financing agreement with a consortium of 13 leading global, regional and local banks on 12 December 2024.

The participating financial institutions include Industrial and Commercial Bank of China (ICBC), Bank of China, Agricultural Bank of China, Bank of Communications, China Construction Bank, KFW IPEX-Bank, State Bank of India, First Abu Dhabi Bank, Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Boubyan Bank, Dubai Islamic Bank, and Saudi Investment Bank.

The financing, which comprises both Islamic Murabaha Syndicated and conventional tranches, is unsecured and has a five-year term, with an option to extend for an additional two years. This agreement underscores the company’s strong creditworthiness and the trust it enjoys within global financial markets. No details were given relating to the profit rate or the size of the conventional and Islamic tranches.

Commenting on the agreement, Khaled Al-Ghamdi, Acting CEO of SEC, stated: “This agreement is not just a mere financing transaction; it represents a key strategic step supporting our ambitious investment strategy. The financing will support our initiatives to modernize and expand our electric gird infrastructure, connect renewable energy plants, build battery storage systems and enhance its capacities as well as providing high quality services for customers. This ultimately is expected to drive sustainable growth prospects while boosting shareholders’ value.”

“At SEC,” he added, “we are fully committed to our pivotal role in enabling a diverse and sustainable energy mix within the Kingdom’s grid, in alignment with Saudi Vision 2030. This along with our mandate to meet the fast-growing demand for electricity services that keep pace with the Kingdom’s dynamic economic progress. Furthermore, we remain steadfast in our dedication to enhancing local content and fostering industry localization while contributing to enriching the national economy.”

Türkiye Treasury Continues Domestic Sovereign Lease Certificates Issuance Raising an Aggregate USD557.01mn Eq. Funds Through Fixed Rate and FX Leasing Certificates Offerings in Two Auctions in November 2024

Ankara – Türkiye’s sovereign domestic Sukuk issuance continued its momentum in November 2024 with two auctions raising an aggregate USD (Eq) 557.01mn as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals.

It also complements the USD2.5bn international Sukuk issued in November 2024 by the Türkiye Treasury, and the USD750mn maiden Sukuk issued by the Türkiye Wealth Fund. (see articles above).

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

The Treasury had an auction in the FX-linked issuance market on 12 November 2024 when it raised USD208.37mn through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 728 days priced at a fixed rental rate of 2.32% over 6 months and maturing on 13 May 2026. Demand for the certificates was robust.

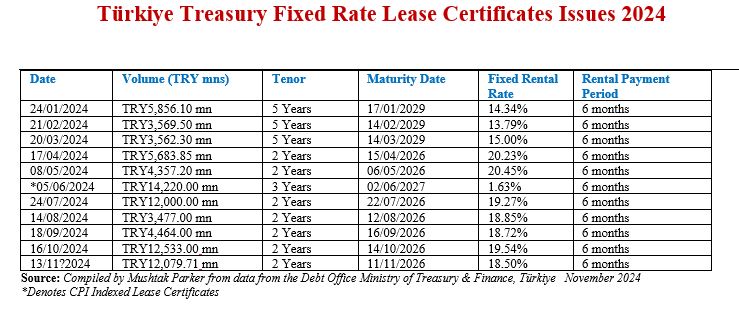

The Fixed Rate Lease Certificate market is the mainstay of the Treasury’s fund-raising in the Sukuk market, with auctions in consecutive months since January 2024.

The Türkiye Treasury raised TRY12,079.71mn (US$348.64mn) in an auction on 13 November 2024 through the issuance of 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 11 November 2026 priced at a fixed profit rate of 18.50% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

This follows the TRY12,533.00mn (US$365.53mn) raised by the Türkiye Treasury in an auction on 16 October 2024 through the issuance 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 14 October 2026 priced at a fixed profit rate of 19.54% over a 6-month rental period.

The Türkiye Treasury in the first eleven months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY81,803.16mn (US$2,390.48mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Türkiye Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds.

The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. Both Auctions were conducted by the Central Bank of Turkey via its AS (Auction System under Central Bank Payment Systems) on 12 November 2024.

Malaysia’s Mortgage Securitiser Cagamas Berhad Raises RM2.2bn (USD490mn) in Hybrid Sukuk and Conventional Bond Issuances in November 2024

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, returned to the Sukuk market in November 2024 after a hiatus of several months.

The mortgage securitiser successfully concluded the issuance of RM1.1bn (US$490mn) worth of bonds and Sukuk on 8 November 2024. This latest offering comprised a RM400mn (USD89.44mn) in 5-year Islamic Medium-Term Notes (IMTNs), RM100mn in 1-year Conventional Medium-Term Notes (CMTNs), RM575mn (USD128.56mn) in Islamic Commercial Papers (ICPs), and RM150mn in Conventional Commercial Papers (CCPs). An additional SGD305mn million (equivalent to RM1bn) was issued in 1-year Singapore Dollar Medium Term Notes (SGD EMTNs) through the Company’s wholly-owned subsidiary, Cagamas Global P.L.C.

Kameel Abdul Halim, President/Chief Executive Officer of Cagamas commented: “The successful conclusion of our fundraising activities, despite continued volatility in the local and global fixed income market, reaffirms our role as a secondary mortgage corporation in providing liquidity to primary lenders of home financing and housing loans. Demand for Cagamas’ foreign currency bonds remains resilient across diverse investor profiles. The SGD issuance was fully subscribed by foreign investors, which include asset managers and financial institutions. This latest issuance has brought the cumulative SGD-denominated issuance for the year to SGD525mn, with total funds raised by Cagamas reaching RM15.2bn as at October 2024.”

The SGD denominated bonds, issued via the Company’s wholly owned subsidiary, Cagamas Global P.LC. are fully and unconditionally guaranteed by Cagamas while the Ringgit issuances, which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM413.76 billion (US$88.16 billion) worth of corporate bonds and Sukuk.

Consortium of GCC Banks Arrange Inaugural SAR2bn (USD800mn) Revolving Murabaha Credit Facility for PIF-owned New Airline Startup Riyadh Air with a Further Committed Accordion Option of SAR2bn (USD530mn)

Riyadh – When you are wholly-owned by one of the world’s largest sovereign wealth funds (SWFs), the Public Investment Fund (PIF) of Saudi Arabia, then your credit essentials assume a trajectory of its own even though you are an ambitious new startup airline in a crowded regional market but backed by the financial power of your parent.

As such Riyadh Air, the newest airline on the bloc as it gears up to its official launch in 2025, successfully closed its inaugural “self-arranged” Murabaha Revolving Credit Facility totalling SAR5.0bn (USD1.33bn) during the FII 8th Edition 2024 (Future Investment Initiative) held in Riyadh.

The transaction comprised an upfront SAR3bn (USD800mn) Murabaha Revolving Credit Facility signed on 31 October 2024, and a committed accordion option for an additional SAR2.0bn (USD530mn) signed on 18 November 2024. The one-year, unsecured financing agreement attracted the participation of eight leading financial institutions including Arab National Bank (ANB), Al Rajhi Bank, Gulf International Bank (GIB), Emirates NBD (ENBD), Riyad Bank, Banque Saudi Fransi (BSF), Saudi Awwal Bank (SAB), and Saudi National Bank (SNB).

This transaction is Riyadh Air’s first foray into the Islamic finance sector and its first corporate finance facility. According to the airline, which aims to serve over 100 destinations, the financing will play a critical role in supporting its ambitious aircraft acquisition activities and addressing its short-term working capital needs as it prepares to launch operations in the summer of 2025.

On 30 October 2024, Riyadh Air placed an order for 60 Airbus A321neo aircraft to its expanding fleet as it inevitably starts to challenge established rivals such as Emirates Airlines and Qatar Airways.

Adam Boukadida, Chief Financial Officer of Riyadh Air, speaking to the media at the Future Investment conference in Riyadh, commented: “Securing this Revolving Credit Facility is a pivotal moment for Riyadh Air as we gear up for our launch. The confidence shown by our banking partners in this facility underscores their belief in our business model and our vision to redefine air travel. We have always strongly maintained that Riyadh Air will be a commercially sustainable business, and this is reflected in their steadfast support for our plans. This financing not only strengthens our liquidity but also aligns with our strategy to maintain financial discipline as we approach our operational debut.”

The facility, he added, highlighted the airline’s strong market positioning and readiness to make a significant impact in the aviation sector, even before the commencement of its operations. “The successful self-arrangement of this facility reflects the confidence and support from the banking community and marks a crucial step in solidifying the airline’s financial foundation. This flexible financing tool will play a critical role in supporting Riyadh Air’s ambitious aircraft acquisition activities and addressing the airline’s short-term working capital needs. The facility is in Saudi riyals and it’s very well priced.” He did stress that future forays into the debt and capital markets, including bonds/Sukuk issuances are likely.

Johor Plantations Group Taps Market for Inaugural RM1.35bn (USD304.05mn) Sukuk Wakalah, Marking the Issuance of the World’s First Sustainability-linked Sukuk in the Plantation Sector

Johor Baru – Johor Plantations Group Berhad successfully completed its inaugural Sukuk issuance – a RM1.35bn (USD304.05mn) Sukuk Wakalah in October 2024. The transaction was done under the company’s unlimited Sukuk Wakalah Programme. With this Sukuk issuance, JPG said it will see a significant reduction in its annual interest expenses.

The blended profit rate for the RM1.3 billion IMTN (Islamic Medium-Term Notes) issuance was priced at 4.08%, compared to an average of 5.12% on existing facilities. This translates to an approximate saving of RM12.8 million annually, improving the group’s cash flow and enhancing profitability.

“Upon repayment of our Islamic Syndicated Term Financing (STF-i) of RM1.5bn and the Islamic Term Financing (TF-i) of RM500mn, collateral valuedat RM2.4bn will be released,” said the company. The proceeds from the Issuance, according to Johor Plantation Group, will be used for Sharia’a-compliant purposes, including refinancing its existing and future Sharia’a-compliant borrowings, supporting working capital, investments and capital expenditure as well as covering fees and expenses related to establishing the Sukuk Wakalah Programme.

Structured on the Sharia’a principle of Wakalah Bi Al-Istithmar, the issuance, stressed the company, marks the world’s first sustainability-linked Sukuk in the plantation sector, and the first rated Sukuk under the Sustainable and Responsible Investment (SRI) Linked Sukuk Guidelines by the Securities Commission in Malaysia.

The Sukuk features a one-way upward adjustment to its profit rates linked to JPG’s achievement of predetermined sustainability performance targets. The targets include 50% carbon intensity reduction (Scope 1 and 2) against its 2012 baseline, 100% traceability to fresh fruit bunches (FFB) suppliers by 2025 and annual water consumption of 1.2 cubic meters per metric tonne FFB and below. Maybank Investment Bank acted as the Sole Principal Adviser, Sole Sustainability Structuring Adviser, Joint Lead Arranger and Joint Lead Manager for the Sukuk transaction.

Bank Islam Malaysia Launches Gold-back Savings Account to Democratise Access of Mass Market Participants in the Precious Metals Market to Diversify their Savings Portfolios and to Promote Wealth Management

Kuala Lumpur – Bank Islam Malaysia Berhad, the flagship Malaysian Islamic bank, launched a gold-backed Shariah-compliant product, Bank Islam Gold Account-i (BIGA-i) in November 2024.

Bank Islam Gold Account-i is essentially a financial inclusion service which “offers the mass market the opportunity to participate in the precious metal market, promoting wealth creation and accumulation.” The innovative offering empowers customers to diversify their financial horizons by adding gold to their asset portfolio or leveraging it as a flexible savings solution.

Bank Islam Group Chief Business Officer – Group Retail Banking, Mizan Masram, said BIGAi is a Shariah-compliant gold product which aims to help promote wealth creation, accumulation, and transfer among customers. “This account is beginner-friendly for those new to the precious metal market. It requires an initial and subsequent purchase of a minimum of RM10 or its gram equivalent based on the prevailing gold price during the transaction, making it also suitable for those with limited experience in the market.

“As a Bank committed to advancing prosperity for all, we are introducing an additional investment diversifier that offers a seamless, secure, and affordable way to purchase and invest in gold. Supported by physical gold with 99.9% purity, accredited by the London Bullion Market Association (LBMA), customers can enjoy the benefits of gold investment without needing to hold or store them physically,” Mizan adds.

Account opening, gold purchasing and selling, account-to-account transfer and gold conversion for BIGA-i are now available at all 135 Bank Islam branches nationwide.

IILM Closes 2024 with a Final Reissuance of an Aggregate USD690mn of Short-term Sukuk and a Steady Expansion of a Diverse Investor Base

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant liquidity management instruments, successfully completed its final Sukuk issuance of the year in an auction on 4 December, capping off a period of remarkable success and growth in 2024.

This 14th reissuance auction of the year raised an aggregate USD690mn and according to IILM, follows a series of significant milestones, including a nearly 20% increase in the outstanding size to USD4.14bn (end-2023: USD3.51bn), and a marked steady and continued expansion of the investor base across diverse jurisdictions and new markets. This latest transaction follows two auctions in November 2024 raising an aggregate USD1.81bn.

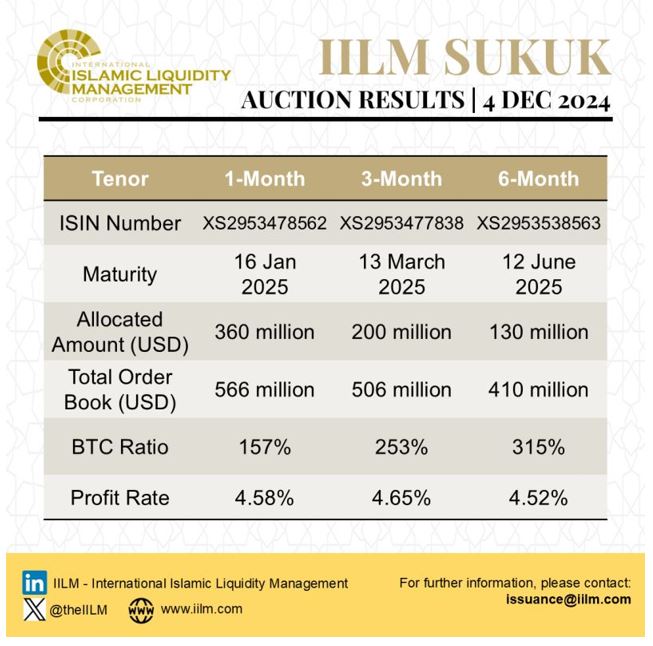

The December auction saw the successful completion of the reissuance of an aggregate USD690mn short-term Sukuk across three different tenors of one, three, and six-month respectively. The three series reissued on 4 December 2024, says the IILM, were priced competitively at:

i) 4.58% for the USD360mn Sukuk with a 1-month tenor.

ii) 4.65% for USD2000mn Sukuk with a 3-month tenor.

iii) 4.52% for USD130mn Sukuk with a 6-month tenor.

According to the Corporation, despite the challenging global market conditions and persistent uncertainty, the demand for the IILM’s Sukuk remained strong, highlighting investor confidence and the resilience of Islamic finance. The substantial growth in both the volume and geographic spread of investor participation underscores the IILM’s strengthened position in the global Islamic capital market and its continued ability to attract both existing and new investors, reflected in the healthy order book more than USD1.48 billion, i.e. a bid-to-cover ratio of 215%, it added.

Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented: “This year’s Sukuk offerings more than a cumulated amount of USD13bn have demonstrated our ability to adapt to new market dynamics, manoeuvre shifting market rates expectations while maintaining a strong investor confidence. The solid demand for the IILM Sukuk, particularly in new markets, reinforces our commitment to expanding access to Sharia’a-compliant liquidity tools opportunities worldwide. This auction represents the final Sukuk issuance for 2024, which further solidifies the IILM’s leadership in the global Sukuk market.

“The expansion of the IILM’s issuance programme size to USD6bn (from USD4bn) has facilitated the inclusion of new Sukuk assets worth approximately USD1bn, allowing us to reach USD4.14bn in outstanding asset portfolio, post-redemption of maturing assets. This has enabled the IILM to further diversify its asset portfolio, while expanding the volume of its monthly short-term Sukuk issuances currently averaging at USD1bn (end-2023: USD 960 million) to a projected average of USD1.3bn in 2025. This will inevitably reinforce the growing importance of IILM’s short-term Sukuk to the Islamic financial institutions across the globe, in providing them with much-needed access to reliable and dependable sources of high-quality liquid asset instruments.”

The year 2024 also saw the IILM’s extension of its global footprint to a broader investor base by tapping new markets, as well as the inclusion of Affin Islamic Bank in May 2024 as the IILM’s eleventh primary dealer, alongside the impending onboarding of Meethaq as the first primary dealer from Oman.

The IILM saw the participation of 25 new investors across different regions for its short-term Sukuk this year, including 13 Islamic accounts, which further reflects the growing market confidence in the IILM’s high-quality Islamic papers and reinforces the IILM’s status as a unique provider of Sharia’a-compliant liquidity management solutions.

Looking ahead into 2025, the IILM plans to ramp up its asset origination activities through bespoke and attractive offerings to address the diverse needs of global sovereign and sovereign-linked Sukuk issuers, as well as rolling out alternative to Sukuk assets to allow further growth of supply and meet the growing market demand.

The IILM will also continue to expand its investor base and network of primary dealers as it looks to expand regional collaborations and enter new markets to further integrate Islamic liquidity solutions into the global financial system. The Corporation, says Mr Mohammed Safri, remains committed to developing the Islamic liquidity management infrastructure and enhancing the Sharia’a-compliant liquidity tools available to the market, working closely with scholars, regulators, and industry stakeholders to resolve inconsistencies that may hinder growth.

The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued a cumulative of USD113.95bn worth of short-term Sukuk across 276 series. The issuance forms part of the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme.

The regular Sukuk auctions and the upsizing of the Sukuk programme to USD6bn reflects the growing and sustainable demand for high quality Sukuk issued by the IILM, which has seen oversubscription rates exceeding 220% year-to-date, stresses Mr Safri, also reinforce “the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Shariah-compliant High-Quality Liquid Assets (HQLA).”

The IILM’s short-term Sukuk is distributed by a diversified network of 12 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, Affin Islamic Bank, Meethaq, and Standard Chartered Bank. The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.