NEWS in BRIEF

IsDB Allocates USD1.15bn to Finance Phase 1 of the Climate Resilient Water Resources Development Project in Kazakhstan

Baku – The Islamic Development Bank (IsDB) and the Republic of Kazakhstan signed a landmark agreement on 12 November 2024 in Baku during the COP29 summit to launch Phase 1 of the Climate Resilient Water Resources Development Project.

The signing ceremony was attended by Kazakhstan’s President Kassym-Jomart Tokayev, with the agreement signed by Mr. Nurlan Baibazarov, Deputy Prime Minister and Minister of National Economy of Kazakhstan, who is also Kazakhstan Governor to the Board of the IsDB, and Dr. Muhammad Al Jasser, President of the IsDB. The Project has a financing value of USD1.32bn, of which the IsDB is funding USD1.15bn billion. It aims to boost Kazakhstan’s water infrastructure, while at the same time strengthening its resilience to climate change.

The project encompasses several major infrastructure developments and capacity-building initiatives. At its core, the project will establish 11 strategic reservoirs designed for seasonal water storage and flood control, while simultaneously rehabilitating 3,400 kilometres of irrigation networks across the country. The initiative will also focus on enhancing river flows across 100 kilometres, significantly improving water distribution and accessibility. To ensure long-term sustainability, the project includes an extensive training programme for 1,100 staff members in advanced water management techniques, along with providing climate-smart agricultural training to 100,000 community members.

“This project demonstrates the powerful synergy between IsDB and Kazakhstan, focusing on long-term climate resilience, food security, and sustainable economic growth for the people of Kazakhstan. By 2032, this project will result in 350,000 hectares of sustainably irrigated land for crop production, an average of 20% yield increase for key crops, and a 25% reduction in water loss in the irrigation system,” emphasised Dr. Muhammad Al Jasser.

As the first phase of a comprehensive water security programme, added Dr Al Jasser, this initiative underscores Kazakhstan’s commitment to environmental sustainability and IsDB’s dedication to innovative development solutions. The project will enhance agricultural productivity, secure water resources for vulnerable communities, and strengthen the nation’s ability to adapt to climate change.

Leading Saudi EPC Contractor, Arkad Engineering & Construction, Issues USD800mn Perpetual Sukuk to Refinance Existing Debt Obligations

Riyadh – Arkad Engineering & Construction, a leading EPC contractor in Saudi Arabia’s oil and gas pipeline industry and which has an extensive track record of delivering high-profile projects, including for Saudi Aramco, is the latest Saudi corporate to raise funds through a Sukuk issuance.

Haykala-IMAP Saudi Arabia acted as the lead arranger for the issuance of USD800mn in Perpetual Sukuk. According to Hisham Ashour, Managing Partner at Haykala-IMAP, the perpetual Sukuk, a quasi-equity instrument, provided Arkad with the flexibility to settle its financial obligations over an extended period through a cash swap mechanism benefiting its creditors. This structure was linked to a cross-default mechanism associated with Arkad’s other debt instruments, with covenants aligned to industry standards.

As part of Arkad’s broader financial restructuring, the company successfully restructured 100% of its USD800mn debt, utilizing a combination of perpetual Sukuk, a Murabaha credit facilities as payments to banks, creditors, government entities, and employees. Haykala, says Mr Ashour, leveraged its extensive expertise in structuring complex financial instruments and its strong relationships with financial institutions to secure creditor approval and execute this strategic transaction, ensuring Arkad’s long-term financial stability and positioning it for future growth.

IsDB Contributes USD96.73mn Towards Financing the Maiden Tower Climate Resilient Water Project in Karabakh in Kazakhstan

Baku – Dr. Muhammad Al Jasser, the President of the Islamic Development Bank (IsDB), met President Ilham Aliyev, the host of the COP29 Summit, on 14th November 2024 when they discussed bilateral relations and how the IsDB can support the country’s economic development and solidify the long-standing relations between Azerbaijan and the IsDB Group.

During the meeting, President Al Jasser commended President Aliyev’s leadership in hosting the 29th session of the UN Climate Conference. He said the Bank was proud to collaborate closely with Azerbaijan authorities to successfully host the conference, during which the IsDB Group showcased its extensive climate initiatives, strategic plans, and projects.

In a significant milestone to enhance the country’s agricultural productivity, food and water security, and economic development, the two leaders witnessed the signing of the project agreements of Maiden Tower Climate Resilient Water Project in the Karabakh region. The agreements were signed by Mikayil Jabbarov, Minister of Economy and IsDB Governor, Samir Sharifov, Minister of Finance and IsDB Alternate Governor, and Zaur Mikayilov, Chairman of Azerbaijan State Water Resources Agency and by Dr. Zamir Iqbal, IsDB Vice President Finance, and Dr. Walid Abdelwahab, IsDB Group Regional Hub and Turkiye Director.

The IsDB is contributing USD96.73mn towards the financing of the project. President Dr. Al Jasser emphasized that the project will significantly improve agricultural productivity, enhance food and water security, and foster socioeconomic development and livelihoods of communities, as its impacts are expected to reach 1.6 million people benefitting from climate-smart agriculture services, and increase agricultural production water use efficiency.

The project aims to construct an irrigation scheme for 8,400 hectares of developed land in the Jabrayil and Fuzuli districts and enhance the water supply conditions for 252,000 hectares of agricultural land in the Mil-Mugan Economic Region. The Azerbaijan State Water Reserves Agency (ASWRA), the newly formed and consolidated Agency in the water sector, will be the project’s executing agency.

Leading Saudi Desalination and Renewables First Mover, ACWA Power Turns to Hybrid Conventional/Sharia’a-compliant Financing Innovations to Fund Projects in Uzbekistan and Azerbaijan

Riyadh – ACWA Power, the world’s largest private water desalination company, leader in energy transition and first mover into green hydrogen, signed four agreements worth USD1,784mn (SAR6,69mn) on the first day of the Future Investment Initiative (FII8) in Riyadh in October 2024.

The agreements encompass streams including projects in GCC, China, Central Asia and North Africa, in financing, renewable energy and storage projects, as well as research and development. These agreements encompass key areas such as project financing, renewable energy and storage projects, as well as research and development initiatives. Another feature of ACWA Power project financing is that it increasingly involves hybrid conventional and Sharia’a compliant financing facilities.

The first agreement in this latest funding round involves a conventional USD690mn (SAR 2,58mn) framework agreement with the National Bank of Kuwait (NBK) for general corporate finance facilities that will support the company’s future project pipeline in Saudi Arabia, Kuwait and other target markets.

A separate financing agreement includes a USD240mn (SAR900mn) Sharia’a-compliant equity bridge loan (EBL) by the International Finance Corporation (IFC), the private sector funding arm of the World Bank Group. The loan will finance two solar power projects in Uzbekistan. Located in Samarkand, the Sazagan 1 and 2 projects each consist of 500MW solar photovoltaic (PV) and 334MW battery energy storage systems (BESS) capacity. Both projects are expected to achieve commercial operations between Q3 2025, Q4 2026.The agreement, says the company, marks the first corporate financing partnership with IFC, establishing a new avenue of collaboration for ACWA Power.

ACWA Power also announced a joint development agreement with battery solutions provider Gotion Power Morocco. As part of the agreement, ACWA Power will develop a 500MW wind power plant, incorporating a 2,000 MWh BESS solution. The project will supply energy to Gotion Power’s battery manufacturing plant in Morocco, which is expected to begin production in the first half of 2026. The initial investment of the project is for USD800 million (SAR 3,000 million)

Meanwhile, ACWA Power also signed a Research and Development Cooperation Agreement with China’s Lujiazui Administration Bureau to establish an R&D centre in Shanghai. The USD54 million (SAR 202 million) project will focus on advancing technologies related to solar, wind, energy storage, green hydrogen, and desalination. The centre will collaborate with local and global partners to develop advanced sustainable water and energy solutions for deployment across ACWA Power’s portfolio.

On 12 November 2024 during COP29 in Baku, ACWA Power, successfully closed senior debt facilities worth USD238mn to finance a key renewable energy project in the Caucasus. The European Bank for Reconstruction and Development (EBRD) and the OPEC Fund for International Development provided the USD238mn senior debt financing facilities for the Absheron-Khizi 240MW Wind Farm in Azerbaijan. Additionally, an equity bridge financing facility of USD 120mn, based on a Sharia’a compliant structure, was secured from First Abu Dhabi Bank (FAB) earlier this year.

Islamic Development Bank Extends USD156.3mn Murabaha Facility to Turkmenistan to Finance Three State-of-the-Art Cancer Treatment Healthcare Facilities

Washington DC – The Islamic Development Bank (IsDB) and Turkmenistan signed a landmark Murabaha financing agreement worth USD156.3mn towards financing the building of 3 state-of-the-art healthcare facilities specialized in cancer treatment in the country.

The agreement was signed in Washington DC during the Fall Annual Meetings of the World Bank/IMF Group in October 2024 Mr. Rahimberdi Jepbarov, Chairman of the State Bank for Foreign Economic Affairs and IsDB Governor for Turkmenistan, and Dr. Muhammad Al Jasser, President of the IsDB.

The total cost of the project is US$259mn which will see the construction of 3 modern hospitals in the key cities in Balkanabad, Turkmenabad, and Mary provinces offering cutting-edge oncology services to 11,750 patients.

The two sides, in their bilateral discussions, further explore their ongoing deep-rooted cooperation and agreed to continue joint efforts in the framework of IsDB Member Country Partnership Strategy document (MCPS 2024-2027). They also agreed to cooperate on a technical assistance programme in green energy and infrastructure projects as well as spearheading further private sector engagement.

IsDB has substantially contributed to development financing in favour of Turkmenistan for different sectors mainly energy, healthcare, ICT, transport and trade. The IsDB Group, says the Bank, has mainly supported major projects in Turkmenistan which reinforce regional connectivity and boost the country’s export potential amongst them; the Bereket-Etrek Railway project; the Telecommunications Network Enhancement Project, and the TAPI Gas Pipeline.

ICD Co-finances Sustainable Highway Project in Istanbul to the Tune of €40mn (USD42.22mn) as Part of a €1.04bn Senior Debt Package

Istanbul – The Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, is participating in a consortium of multilateral development institutions, export credit agencies to co-finance the Nakkaş-Başakşehir section of Türkiye Northern Marmara Highway Project in Türkiye.

The project has a €.14bn senior debt package, fully financed by international institutions, including the European Bank for Reconstruction and Development (EBRD), the Asian Infrastructure Investment Bank (AIIB), the Islamic Development Bank (IsDB), alongside Atradius and SERV as European export credit agencies, and ICIEC, the multilateral insurer of the IsDB Group. and a consortium of commercial lenders. ICD’s co-financing contribution is €40mn.

The Project aims to enhance Istanbul’s east-west connectivity, improve road safety and reduce congestion. It is being developed under a build-operate-transfer agreement by a consortium led by Rönesans Holding A.Ş. in partnership with Samsung C&T Corporation and other Korean investors. It involves a 31.3-km toll road, including a 1.6-km cable-stayed bridge and multiple overpasses and underpasses.

The project has sustainability embedded in its core design thanks to a Solar Energy Production System to be installed within the scope of the Nakkaş-Başakşehir project. The clean energy obtained from solar panels, says ICD, will meet the energy needs of the highway’s operation and management (O&M) centre and service stations.

The installation of over 4,500 LED lamps, replacing sodium lamps, will cut energy consumption by 37.5%, saving over 35 MWh. Within the scope of the project, in which all O&M highway vehicles are planned to be hybrid or electric, it is expected to save approximately 112 thousand litres of fuel annually. While the Nakkaş-Başakşehir Highway Project is expected to prevent 7.9 million tons of greenhouse gas (GHG) emissions in 30 years it will reduce particulate matter (PM) emissions by 1,399 tons, nitrogen oxides (NOx) by 58,699 tons and sulphur dioxide (SO2) by 95 tons.

ITFC Joins Consortium of MDBs to Develop Supply Chain Finance Markets Including International Islamic Supply Chain Finance for SMEs in Member Countries Through WTOs Working Group

Jeddah – A Group of Multilateral Development Banks (MDBs) and financial institutions agreed in a meeting in October 2024 to coordinate and collaborate “to further increase financial support, improve regulatory frameworks, promote marketplaces, drive E&S agenda, build market capacity, and increase product availability in supply chain finance markets.”

They include the World Trade Organization (WTO), International Finance Corporation (IFC), The World Bank Group), African Export-Import Bank (AFREXIMBANK), Asian Development Bank (ADB), European Bank for Reconstruction and Development (EBRD), IDB Invest (IDBI), and the International Islamic Trade Finance Corporation (ITFC), the trade fund of the Islamic Development Bank (IsDB) Group.

The coordination will be done through the already established Supply Chain Finance Task Force under WTO’s Multilateral Development Banks (MDBs) Working Group to i) increase financial support through their existing SCF programmes; ii) strengthen the legal infrastructure; iii) promote common sector-level operating marketplaces; iv) build market awareness and stakeholder capacity; and v) work with financial institutions and Fintechs to increase product diversity and availability.

However, according to Eng. Hani Salem Sonbol, CEO of ITFC, recent studies conducted by International Finance Corporation (IFC) and the World Trade Organization (WTO), local availability of SCF, especially in low income and fragile countries, is scarcer than traditional trade finance due to weaker financial and legal infrastructures, leading to missed economic opportunities.

The International Islamic Supply Chain Finance (SCF), he added, is essential for enabling emerging markets firms, particularly Small and Medium sized Enterprises (SMEs), to participate in both global and local markets. Greater participation of SME firms in global value chains will increase trade and development opportunities, integrate value chains, and incentivize better Environment and Social (E&S) performance.

IILM Successfully Closes Two Auctions of Short-term Sukuk in November 2024 with an Aggregate Volume of USD1.81bn on the Back of Rising Investor Demand Including from Nigerian Debutantes

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant liquidity management instruments, continued its short-term Sukuk issuance momentum with two auctions in November 2024 raising an aggregate USD1.81bn.

This follows a similar re-issuance auction on 1 October 2024 of an aggregate USD1.14bn of papers.

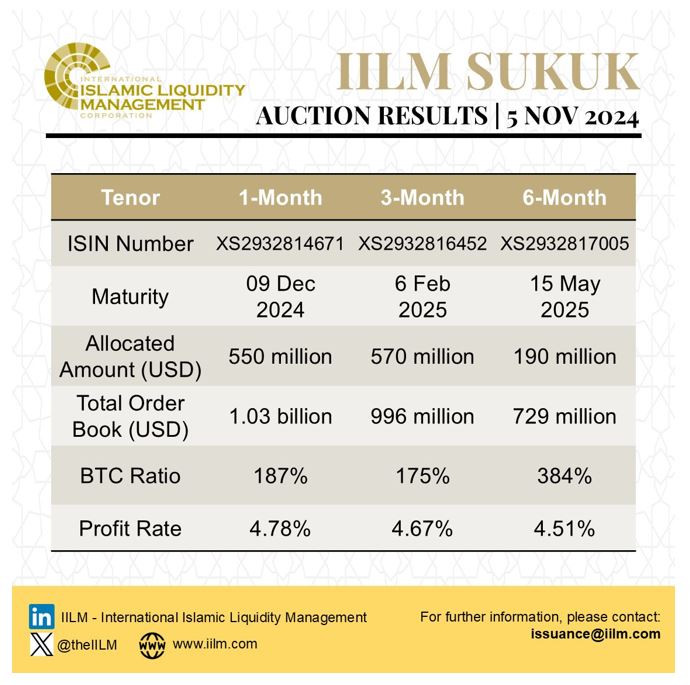

The first auction on 5 November 2024 saw the successful completion of the reissuance of an aggregate USD1.31bn short-term Sukuk across three different tenors of one, three, and six-month respectively. The three series reissued on 8 November 2024, says the IILM, were priced competitively at:

i) 4.78% for the USD550mn Sukuk with a 1-month tenor.

ii) 4.67% for USD570mn Sukuk with a 3-month tenor.

iii) 4.51% for USD190mn Sukuk with a 6-month tenor.

This Sukuk issuance marked the IILM’s twelfth auction for the year and its largest issuance size year-to-date. The auction a witnessed a competitive tender among Primary Dealers and investors from markets across the GCC, Asia, and Africa, with a combined orderbook more than USD2.75bn, representing an average bid-to-cover ratio of 210%.

Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented on this first auction in November: “We are extremely pleased with the outcome of the IILM’s largest issuance year-to-date, ahead of possibly one of the most important days in 2024. Today’s auction saw a strong and solid demand from global Islamic investors seeking high quality safe-haven liquidity management instruments, as reflected by a healthy bid-to-cover ratio across all three tenors on offer. Today’s auction also witnessed the participation of two African financial institutions for the very first time, both from Nigeria – an Islamic bank and a conventional bank – reflecting the growing global appeal of the IILM’s short-term Islamic papers.”

The second auction on 19 November 2024 saw the successful completion of the the issuance of three new short-term Sukuk worth a total of USD500mn. The issuance, spread across one-month, three-month, and six-month tenors, were priced competitively at:

i) 4.80% for USD280mn for 1-month tenor

ii) 4.68% for USD160mn for 3-month tenor

iii) 4.60% for USD60mn for 6-month tenor

The second transaction in November marked the IILM’s thirteenth auction for the year. The auction also witnessed a competitive tender among Primary Dealers and investors from markets across the GCC and Asia with a combined orderbook more than USD1.05bn, representing an average bid-to-cover ratio of 209%.

Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, said: “We are extremely pleased with the outcome of this latest auction (the second for this month), bringing the IILM’s outstanding asset portfolio to an all-time high of USD 4.5bn.

Despite the continued market uncertainty and reaction surrounding the new leadership in the US as well as the Federal Reserve’s rate cuts’ impact on global capital markets, the IILM’s fresh issuance today represents a significant milestone as we ramp up and diversify our asset portfolio further with the inclusion of a new asset obligor.

“The increase in the IILM’s asset portfolio will enable us to gradually expand the size of its short-term Sukuk from USD1bn a month in average currently, in line with its core mandate to meet and fulfil the growing needs of the global Islamic financial institutions, in search of stable and reliable sources of high-quality liquidity management instruments”.

The IILM’s total outstanding Sukuk in the market now stands at USD 4.5bn. Year-to-date, the IILM has issued a cumulative USD 12.32 billion across 39 Sukuk series. The issuance forms part of the IILM’s USD6bn short-term Sukuk issuance programme. In September 2024, the IILM raised the ceiling of its Programme from USD4bn to USD6bn. “We are delighted to have successfully completed the upsizing of the IILM Sukuk Programme by 50% from USD4bn to USD6bn,” explained Mr Mohamad Safri. “This increase will allow us to add more high-quality assets and inevitably help strengthen our mandate and role in facilitating effective cross-border liquidity management amongst institutions offering Islamic financial services, in particular.

“The upsizing of the Sukuk programme to USD6bn reflects the growing and sustainable demand for high quality Sukuk issued by the IILM, which has seen oversubscription rates exceeding 220% year-to-date. It also reinforces the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Shariah-compliant High-Quality Liquid Assets (HQLA).”

The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

The IILM consistently issues short-term Sukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued over USD112.27bn in Sukuk across 269 series. The regular Sukuk auctions, stresses Mr Safri, also reinforce “the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Shariah-compliant High-Quality Liquid Assets (HQLA).”

The IILM’s short-term Sukuk is distributed by a diversified network of 11 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, Affin Islamic Bank, and Standard Chartered Bank. The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group. performance.

Ireland Trumps London and Dubai as Largest Sukuk Listing Venue with a Significant Presence in the Public Islamic Funds Market says Fitch Ratings

Dublin – The Irish Stock Exchange (Euronext Dublin) is the largest listing venue for global Sukuk outstanding in hard currencies, covering 38% of global Sukuk at end-Q3 2024 (Q4 2023: 41%), with the London Stock Exchange (LSE) and Nasdaq Dubai not far behind, according to a latest report from Fitch Ratings.

Fitch rated over three quarters of the hard currency Sukuk listed on Euronext in Q3 2024, with about 70% of the rated Sukuk being investment grade, and expects Euronext Dublin to remain one of the top three global Sukuk listing destinations. Fitch also rated its first Sukuk out of Ireland, a USD500mn benchmark Sukuk Al Ijara issued by AerCap Holdings N.V. (BBB/Positive) in November 2024. Moreover, Ireland has the largest public Islamic funds market amongst western jurisdictions and ranks third-largest globally.

The listed Sukuk in Euronext Dublin, said the rating agency, was up by 5.2% year on year at end-Q3 2024 (about USD90bn outstanding: hard currencies), outpacing listed bonds, which fell by 2%. However, Sukuk still represents a minor share of outstanding debt in Euronext (4%: hard currencies). “The exchange has attracted numerous Sukuk issuers and Islamic funds globally, on the back of Ireland’s enabling regulatory and legal framework, along with a favourable tax regime and supportive human capital that can service the sector. This enables Islamic finance issuers and investors to access broader markets, including Europe,” said Fitch.

In 2018, the Irish Revenue Commissioners issued a detailed guideline outlining the tax treatment of Islamic finance transactions in Ireland, including Sukuk, Islamic funds and other Islamic financial products. To provide a level playing field, Ireland grants a specific tax exemption for Sukuk, when it is issued or transferred covering both direct taxation and VAT and equates with Ireland’s exemption for Section 110 securitisation companies. This, says Fitch, provides a clear tax framework to the issuers and investors and increases Sukuk credibility among market participants, which supports the issuance and trading of Islamic financial products in the country.

According to Fitch, Euronext-listed Sukuk are diverse in terms of country of risk. The UAE has the largest share (28.1%), followed by Turkiye (14.7%), Saudi Arabia (12.5%), and other domiciles (44.7%). These listed Sukuk are less diverse by currency distribution, and mostly dominated in US dollars (Q3 2024: 96.9%; USD86.5bn), with smaller portions in euros (3%; USD2.6bn) and pound sterling (0.1%; USD0.1bn).

Fitch also confirmed that Ireland has the largest public Islamic funds market out of western jurisdictions, and the third-largest public Islamic funds market globally, with a 17.9% share at end-Fits Half 2024, after Malaysia (26%) and Saudi Arabia (18.5%).

Ireland’s Islamic public funds held USD22.9bn in assets under management (AUM) at end-Q2 2024, expanded 19.4% yoy, outpacing conventional public AUM funds, which grew 18.9% yoy to USD3.8 trillion at end-Q2 2024. The total number of public Islamic funds exceeded 33 funds in Q2 2024, dominated by equity funds (65%), with the majority in mutual funds.

Global Sukuk Issuance Set for Record Year as Moody’s Expects Total Volume to Reach Between USD200bn and USD210bn in 2024

Dubai – Another sign that 2024 is going to be a bumper year for primary Sukuk issuances is the expectation of Moody’s Ratings in a report in November 2024 that global Sukuk issuance this year is set to reach between USD200bn and USD210bn, beating 2023’s total of just under USD200bn. This activity is supported by strong sovereign issuance across the Gulf Cooperation Council (GCC) and Southeast Asia, and from Saudi Arabia and Malaysia in particular.

“Issuance will slow in the second half of the year to be around USD80 to USD90bn but will remain strong in GCC countries, as the region’s governments continue to pursue strategies to diversify their economies away from oil. Issuance by companies and financial institutions will be driven by those returning to the market after delaying issuance, those looking to diversify funding sources and investors, or looking to issue sustainable Sukuk,” observed Abdulla Al Hammadi, Assistant Vice President, Analyst at Moody’s Ratings.

“We see significant growth potential in the coming years, supported by increasing demand for sukuk instruments. The pool of investors will continue to grow, thanks to the growing popularity of Islamic products beyond core Islamic markets, rising demand for green and sustainable sukuk, and the increasing sophistication and diversity of Islamic instruments,” adds Al Hammadi.