KFH Completes Conversion of Ahli United Bank UK and Egypt to Dedicated Islamic Banks Following its Voluntary Withdrawal from the Malaysian Market in Pursuit of a New Focus on MENA and UK

Kuwait City – Kuwait Finance House (KFH), one of the oldest commercial Islamic banks in the world, completed the conversion of Ahli United Bank – UK and Egypt (both subsidiaries to KFH Group) from conventional banking services “to banking services that comply with the provisions and principles of Islamic Sharia’a.”

In a disclosure to Boursa Kuwait on 2 September 2024, Abdullah M. Abualhous, Acting Group Chief Executive Officer, confirmed the completion of the bank’s operational conversion, which he stressed is part of KFH’s strategy to strengthen its capabilities and enhance the spread of its Islamic banking services in global markets.

Kuwait Finance House (KFH) Chairman, Hamad Abdulmohsen Al Marzouq emphasized the significance of this step as crucial in supporting KFH’s strategy aimed at expanding its Sharia’a-compliant banking operations in the Egyptian market that enjoys high growth potential. He added that converting Ahli United Bank – UK to Islamic banking supports KFH’s efforts to diversify its services, particularly those catering to high-net-worth individuals and their specific financial and banking needs, while also fostering wealth growth and meeting their aspirations through integration across the Group’s units. “This step adds significant value to the Islamic banking industry in Europe and the world, particularly since the UK market offers various promising opportunities and demonstrates increasing interest in Sharia-compliant services and solution,” he stressed.

The Ahli United Bank conversions are part of the strategic shift that the Group initiated following the successful acquisition of Ahli United Group-Bahrain in October 2022, which was also converted to dedicated Islamic banking operations. It is also part of KFH plans to expand its Islamic banking services and broaden its presence at the local, regional and global aspects.

According to KFH, AUB UK and AUB Egypt shall provide an integrated set of financial products and services which are compatible with the provisions and principles of Islamic Sharia’a.

According to international law firm, Trowers & Hamlins, which advised Ahli United Bank (UK) on its conversion from a conventional bank to a fully compliant Islamic bank, the conversion was the first of its kind in the UK banking industry. “We are delighted to have advised Ahli United Bank (UK) on its groundbreaking, market-leading conversion to a fully Sharia’a compliant institution. This landmark transformation underscores our commitment to innovation in Islamic finance, guiding the bank through the entire process from strategic planning to advising on both existing and new Shariah compliant products. This successful conversion sets a new standard in the UK banking sector and reinforces our role as a leader in Islamic finance advisory services,” explained Helen Fysh, Partner at Trowers & Hamlins.

The firm advised on all aspects of the conversion process from advice on the options available to the bank to achieve the goal of becoming an Islamic bank through to the review and update of existing Sharia’a compliant products. It also continues to advise on the preparation of new Sharia’a compliant products which will be offered by the bank shortly following the conversion (including ensuring those products being made available to retail customers comply with UK financial services requirements) and advice on its strategy for communicating the changes to its customers. Whether this could be a model for any future conversions in the UK market remains to be seen.

The above conversions strategy is in sharp contrast to KFH’s announcement in July 2024 that “following a strategic review, Kuwait Finance House Group (KFH Group) has decided to voluntarily withdraw from the Malaysian market and wind down its Malaysian subsidiary, Kuwait Finance House (Malaysia) Berhad (KFHMB), in line with KFH Group’s international business strategy to focus and expand in regional markets (GCC and Middle East).” As part of this decision, KFHMB is also evaluating the potential sale of certain portfolio segments to prospective buyer(s), subject to regulatory approvals.

In a disclosure to Boursa Kuwait, then Acting KFH Chief Executive Officer, Abdulwahab Issa Al-Rushood, assured that “while there is no immediate impact on our clients in Malaysia, we would like to assure our clients and other stakeholders that KFHMB is fully committed to preserving their interests and we will ensure a smooth, transparent and seamless transition with minimal impact to all stakeholders (including clients, employees, and business partners). KFH Group acknowledges the valued relationships it has with all stakeholders in Malaysia. This decision has no impact on KFH Group’s commitment to its other businesses and markets.”

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was also involved in the conversion processes for both AUB Egypt and AUB UK, which were facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.

RAKBANK Completes its Maiden USD250mn Tier2 Security Sukuk Issuance on the Back of its USD600mn Euro Medium-Term Note

Ras Al Khaimah – The National Bank of Ras Al Khaimah (RAKBANK) issued its inaugural USD250mn Tier 2 Security Sukuk issuance on 4 September 2024.

The Sukuk has a tenor of 10.25 years maturing in March 2035, and a non-call period of 5.25 years (10.25NC5.25). The transaction, according to RAKBANK, was priced at a coupon rate of 5.875% per annum payable semi-annually in arrears.

The issuance, says the Bank, was met with a very strong investor demand, being oversubscribed by 4 times with peak orders received more than USD1bn. This significant demand enabled RAKBANK to tighten the pricing by 42.5bp, reflecting investor confidence in the bank’s financial stability and growth prospects.

This issuance follows the recent issuance of RAKBANK’s 5-year Euro Medium-Term Note (EMTN) Bond in July 2024 under its Social Finance Framework. That transaction was oversubscribed by more than 3 times allowing the Bank to upsize the issue to USD600mn and tighten the pricing by 35bps to US Treasuries + 135bps. This translates into a coupon of 5.375% with a yield to maturity of 5.439%.

According to Raheel Ahmed, Group Chief Executive Officer of RAKBANK, both transactions are important milestones for RAKBANK in support of the UAE Vision 2031and integrating ESG into the Bank’s core business strategy for long-term financial growth through contributing to GDP growth, job creation, and aligning with UBF’s 2030 sustainable finance pledge.

“As a leading SME bank, we already play a crucial role in supporting the success and growth of more than 86,000 SME customers that act as a catalyst for the economy through employment generation. The issuance allows us to further our efforts in this space,” he added.

The Social Finance Framework established by the Bank outlines the purposes and manner in which funds raised through these bonds will be utilized, including the support to MSME (Micro, Small, and Medium Enterprises) customers and enhancing the provision of healthcare within society.

In July 2024, RAKBANK announced record net profit after tax of AED1.1bn (USD300mn) for First Half 2024 – a growth of 21% YoY, driven by “diversified growth in balance sheet, continued sales momentum and strong credit quality.”

Gross loans and advances at AED43.7bn (USD11.9bn) were up 9.4% YoY, driven by growth across all segments, with Wholesale Banking loans and advances growing by 19.4%, in line with the Bank’s diversification strategy. Customer deposits at AED58.5bn (USD15.93bn) were similarly up 19.4% YoY, with a CASA ratio of 6%.

Qatar’s Estithmar Holding Closes its Maiden Domestic QAR500mn (USD137.1mn) Sukuk as More Issuances on the Cards to Finance the Company’s Ambitious Regional Expansion in the Healthcare Sector

Doha – Qatar’s Estithmar Holding is the latest Qatari corporate to access the Sukuk market. It successfully closed its maiden Sukuk offering on 25 August 2024 – a QAR500mn (USD137.1mn) Sukuk denominated in Qatari riyals.

This issuance, according to Estithmar Holdings is the inaugural tranche issued under its QAR3.4bn (USD930mn) Trust Certificates Issuance Programme, which was admitted for listing on 19 September 2024 on the London Stock Exchange’s International Securities Market (ISM). The Sukuk programme is rated qaBBB (stable) on the Qatar National Scale by Capital Intelligence.

The Sukuk, which has a tenor of 3 years maturing in September 2027, was priced at a coupon rate of 8.75% per annum coupons and according to the company, attracted significant interest from institutional governmental and non-governmental investors. The mix of investors included banks, insurance companies and asset managers.

Al Rayan Investment LLC, The First Investor and Lesha Bank LLC acted as Joint Lead Managers to the transaction.

According to Eng. Mohamad Bin Badr Al-Sadah, Group CEO of Estithmar Holding, “the issuance of the first corporate QAR-denominated Sukuk is a historic milestone for Estithmar Holding, demonstrating its ability to diversify funding sources to support its long-term strategic growth plans and objectives. Being listed on the London Stock Exchange’s International Securities Market, this issuance has garnered significant interest from a diverse mix of investors. This broad investor appetite is a testament to the confidence in our strategic growth plan across all four of our key divisions: healthcare, services, ventures, and specialized contracting.”

The company has been expanding its activities in the healthcare sector. “Estithmar Holding has witnessed a remarkable growth,” added Eng. Al Sadah, “with the progress of The View Hospital in affiliation with Cedars Sinai, the opening of the Korean Medical Center KMC, which sustains our commitment to providing world-class healthcare services to Qatar and the region and contributes to medical tourism, with regional expansion through operating two hospitals in Iraq, and the upcoming completion of the Algerian-Qatari-German Hospital in Algeria. Estithmar Holding currently owns and operates facilities with a total capacity of more than 2000 beds. Furthermore, our services sector, encompassing facilities management, catering, and resource supply, continues to grow both in Qatar and abroad.”

Given the company’s rapid expansion in the region, the possibility of further forays into the Sukuk market especially through Tap issuances, is very strong.

“Our ventures sector is poised for significant success with major projects such as the Rosewood Resort in the Maldives and Rixos in Baghdad, both of which are expected to open soon, in addition to the continuous development of our current touristic ventures in Qatar; Al Maha Island, Katara Hills, Maysan Doha and others. Our specialized contracting sector is also witnessing significant growth, especially in the Kingdom of Saudi Arabia, with a remarkable increase in our market share through important strategic projects in the Kingdom. The success of the Sukuk Program is a culmination of our broader growth strategy, which aims to achieve an ever-growing investment value for our shareholders and ensure Estithmar Holding’s leadership across all its operating sectors,” added Eng Sadah.

SAMA Governor Al-Sayari Projects Fintech Solutions to Become an Engine of Economic Growth in the Kingdom as They Become a Larger Part of the Financial System with 230 Fintech Companies and Start-ups Now Licensed by SAMA in the Kingdom

Riyadh – Mr. Ayman Al-Sayari, Governor of SAMA (the Saudi Central Bank) speaking at the inaugural 24 Fintech Conference in Riyadh on 3 September 2024, emphasised that the growth of Fintech solutions in the Kingdom has expanded access to the financial system, improved financial intermediation, and efficiency gains in the speed and cost of transactions.

“A broad range of Fintech segments have emerged, with notably strong activity in the domains of payments and finance. Growth in decentralized services in the economy has fuelled demand for peer-to-peer transactions, in turn creating a need for more innovative payment solutions. Therefore, the share of cashless transactions has grown to over 70% of total payments last year,” he explained.

The increasing diversification of the Kingdom’s financial sector has also stimulated considerable demand for Open Banking services, where there are now 12 operators. In the context of these developments, SAMA’s focus remains on stabilizing growth by applying prudential measures that ensure long-term financial stability, and steady economic activity, while enabling a supportive environment for market innovation.

The four key drivers of Fintech and digitalisation in the Kingdom are:

- National initiatives through Vision 2030 to develop a digital economy have stimulated demand for technology-enabled financial services.

- The advancements in computational and analytical technology have allowed the development of more sophisticated products and services.

- A young, growing and highly connected Saudi population has led to rapid growth in demand for consumer banking services, particularly digital.

- Strong growth in economic activity, has supported growth in demand for credit and increased the attractiveness of the market for service providers.

SAMA pays close attention to risks that may emerge from the introduction of new financial service business models, or existing risk factors that may be magnified.

Governor Al-Sayari identified four areas of concern and therefore greater surveillance. These include:

- The robustness of AML/CFT compliance must be preserved.

- Cybersecurity and business continuity must be safeguarded.

- Adequate controls for consumer protection and fraud prevention must be adopted.

- The transition from the traditional banking model must be carefully managed to avoid disruption to the overall financial system.

To achieve an optimal balance between these risk considerations and enablement of innovation, SAMA’s Risk-Based Supervision framework provides a balanced supervisory approach for entities under its supervision. This model takes into consideration, the proportionality of potential risks to consumers, and to the overall financial system, and allows agility in reacting to developing risks.

“SAMA employs multiple tools to identify and quantify potential risks, when assessing business models,” added Governor Al-Sayari. “We also employ learnings from the experiences of other central banks, to help inform SAMA’s policy stance. This in turn allows the sector to swiftly adapt to potential stresses in the macroeconomic environment, regulatory changes, and consumer expectations. Ultimately, the most significant contributor to achieving a healthy balance, is the stability of the underlying financial ecosystem.”

SAMA believes that a resilient and stable financial system is key to supporting economic growth, which in turn creates a conducive environment for startups through the availability of fairly priced risk capital, with the ability to invest in innovative growth, as well as withstand failures. Through this approach, SAMA says it has actively supported the development of the Fintech ecosystem, with the objective of ensuring equitable market opportunities, accessible common infrastructure, and the creation of an accommodative regulatory environment.

In this respect, SAMA has deployed the Regulatory Sandbox, launched in 2018, and the Makken programme, which was launched last year. The Regulatory Sandbox allows start-ups to test innovative solutions within a ring-fenced environment. Insights from the Sandbox have helped evolve SAMA’s supervisory framework and provided regulatory clarity.

The Makken programme, launched through Fintech Saudi, is a joint initiative between SAMA and the CMA (Capital Market Authority). It is designed to support new Fintech companies in their cloud and cyber-security needs, while also lowering their cost of compliance. These cumulative efforts have proved fruitful, with the number of Fintechs operating in the Kingdom today growing by 57% since the start of 2023, and now reaching 230 in total.

Governor Al-Sayari concluded that the Fintech industry has the potential to play an even greater role in reshaping the future landscape of the Kingdom’s financial sector.

“The next wave of transformation, following the deepening and broadening of the sector which we saw in the last two decades,” he maintained, “will likely be characterized by Fintech solutions becoming an engine of economic growth as they become a larger part of the financial system. However, we must ensure that innovation is adopted in a prudent manner while prioritizing monetary and financial stability.

Two Saudi Banks Extend a Total SAR1.01bn (USD269.3mn) of Murabaha Financing for Ataa Educational Company and SARCO

Jeddah – Saudi corporates continued to access the local banking sector in August and September 2024 for Murabaha financing to fund projects and for general working capital and balance sheet purposes. The two largest facilities involved Ataa Educational Co. and the Saudi Arabia Refineries Company (SARCO). The aggregate financing for the two facilities totalled SAR1,010.461mn (USD269.252mn).

In a disclosure to Tadawul (Saudi Exchange) Ataa Educational Co. stressed that the latest facility approved on 9 September 2024, is a renewal of a SAR510,460,556 (USD136.022mn) Murabaha facility provided by the Saudi Investment Bank. This facility has a tenor of 10 years and is secured by a promissory note with the value of the facilities in favour of the bank.

Ataa Educational Co. said the proceeds of the renewed facility will be used for on-demand financing for the purpose of acquiring and building educational complexes and supporting working capital.

SARCO obtained a SAR500mn (USD133.23mn) Murabaha facility from Riyadh Bank on 17 September 2024. In a disclosure to Tadawul (Saudi Exchange) SARCO stressed that the facility has a 3-year tenor, renewable every 360 days. The proceeds from the facility will be used to finance the company’s public investments which include buying shares and investment portfolios. The facility also is guaranteed by SARCO’s investment portfolio.

Türkiye Treasury Continues Domestic Sovereign Lease Certificates Issuance Raising TRY7,941.5mn (USD232.8mn) in September and August as Total to Date in 2024 Tops TRY57,190.4mn (USD1,676.3mn)

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum in August and September 2024 with two auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic markets on the back of improving macro-economic fundamentals. The aggregate amount raised for the two auctions in August and September 2024 totalled TRY7,941.50mn (USD comprising TRY3,477.50mn (USD101.93mn) in August and TRY4,464.00mn (USD130.84mn) in September.

The Treasury’s public debt issuance domain includes domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

The Fixed Rate Lease Certificate market is the mainstay of the Treasury’s fund-raising in the Sukuk market, with auctions in consecutive months since January 2024.

Prior to these latest two auctions, the Türkiye Treasury raised TRY12,000.00mn (US$353.91mn) in an auction on 24 July 2024 through the issuance 2-year Fixed Rate Lease Certificates (Sukuk al Ijarah) maturing on 22 July 2026 priced at a fixed profit rate of 19.27% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury in fact raised TRY120,994.22 mn (US$4,174.22 mn) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. The Türkiye Treasury in the first nine months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY57,190.45mn (US$1,676.31mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor.

DDCAP Group Managing Director Stella Cox Participates in TheCityUK Fora with BNM, SC and MLC in London Focussing on Collaborative Harnessing of IF for Green Investments and Growth

London – TheCityUK, the industry-led body representing UK-based financial and related professional services, welcomed two official Malaysian delegations visiting the UK in September 2024 – one from Bank Negara Malaysia (BNM), the central bank, and the other from the Securities Commission Malaysia (SC), the securities regulator. UK-Malaysian relations in Islamic finance featured strongly with the focus on harnessing the potential of Islamic finance for green investments.

As Chair of the Islamic Finance Market Advisory Group at TheCityUK, DDCAP Group Managing Director, Stella Cox CBE, FCSI (Hon), was pleased to join the Roundtables convened to mark the visit to London and the UK by the delegation of senior executives representing Malaysia’s BNM, SC and MIFC Leadership Council (MLC).

The MIFC-UK Business Forum, organised in collaboration with the TheCityUK, was headed by MLC Chairman Tan Sri Azman Mokhtar and BNM Deputy Governor Adnan Zaylani. This was preceded by MLC Chairman Tan Sri Azman Mokhtar a similar meeting a week earlier with a delegation from the SC led by Chair Faiz Azmi.

At the Forum with the MIFC and BNM, Stella Cox, observed that “The UK and Malaysia have enjoyed a series of collaborative financial sector initiatives, across many years, related to their shared interest in enabling Islamic banking and finance, deepening Islamic financial markets and creating the supporting infrastructure and technology necessary to sustain them. We are greatly encouraged by the prospect that these collaborations will continue, building upon long held objectives, as well as introducing new projects to improve financial inclusion and further develop sustainable and responsible standards, business activities and related practices to promote growth and deliver benefits to broader communities.”

She added “DDCAP Group™ looks forward to responding to the MLC’s call to action set out within its recently published Position Paper. The principles, areas of focus and proposed implementations will support the steering of Islamic finance through its next phase of growth and development, deliver thought leadership and create alignments to bring greater societal and individual impacts.”

The CityUK commented: “This morning, we were pleased to host the delegation led by Tan Sri Azman Mokhtar, Chairman, MLC and Adnan Zaylani Zahid, Deputy Governor, BNM) alongside some of our members who are active in the UK-Malaysia Islamic Finance corridors. The discussion focused on facilitating greater trade and investment links and ways in which we could collectively build on the two financial centres’ Islamic finance aspirations. We look forward to advancing these conversations and strengthening our partnerships via our Islamic Finance Advisory Group and ASEAN Market Advisory Group as Malaysia takes over the ASEAN chair next year.”

In the meeting with the SC delegation, Nicola Watkinson, similarly observed: “Last week we met with the delegation led by Faiz Azmi, Chair of Securities Commission Malaysia, where we held a constructive and collaborative discussion on several key issues including climate adaptation, the ageing population, and the role of financial and related professional services in addressing these challenges.

“It was a pleasure to welcome Faiz Azmi Chair of Securities Commission Malaysia and his team to discuss future partnership opportunities. From blended finance to crowd in more private sector investment to address the green transition to pension reform to improve retirement outcomes for our citizens there is much we can do together. And with Malaysia taking on the ASEAN presidency next year there was even more to discuss as the UK develops its financial partnership with this important high growth region. TheCityUK through our market advisory groups are excited to build future relationships to drive investment, growth, trade and innovation.’

Riyad Bank and Saudi Awwal Bank Extend Aggregate SAR473mn (USD126.05mn) Medium Ticket Murabaha Financing to MIS and CATRION Catering as Small-and-Medium-Ticket Financing Grows

Riyadh – Saudi Awwal Bank and Riyad Bank extended a combined SAR473mn (USD126.05mn) in two Murabaha facilities – the one a SAR252mn (USD67.16mn) financing facility for Al Moammar Information Systems Co. (MIS), a regular corporate user of Islamic finance, and the second a SAR221mn (USD58.89mn) financing facility for CATRION Catering Holding Company.

Both the facilities were signed in early September 2024 and represent an increase in medium sized ticket Murabaha financings in the Saudi corporate and banking sector, which has also seen a proliferation of standard small ticket financing agreements, largely to cover bridge facilities, and other balance sheet purposes.

The MIS facility, extended by Riyad Bank, has a tenor of three years maturing on 8 September 2027. The use of proceeds said MIS in a disclosure to Tadawul (the Saudi Exchange) will be used to finance Invoice Payables, project financing and issuance of Letters of Credit and Guarantees. The facility is secured by a promissory note to the value of the total facility limit.

In the CATRION facility, extended to the company’s project implementation subsidiary CATRION Catering Services LLC by Saudi Awwal Bank, has a tenor of 15.5 years including a grace period of the first 13.5 months for the project financing.

CATRION in a disclosure to Tadawul (the Saudi Exchange) said the facility will be used for financing the ongoing Red Sea catering project execution (with a cost of SAR209mn (USD55.70mn), and for financing value added tax during the construction period to the tune of SAR12mn (USD3.20mn). The facilities are guaranteed by a Debt Service Undertaking from the parent Company and a promissory note from the Project Company.

SAMA Licences Six New Fintech Companies in the Kingdom in August and September 2024 as Financial Market Embraces Greater Digitalisation in Finance and Payments Landscape

Riyadh – The Saudi Central Bank (SAMA) licensed six new companies in the Fintech sector in August and September 2024 as the sector continues its expansion with some 230 Fintech companies and start-ups now licensed and operating in the Kingdom.

The companies licensed by SAMA included Emkan Finance, a leading Saudi FinTech company specializing in innovative financing solutions, XSquare, NeotTek, MoneyMoon, Sulfah for Finance, and Wadaie.

Emkan Finance got a license from SAMA to offer deferred payment services, commonly known as ‘Buy Now, Pay Later.’ Emkan is dedicated to driving positive change in the financial sector by developing smart solutions that underline its pivotal role in leading digital transformation as a prominent financial technology company in the Kingdom. With the rapid growth of digital financial services, Emkan, says the company, is committed to meeting the evolving needs of its customers and contributing to the advancement of the financial sector.

The ‘Buy Now, Pay Later’ service provides a flexible shopping experience by allowing customers to make purchases with easy, interest-free instalments. This service offers greater flexibility for Saudis and residents, whether shopping in stores or online, through a fully digital experience. It also supports store owners by boosting sales and streamlining operations. Abdullah Al-Habdan, CEO of Emkan, commended the Saudi Central Bank for its continuous support of the financial sector and fintech companies in the Kingdom. He also reaffirmed the company’s commitment to delivering the best financing and financial solutions that align with Islamic Sharia’a principles.”

SAMA also permitted three new FinTech startups to test their innovative solutions in SAMA’s regulatory sandbox. “XSquare” and “NeotTek” are authorized to launch an Open Banking platform, and “MoneyMoon” is authorized to launch a peer-to-peer lending platform.

With these additions, the total number of FinTech companies currently operating under SAMA’s Regulatory Sandbox increased to 19. Since its launch in 2018, SAMA’s Regulatory Sandbox has permitted 50 Fintechs to test and refine their offerings in a controlled environment. This trend underscores SAMA’s continued efforts in developing the Saudi Fintech sector and its commitment to promoting financial inclusion and innovation.

SAMA also allowed two new FinTech startups to test their innovative solutions in SAMA’s regulatory sandbox. “Sulfah for Finance” is authorized to launch a peer-to-peer (P2P) lending platform and “Wadaie for FinTech” to launch a Time Deposit Aggregation platform.

SAMA emphasizes the importance of dealing with licensed/or permitted financial institutions.

IILM Successfully Closes Three Auctions of Short-term Sukuk in August/September 2024 with an Aggregate USD2,740mn Attracting New Investors from the GCC, SE Asia and Africa

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant liquidity management instruments, has had a busy August and early September 2024 with three auctions – two in August and the third in early September.

The August auctions comprised the reissuance of an aggregate US$1.26bn of 1-3-6-month Sukuk on 6 August 2024, and the issuance of a new short-term Sukuk worth USD490mn in three series of 1, 3, and 6-month tenors on 21 August 2024. Thus, bringing the aggregate amount issued in August to USD1,750mn. The September auction resulted in the reissuance of an aggregate USD990mn short-term Sukuk across three different tenors of one, three, and six-month on 3 September 2024. This means that the IILM issued Sukuk totalling USD2,740mn in August and September to date.

There seems to be new-found urgency at the Corporation since Chief Executive Officer Mohamad Safri Shahul Hamid took over last year. But whether this is more concentrated on increasing issuance volumes and Sukuk outstanding, widening the primary dealer network, and perhaps increasing the frequency of auctions given that the demand of such liquidity management instruments is much higher, remains to be seen. There is a case for the IILM to widen its product suite to incorporate an element of financial and social inclusion by ringfencing an allocation to retail investors – in a way to “democratise” access to the Islamic capital market for ordinary investors.

The September Sukuk reissuance of a total USD990mn witnessed a competitive tender among Primary Dealers and investors from markets across the GCC, Europe, Asia, as well as Africa. The three series reissued on 3 September 2024, says the IILM, were priced competitively at:

i) 5.35% for USD330mn for a 1-month tenor.

ii) 5.15% for USD350mn for 3-month tenor.

iii) 5.00% for USD310mn for 6-month tenor.

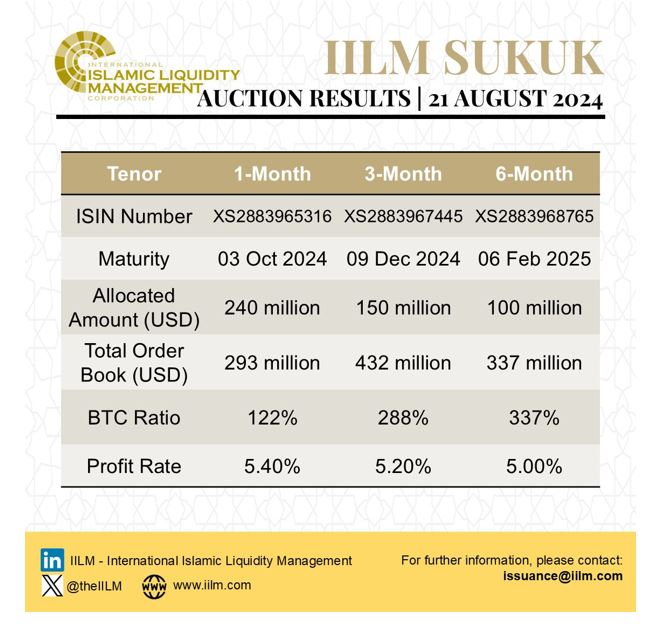

The two August Ṣukuk reissuances of a total USD1,750mn similarly witnessed a competitive tender among Primary Dealers and investors from markets across the GCC, Europe, Asia, and Africa. The three series Sukuk reissued on 21 August 2024 comprising USD490mn of one, three, and six-month tenors were priced at:

i) 5.40% for the USD240mn Sukuk with a 1-month tenor.

ii) 5.20% for USD150mn Sukuk with a 3-month tenor.

iii) 5.00% for USD100mn Sukuk with a 6-month tenor.

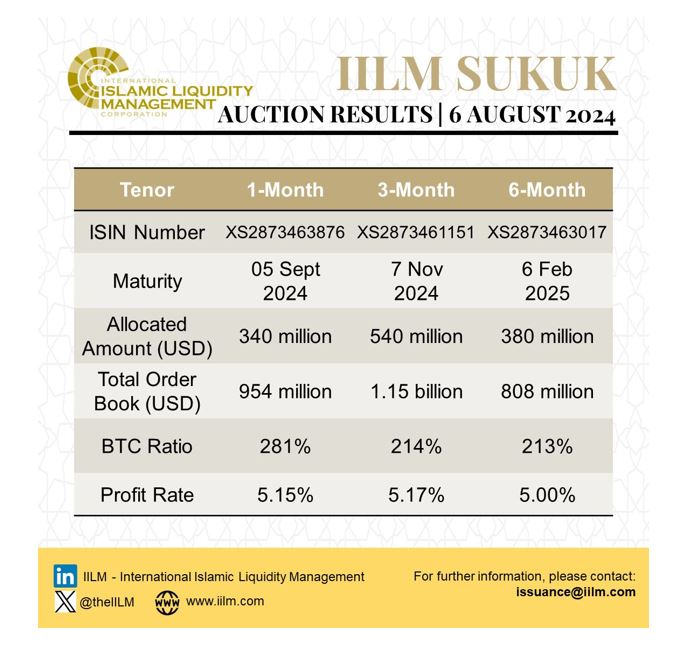

The three series Sukuk reissued on 6 August 2024 comprising USD1,260mn of one, three, and six-month tenors were priced competitively at:

i) 5.15% for the USD340mn Sukuk with a 1-month tenor.

ii) 5.17% for USD540mn Sukuk with a 3-month tenor.

iii) 5.00% for USD380mn Sukuk with a 6-month tenor.

The three transactions marked the 8th, 9th, and 10th auction of the year. The demand for all auctions was robust. The USD990mn September auction saw an orderbook of USD2.05bn from GCC, Europe and Asia investors, representing an average bid-to-cover ratio of 207%.

The USD490mn auction on 21 August 2024 saw a combined orderbook of USD1.06bn from GCC, Europe, Asia and African investors, representing an average bid-to-cover ratio of 217%. This despite a volatile market environment, characterized by uncertainty surrounding the Federal Reserve’s upcoming interest rate decisions.

The US$1,206mn auction on 6 August saw a combined orderbook more than USD2.91bn. This robust demand explained Mr Mohamad Safri “represents an average bid-to-cover ratio of 231%, which is also the largest orderbook year-to-date. The profit rates for both the 1-month and 3-month tenors came up tighter than the IILM’s indicative pricing guidance, while the profit rate for the 6-month tenor fell within the pricing guidance range.”

The August auctions, according to the IILM, also witnessed the first-time participation of new investors from across the GCC and Asia, namely an Oman-based bank, a Qatari bank, and asset managers from Singapore and Malaysia respectively. The increased participation by investors, said Mr. Mohamad Safri, “demonstrates the safe haven status of the IILM Sukuk in a highly volatile market environment.” The second Sukuk auction “represents a significant milestone for the IILM, as we expand our portfolio to include a new highly rated underlying asset, for the first time since 2020 (rated AA- internationally).”

This auction also coincided with the announcement by the IILM of a significant expansion of its Ṣukuk Programme, raising the ceiling from USD4bn to USD6bn. “We are delighted to have successfully completed the upsizing of the IILM Ṣukuk Programme by 50% from USD4bn to USD6bn,” explained Mr Mohamad Safri. “This increase will allow us to add more high-quality assets and inevitably help strengthen our mandate and role in facilitating effective cross-border liquidity management amongst institutions offering Islamic financial services, in particular.”

The IILM’s outstanding Ṣukuk in the market reached USD4bn, its highest ever in the market since the inception of the IILM Ṣukuk Programme in 2013, on the back of a fresh USD490mn Ṣukuk auctioned on 21August 2024. “The upsizing of the Sukuk programme to USD6bn reflects the growing and sustainable demand for high quality Ṣukuk issued by the IILM, which has seen oversubscription rates exceeding 220% year-to-date. It also reinforces the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Sharia’a-compliant High-Quality Liquid Assets (HQLA). The 21 August Ṣukuk represents a significant milestone for the IILM, as we expand our portfolio to include a new highly rated underlying asset, for the first time since 2020 (rated AA- internationally),” he added.

The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

“We extend our deepest gratitude to our central bank members, growing global network of Primary Dealers, and stakeholders worldwide, whose unwavering support has been instrumental in propelling the IILM’s Ṣukuk Programme forward. Their trust and collaboration have been vital in strengthening the Islamic finance ecosystem, especially in today’s complex and volatile market environment,” added Mr Safri.

The IILM’s outstanding Sukuk in the market reached USD4bn, its highest ever in the market since the inception of the IILM Sukuk Programme in 2013, on the back of a fresh USD490mn Sukuk auctioned on 21August 2024. “The upsizing of the Sukuk programme to USD6bn reflects the growing and sustainable demand for high quality Sukuk issued by the IILM, which has seen oversubscription rates exceeding 220% year-to-date. It also reinforces the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Sharia’a-compliant High-Quality Liquid Assets (HQLA). The 21 August Sukuk represents a significant milestone for the IILM, as we expand our portfolio to include a new highly rated underlying asset, for the first time since 2020 (rated AA- internationally),” he added.

The IILM’s ongoing commitment to innovation and impact, according to the Corporation, continues to bolster the liquidity management capabilities of Islamic financial institutions. By providing highly rated tools that are increasingly traded in secondary markets, the IILM helps these institutions meet their Liquidity Coverage Ratio (LCR) requirements while offering sustainable returns.

“We extend our deepest gratitude to our central bank members, growing global network of Primary Dealers, and stakeholders worldwide, whose unwavering support has been instrumental in propelling the IILM’s Sukuk Programme forward. Their trust and collaboration have been vital in strengthening the Islamic finance ecosystem, especially in today’s complex and volatile market environment,” added Mr Safri.

The IILM consistently issues short-term Ṣukuk across 1-month, 3-month, 6-month, as well as 12-month tenors, tailored to the liquidity needs of Islamic financial institutions. Since its inaugural issuance in 2013, the IILM has successfully issued over USD109.32bn in Ṣukuk across 260 series.

The IILM’s two Ṣukuk issuances in August 2024 totalled USD 1.75 billion, which represents the biggest total monthly issuance recorded by the IILM in 2024. This further underscore the strong and growing market confidence in the IILM’s high-quality Islamic papers, as evident by the steady increase in the number of new investors, including from a new Islamic account from Indonesia for today’s issuance.”

This follows a similar transaction totalling US$940mn of short-term Ṣukuk across the same three tenors on 9 July 2024. The August auction, according to the IILM, also witnessed the first-time participation of new investors from across the GCC and Asia, namely an Oman-based bank, a Qatari bank, and asset managers from Singapore and Malaysia respectively. The increased participation by investors, said Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, “demonstrates the safe haven status of the IILM Ṣukuk in a highly volatile market environment.”

“The combined orderbook in excess of US$2.91bn,” explained Mr. Mohamad Safri Shahul Hamid, CEO of IILM, “represents an average bid-to-cover ratio of 231%, which is also the largest orderbook year-to-date. The profit rates for both the 1-month and 3-month tenors came up tighter than the IILM’s indicative pricing guidance, while the profit rate for the 6-month tenor fell within the pricing guidance range.”

Year-to-date, the IILM has issued a cumulative USD9.37bn across 30 Ṣukuk series. The issuance forms part of the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated USD6bn short-term Sukuk issuance programme. The total amount of IILM Ṣukuk outstanding is now USD4bn. The IILM is a regular issuer of short-term Ṣukuk across 1-month, 3-month, 6-month, and 12-month tenors to cater to the liquidity needs of institutions offering Islamic financial services. The Corporation will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The regular Sukuk auctions, stresses Mr Safri, also reinforce “the IILM’s status as a unique provider of Islamic safe-haven liquidity management instruments, vital for institutions seeking Sharia’a-compliant High-Quality Liquid Assets (HQLA).

The IILM’s short-term Sukuk is distributed by a diversified network of 11 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, Affin Islamic Bank, and Standard Chartered Bank. The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

IsDBI and Malaysia’s INCEIF University Collaborate to Launch the “International Journal of Islamic Finance and Sustainable Development” to Stress IF Principles with Global Sustainability Goals

Jeddah – The Islamic Development Bank Institute (IsDBI) and the International Centre for Education in Islamic Finance (INCEIF) University launched the “International Journal of Islamic Finance and Sustainable Development” (IJIFSD), formerly known as the “ISRA International Journal of Islamic Finance” (IJIF) on 1 September 2024.

The new publication, say the promoters, represents a significant leap forward in integrating Islamic finance principles with global sustainability goals. With the rebranding, IJIFSD has undergone a transformation from focusing on Islamic economics and finance to incorporating sustainable development, hence expanding its scope. The journal aims to establish itself as the premier platform for cutting-edge research at the intersection of Islamic finance and sustainable economic development. This collaboration harnesses the combined expertise and resources of both institutions to drive innovation and create meaningful impact in the field.

Key features of the journal include:

i) Focusing on emerging trends such as green finance, impact investing, and financial inclusion.

ii) Providing a platform for scholars, policymakers, regulators, and practitioners to share insights.

iii) Emphasising on practical solutions for sustainable infrastructure development.

iv) Showcasing the potential of Islamic finance in creating shared prosperity.

Professor Dato’ Dr. Mohd Azmi Omar, the President and Chief Executive Officer of INCEIF University, emphasised: “Our partnership with IsDBI in establishing the journal demonstrates the growing recognition of Islamic finance for sustainable development. This journal will bridge the gap between academic insights and practical implementation, nurturing thought leaders to drive the convergence of Islamic finance principles with sustainable development practices, ultimately contributing to a more equitable and prosperous world.”

Dr. Sami Al-Suwailem, Acting Director General of the IsDBI, added: “This collaboration with INCEIF University reflects our commitment to fostering innovative research for real-world impact with the vision of shaping the future of ethical finance and contributing to sustainable economic development across the Islamic world and beyond.”