IsDB Board Allocates US$368.98mn of New Financing for Sustainable Development Projects in Türkiye, Turkmenistan, and Suriname Targeting Education, Power Transmission and Oncology Sectors

Jeddah – The Board of Executive Directors of the Islamic Development Bank (IsDB) at its 356th meeting chaired by IsDB Group Chairman, Dr. Muhammad Al Jasser, at the Group’s Headquarters in Jeddah on 29 June 2024, approved US$368.98mn of new financing to finance new development projects in three member countries, namely Türkiye, Turkmenistan, and Suriname.

The allocations include US$165mn to Türkiye for the construction and operationalization of green, resilient, and sustainable schools in earthquake affected and earthquake-prone areas. This initiative, said the IsDB, will construct 33 schools, adding 808 classrooms, benefiting 24,640 students annually, and enhancing disaster resilience for over 319,206 people through the rapid delivery of inclusive, equitable, and quality education.

The Board also allocated US$47.685mn to Suriname for enhancing its power transmission and distribution network. “This project aims to eliminate bottlenecks, increase capacity, and improve system performance. It will connect 4,350 new households and 470 commercial units to the grid, thus meeting the increasing national electricity demand and ensuring a more reliable power supply,” said the IsDB.

The IsDB Board also approved US$156.3mn of financing for Turkmenistan, which is aimed at enhancing access to high-quality oncology services through the construction of three oncology centres and the training of healthcare providers. The project will increase daily in-patient services by 33% and improve cancer treatment for 11,750 patients annually, significantly reducing cancer incidence and mortality rates.

These strategic projects explained Dr Al Jasser “aim to foster sustainable development and socio-economic growth across the IsDB member states. The Bank remains committed to supporting its member states in achieving sustainable development and economic growth through these strategic projects. These investments not only address immediate needs but also lay the foundation for long-term resilience and prosperity.”

UAE Government Domestic Treasury T-Sukuk Auction in July Raises AED1.1bn (US$300mn) as Total Volume of Issuances for 2024 to Date Reaches AED7.2bn (US$1.96bn) Buoyed by Strong Investor Demand

Abu Dhabi – The dirham-denominated Islamic Treasury Sukuk (T-Sukuk) first introduced by the UAE Ministry of Finance (MoF) in collaboration with the Central Bank of the UAE (CBUAE) in 2023 continues to gain traction as sovereign domestic Sukuk issuances to regulate liquidity management and reserve requirements of Islamic financial institutions at the central banks gains momentum beyond traditional markets where Islamic finance is deemed of systemic importance in the banking system.

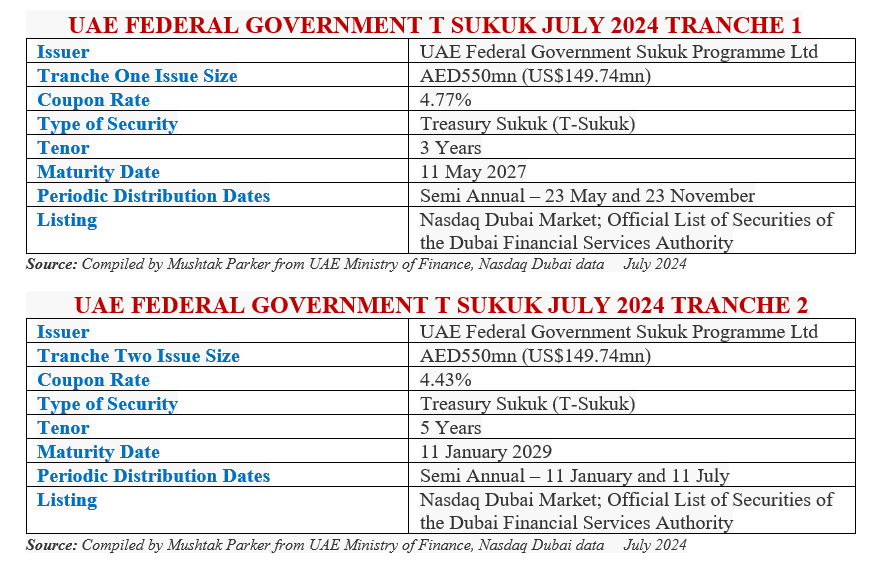

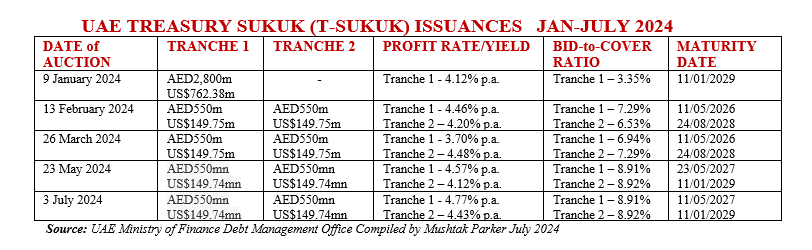

The Ministry of Finance (MoF) as the issuer, in collaboration with the Central Bank of the UAE (CBUAE) as the issuing and paying agent, announced the results of the Islamic Treasury Sukuk (T-Sukuk) auction on 3 July 2024, which is part of the Islamic T-Sukuk issuance programme for Q3 2024 as published on the ministry’s website. Two further auctions are scheduled on 27 August and 24 September for the Q3 period – both with two tranches of AED500mn each.

The July 2024 auction, the fifth to date in 2024, witnessed a strong demand through the eight primary dealers for the 3-year and 5-year tranches of the Islamic T-Sukuk, with bids received totalling AED6.76bn (US$1.84bn) and an oversubscription by 6.1 times.

The success of the auction, said the UAE Ministry of Finance Debt Management Office (DMO), is reflected in the attractive market driven prices, with a Yield to Maturity (YTM) of 4.77 % on the 3-Year tranche and 4.43 % on the 5-Year tranche, representing a 1 to 3 basis points (bps) price tightening below US Treasuries with similar maturities at the time of the auction.

The Islamic T-Sukuk issuance programme, added the DMO, will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

This auction follows the previous one in May 2024 which raised an aggregated AED1,100mn (US$299.48mn) through two AED550mn (US$149.74mn) tranches. With this latest transaction, the total volume of T-Sukuk issued by the CBUAE on behalf of the Government, the Obligor, amounted to AED7,200mn (US$1,960.25mn) in the January-July period 2024.

The published target for Q3 is AED9,400mn (US$2,559.22mn) The total T-Sukuk outstanding as on 3 July 2024 stood at AED19,050mn (US$ US$5,186.50mn). There is no doubt that T-Sukuk issuance is gaining momentum, albeit that issuance volumes will have to be increased dramatically to establish that all important yield curve for such issuances and to stimulate secondary trading and unleashing greater liquidity in the market. The Sukuk certificates are listed and traded on the Nasdaq Dubai Main Market and on the Official List of Securities of the Dubai Financial Services Authority (DFSA). All the T Sukuk offerings are issued under the unlimited UAE Treasury Sukuk Program.

Traction in T-Sukuk issuance is steady if not spectacular. In FY 2023 the aggregate volume of T-Sukuk issued by the MoF/(CBUAE) in 10 auctions held during the year amounted to AED5,000mn (US$1,361.40mn) through auctions held in May, June, August, October, and November. Thus far in FH2024 the volume has already reached AED7,200mn. It is likely that the total T-Sukuk issuance for the full year 2024 could exceed AED14,400mn given the FH2024 issuance trend.

The T-Sukuk structure is based on Murabaha/Ijara assets with the asset pool comprising 54% Ijara assets and 46% Murabaha receivables. The UAE Federal Government Sukuk Programme Ltd is the Trustee and Lessor acting on behalf of the Government of the United Arab Emirates, acting through the Ministry of Finance – the Obligor, Seller, Lessee and Servicing Agent to the transaction.

According to UAE Minister of State for Financial Affairs, Mohamed Bin Hadi Al Hussaini, the introduction of the T Sukuk “reaffirmed the UAE’s keenness to strengthen the Islamic economy and build a pioneering investment infrastructure to boost it as one of the key pillars of the national economy. The T-Sukuk are Sharia’a-compliant financial certificates, and they will be traded to reflect the local return on investment, support economic diversification and financial inclusion, as well as contribute to achieving comprehensive and sustainable economic and social development goals.”

The T-Sukuk issuance programme, added Minister Al Hussaini, will contribute to building the UAE dirham denominated yield curve, providing safe investment alternatives for investors, strengthening the local debt capital market, developing the investment environment, as well as supporting sustainable economic growth.

The Sukuk are issued via eight primary dealers, namely Abu Dhabi Islamic Bank, Dubai Islamic Bank, Abu Dhabi Commercial Bank, Emirates NBD, First Abu Dhabi Bank, HSBC, Mashreq and Standard Chartered.

The launching of the T-Sukuk also incorporates a series of issuances, to attract a new category of investors and support the sustainability of economic growth and is also aimed at enhancing the UAE’s economic competitiveness by providing high-quality Islamic assets at competitive prices. This will support the CBUAE in managing liquidity within the banking sector and boosts the size of financial investments, which will reflect positively on the country’s economy, investment environment, per capita income, and gross national income.

In addition, issuing the T-Sukuk in local currency would contribute to building a local currency bond/Sukuk market, diversifying financing resources, boosting the local financial and banking sector, providing safe investment alternatives for local and foreign investors, as well as helping build a UAE Dirham-denominated yield curve, thereby strengthening the local financial market and developing the investment environment.

The T-Sukuk, according to the MoF, will be issued initially in 2/3/5-year tenures, followed later by a 10-year Sukuk. The T-Sukuk programme, says the MoF, was developed in uniform pricing (the Dutch Auction) for final bid acceptance of bids and final allocation amounts, regardless of the lower-priced bids received, to ensure full transparency in accordance with global best practices for Sukuk structuring. These Sukuk will provide safe investment alternatives for investors which contributes to developing the UAE’s investment environment.

IsDB Signs US$150mn Financing Facility for Tajikistan’s Rogun Hydropower Project Aimed at Boosting Sustainable Development and Energy Resilience

Dushanbe – The Islamic Development Bank (IsDB) signed a US$150mn financing agreement with the Republic of Tajikistan towards funding the Rogun Hydropower Plant Project to enhance the central Asian country’s sustainable development and energy resilience agenda.

The agreement was signed by IsDB President Dr Muhammad Al Jasser during his visit to the country in June 2024 in the presence of Mr. Zavqi Zavqizoda, Minister of Economic Development and Trade and IsDB Governor for the Republic of Tajikistan, and Tajikistan Finance Minister, Mr. Faiziddin Qahhorzoda.

The Rogun Hydropower Project is the latest IsDB-funded development projects in Tajikistan with a particular focus on hydropower generation and transmission initiatives. The project aims to significantly boost Tajikistan’s hydropower capacity, contributing to the country’s energy security and economic growth.

The Rogun hydropower complex is designed as a multi-purpose dam for generating electricity, regulating water, and reducing the risk of floods and droughts. The project, says the promoters, will produce sufficient environmentally friendly and clean electricity to fully satisfy Tajikistan’s electricity demand. It will also generate enough electricity to export to neighbouring countries which presently use mostly fossil fuels for electricity generation.

Once completed, the plant will have 6 turbines of 600 MW each with a total installed capacity of 3,600 MW. The most significant impact of the new dam will be to make Tajikistan a point of reference for the energy sector in the region, doubling energy output in the country and strongly contributing to the reduction of power shortages suffered during the winter months.

Speaking at the signing ceremony, Dr. Muhammad Al Jasser emphasized the importance of the Rogun Hydropower Plant in Tajikistan’s development strategy. “We are delighted to partner with the Government of Tajikistan in advancing the Rogun Hydropower Project. This initiative underscores our commitment to supporting sustainable energy solutions and fostering economic growth within our member countries. The Rogun Hydropower Project not only promises to significantly enhance Tajikistan’s energy capacity but also plays a crucial role in regional energy cooperation and security.”

ICIEC Extends NHSFO Policy Cover for ING Bank’s €115mn Murabaha Facility to Turk Exim Bank to Finance Turkish Exports

Jeddah – The Islamic Corporation for the Insurance of Export Credit and Investment (ICIEC), the multilateral Sharia’a compliant insurer of the Islamic Development Bank (IsDB Group), has extended a Non-Honouring of Financial Obligation by a State Owned Enterprise (NHSFO) policy to cover a €115mn Murabaha financing facility given by ING Bank to Turk Exim Bank to support the export finance needs of Turkish exporters.

The 5-year policy was issued on 11 June 2024 and covers 95% of the financing facility. ICIEC covers the risk that Turk Eximbank, a state-owned export credit agency (ECA), will fail to honour its financial obligations, ensuring payment protection for lenders against default.

According to the ICIEC, it has extended its support to a significant financial initiative involving a EUR115mn facility from ING Bank to Turk Eximbank, with a tenor of five years.

“This strategic collaboration,” stressed ICIEC “underscores ICIEC’s commitment to bolstering economic stability and growth within the region. The facility, facilitated by ICIEC’s comprehensive coverage, aims to enhance Turk Eximbank’s capacity to fulfil its financial obligations, thereby promoting trade and export activities. By mitigating risks associated with non-payment, ICIEC ensures that ING Bank is protected, fostering a secure and reliable financial environment. This project exemplifies ICIEC’s dedication to leveraging its insurance capabilities to facilitate impactful financial transactions, ultimately contributing to the broader economic development goals. The partnership between ICIEC, ING Bank, and Turk Eximbank highlights the importance of collaborative efforts in driving sustainable economic progress and strengthening international trade relations.”

As a member of the IsDB Group, ICIEC’s involvement is instrumental in ensuring that the transaction aligns with international best practices and Sharia’a-compliant financing principles. Its primary role is to offer a NHSFO policy by a State-Owned Enterprise (NHFO-SOE) policy, which guarantees repayment to ING Bank in case Turk Eximbank fails to meet its financial obligations. This risk mitigation encourages ING Bank to extend the loan, knowing that ICIEC’s backing significantly reduces the default risk.

Moreover, ICIEC’s support fosters confidence among international lenders, promoting a more favourable lending environment for Turkish enterprises. By covering the loan, ICIEC enhances Turk Eximbank’s ability to finance exporters, thereby stimulating trade and economic growth.

According to the Corporation, its role extends beyond risk coverage; it involves active engagement in due diligence, ensuring compliance with environmental and social standards, and facilitating the smooth execution of the financial agreement.

This comprehensive involvement underscores ICIEC’s commitment to fostering sustainable economic development through strategic partnerships and risk management solutions. Overall, ICIEC’s participation is crucial in mobilizing international finance for Turkey’s export sector, thereby contributing to broader economic stability and growth.

ADES Secures US$3bn Multi-Tranche, Dual-Currency Upsize to its Existing Syndicated Murabaha Credit Facility

Al Khobar – ADES Holding Company, a world leading international oil and gas drilling services provider, successfully amended its existing syndicated Murabaha credit facility, securing an additional US$3 billion, with most existing lenders participating along with new, leading local and regional financial institutions.

The new US$3bn upsized financing is predominantly intended as a standby facility for the Group’s ambitious expansion plans, divided into the equivalent of a US$2.7 billion standby term tranche and additional US$300 million Revolving Credit Facility (RCF) tranche.

In a disclosure to Tadawul, the Saudi Stock Exchange, ADES stressed that the significantly upsized syndication will provide ADES with the financial flexibility to capitalize on new potential growth opportunities, including acquisitions and organic growth. The additional commitments will be available in both US dollar and Saudi Arabian riyals (38.5% in USD and 61.5% in SAR). Utilization under the standby term tranche will be subject to completion of certain conditions and will be secured by the potential assets to be newly acquired along with their associated backlog.

The additional commitments will be available in both US dollar and Saudi Arabian riyals (38.5% in USD and 61.5% in SAR). Utilization under the standby term tranche will be subject to completion of certain conditions and will be secured by the potential assets to be newly acquired along with their associated backlog.

The proceeds of the standby term facility will be used for the purpose of financing the group’s expansion plans, while the amounts under the Revolving Credit Facility shall be applied towards the general corporate purposes of the company.

The consortium comprises Saudi Awwal Bank, Riyad Bank, Al Rajhi Banking and Investment Corporation, Arab National Bank, The Saudi National Bank, Alinma Bank, Banque Saudi Fransi, Aljazira Bank, Arab Petroleum Investments Corporation (APICORP) and Commercial Bank of Dubai PSC as Financial Institutions.

Key terms of the Upsized Facility signed on 14 July 2024, include:

- Total Upsize Amount: Equivalent to US$3 billion, including a standby term tranche of US$2.7 billion and a Revolving Credit Facility (RCF) tranche of USD$300 million.

- Tenor Standby Term Tranche: 8.5 years with a final maturity in December 2032, including a 12-month grace period.

- Tenor RCF Tranche: 8 years with a final maturity in June 2032.

- Repayment Schedule: The amount to be utilized under the standby term tranche shall be repaid on a semi-annual basis and includes a bullet repayment of 31.5% at the final maturity date.

The financing facility is guaranteed by a mix of mortgages and pledges comprising mortgages over offshore rigs, a share of mortgages/pledges over entities which hold onshore or offshore rigs, security over collection accounts and a debt service accrual (DSA) account, assignment of receivables under client contracts, assignment of receivables under insurance contracts in respect of financed rigs, and Promissory notes.

Dr. Mohamed Farouk, CEO of ADES Holding commended the success in securing “this substantial funding with commitments from both existing and new lenders, which underscores the strong confidence our lenders have in our business model, strategic vision and the oil & gas industry. This additional capital will further strengthen our purchasing power, providing us with greater flexibility to consider and act swiftly on value-accretive acquisitions and other growth opportunities, all while maintaining sustainable leverage levels.

“I am also pleased to highlight the competitive pricing of the new facility, further strengthening ADES’ robust financial health. We remain committed to delivering long-term sustainable value to our stakeholders while continuing to expand our global footprint and leadership in the oil and gas drilling industry.”

IsDB-led Consortium of MDBs Co-finance US$105.7mn Electricity Transmission and Distribution Network Project in Suriname

Paramaribo – Another sign of growing involvement of the Islamic Development Bank (IsDB) Group in cooperation with peer multilateral development banks (MDBs) and funds in the energy sector in member states is the US$105.695mn co-financing facility extended by the IsDB, the Saudi Fund for Development (SFD) as well as the OPEC Fund for International Development (OFID) in June 2024.

Suriname, says the IsDB President Dr Muhammad Al Jasser, is facing significant challenges due to the strong growth in energy demand. The challenges include limited technical, institutional, and financial capacity to service the grid areas and hinterlands. To address these challenges, the IsDB Group, SFD, and OFID have commenced financing a project for the “Expansion of Transmission and Distribution Systems” through an executing agency called Energy Berijven Suriname (EBS) that provides electricity to the capital, Paramaribo, and surrounding districts.

According to Dr. Sobir Komilov, Head of IsDB Regional Hub in Suriname, “this is the first intervention of IsDB in supporting the power sector in the country and fully in line with the recently launched Country Engagement Framework for Suriname (2024-2026).

The Project will contribute to satisfying the increasing national electricity demand, allow connecting 4,350 new households and 470 new commercial units, and improve the electricity network performances by reducing the system average interruption frequency and duration.”

The project aims to increase the transmission capacity and enhance the stability and reliability of electricity service supply through expanding the electricity transmission and distribution network in Paramaribo and Nickerie, thereby increasing capacity and efficiency in the electricity sector. It comprises four key components with a total budget of US$105,695,000 and is scheduled for completion in the third quarter of 2028.

The co-financing amount from the development partners comprise:

- IsDB contribution: US$47,685,000

- SFD contribution: US$20,240,000

- OFID contribution: US$25,300,000

- Government of Suriname contribution: US$12,470,000

The initiative, says the IsDB, is a significant effort to improve the welfare of the population in greater Paramaribo with the surrounding districts and Nickerie in the western part of the country, and to enhance the competitiveness of domestic producers and exporters by ensuring reliable electricity delivery.

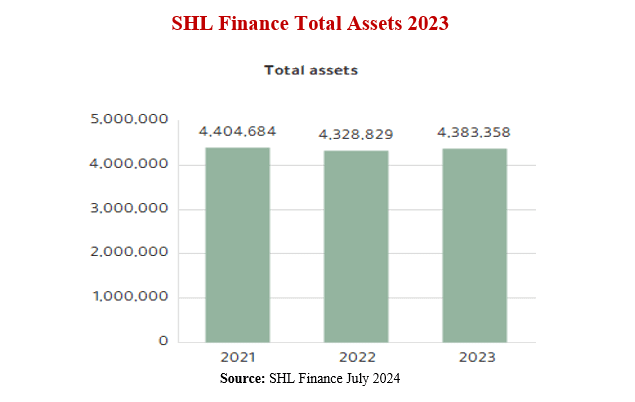

Islamic Mortgage Finance Giant SHL Finance Raises SAR2.34bn (US$631.57mn) Through Two Murabaha Financing Facilities in July

Jeddah – Big ticket Mubaraha financing facilities, a growing feature of the Saudi trade and project finance landscape, continued their momentum in July 2024. SHL (Saudi Home Loans) Finance Company, a Sharia’a compliant mortgage finance company, was involved in two transactions aggregating SAR2,369.10mn (US$631.57mn) – one a renewal of a Sharia’a-compliant credit facility agreement with Arab National Bank on 8 July 2024 totalling SAR2,057.229mn (US$548.43mn) with a maturity on 30 April 2025; and the second transaction a new SAR311.871mn (US$83.14mn) Murabaha credit facility extended by Al Bilad Bank with a maturity on 21 May 2025.

In a disclosure to Tadawul, the Saudi Stock Exchange, SHL Finance stressed that the proceeds from both facilities will be used to expand and increase the sales volume in line with the company’s strategy and future strategy. Both facilities are covered by promissory notes for the total amount of the facility, and the assignment of receivables to cover 105% of the outstanding balance of the facilities.

Saudi Home Loans Company, which changed its name to SHL Finance in 2023, was established by the Minister of Commerce in 2007 as a Saudi joint stock company established in alliance with the Arab National Bank, Dar Al-Arkan and the International Finance Corporation (IFC) to expand the mortgage finance market in the Kingdom to serve a growing young demography of future homeowners. The company falls under the supervision of the Central Bank of Saudi Arabia.

SHL Financing Company (SHL) is one of the leading real estate finance companies in the Saudi market. It specializes in Sharia’a compliant residential mortgages and provides multiple financing products and solutions for both retail and commercial customers that suits their needs and in compliance with laws and regulations in Saudi Arabia. It is among the first real estate financing companies that believed in propagating the residential mortgages and support home ownership from its inception. It has had a strong presence in the Saudi Arabia mortgage market since 2008 especially in key cities and focuses on fully digital channels for the loan origination process.

Saudi Arabia’s ACWA Power Raises SAR1.4bn (US$373.17mn) Financing Facility from International Consortium of MDBs Including the IsDB Towards Funding the Construction of a Battery Storage Power Plant Near Tashkent in Uzbekistan.

Tashkent – The Saudi renewable and clean energy giant ACWA Power, which is owned by the Public Investment Fund (PIF), the Saudi sovereign wealth fund, has secured a multi-prong finance facility co-financed by a consortium of development finance institutions and banks, which include the Islamic development Bank (IsDB) to finance the construction of a battery storage power plant in Uzbekistan.

The SAR1.4bn (US$373.17mn) facility agreement which has a tenor of 19 years was signed on 1 July 2024. In a disclosure to Tadawul, the Saudi Stock Exchange, ACWA Power said the consortium comprised EBRD, IsDB, Proparco, DEG, Standard Chartered Bank and KfW-IPEX Bank.

The proceeds from the facility will be used by ACWA Power to fund the 200MW PV and 500MWh Battery Storage Riverside Tashkent Power Plant in the Tashkent region of Uzbekistan.

The total project finance which includes equity contributions amounts to SAR2bn (US$530mn). The project executing company is ACWA Power Riverside Solar Holding Company, which is effectively 100% owned by the Saudi company, which will be responsible for the development, finance, design, construction and operation of the plant. The financing guarantees for ACWA Power are limited to its equity bridge loan, and standby equity.

Abraj Energy Services Secures US$104m Diminishing Musharaka Facility from Alizz Bank to Finance Drilling in Kuwait’s Wafra Field

Muscat – Abraj Energy Services (ABS), Oman’s leading provider of oil and gas services and partly owned by state energy company OQ, signed a Sharia’a-compliant Islamic financing facility worth OR40 million (US$104 million) with Alizz Islamic Bank on 9 June 2024.

The facility according to ABS is structured under a Diminishing Musharaka Structure. In a disclosure to the Muscat Stock Exchange, the company stressed that a total of OR30 million will be used to finance the building of Kuwaiti oil rigs while the remaining OR10 million will be utilised for non-funded working capital facilities.

The new credit facility is the result of the company’s continuous efforts to reduce its reliance on conventional debt and seek more Sharia’a compliant financial solutions, the statement added. Abraj Energy Services signed a five-year strategic partnership deal with Kuwait Gulf Oil Company and Saudi Arabian Chevron to extract and drill for oil in Kuwait. The deal will see Abraj build three drilling platforms in the Wafra oilfield in Kuwait.

IILM Successfully Closes its Seventh Auction in 2024 with a US$940mn Three Tranche Re/issuance of Short-Term A-1 Rated Sukuk in July

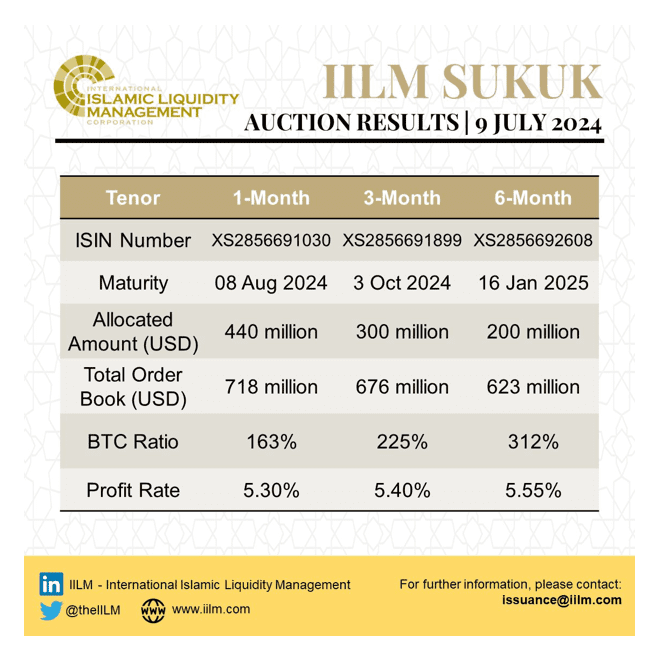

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully reissued its seventh transaction of the year with the reissuance of an aggregate US$940mn of short-term Ṣukuk across three different tenors of one, three, and six-months respectively on 9 July 2024.

This follows a similar auction on 4 June 2024 when the IILM raised a total of US$1.05 billion of short-term Ṣukuk across three different tenors of one, three, and twelve-months. The three series reissued on 9 July 2024 were priced competitively at:

i) 5.30% for the US$440mn Sukuk with a 1-month tenor.

ii) 5.40% for US$300mn with a 3-month tenor.

iii) 5.5% for US$200mn with a 6-month tenor.

The Sukuk reissuance witnessed a competitive tender among Primary Dealers and investors from markets across the GCC region as well as Asia, with a combined orderbook more than US$2.01bn, representing an average bid-to-cover ratio of 214%.

Mr. Mohamad Safri Shahul Hamid, Chief Executive Officer of the IILM, commented on the transaction: “As we continue the momentum post-Eid Al Adha holidays, we are pleased to observe a healthy market activity and strong demand among investors for the IILM’s Islamic papers amidst uncertain market conditions. Apart from having the participation of Affin Islamic Bank as the IILM’s latest Primary Dealer, today’s auction also witnessed an encouraging level of interest from an Islamic banking window in a GCC country where the IILM does not currently have a Primary Dealer, further reinforcing the growing appeal of the IILM Sukuk amongst Islamic investors in the region.”

With this latest reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$6.63bn through 21 Sukuk series. The Sukuk offering was completed under the IILM’s US$4bn short-term Sukuk Issuance Programme rated “A-1” (S&P) and “F1” (Fitch Ratings). The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The total amount of IILM Sukuk outstanding is now US$3.51 bn. The IILM, added Mr Mohammed Safri, will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM’s short-term Sukuk is distributed by a diversified network of 11 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, Affin Islamic Bank, and Standard Chartered Bank. The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

Malaysia’s Mortgage Securitiser Cagamas Berhad Continues Issuance Momentum with Aggregate RM8.15bn (US$1.74bn) of Sukuk and Conventional Bond Issuances in First Half 2024 to Fund Purchase of Islamic and Conventional Mortgages from the Market

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of mortgage finance-related Sukuk, successfully raised a cumulative total of RM8.15bn (US$1.74bn) in the First Half of 2024, comprising RM1.64bn (US$350mn) of Islamic-Medium Term Notes (IMTN), RM2.08bn (US$440mn) Conventional Medium Term Notes (CMTNs), SGD70mn Singapore Dollar Medium Term Notes (SGD EMTNs), RM2.38bn (US$510mn) Islamic Commercial Papers (ICPs), RM0.51bn (US$108.80mn) Conventional Commercial Papers (CCPs), and RM1.3bn (US$280mn) through other sources of funding.

Kameel Abdul Halim, President/Chief Executive Officer of Cagamas, reiterated the Company’s continued commitment to supporting home ownership and the growth of the secondary mortgage market in Malaysia. “Cagamas has demonstrated resilience by providing liquidity to asset-selling institutions, successfully raising RM8.15 billion in the first half of 2024,” he said.

Highlighting Cagamas’ financial intermediary role in the banking sector, Kameel maintained that the Corporation’s “effective funding strategy and ongoing investor confidence in the Company have contributed to our healthy performance in the fund-raising activities, underscoring the strategic importance of Cagamas within the financial ecosystem.”

The Company’s issuances will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu with all other existing unsecured obligations of the Company.

Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers are listed and traded under the Scripless Securities Trading System of Bursa Malaysia. Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM421.91 billion (US$90.01 billion) worth of corporate bonds and Sukuk.