Trade Electronic Intermediation Leader DDCAP Group Accorded Malaysia Digital (MD) Status by Minister of Digital Malaysia as UK Investments in the Country’s Digitalisation Ecosystem Grows

Kuala Lumpur – The DDCAP Group together with six other international corporates has been accorded Malaysia Digital (MD) status – an initiative of the Malaysian Government aimed at attracting and promoting foreign direct investment in the country’s burgeoning digital technology and business sector.

“I had a frank discussion with representatives from 34 companies at the Digital Investment Roundtable about the unique advantages offered by Malaysia as a digital hub of Southeast Asia, and how it’s currently a preferred destination for global technology and digital investments,” stressed Gobind Singh Deo, Minister of Digital Malaysia.

The minister was addressing delegates at the Roundtable in Kuala Lumpur in June 2024, which was attended by DDCAP Group Deputy CEO Lawrence Oliver. DDCAP Group joins six other corporates comprising AiRecruiter, Bitsilica, Capco, Kestrl, Tribal, dan Vodafone to be accorded the MD Status. The event was also attended by Ng Sze Han, the Selangor State Exco of Investment, Trade and Mobility.

Minister Gobind Singh Deo maintained that “Malaysia’s strategic location, robust digital ecosystem, talent availability and government initiatives like Malaysia Digital (MD), make it a top choice for investors. I acknowledge the 7 companies which have recently been accorded MD status in Malaysia.”

There is great interest from many parties in the last few years, with significant investments by global giants such as Amazon, Microsoft, Google, and others.

“Digital investments from the UK continue to grow and today we are well-positioned to attract more companies from the UK. With UK’s upcoming ratification of the CPTPP, both countries are on a firm footing to reap the benefits of bilateral trade and investments,” he added.

It is noteworthy that the British Malaysia Chamber of Commerce (BMCC), of which DDCAP Group is a member, signed an MoU with the Malaysian Digital Economy Corporation (MDEC) in March 2024 to bolster digital trade and economic cooperation between the UK and Malaysia, which was also followed by a Roundtable discussion on Malaysia’s digital agenda, strategies within the digital and tech domains, and collaborative opportunities for the Chamber and its members to contribute to these initiatives. Dato’ Zabidi, Director of DDGI KL Regional Office participated in the Roundtable.

Sharjah Real Estate Developer, Arada Returns to International Debt Market with Second Fixed Rate RegS US$400mn Public Sukuk Issuance

Sharjah – Arada Developments LLC, the largest developer in Sharjah, successfully closed its second public Sukuk issuance – a 5-year fixed rate US$400mn RegS Sukuk Ijara/Murabaha on 11 June 2024.

The Sukuk Certificates were issued by Arada Sukuk 2 Limited, incorporated in the Cayman Islands, as the Issuer, Trustee and Lessor, on behalf of the Obligor and Lessee, Arada Developments LLC. This is the This is the first issuance under Arada Sukuk 2 Limited’s newly established US$1bn Trust Certificate Issuance Programme, which was arranged by Emirates NBD Capital and Standard Chartered Bank.

Arada had mandated Abu Dhabi Commercial Bank, Dubai Islamic Bank, Emirates NBD Capital, and Standard Chartered Bank to act as Joint Global Coordinators for the transaction, and were joined by Arab Bank, Kamco Invest, Mashreq, RAK Bank, Sharjah Islamic Bank and Warba Bank as Joint Lead Managers and Bookrunners.

Arada, rated ‘B1’ by Moody’s Investors Service and ‘B+’ by Fitch Ratings, priced the transaction at par with a coupon of 8.000% per annum payable semi-annually in arrear, inside the initial guidance area of 8.625% for a spread of 355 basis points (bps) over US Treasuries. The transaction, says Arada Developments, “achieved one of the highest price tightening by a real estate issuer from the GCC, and also priced with a spread which is more than 150bps inside the previously priced debut Sukuk.”

The proceeds of the Sukuk will be used for the management of existing bilateral funding, general corporate purposes and to support development of Arada’s existing projects. According to the real estate developer, the Sukuk issuance saw strong demand from regional and international investors, with the issuance oversubscribed 3.5 times and the order book exceeding US$1.45bn. Investor interest for the Sukuk was diversified geographically, coming from Europe, Middle East and Asia, comprising institutional investors, fund managers, High Net Worth Individuals (HNWIs), and banks.

Prince Khaled bin Alwaleed bin Talal, Vice Chairman of Arada, commented: “We are pleased to have enjoyed a successful return to the market with the closure of our second Sukuk. This landmark issuance is once again testament to the strong level of interest from institutional investors around the world in Arada’s stable track record, good governance, and compelling growth story.”

The Sukuk certificates of this latest issuance have been admitted for listing and trading on the International Securities Market of the London Stock Exchange, the Main Market of Nasdaq Dubai, and Official List of the Dubai Financial Services Authority (DFSA).

Arada Developments issued its maiden Sukuk, a US$350mn 5-year fixed rate RegS issuance in June 2022. The certificates were priced at par with a coupon of 8.125% per annum, inside the initial price guidance area of 8.25% for a spread of 530 basis points over US Treasuries. In October 2022, Arada raised US$100mn in a first tap issue which received an overwhelming response from the international debt capital market, resulting in an oversubscription with orders exceeding US$185 million. The tap was priced at 99 cents on the dollar, with an investor yield of 8.386%.

In February 2023, the company raised another US$50mn through a second tap issuance which brought the total size of the Sukuk to US$500mn, which was priced at 99 cents on the dollar, with an investor yield of 8.448%. The second tap, according to Arada Developments, was executed based on investor feedback and inquiries, following extensive roadshows across the UK and GCC. Mashreq acted as the sole Manager and Bookrunner for the second tap.

Consortium of 17 Banks Close Record US$1.2bn Hybrid Ijara-Cum-and Conventional Financing Facility for Bahrain’s Al Dur Power and Water Company (ADPWC) to Refinance Existing Conventional Debt

Manama – Al Dur Power & Water Company, the one of the largest power generation and water desalination company in Bahrain, successfully closed a US$1.2bn hybrid conventional finance and Ijara (leasing) refinancing facility provided by a syndicate of 17 local, regional, and international banks on 18 June 2024.

The refinancing facilities comprise a US$643mn conventional loan facility and a US$557mn Ijara (lease financing) facility involving a wide range of commercial lenders active in the European and Middle Eastern project finance markets. The facilities have a tenor of up to 11 years.

The lenders and hedge providers, via conventional and Islamic facilities, include Abu Dhabi Commercial Bank, Al Ahli Bank of Kuwait, Ahli United Bank, Arab Bank, Bank ABC, ABC Islamic Bank, Arab Petroleum Investments Corporation (APICORP), Al Salam Bank, Banque Saudi Fransi, Boubyan Bank, Gulf International Bank, Kuwait Finance House (Bahrain), Mashreqbank, National Bank of Kuwait – Bahrain Branch, Société Générale, Standard Chartered Bank and Warba Bank.

Al Dur Power & Water Company is owned by a consortium comprising of Kahrabel F.Z.E., a wholly owned subsidiary of ENGIE, a French-based utility major and global reference in low-carbon energy and services with an annual turnover in 2023 of €82.6bn (US$88.70bn), the Kuwait-based Gulf Investment Corporation (GIC), Japanese Group Kyushu Electric Power Company (Kyuden), and the Social Insurance Organisation (SIO) of Bahrain.

According to ADPWC, the new facilities allow the Company “to refinance its existing project-level debt on terms reflecting the status of the project as an asset with no construction risk and a proven operating history.”

The company’s flagship project is the Al Dur Independent Water and Power Project (Al Dur IWPP) in Bahrain, which accounts for a significant portion of the country’s power and water production, with a capacity of 1,234MW in respect of power and 48 MIGD in respect of water per day. ADPWC benefits from a 25-year power and water purchase agreement with the Electricity and Water Authority in Bahrain.

According to City law firm, Latham & Watkins, who advised the commercial banks and Islamic financiers on the transaction, the project relates to the private generation of electrical power through a gas to power plant of 1,234 MW net power capacity and the production of desalinated water by a 48 MIGD desalination facility.

Al Rajhi Bank and Zain Saudi Arabia Sign SAR1.6bn (US$430mn)

Agreement to Finance Supply Chains and Receivables

Jeddah – Al Rajhi Bank, one of the largest Islamic banks in the world in terms of assets, signed a supplier financing contract agreement worth SAR1.625bn (US$430mn) with Zain Saudi Arabia, the leading provider of communications and digital services in the Kingdom. This financing agreement aims to invest in expanding Zain’s fifth generation (5G) network and enhancing the infrastructure to support the business sector.

According to Engineer Sultan bin Abdulaziz Al-Deghaither, CEO of Zain Saudi Arabia, “with this investment, Zain Saudi Arabia will significantly expand its qualitative investments in its 5G network across the Kingdom, enhancing its portfolio with innovative digital solutions and applications tailored for individual customers and the business sector. This initiative is set to provide the latest and most advanced digital experiences.”

This latest agreement is under the memorandum of understanding signed last year by Al Rajhi Bank and Zain Saudi Arabia to form a strategic partnership, allowing closer cooperation between the leading bank in the sector and one of the most important telecommunications companies in the Kingdom.

Engineer Al-Deghaither, CEO of Zain Saudi Arabia, commented: “At Zain Saudi Arabia, we are committed to an integrated strategy that balances achieving our core objective of empowering our individual and business customers with the latest technologies and digital solutions. Our partnership with Al Rajhi Bank aligns with the ambitions of Saudi Vision 2030, aiming for sustainable digital transformation and contributing to a new era of digital innovation in the Kingdom. This financing agreement supports our strategy to provide a distinguished customer experience, innovative services, and enhanced services for religious tourism, particularly for pilgrims. It also further solidifies this strategic partnership, highlighting the mutual commitment to enriching the digital landscape in Saudi Arabia.”

According to Waleed Al-Mugbel, Managing Director and CEO of Al Rajhi Bank, the two parties plan to deepen their collaboration in the digital space, thus opening new horizons for the development of the communications and digital services sector in the Kingdom.

Türkiye Treasury Continues Domestic Sovereign Lease Certificates (Sukuk Al-Ijarah) Issuance Momentum Raising an Aggregate TRY18,490.41mn (US$568.16mn) in June 2024

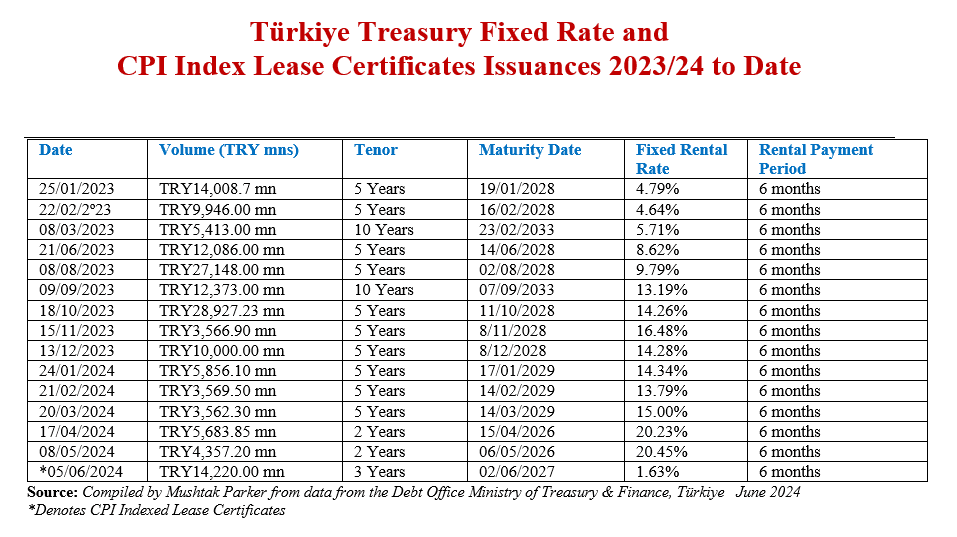

Ankara – Türkiye’s sovereign Sukuk issuance continued its momentum in May and June 2024 with several auctions as the Türkiye Treasury further consolidated its regular issuance of Sukuk Al-Ijarah in the domestic, international, and Gold-linked markets on the back of improving macro-economic fundamentals, with inflation on a downward trajectory from the 65% recorded in January 2024.

Not surprisingly, for manifold reasons, public debt issuance including domestic fixed rate and CP Indexed lease certificates (Sukuk Al Ijarah), FX-linked lease certificates and Gold-linked lease certificates have settled down into a regular pattern as part of the country’s public debt fund raising strategy in addition to the Treasury’s regular forays into the US Dollar and Eurobond markets. The FX-linked certificates are primarily issued in the US Dollar and the Euro Fixed Rent Rate Lease Certificates (Sukuk Al-Ijarah) market.

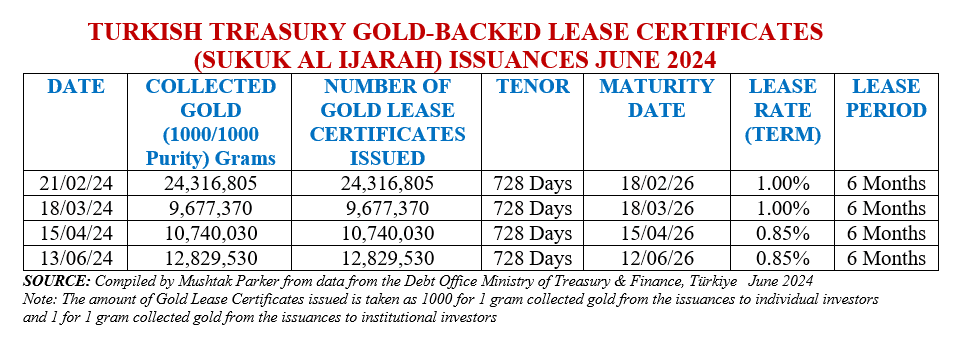

On 13 June 2024, the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 12 June 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 12,829,530 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 12,829,530 gold lease certificates (at a nominal value).

The amount of Gold Lease Certificates issued, according to the Treasury, is taken as 1,000 for 1 gram collected gold from the issuances to individual investors and 1 for 1 gram collected gold from the issuances to institutional investors.

This transaction was followed by a similar one on 15 April 2024 when the Treasury issued Gold-backed Lease Certificates (Sukuk Ijarah) with a tenor of 728 days maturing on 15 April 2026 priced at a Lease Rate of 0.85% payable over the 6 Month lease period. The amount of gold collected, according to the Treasury, amounted to 10,740,030 grams of gold (1000/1000 purity) from institutional investors for issuance of an aggregate 10,740,030 gold lease certificates (at a nominal value).

The direct sale auction of its latest Gold-backed Lease Certificates (Sukuk Ijarah) offering was conducted by the Central Bank of Türkiye via AS (Auction System under Central Bank Payment Systems).

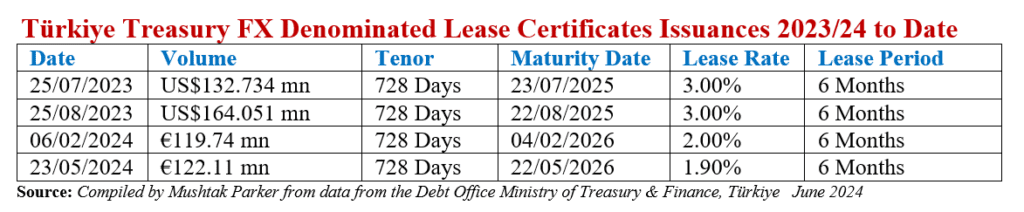

The Treasury also had an auction in the FX-linked issuance market on 23 May 2024 when the Treasury raised €122.11mn (US$131.27mn) through a Fixed Rent Rate Lease Certificate (Sukuk Al Ijarah) issuance with a tenor of 728 days priced at a fixed rental rate of 1.90% over 6 months and maturing on 22 May 2026. Demand for the certificates was robust.

In the CPI Indexed Lease Certificate market, the Türkiye Treasury raised TRY14,220.00mn (US$436.89mn) in an auction on 5 June 2024 through the issuance 3-year CPI Indexed Lease Certificates (Sukuk al Ijarah) maturing on 2 June 2027 priced at a fixed profit rate of 1.90% over a 6-month rental period. The total bids for this issuance matched the allocated amount.

The Türkiye Treasury in fact raised TRY120,994.22 mn (US$4,174.22 mn) from the domestic market through the issuance of Fixed Rate Lease Certificate (Sukuk al Ijarah) in nine auctions in FY2023. The Türkiye Treasury in the first six months of 2024 have issued consecutive monthly Sukuk Al Ijarah aggregating TRY37,248.95mn (US$1,145.00mn), suggesting that Sukuk Al Ijarah are now a fixed feature of the Treasury’s public debt fund raising strategy.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates and bonds, FX denominated issuances and gold-backed certificates/bonds.

The usual mantra of the Turkish Treasury when announcing these auctions are “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle owned by and on behalf of the Ministry of Treasury & Finance, the obligor. The Ministry of Treasury & Finance also issues these gold-backed lease certificates “to diversify borrowing instruments, broaden the investor base and bring the idle gold into the economy.”

According to Turkish Treasury “citizens are provided with a safe investment tool for gold savings. With the gold bond and gold-denominated lease certificate issuance through five banks, our citizens will win themselves and contribute to the economy.” Investors will be paid TL-denominated returns on a semi-annual basis indexed to the gold price. On maturity, according to the Treasury, investors may request the principal payment as 1 kilogram of gold bar (produced by refineries) or Republic Gold Quarter Coins printed by the Turkish State Mint.

Italian State Export Credit Agency SACE Guarantees First-of-its-kind “Substantive” Commodity Murabaha Facility Provided by HSBC to UAE’s Food Giant, IFFCO, in Support of Italian Food and Beverages Exports to the Middle East

Rome/Dubai – Another sign of growing interest by export credit agencies from non-OIC countries in using Sharia’a compliant credit and investment insurance to support their exports and FDI investments to OIC markets especially in the MENA Region and Southeast Asia, is the “substantive facility” provided by SACE (Italy’s state Export Credit Company) under its Push Programme to support the Italian food and beverage value chain.

The programme, according to SACE, is in collaboration with the IFFCO Group, the international group headquartered in the United Arab Emirates that manufactures and markets a well-integrated range of mass-market food products, related derivatives, intermediates, and services. The IFFCO Group operates 95 facilities in 50 countries, employs around 15,000 people and reaches five continents with its portfolio of over 80 brands.

For the first time globally, SACE has guaranteed financing with an Islamic finance structure in favour of the IFFCO Group in the UAE. SACE’s facilitation aims to maximize business opportunities for companies in the Italian agri-food system, representing a key component of national interest, while ensuring new export opportunities for the entire supply chain involved.

“We are proud to announce the new payment programme which offers substantial facilities aimed at supporting the Italian value chain in the food and beverage sector. SACE secured financing with an Islamic financing structure (Murabaha Al Siala) for IFFCO Group, with HSBC as the sole participant. The SACE facility aims to improve business opportunities for companies through the Italian agri-food system, which is a key element of the national interest, while ensuring new export opportunities for the entire supply chain concerned,” said the export credit company.

Michal Ron, Chief International Officer of SACE, is confident that the agreement with IFFCO will open further opportunities in the Islamic trade finance space. “IFFCO, a leading international player in the fast-moving consumer goods (FMCG) sector, and we agree that this operation will open numerous other opportunities for Italian SMEs in their respective sectors of interest. Furthermore, this is the first Push Strategy operation structured according to Islamic finance principles, which will enable the opening of new markets in the Middle East and other geographies, with a positive impact on Italian exports.”

IFFCO and HSBC both stressed that creating a “global first” Islamic structure under SACE’s Push Programme “exemplified designing a creative financial structure working around complex parameters to synchronize ECA clauses to fit into an Islamic structure to deliver an innovative solution versus conventional offering.”

Alexei Rybakov, HSBC’s Head of Export Finance for MENAT, sees the transaction potentially boosting Euro-Middle East trade using Islamic finance solutions. “This transaction,” he explained, “marks a further development in Sharia’a compliant structures. Innovative cross-border transactions like this are accelerating trade and investment between Europe and the Middle East. This collaboration between IFFCO, SACE, and HSBC has resulted in a ready templated solution to execute Sharia’a compliant ECA financing under SACE’s Push Programme.”

SPAMACO Pens SAR1.53bn (US$410mn) Syndicated Murabaha Financing Facility led by AlRajhi Bank and Banque Saudi Fransi to Refinance

Al Khobar – Sahara and Ma’aden Petrochemicals Co. (SAMAPCO), an affiliate of Sahara International Petrochemical Co. (Sipchem), one of the leading and most ambitious petrochemical companies in the world in sustainable, high-quality polymer and petrochemical products, signed a syndicated SAR1.53bn (US$410mn) Murabaha financing facility in May 2024 with Banque Saudi Fransi and Al Rajhi Bank.

The proceeds will be used towards refinancing SAMAPCO’s SAR 2.25bn (US$600mn) outstanding syndicated loan with the banks. The new SAR1.53bn facility has a tenor of 8 years. In a disclosure to Tadawul (the Saudi Stock Exchange), Sipchem said the agreements also cover a revolving Murabaha facility amounting to SAR200mn (US$ 53.31mn) with each bank to support the company’s working capital and general operational and balance sheet objectives.

According to Sipchem, the new agreements provide better commercial terms and competitive rates, which would contribute to reducing financial costs. Sipchem provided a promissory note as collateral for the rescheduled financing.

UNDP Consolidates Partnership with Islamic Finance Sector by Signing a First-of-its-kind Global Takaful Alliance Agreement with KFH to Provide Insurance Cover to 100mn Farmers Worldwide

Kuwait City – Another sign of greater collaboration between major Islamic finance institutions and global multilateral development institutions is the agreement signed between Kuwait Finance House (KFH) and the United Nations Development Programme (UNDP) in May 2024 at KFH’s headquarters.

Under the “first-of-its-kind Global Takaful Alliance (GTA) agreement,” upon signing KFH becomes a member of the GTA, which aims to provide Takaful cover to 100 million farmers worldwide, and to empower them under a financial inclusion initiative by enabling them to access financing and other instruments to expand their businesses.

According to Dr Abdallah Al Dardari, Assistant Secretary-General of UNDP, and Director of its Regional Middle East Bureau, “the agreement with KFH establishes collaboration on several aspects. The focus will be on supporting small and medium-sized enterprises (SMEs) through Islamic financing solutions for sustainable operations and achieving business sustainability, including through Fintech solutions.”

The two parties have agreed in principle to create a sustainable financing platform, the Green Finance Facility, which aims to connect Islamic finance with sustainable development projects across the Arab region, Africa, and beyond. The rationale behind this lies he added, is the inherent compatibility of Islamic finance principles with the goals of sustainable development.

KFH Acting Group Chief Executive Officer, Abdulwahab Al Rushood emphasized the Bank’s continued efforts to strengthen its leadership role in implementing the UN’s Sustainable Development Goals (SDGs) agenda. He also underscored the importance of solidifying ESG principles across all KFH`s operations.

“KFH pioneered both impact measurement reporting and the issuance of sustainable Sukuk. The strong demand for these Sukuk reflects the growing trend towards sustainability. KFH further solidified its leadership in sustainability by issuing sustainability report and the Kuwaiti banking sector’s first-of-its-kind carbon footprint report. The bank also launched the ‘Keep it Green’ campaign, which has spurred numerous sustainability initiatives,” he added.

Dr Khalid Khalafalla Appointed as Officer-in-Charge of ICIEC

Jeddah – The Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC), the only Shariah-compliant multilateral insurer in the world and a member of the Islamic Development Bank (IsDB) Group, has appointment of Dr. Khalid Khalafalla as Officer-in-Charge of ICIEC, effective 19 May 2024.

Dr Khalafalla takes over from Mr Oussama Kaissi, the CEO of ICIEC, who retired from the Corporation in May 2024 after his appointment in 2015 effective in 2016, since when the membership of the multilateral insurer has increased to 49 with Azerbaijan the latest member states to accede to ICIEC membership earlier this year.

He brings a wealth of experience and expertise to this role, having served in various capacities within the Islamic Development Bank (IsDB) Group. Most recently, he was the Principal Executive Assistant to Dr Muhammad Al Jasser, President of IsDB. Prior to that, he served as Lead Underwriter at ICIEC as well as Acting Head of the IsDB Group Investment Promotion Technical Assistance Program (ITAP).

ICIEC, which is marking its 30th Anniversary this year, has cumulatively insured business to date surpassing US$108.3bn since it started operations in 1995, comprising US$86.2bn in export credit insurance and US$22.1bn in investment insurance. ICIEC has also underwritten policies since inception totalling US$51bn in support of intra-OIC trade and business at end FY2023, and cumulative business insured by SDG Impact since inception of US$77.8bn.

IILM Successfully Closes its Sixth Auction of 2024 with a US$1.05bn

Three Tranche Re/issuance of Short-Term A-1 Rated Sukuk in June

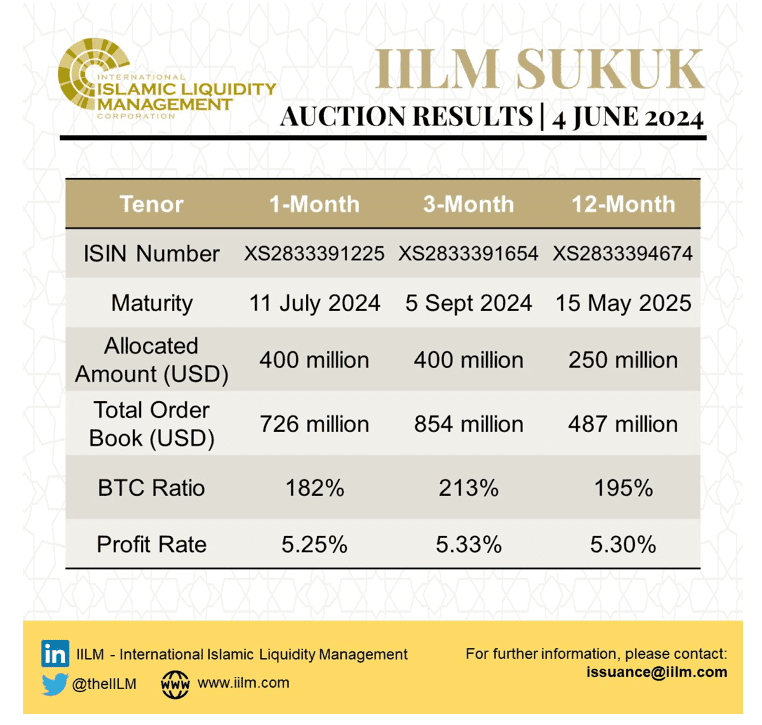

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM), the multilateral international industry organisation that develops and issues short-term Sharia’a-compliant financial instruments, successfully reissued its sixth transaction of the year with the reissuance of an aggregate US$1.05 billion of short-term Ṣukuk across three different tenors of one, three, and twelve-months respectively on 4 June 2024.

This follows a similar auction on 7 May 2024 when the IILM raised a total of US$1.03 billion of short-term Ṣukuk across three different tenors of one, three, and six-months.

The three series reissued on 4 June 2024 were priced competitively at:

i) 5.25% for the US$400mn Sukuk with a 1-month tenor.

ii) 5.33% for US$400mn with a 3-month tenor.

iii) 5.30% for US$250mn with a 12-month tenor.

“The IILM’s Sukuk reissuance today witnessed a competitive tender among Primary Dealers and investors from markets across the GCC region as well as Asia, with a combined orderbook more than US$2.07bn, representing an average bid-to-cover ratio of 197%. Today’s Sukuk reissuance also featured the IILM’s sixth 12-month tenor since its introduction in 2022,” said the Corporation.

With this latest reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$5.69bn through 18 Sukuk series. The Sukuk offering was completed under the IILM’s “A-1” (S&P) and “F1” (Fitch Ratings) rated US$4bn short-term Sukuk Issuance Programme.

The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services. The total amount of IILM Sukuk outstanding is now US$3.51 bn. The IILM, added Mr Mohammed Safri, will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar.

The IILM’s short-term Sukuk is distributed by a diversified network of 10 primary dealers globally, namely Abu Dhabi Islamic Bank, Al Baraka Turk, Boubyan Bank, CIMB Islamic Bank, Dukhan Bank, First Abu Dhabi Bank, Kuwait Finance House, Maybank Islamic, Qatar Islamic Bank, and Standard Chartered Bank.

In early June 2024, the IILM onboarded Affin Islamic Bank Berhad as its eleventh Primary Dealer, becoming the third Malaysian-based Primary Dealer for the IILM’s ‘A-1’ and ‘F1’ rated short-term Sukuk Programme. The agreement was formalised at the signing ceremony between the IILM’s Chief Executive Officer, Mohamad Safri Shahul Hamid and Affin Islamic Bank Berhad’s Chief Executive Officer, Datuk Paduka Syed Mashafuddin Syed Badarudin during the Global Forum on Islamic Economics and Finance (GFIEF) in Kuala Lumpur.

“We look forward to forming a closer relationship with Affin Islamic to reach out to a wider base of investors for the IILM’s short-term Sukuk,” stressed IILM’s Chief Executive Officer, Mohamad Safri Shahul Hamid.

The current members of the IILM Board are the central banks of Indonesia, Kuwait, Malaysia, Mauritius, Nigeria, Qatar, Türkiye, the United Arab Emirates, as well as the multilateral Islamic Corporation for the Development of the Private Sector, the private sector funding arm of the Islamic Development Bank Group.

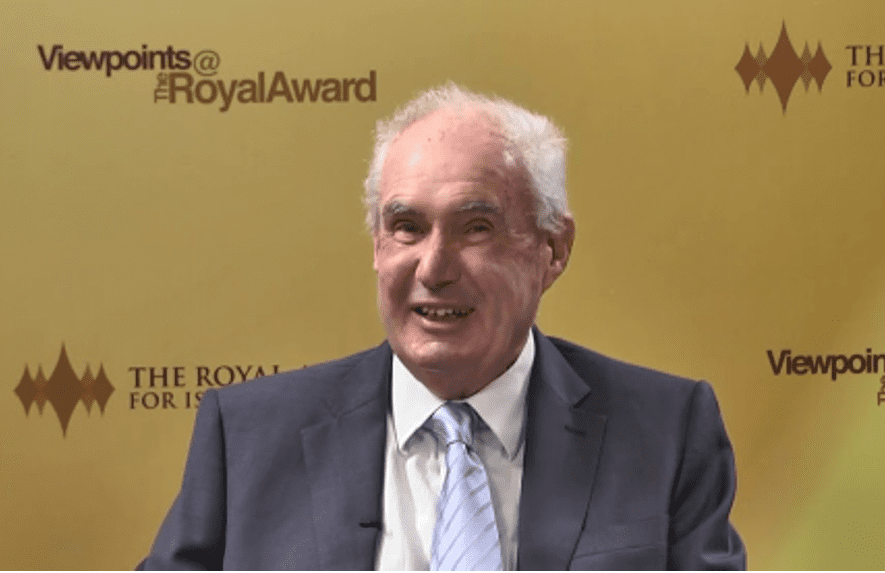

Obituary – Professor Rodney Wilson

Written by Mushtak Parker

A Fond Farewell to Dr Rodney Wilson 1946-2024

London – The global Islamic finance community mourns the passing on 12th June 2024 in France of Professor Rodney Wilson, a distinguished member of the industry academic fraternity, who was the founder of the Islamic Finance Programme at Durham University, a top British higher education institution and member of the prestigious Russell Group.

Professor Wilson started his career at Durham University’s Economics Department, specialising in economic development in the mid-1970s, which led him to take a special interest in Islamic economics and finance when he was at the University’s Institute for Middle Eastern and Islamic Studies & later at the Durham University Business School.

Professor Wilson held senior academic posts in several institutions – ranging from the UK, the Gulf Cooperation Council (GCC) States, to Malaysia. Behind his very genteel persona and deportment, he displayed an unwavering determination to put Islamic finance education, scholarship, and research on the academic map, first at Durham University, and later as Visiting Professor at the Faculty of Islamic Studies at Hamad Bin Khalifa University in Doha Qatar, and as Emeritus Professor at the INCEIF University, in Kuala Lumpur in Malaysia.

He was a prolific writer and publisher of articles, books and reports on Islamic finance and its various rubrics. As such, his numerous publications and tireless advocacy helped to popularize Islamic finance globally.

In addition, he also advised several regulators and industry bodies on various aspects of economics, finance, and Islamic banking. Some of his published books included ‘Islamic Perspectives on Wealth Creation’, ‘Islamic Economics – A Short History’, ‘Islamic Banking and Financial Crisis’, and ‘Legal, Regulatory and Governance Issues in Islamic Finance’.

These included as an Advisor to the Central Bank of Qatar (2009-2010) on Monetary Policy and Prudential Ratios; Advisor to the multilateral Islamic Financial Services Board (IFSB) based in Kuala Lumpur (2007-2009) on Shariah Governance; Consultant to the African Development Bank on Assessing the Potential of the Islamic Finance Industry and the Capital Markets in North Africa; Consultant to the Islamic Development Bank and the Ministry of Economy and Planning of Saudi Arabia.

Not surprisingly, his achievements and dedication were recognised through several awards including the Islamic Development Bank Prize in Islamic Banking and Finance, which he shared with Mufti Taqi Usmani of Pakistan in 2014. He was cited for his contribution to Islamic economics and finance knowledge and practice.

I served with Professor Wilson as a Member of the International Jury of the Royal Award for Islamic Finance (RAIF), launched by the Malaysian Ministry of Finance, Bank Negara Malaysia and the Securities Commission Malaysia under the Patronage of the Malaysian Agong (King). Professor Wilson’s contributions to the process were always informed, incisive and considered.

Professor Wilson’s demise at the age of 78, leaves a void in the academic and professional landscape, but his legacy will continue to inspire and guide those who were his students, mentees, collaborators, and partners.

He will be remembered not only for his intellectual contributions, but also for his warmth, generosity of spirit, and unwavering belief in the power of Islamic finance to create a more just and equitable system of financial intermediation.

Professor Rodney Wilson 1946-2024 May his Soul Rest in Peace!