NEWS in BRIEF

IsDB Board Approves US$130m Total New Financing for Sustainable Development Projects in Four Member Countries in September 2021

Jeddah – The Board of Executive Directors of the Islamic Development Bank (IsDB) Group, the multilateral development bank (MDB) of the 57 member countries of the Organisation of Islamic Cooperation (OIC), approved total new financing of US$130.12 million to member countries at its 342nd periodic meeting in Jeddah in September 2021.

The financing includes:

i) A US$ 20.15 million facility for the Rural Electrification Project comprising a number of Mini Solar Power Plants in Togo. In addition, the Lives and Livelihoods Fund (LLF) provided US$10.85 million to improve the level of human development in Togo by providing a sustainable supply of electricity to the rural population who live in dense and sparsely populated areas far from the existing grid. The electricity, according to the IsDB, will benefit 372 schools, 22, 092 families, and 102 health centres.

ii) A US$17 million facility to Iraq for the Reconstruction of the Hawija Technical Institute Project to support the efforts of the Iraqi government to reconstruct the most affected areas after the conflict.

iii) A US$36.4 million facility for Bangladesh for the Inclusive and Integrated Sanitation and Hygiene Project. The LLF also provided US$19.6 million for the project which aims to ensure better lives and livelihoods for 1.4 million Bangladeshi people by providing adequate and accessible sanitation and hygiene facilities and services with a focus on poor urban women and children.

iv) A US$26.12 million line of financing for Cameroon to support small-and-medium-size enterprises (SMEs) which are the engine of economic activities in Cameroon, and thus job creation.

Cameroon is experiencing severe challenges as a result of the dual COVID-19 epidemic and trade shocks. Weak global demand, low commodity prices, and local containment measures all weigh on the country’s future, generating major economic and social consequences. The shocks have resulted in budgetary constraints and negatively affected the country’s balance-of-payments.

In early September the IsDB at its 46th Annual Meetings in Tashkent, Uzbekistan in addition boosted its COVID-19 mitigation financing response with an additional US$1.2 billion in funding commitments as part of its effort to support the post-pandemic economic recovery among its member countries.

Pakistan’s Meezan Bank Leads PKR4.5bn (US$25.98m) Murabaha Syndication Facility for Engro Enfrashare

Karachi – A consortium led by Meezan Bank and Faysal Bank arranged a PKR4.5 billion (US$25.98 million) Syndicated Murabaha Facility in September 2021 for the local Engro Enfrashare, a wholly owned subsidiary of Engro Corporation.

The proceeds raised through this Islamic syndication, according to Meezan Bank, would be utilized to finance the development of tower sites for various mobile network operators (MNOs) operating in Pakistan.

The facility has a tenor of seven years, including a grace period of two years. The syndicate includes Meezan Bank Limited, Faysal Bank Limited, National Bank of Pakistan, MCB Islamic Bank and Allied Islamic Bank.

Engro recently increased its total equity investment in the Telecom Infrastructure Vertical to PKR21,500 million. The Telecom Infrastructure Vertical was setup in 2019 to accelerate the development of connectivity infrastructure in Pakistan, thereby providing an opportunity for the people to be part of the new digital era.

Engro Enfrashare is engaged in the acquisition and construction of shared telecom towers, provision of various telecommunication infrastructure and related services, including state of the art network monitoring solutions. Since its inception, the Company has now established strong relationships with all MNOs active in Pakistan and is working closely with them to develop build-to-suit (B2S) sites across the country to serve their coverage and capacity requirements.

According to Ghias Khan, President & CEO Engro Corporation, “Engro is committed to expand its footprint in the Telecom Infrastructure vertical to power Pakistan’s progress in the digital era. With the support of banking partners like Meezan Bank, Engro Enfrashare will continue to work towards its purpose of making connectivity more accessible and affordable for everyone.”

Irfan Siddiqui, Founding President & CEO, Meezan Bank, added that digitization would be a major element driving business success.

Meezan Bank, Pakistan’s leading Islamic bank, is also collaborating with the National Clearing Company of Pakistan Limited (NCCPL) for developing new Sharia’a-compliant products for the country’s capital market. “Through this collaboration,” explained Mr Siddiqui, “Meezan Bank will extend its support in introducing a Murabaha Share Financing System (MSF), a new Sharia’a-compliant product, implemented by NCCPL, that will help in extending Sharia’a-compliant stock financing facilities to stockbrokers and their customers.”

Under this collaboration, both organizations will work to enhance the proportion of Islamic products in Pakistan’s capital markets and develop new Sharia’a-compliant financial instruments. Meezan Bank is the first bank in the country to be inducted in the MSF System as a Non-Broker Clearing Member for the purpose of extending Sharia’a-compliant financing to stockbrokers and their customers in Pakistan.

Maybank and UOB Lead Consortium for RM2bn (US$481m) Syndicated Commodity Murabaha Facility for Malayan Cement Bhd

Kuala Lumpur – Malaysia’s Maybank Investment Bank and United Overseas Bank (Malaysia) Bhd are leading a consortium of banks arranging a RM2 billion (US$481.41 million) Syndicated Murabaha Facility for Malayan Cement Bhd (MCB).

The two banks were appointed the underwriter and bookrunner for the transaction on an equal basis in September 2021. The facility will fund MCB’s acquisition of 10 companies in the cement and ready-mixed concrete sector in Malaysia from its parent company, YTL Cement Bhd. MCB will use the Commodity Murabaha (Tawarruq) facility to finance the cash consideration for the acquisition of the entire equity interest of the 10 companies and their respective subsidiaries from YTL Cement for a total consideration estimated at RM5.2 billion.

“We would like to thank MCB for the trust given to Maybank to support this landmark transaction. We look forward to further collaboration as MCB continues its transformative journey as one of the pioneers of the local building materials industry,” said Maybank Investment Bank chief executive officer (CEO) Fad’l Mohamed.

The acquisition exercise, according to YTL Cement and MCB managing director Datuk Seri Michael Yeoh Sock Siong, will allow the group to streamline and improve its operational efficiencies as it leverages each other’s resources, expertise, and experience. “This consolidation will help us achieve economies of scale, enhance market presence, reduce duplicated functions, and ultimately, provide seamless solutions to our customers,” he said.

ICD Extends US$25m Line of Financing for Nigerian Islamic Financial Institution, JAIZ Bank

Tashkent – The Islamic Corporation for the Development of the Private Sector (ICD), the private sector arm of IsDB Group, extended a US$25 million Islamic line of financing in September 2021 to Jaiz Bank, Nigeria’s premier Islamic bank.

The facility agreement was signed in early September on the sideline of the 46th Annual Meetings of the IsDB Group in Tashkent, Uzbekistan.

According to the ICD, the proceeds from the facility will be used to support SMEs in Nigeria, in particular those SMEs adversely affected by the COVID-19 outbreak. Out of this US$25 million facility, US$10 million is being allocated under the ICD’s US$250 million COVID-19 Support Package to help the private sector affected by the pandemic by leveraging on the experience of the banking system of its member countries.

According to ICD Chief Executive Officer Ayman Sejiny, “the facility will help to expand Jaiz Bank’s customer base through the provision of Sharia’a-compliant financing in response to growing demand for Islamic finance to support, among others, COVID-19 affected projects and industries.”

Malaysia’s Mortgage Securitiser Cagamas Berhad Sustains its Sukuk Issuance with RM300m (US$72.21m) Sukuk in October 2021

Kuala Lumpur – Cagamas Berhad, the National Mortgage Corporation of Malaysia, one of the most prolific issuers of Sukuk, successfully closed its latest Islamic debt offering – a RM300 million (US$72.21 million) 3-month Islamic Commercial Papers (ICPs) issuance on 13 October 2021.

The ICPs were issued under Cagamas’s existing RM60 billion Islamic/Conventional Medium Term Notes Programme. Proceeds from the issuance will be used to purchase Islamic home financing from the financial system.

“We are pleased with the conclusion of Cagamas’ latest issuance which saw continued buying interest of our short-term papers, despite the global and local fixed income markets coming under pressure from the growing expectations of the asset-tapering announcement by the US Federal Reserve at its November meeting,” said Cagamas President and Chief Executive Officer, Datuk Chung Chee Leong.

“The ICPs were priced at the corresponding 3-month Kuala Lumpur Interbank Offered Rate (KLIBOR) plus 5 basis points (bps), or equivalent to 1.99% based on KLIBOR fixing on the pricing date. The spread was 23 bps above the corresponding Malaysia Islamic Treasury Bills,” he added.

The issuance brings the Company’s aggregate issuances for the year to RM12.25 billion (US$2.95 billion). Cagamas plays a major role in Sukuk origination and continues to be an innovator in the mortgage finance and securitisation market. The Cagamas papers, which will be redeemed at their full nominal value upon maturity, are unsecured obligations of the Company, ranking pari passu among themselves and with all other existing unsecured obligations of the Company. They will be listed and traded under the Scripless Securities Trading System of Bursa Malaysia.

Cagamas’ corporate bonds and Sukuk continue to be assigned the highest ratings of AAA and P1 by RAM Rating Services Berhad and AAA/AAAIS and MARC-1/MARC-1IS by Malaysian Rating Corporation Berhad, denoting its strong credit quality. Cagamas is also well regarded internationally and has been assigned local and foreign currency long-term issuer ratings of A3 by Moody’s Investors Service Inc. that are in line with Malaysian sovereign ratings.

The Cagamas model is well regarded by the World Bank as the most successful secondary mortgage liquidity facility. Cagamas is the second largest issuer of debt instruments after the Government of Malaysia and the largest issuer of AAA corporate bonds and Sukuk in the market. Since incorporation in 1986, Cagamas has cumulatively issued circa RM320.1 billion worth of corporate bonds and Sukuk

——————————————————————————————————-

IILM Continues Ninth Consecutive Monthly Short-Term Sukuk Issuance with US$1.2bn Three-Tranche Offering in September 2021 as Year-to-Date Aggregate Tops US$10.56bn

Kuala Lumpur – The International Islamic Liquidity Management Corporation (IILM) continued its short-term Sukuk issuance calendar with its ninth monthly auction in September 2021 by successfully reissuing a total of US$1.2 billion short-term A-1-rated Sukuk across three tenors – 1 month, 3 months and 6 months.

The transaction comes under IILM’s US$4.0 billion short-term issuance programme. The Corporation held an auction on 13 September 2021 for the three series of re-issuances, priced by the market as follows:

- US$400 million of 1-month tenor certificates at 0.22%

- US$500 million of 3-month tenor certificates at 0.28%

- US$300 million of 6-month tenor certificates at 0.35%

This reissuance follows the three-tranche issuance of short-term securities in August 2021 totalling US$1.25 billion.

The Sukuk reissuance, which marks the IILM’s ninth Sukuk auction for 2021, garnered significant interest among the GCC-based Islamic Primary Dealers and investors, as well as higher participation observed among Asian-based Primary Dealers and investors for the 3- month tenor, resulting in lower pricing compared to the August Sukuk auction, explained the Corporation. The issuances were distributed through a competitive tender process which witnessed a strong orderbook in excess of US$2.07 billion, representing an average oversubscription rate of 1.73 times.

In light of the reissuance, the IILM has achieved year-to-date cumulative issuances totalling US$10.56 billion through 27 Sukuk series. The IILM will continue to reissue its short-term liquidity instruments monthly as scheduled in its issuance calendar. The IILM is a regular issuer of short-term Sukuk across varying tenors and amounts to cater to the liquidity needs of institutions offering Islamic financial services.

The IILM’s short-term Sukuk programme is rated “A-1” by S&P with current outstanding issuance size amounting to US$3.51 billion. According to the IILM, the primary dealers that participated in the auction conducted under the competitive bidding of the Bloomberg AUPD Platform included Abu Dhabi Islamic Bank; Al Baraka Turk Participation Bank; Barwa Bank; Boubyan Bank; CIMB Islamic Bank Berhad; First Abu Dhabi Bank; Kuwait Finance House; Macquarie Bank; Maybank Islamic Berhad; Qatar Islamic Bank; and Standard Chartered Bank.

Jabal Omar Development Company Signs SAR5.9bn (US$1.57bn) Restructured Islamic Term Financing Facility with SABB and SNB

Jeddah – Jabal Omar Development Company (JODC) signed an agreement with Saudi British Bank (SABB) and Saudi National Bank (SNB) on 4 October 2021 to restructure an existing Islamic term financing facility provided by the two banks in 2015.

In a filing with Tadawul (the Saudi Stock Exchange) JODC confirmed that the restructuring included:

i) Reinstating SR1.2 billion of available limit to be drawn.

ii) Extending the facility’s final maturity by 3 years from the date of maturity of the original financing; with an option to extend by a further 3 years, subject to certain pre-agreed conditions.

iii) Sculpted amortization schedule based on the underlying projects’ cash flows with sufficient headroom.

iv) Scheduled repayments will initiate after a grace period of 3 years.

v) Scope for step-down in profit rate based on achieved progress on Phases 2 and 4 of the Project and deleveraging of the facility.

The restructuring became effective on the date of the agreement signing. The total financing limit before restructuring was SR4.7 billion and the total financing limit after restructuring is SR5.9 billion. The reason for the restructuring is increased funding required to complete Phases 2 & 4 of Jabal Omar Project and to improve the commercial terms of the facility to be aligned with the company’s cash flows and capital structure.

According to JODC, the tenor of the original facility was 12 years from the date of signing the agreement on May 2015. The tenor of the restructured facility is 9 years from the date of signing the agreement to restructure the facility on 4 October 2021, with an option to extend by a further 3 years subject to certain pre-agreed conditions.

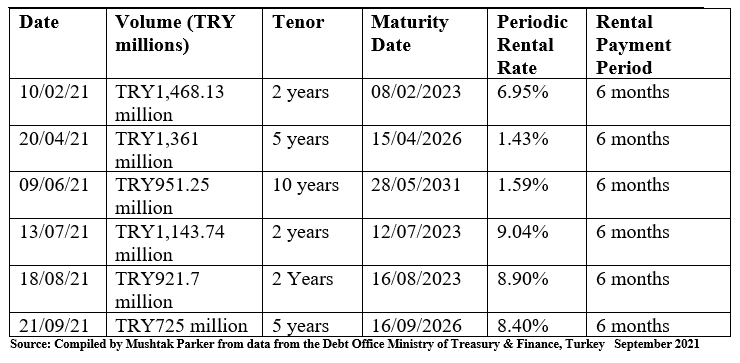

Turkish Treasury Raises TYR725m (US$76.27m) Through Fixed Rate TRY Lease Certificate Issuance in September 2021

Ankara – The Debt Office of the Turkish Treasury and Finance Ministry raised TRY725 million (US$76.27 million) through a TRY 5-year Fixed Rate Lease Certificate (Sukuk al Ijarah) issuance on 22 September 2021.

The Lease Certificate issuance was done through a direct sale auction on 21 September2021. The auction was conducted by the Central Bank of Turkey via AS (Auction System under Central Bank Payment Systems). The issuance has a tenor of 5 years maturing on 16 September 2026 and was priced at a fixed rental rate of 8.40% over a 6-month rental payment period.

This is the third consecutive month of Fixed Rate Lease Certificates issued by the Debt Office. In July it raised TRY1,143.74 million (US$135.45 million) through a TRY 2-year Fixed Rate Sukuk al Ijarah which had a fixed rental rate of 9.04% over a 6-month rental payment period maturing on 12 July 2023. In August it raised TRY921.7 million (US$106.69 million) through a TRY 2-year Fixed Rate Sukuk al Ijarah which had a fixed rental rate of 8.90% over a 6-month rental payment period maturing on 16 August 2023.

The Turkish Treasury is a proactive issuer of lease certificates as part of a wider universe of government fund-raising instruments which include bonds and Sukuk – leasing certificates/bonds, FX denominated issuances and gold-backed certificates/bonds. The usual mantra of the Turkish Treasury when announcing these auctions is “in order to increase the domestic savings, broaden the investor base and diversify the borrowing instruments, TRY denominated fixed rent rate lease certificates will be issue to the banks through direct sale method.”

All the lease certificates were issued by Hazine Mustesarligi Varlik Kiralama A.S., a special purpose vehicle wholly-owned by the Ministry of Treasury & Finance, the obligor.

TURKISH TREASURY TRY FIXED RATE LEASE CERTIFICATES

(SUKUK AL IJARAH) ISSUANCES JANUARY-SEPTEMBER 2021

Indonesian Government Raises IDR27.1 Trillion (US$1.9bn) Through Four Rupiah-denominated Sukuk Auctions in September/October 2021 as Aggregate Funds Raised in January-October 2021 Total IDR173.12 Trillion (US$12bn)

Jakarta – The Government of Indonesia continues to consolidate its role as one of the most proactive repeat issuers of sovereign domestic Sukuk in the market through three auctions and one private placement during the month of September 2021.

The Department of Islamic Financing at the Directorate General of Budget Financing and Risk Management, Ministry of Finance of Indonesia, in fact raised a total IDR27.1 trillion in September and early October 2021, with an aggregate total of domestic sovereign Sukuk raised for January-October 2021 amounting to IDR173.12 trillion.

The Government of Indonesia is a prolific issuer of domestic Sukuk and demand from local institutional investors is robust. The total bids for the current auctions for instance amounted to IDR193.54 trillion.

The September/October 2021 issuances comprised four auctions of Sovereign Shariah Securities (SSS) or Sukuk Negara through the auction system of Bank of Indonesia and one transaction through a private placement.

The auction held on 2 September 2021 of Sovereign Shariah Securities (SSS) raised IDR6.1 trillion comprising five tranches with tenors of 3 years, 5 years, 7 years, 13 years and 25 years. The tranches were priced at a coupon rate of 4%, 4.875%, 5.875%, 6.375% and 7.75% respectively. Total incoming bids for the auction amounted to IDR45.41trillion.

The auction held on 7 September 2021 of Sovereign Shariah Securities (SSS) raised IDR10 trillion comprising six tranches with tenors at of 6 months, 3 years, 5 years, 13 years, 16 years and 25 years. The tranches were priced at a coupon rate at discount, 4%, 4.875%, 6.375%, 6.1% and 7.75% respectively. Total incoming bids for the auction amounted to IDR56.71 trillion.

The auction held on 21 September 2021 of Sovereign Shariah Securities raised IDR6.1 trillion comprising five tranches with tenors of 3 years, 5 years, 7 years, 13 years and 25 years. The tranches were priced at a coupon rate of 4%, 4.875%, 5.875%, 6.375%, 7.75% respectively. Total incoming bids for the auction amounted to IDR52.478 trillion.

The auction held on 5 October 2021 of Sovereign Shariah Securities raised IDR5.0 trillion comprising six tranches with tenors of 6 months, 3 years, 5 years, 7 years, 13 years, 16 years and 25 years. The tranches were priced at a coupon rate at discount, 4%, 4.875%, 6.375%, 6.1% and 7.75% respectively. Total incoming bids for the auction amounted to IDR46.11 trillion.

Bank Al Jazira Extends SAR140 million (US$37.33 million) Islamic Credit Facility to BATIC Investment and Logistics Company to Finance Share Purchase and Other Capital Expenditures

Jeddah – BATIC Investment and Logistics Company (BILC) signed a SAR140 million (US$37.33 million) Islamic credit financing facility agreement with Bank Al-Jazira in October 2021.

In a filing to Tadawul (Saudi Stock Exchange), BILC confirmed that SAR101.362 million, had immediately been drawn down after the agreement signing. The proceeds from the facility is being used to facilitate BILC’s share purchase of 35.8% of Smart Cities Solutions Company for Communications and Information Technology, and in addition to finance other capital expenditures and operating expenses.

The credit facility shall be fully repaid and satisfied under a single payment due within a maximum period of 12 months or upon the receipt of rights issue proceeds (whichever is earlier).

The facility is guaranteed against assignment of the rights issue proceeds and order notes totalling the principal amount of the facility of SAR140 million.