IsDB Closes its Second SOFR-linked Public Sukuk Issuance in 2024 with Hybrid USD1.25bn Sukuk Wakala/Murabaha/Mudarabah Issue

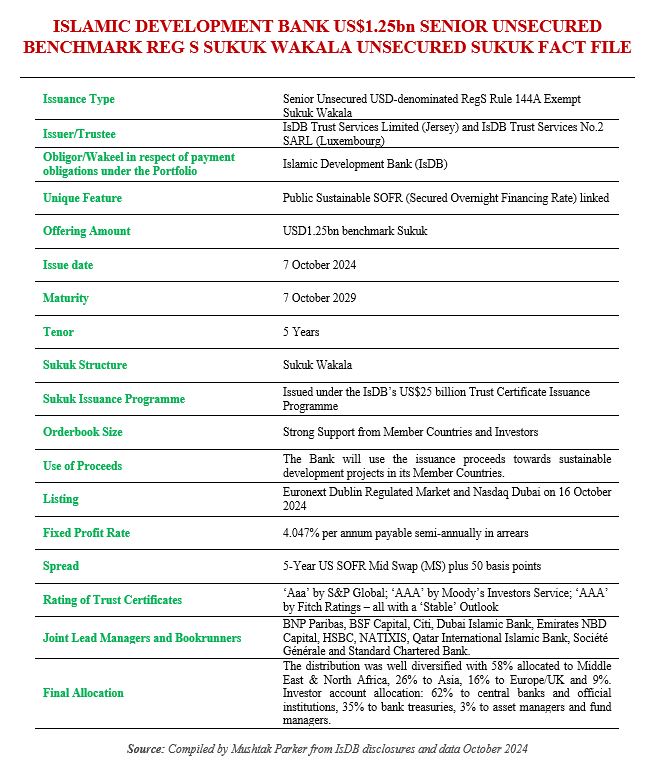

The Islamic Development Bank (IsDB), the multilateral development bank (MDB) of the 57-member OIC (Organisation of Islamic Cooperation) countries, successfully priced its second public Sukuk issuance of 2024 – a USD1.25bn offering on 7 October 2024 with a tenor of five years. The structure is based on a Public Sustainable SOFR (Secured Overnight Financing Rate) linked Sukuk Wakala with Murabaha and Mudaraba components.

This follows a similar transaction for a US$2.00bn offering on 15 May 2024 with a tenor of five years, bringing the aggregate funds raised in 2024 thus far to USD3.25bn trough two Sukuk offerings. The structure for both issuances is based on a Public Sustainable SOFR (Secured Overnight Financing Rate) linked Sukuk Wakala with Murabaha and Mudaraba components.

The Senior Unsecured US Dollar-denominated RegS Sukuk Wakala was issued by IsDB Trust Services Limited (Jersey) and IsDB Trust Services No.2 SARL (Luxembourg), who acted as Trustees to the Obligor/Wakeel, the IsDB, in respect of payment obligations under the Portfolio of the relevant Series of Trust Certificates) provided by the IsDB. The transaction was completed under the IsDB’s US$25 billion Trust Certificate Issuance Programme, which was first established in September 2023 and upgraded in May 2024 as a supplement.

The IsDB remains the most proactive and prolific issuer of AAA-rated Sukuk in the international market. The Bank is rated Aaa/AAA/AAA by S&P, Moody’s Investors Service and Fitch Ratings – all with Stable Outlook.

The IsDB mandated BNP Paribas, BSF Capital, Citi, Dubai Islamic Bank, Emirates NBD Capital, HSBC, NATIXIS, Qatar International Islamic Bank, Société Générale, and Standard Chartered Bank in early October 2024 to act as Joint Lead Managers and Joint Bookrunners for the issuance and to arrange a series of investor calls and visits in the UK, Europe, the Middle East, and Asia.

According to the IsDB, the proceeds of the issuance will be used towards sustainable development projects in its Member Countries. “Celebrating its Golden Jubilee this year, the IsDB aims to deliver socio-economic growth in its 57 Member Countries and Muslim communities globally. This covers projects targeting poverty, climate action, food insecurity, and building resilience. The initiatives follow the Bank’s Realigned Strategy, emphasizing on green and resilient infrastructure and inclusive human development.”

The interventions are guided by the fit-for-purpose Realigned Strategy of the Bank with a stronger focus on green, resilient, and sustainable infrastructure as well as inclusive human development. The IsDB Sukuk issuances are driven by its Strategic Realigment Strategy 2023-2025, first approved at the Group’s 46th Annual Meetings in Tashkent in Uzbekistan.

The Realigned Strategy hinges on three overarching objectives: boosting recovery; tackling poverty and building resilience; and driving green economic growth agenda. The commitment to this strategy was renewed by the Board of Governors of the IsDB at its 47th Annual Meetings in April 2024 in Riyadh, Saudi Arabia.

These objectives will be achieved by focusing the Bank’s interventions on two key pillars over the next three years (2023-2025): (1) developing green, resilient, and sustainable infrastructure; and (2) supporting inclusive human capital development through projects and capacity development initiatives.

The Sukuk transaction was announced to the markets on 7 October, with Initial Price Thoughts (IPTs) set at 5-Year US SOFR Mid Swap (MS) plus 55 basis points (bps) area. With a strong orderbook, the Bank further tightened the guidance by 5 bps on 8 October, to finally close the transaction at 5Y US SOFR MS plus 50 bps, translating into an overall profit rate of 4.047% pr annum.

This contrasts with the similar final spread of 5Y US SOFR MS plus 50 bps for the May 2024 transaction, translating into an overall profit rate of 4.754% per annum payable on a semi-annual basis in arrears.

Following the final pricing, Dr Zamir Iqbal, the Vice President (Finance) and CFO of IsDB, commented: “We are very pleased to have executed another benchmark issuance in a challenging environment. This would not have been possible without the strong support from IsDB’s Member Countries as well as our investors. Special thanks to the new investors who participated in IsDB Sukuk for the first time. They are now our partners for sustainable development around the world.”

In terms of the final allocation, said the IsDB, the distribution was well diversified with 58% allocated to Middle East and North Africa, 26% to Asia and 16% to Europe/UK. Overall, the deal witnessed strong participation from real money accounts and official institutions as well as several first-time investors, a testament of IsDB’s credit strength, as 62% was allocated to central banks and official institutions, 35% to bank treasuries, 3% to asset managers and fund managers.

Mohammed Sharaf, the Head of Treasury at the IsDB and Zakky Bantan, the Manager of the IsDB Capital Markets Division further added: “This issuance is another milestone in our progress towards the Bank’s funding plan for the year. It also met our objectives of building on the success of our previous transactions and achieving a lower overall pricing for the Sukuk. We are very grateful to the investors for their confidence and would also like to thank the joint lead managers for their efforts on this trade.”

The Bank was the first Islamic financial institution to issue a SOFR-linked Sukuk. The Trust Certificates have been admitted for listing on the Regular Market of Euronext Dublin and NASDAQ Dubai on 8 October 2024.

According to Nasdaq Dubai, the listing further cements IsDB’s position as one of the largest Sukuk issuers on the bourse, bringing the current total outstanding value of IsDB’s Sukuk listings on the exchange to USD15.48bn.

“With a total Sukuk listing value of USD92bn, including this latest issuance, Nasdaq Dubai continues to strengthen its standing as one of the world’s leading Sukuk listing venues. The new issuances reiterate the exchange’s commitment to strengthening the Islamic finance sector by providing a robust platform that supports institutions in raising responsible capital, fostering sustainable growth and development across the region,” added the bourse.