IsDB Closes its Third SOFR-linked Public Sukuk Issuance in 2024 with Hybrid €500mn (USD 527.23mn) Sukuk in October

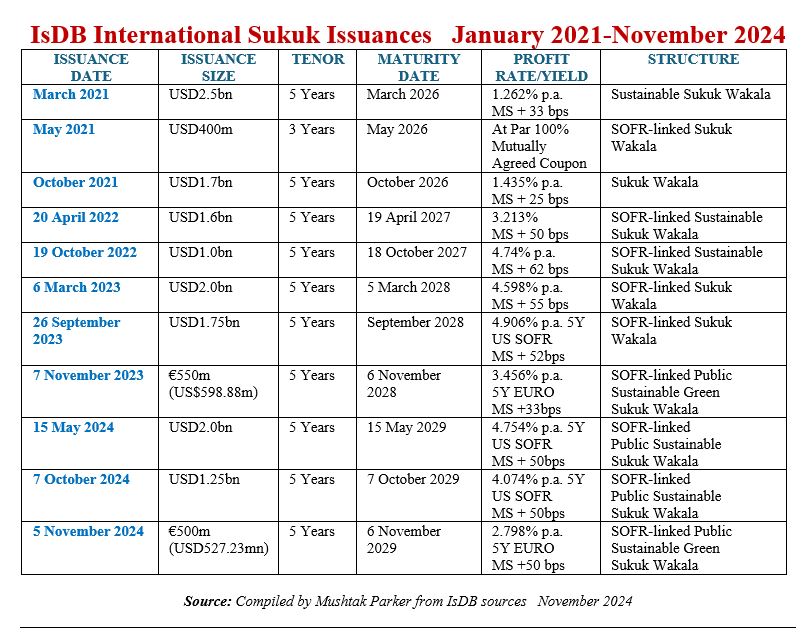

The Islamic Development Bank (IsDB), the multilateral development bank (MDB) of the 57-member OIC (Organisation of Islamic Cooperation) countries, successfully priced its third public Sukuk issuance of 2024 – a €500mn (USD527.23mn) benchmark offering on 30 October 2024 with a tenor of 5 years.

Prior to this third transaction, the IsDB raised USD1.25bn on 7 October 2024, and a further USD2.0bn on 15 May 2024 – both through Public Sustainable SOFR (Secured Overnight Financing Rate) linked Sukuk Wakala/Mudaraba components with a tenor of five years. This brings the aggregate funds raised in 2024 thus far by the IsDB to USD3,777.23mn, trough three Sukuk offerings.

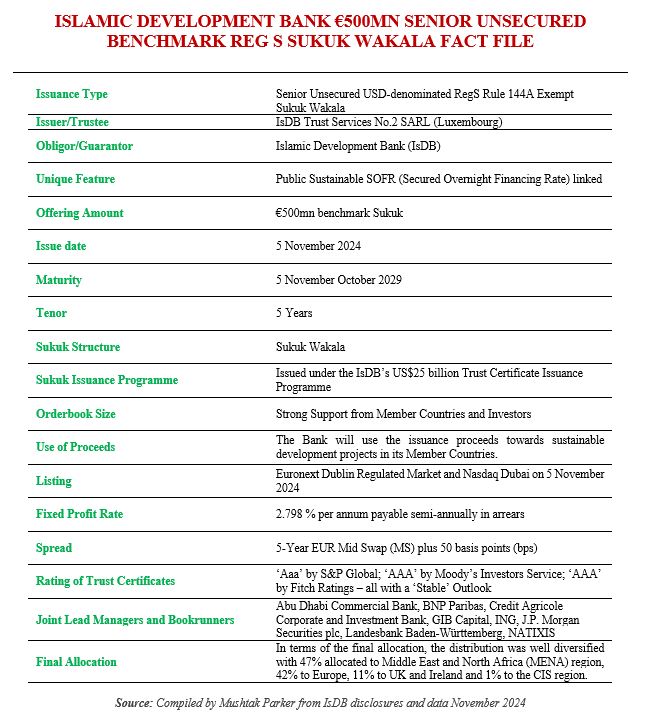

The Senior Unsecured US Dollar-denominated RegS Sukuk Wakala was issued by IsDB Trust Services No.2 SARL (Luxembourg), who acted as Trustees to the Obligor/Wakeel, the IsDB, in respect of payment obligations under the Portfolio of the relevant Series of Trust Certificates provided by the IsDB. The transaction like the two previous ones was completed under the IsDB’s US$25 billion Trust Certificate Issuance Programme, which was first established in September 2023 and upgraded in May 2024 as a supplement.

The IsDB remains the most proactive and prolific issuer of AAA-rated Sukuk in the international market. The Bank is rated Aaa/AAA/AAA by S&P Global Ratings, Moody’s Investors Service and Fitch Ratings (all with Stable Outlook), and has been designated as a Zero Risk Weighted Multilateral Development Bank (MDB) by the Basel Committee on Banking Supervision and the Commission of the European Communities.

The IsDB mandated BNP Paribas, Abu Dhabi Commercial Bank, Credit Agricole Corporate and Investment Bank, GIB Capital, ING, JP Morgan Securities, Landesbank Baden-Württemberg and NATIXIS on 29 October 2024 to act as Joint Lead Managers and Joint Bookrunners for the issuance and to arrange a series of investor calls and visits to the UK, Europe, the Middle East, and Asia.

According to the Bank, it announced the mandate on Tuesday, 29 October, to sound the market and receive expressions of interest from investors. With strong indications, the transaction was then announced to the markets on Wednesday, 30 October, with guidance set at the 5Y EUR Mid Swap (MS) plus 50 basis points (bps) area.

Having achieved the target benchmark size by 12.30pm London time on the same day, and with an oversubscribed orderbook, the Bank maintained the final guidance as is, which translated into an overall profit rate of 2.798%, payable on an annual basis. The issuance was priced at par.

Overall, says the IsDB, the transaction witnessed strong participation from real money accounts and official institutions as well as several first-time investors, a testament of IsDB’s credit strength, as 33% was allocated to central banks and official institutions, 39% to bank treasuries and private banks and 29% to asset managers, fund managers and pension and insurance funds.

In terms of the final allocation, the distribution was well diversified with 47% allocated to Middle East and North Africa (MENA) region, 42% to Europe, 11% to UK and Ireland and 1% to the CIS region.

According to Dr. Zamir Iqbal, the Vice President (Finance) and CFO of IsDB, “This latest transaction is another milestone issuance in Euros for the IsDB in a dynamic environment and we are very pleased with the investors’ response, especially our anchor investors as well as new investors. We thank them for their trust in IsDB’s mission of sustainable development and supporting this transaction.”

The Euro-denominated paper is the Bank’s second consecutive benchmark size issuance in October. The issuance proceeds, according to the IsDB will be deployed towards sustainable development projects in line with the Bank’s strategic objectives that are (a) boosting recovery, (b) tackling poverty and building resilience, and (c) driving green economic growth under its Realigned Strategy in its Member Countries.

The IsDB is celebrating its Golden Jubilee this year. It aims to deliver socio-economic growth in its 57 Member Countries and Muslim communities globally. This covers projects targeting poverty, climate action, food insecurity, and building resilience. The initiatives follow the Bank’s Realigned Strategy, emphasizing on green and resilient infrastructure and inclusive human development.”

The interventions are guided by the fit-for-purpose Realigned Strategy of the Bank with a stronger focus on green, resilient, and sustainable infrastructure as well as inclusive human development. The IsDB Sukuk issuances are driven by its Strategic Realignment Strategy 2023-2025, first approved at the Group’s 46th Annual Meetings in Tashkent in Uzbekistan.

The Realigned Strategy hinges on three overarching objectives: boosting recovery; tackling poverty and building resilience; and driving green economic growth agenda. The commitment to this strategy was renewed by the Board of Governors of the IsDB at its 47th Annual Meetings in April 2024 in Riyadh, Saudi Arabia. These objectives will be achieved by focusing the Bank’s interventions on two key pillars over the next three years (2023-2025): (1) developing green, resilient, and sustainable infrastructure; and (2) supporting inclusive human capital development through projects and capacity development initiatives.

The Sukuk transaction was announced to the markets on 7 October, with Initial Price Thoughts (IPTs) set at 5-Year US SOFR Mid Swap (MS) plus 55 basis points (bps) area. With a strong orderbook, the Bank further tightened the guidance by 5 bps on 8 October,

The pricing for the first transaction in October 2024 closed at 5Y US SOFR MS plus 50 bps, translating into an overall profit rate of 4.047% pr annum. This contrasts with a similar final spread of 5Y US SOFR MS plus 50 bps for the May 2024 transaction, translating into an overall profit rate of 4.754% per annum payable on a semi-annual basis in arrears.