PIF Islamic Mortgage Securitisation Subsidiary Saudi Real Estate Refinance Company (SRC) Completes Pricing of its Inaugural Government-Guaranteed US$2bn International Sukuk Offering

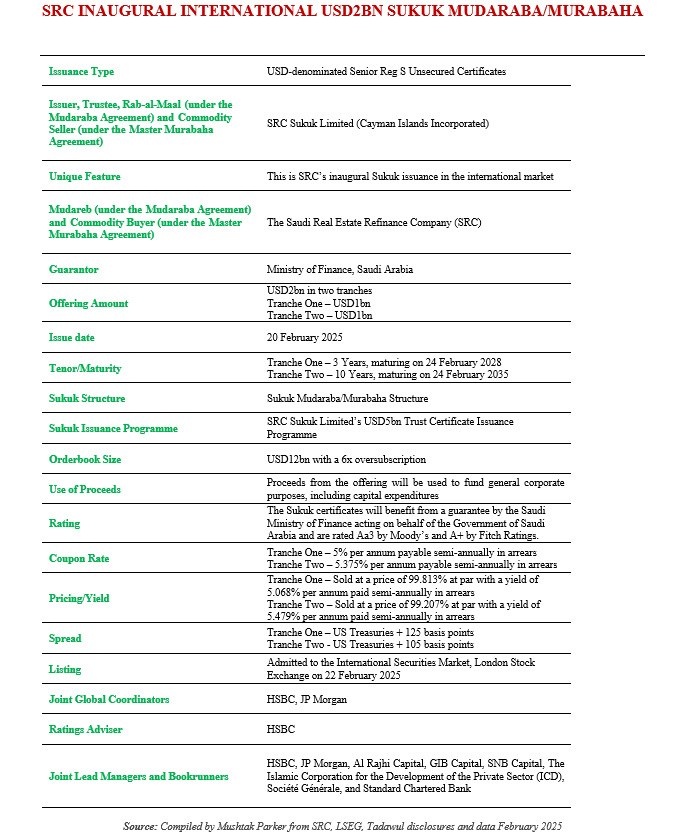

Another major new debutant in addition to Ma’aden to the international Sukuk market in February 2025 was The Saudi Real Estate Refinance Company (SRC), also a subsidiary of the Public Investment Fund (PIF), the Saudi sovereign wealth fund. SRC successfully completed the pricing of its first government-guaranteed international Sukuk, an aggregate US$2bn on 24 February 2025.

SRC mandated HSBC and J.P. Morgan to act as joint global coordinators, and together with Al Rajhi Capital, GIB Capital, SNB Capital, The Islamic Corporation for the Development of the Private Sector (ICD), Société Générale and Standard Chartered Bank as Joint Lead Managers and Bookrunners to the transaction, and to arrange pre-recorded global investor call along with a series of fixed income investor meetings in London, Europe, the Mena region, Asia and with Offshore US Accounts commencing on Monday 17 February 2025.

This was a for a sale of a benchmark US dollar-denominated Reg S senior unsecured Sukuk Mudaraba/Murabaha offering consisting of three and 10-year tranches issued by SRC Sukuk Limited (Cayman Islands Incorporated) under its USD5bn Trust Certificate Issuance Programme on behalf of the Obligor, SRC.

Initial price thoughts (IPTs) for SRC’s debut dual-tranche international offering was set at 110bps +US Treasuries for the 3-Year certificates and 135bps +US Treasuries for the 10-Year certificates. The issuance, structured in two tranches of USD1bn each with maturities of three and ten years, attracted an aggregate orderbook exceeding USD12bn with the issuance oversubscribed 6 times, reflecting strong demand from more than 300 institutional investors.

The 3-year USD1bn tranche was priced at a coupon rate of 5% per annum payable semi-annually in arrears, and the 10-year tranche was priced at a coupon rate of 5.375% per annum payable semi-annually in arrears.

Majid bin Abdullah Al-Hogail, Minister of Municipalities and Housing and Chairman of the Board of the SRC, commented: “The successful listing of the international Sukuk Programme Sukuk Programme on the International Securities Market (ISM) of the London Stock Exchange (LSE), integrating the Saudi economy with global markets, reflects the unwavering support of our wise leadership and reinforces Saudi Arabia’s housing finance ecosystem, while providing innovative financing solutions for citizens. This marks a significant milestone in integrating the Saudi economy with global markets, attracting foreign direct investment, enhancing liquidity, and developing the secondary mortgage market in Saudi Arabia.”

Saudi Arabia, he added, aims to expand the mortgage finance sector by SAR500bn (USD133.32bn) by 2030, reaching SAR 1.3 trillion (USD350bn). The Kingdom’s mortgage market was approximately SAR800bn (USD213.31bn) in 2024, up from SAR200bn (USD53.33bn) in 2018. These financings now account for 23% of total bank assets.

According to Al-Hogail, this growth is driven by the Kingdom’s mega projects and the objectives of Vision 2030, which set a target homeownership rate of 70% for Saudi families by the end of the decade. By the end of 2023, homeownership reached 63.7%, surpassing the 63% target. “The new issuance supports the sustainability of the housing sector and contributes to achieving the objectives of the Housing Programme under Saudi Vision 2030 by providing more efficient funding channels,” he concluded.

Majid Al-Abduljabbar, CEO of SRC, emphasized that the issuance reflects global market confidence in the Saudi economy and strengthens the diversification of funding sources. “The listing of the Sukuk Programme on the LSE not only strengthens SRC’s global presence and strategy to attract a diverse base of international investors but also solidifies the company’s position as a key player in the mortgage finance market, paving the way for new strategic partnerships and high-quality international investments.”

Al-Abduljabbar said that the successful listing of the international Sukuk also reflects SRC’s commitment to providing innovative financing solutions and accelerating the growth of Saudi Arabia’s housing sector, contributing to the objectives of the Housing Programme and the Financial Sector Development Programme.

SRC has been assigned strong credit ratings from leading rating agencies, including Fitch (‘A+’ – Stable), S&P (‘A’ – Positive), and Moody’s (A2 – Positive). These ratings reinforce the company’s strong position in launching its first international Sukuk Programme, which aligns with global Sukuk market standards and best practices in Islamic finance. The Sukuk certificates will benefit from a guarantee by the Saudi Ministry of Finance acting on behalf of the Government of Saudi Arabia and are rated Aa3 by Moody’s and A+ by Fitch Ratings.

The issuance was admitted for listing on the International Securities Market (ISM) of the London Stock Exchange (LSE) on 22 February 2025, further enhancing market liquidity and supporting Saudi Arabia’s mortgage finance ecosystem.

Minister Al-Hogail in fact attended the listing ceremony at the LSEG in London on 22 February 2025 with H.R.H. Prince Khalid bin Bandar bin Sultan Al Saud, Ambassador of Saudi Arabia to the UK, and The Rt. Hon. Alastair King, Lord Mayor of the City of London, alongside senior figures from the financial and investment sectors.

The Sukuk issuance stressed the Minister plays a key role in advancing Saudi Arabia’s housing finance sector by increasing liquidity and attracting FDI. It aligns with the objectives of Saudi Vision 2030, supporting key initiatives such as the Financial Sector Development Programme, the Public Investment Fund (PIF) Programme, and the Housing Programme, all of which aim to strengthen the housing sector and promote sustainable homeownership financing.

Minister Al-Hogail added that SRC plays a vital role in ensuring the sustainability of housing finance by developing innovative financing solutions that support mortgage lenders and expand financing options for Saudi citizens at competitive rates. He further noted that the Sukuk issuance is expected to stimulate foreign investment in the housing sector, supporting Saudi Arabia’s goal of increasing homeownership rates to 70% by 2030 through sustainable financing solutions and the development of a secondary mortgage market.

Shrey Kohli, Head of Dept Capital Markets & Issuer Services, London Stock Exchange (LSE), commented: “The listing of SRC’s international Sukuk underscores LSE’s strength as a hub for debt financing and the world’s largest international market for Sukuk issuance, supporting financial innovation and market expansion. The London Stock Exchange plays a pivotal role in connecting global investors with strategic opportunities and facilitating capital flows for issuers through diverse sources of funding to create sustainable economic growth.”

The Saudi Real Estate Refinance Company (SRC) was established by the Public Investment Fund (PIF) in 2017 to develop Saudi Arabia’s real estate finance market. It operates under a license from the Saudi Central Bank (SAMA) to facilitate real estate refinancing.

SRC plays a key role in achieving the objectives of the Housing Programme under Saudi Vision 2030, which aims to increase homeownership rates among Saudi citizens. The company supports this goal by providing liquidity to lenders, enabling them to offer affordable housing finance to individuals. Additionally, SRC works closely with partners to strengthen Saudi Arabia’s housing ecosystem.

The potential for mortgage securitisation through Sukuk issuances to buy mortgage finance portfolios from the commercial market is huge, especially to free further liquidity in the market and thus financing more mortgages in line with the government’s aim of making affordable housing available to citizens thus increasing home ownership in the Kingdom.

The emergence and maturity of SRC means that it could overtake The Malaysian Housing Finance Corporation (Cagamas Corporation), by far the most experienced in mortgage securitisation, albeit both conventional and Shariah compliant mortgages. Since incorporation in 1986, Cagamas has cumulatively issued circa RM413.76 billion (US$88.16 billion) worth of corporate bonds and Sukuk, the proceeds of which were used to buy mortgage finance portfolios from banks and mortgage finance companies.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by SRC, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.