Debutant Saudi Mining and Minerals Giant Ma’aden Closes Inaugural USD1.25bn Sukuk Murabaha/Ijara as Kingdom Seeks the Sector to Contribute USD75bn to National GDP by 2035

A major new debutant to the international Sukuk market in February 2025 was The Saudi Arabian Mining Company (Ma’aden), the largest multi-commodity mining and metals company in the Middle East and one of the fastest growing in the world, and yes, a subsidiary company of the Public Investment Fund (PIF), the Saudi sovereign wealth fund.

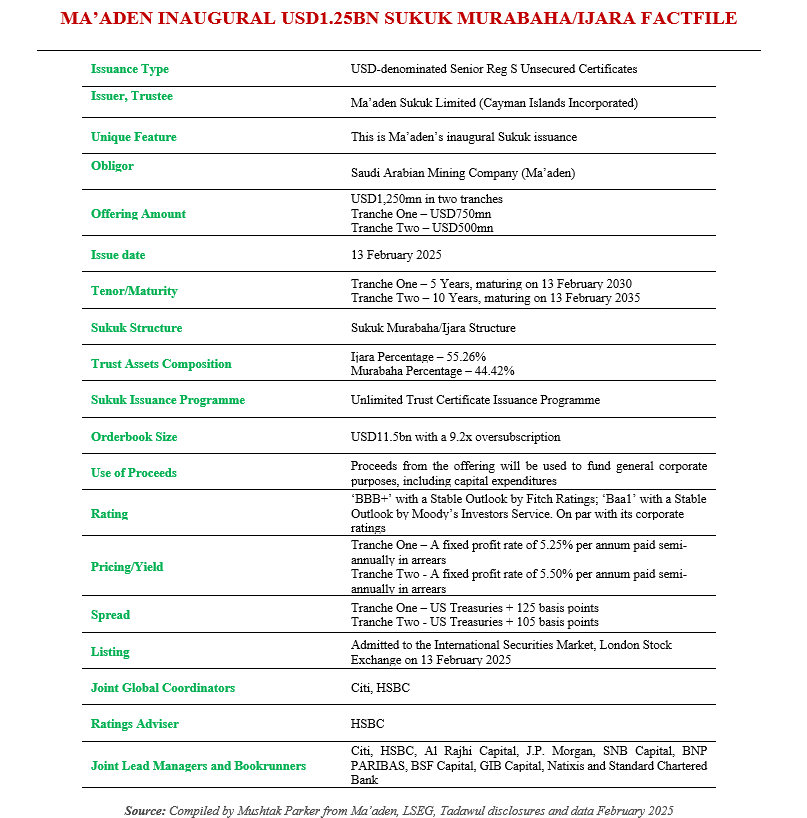

Ma’aden priced its first international USD-denominated Senior Reg S Unsecured Sukuk on 13 February 2025 with an aggregate face amount of USD1.25bn. Indeed, several issuers have been accessing the market before the onset of Ramadan, the Muslim holy month of fasting, when debt issuance historically tends to quieten down.

The two-tranche offering, according to the company, “has become one of the most successful debut international sukuk offering in Saudi Arabia to date.” A Ma’aden subsidiary, Maaden Phosphate Co. (MPC), issued a local currency SAR3.5bn Sukuk in 2018, which has since been fully redeemed.

The USD1.25bn Sukuk Murabaha/Ijara transaction comprised two tranches – a first Tranche of USD750mn with a 5-year tenor priced at a fixed profit rate of 5.25% per annum maturing on 13 February 2030 and payable semi-annually in arrears, and a second Tranche of USD500mn with a 10-year tenor priced at a fixed profit rate of 5.50% per annum maturing on 13 February 2035 and payable semi-annually in arrears.

The Sukuk certificates were issued by Ma’aden Sukuk Limited (Cayman Islands incorporated), on behalf of the Obligor, Saudi Arabian Mining Company (Ma’aden) under its Unlimited Trust Certificate Issuance Programme.

Earlier the company had mandated Citi and HSBC as Joint Global Coordinators, and together with Al Rajhi Capital, J.P. Morgan and SNB Capital, BNP PARIBAS, BSF Capital, GIB Capital, Natixis and Standard Chartered Bank as Joint Lead Managers and Bookrunners to the transaction and to arrange a series of investor calls and roadshows in London, Europe, the GCC, the Middle East, Asia and with Offshore US Accounts. The offer commenced on 6 February according to a Ma’aden disclosure to Tadawul (the Saudi Exchange).

The company set the initial price thoughts of US Treasuries plus 140 basis points (bps) for a five-year Sukuk and US Treasuries plus 155bps for the 10-year tranche. The Offering was more than 9.2 times oversubscribed, with orders exceeding USD11.5bn.

“The strong investor demand,” stressed Bob Wilt, CEO of Ma’aden, “underlines Ma’aden’s investment case and recognizes its role as a key contributor to the development of the mining sector as the third pillar of the Saudi economy, in line with Vision 2030. The significant success of this inaugural international Sukuk offering demonstrates the confidence and interest that investors have in Ma’aden’s growth.

“Such strong international investor demand, some of the highest seen in the Kingdom, is testament to global confidence in our strategic direction and the integral role we play in unlocking Saudi Arabia’s USD2.5 trillion of untapped mineral potential. As we continue to deliver on our ambitious growth strategy, the proceeds will speed our efforts to secure essential minerals that drive energy transition and long-term development. We remain committed to building a globally competitive mining sector as the third pillar of Saudi Arabia’s economy.”

This strong investor demand resulted in a significant price tightening with the 5 Year papers settling at 125 bps + US Treasuries and the 10 Year papers at 105 bps + US Treasuries. Ma’aden is rated ‘Baa1’ (stable outlook) by Moody’s and ‘BBB+’ (stable outlook) by Fitch Ratings. The Sukuk certificates are rated on par with Ma’aden’s corporate ratings and were admitted to trading on the London Stock Exchange’s International Securities Market. Settlement is on 13 February 2025.

Ma’aden is clearly a company on the go. In over two decades since its establishment in 1997 by Royal Decree to diversify the economy away from reliance on the oil and gas sector, Ma’aden has grown exponentially and currently ranked among the top 10 global mining companies based on market capitalization.

Ma’aden was wholly owned by the Saudi Government until 2008 when half its shares were floated on the Saudi Stock Exchange (Tadawul). In June 2018, the government holding went up with the Public Investment Fund (PIF) increasing its shareholding to 65.44%.

Since its IPO, Ma’aden has diversified from being a gold producing company by building abundant, world-class phosphate, aluminium, industrial minerals and copper concentrate operations. Ma’aden recently unveiled plans to invest more than USD10bn over the next few years to support the company’s growth. Last month, the mining giant and Saudi Aramco signed a head of terms agreement to set up a minerals exploration and mining joint venture focusing on energy transition minerals, including lithium.

The Saudi Government is keen for all non-oil sectors including mining and minerals to increase their contribution to the country’s GDP from USD17bn to US75bn by 2035, in an ongoing effort to diversify the economy away from reliance on hydrocarbons. Ma’aden is planning to increase its operations across Saudi Arabia, including in gold, phosphates, copper and aluminium, over the next decade in line with the Kingdom’s mining targets, and as the country seeks to capitalise on its estimated USD1.3 trillion worth of untapped mineral resources.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by Ma’aden, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.