Malaysian ICM Consolidates its Resilience and Dominance of the Overall Capital Market in 2023 Accounting for 64% Market Share with a Total Size of RM2,426.77bn (US$507.91bn) and CAGR of 4.5%

For sheer sustainability and incremental progress, the Malaysian Islamic Capital Market (ICM) continues to hold its own despite the manifold geopolitical, governance, economic and market challenges the country is faced with.

The ICM continued its resilience and dominance of the overall domestic capital market in 2023 growing by 4.5% year-on-year, increasing from RM2,322.30 bn (US$486.04 bn) in 2022 to RM2,426.77 bn (US$507.91 bn) at end 2023.

Since 2019, the ICM has grown with a CAGR (compound annual growth rate) of 5.2% p.a., with Sukuk outstanding growing by 8.5% p.a. and Sharia’a-compliant equities by 2.2% p.a. To put it in a general market context, according to the latest 2022 Annual Report of the Securities Commission Malaysia (SC) released in March 2024, the overall capital market grew by 5.6% to RM3.8 trillion (US$800 bn) in 2023 from RM3.6 trillion (US$750 bn) the previous year, driven by growth in both equity market capitalisation and total bonds and Sukuk outstanding.

Since 2019, the overall capital market has grown by a CAGR (compound annual growth rate) of 4.1% p.a. The ICM constituted RM2,426.77 bn (US$507.91 bn) of the overall market, compared with RM1.4 trillion (US$290.00 bn) for the conventional capital market.

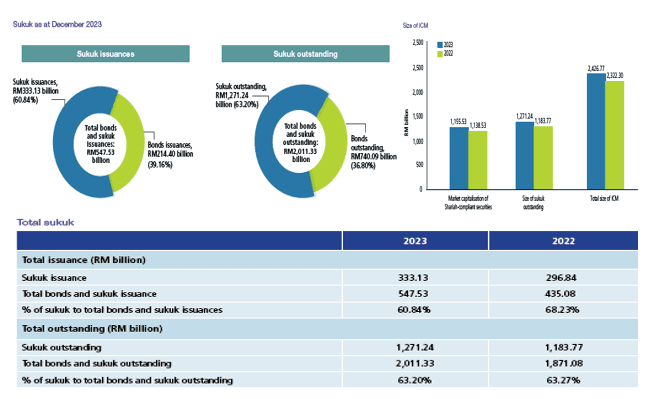

This trend of ICM dominance continued in the various market segments of the capital market – Sukuk, asset management etc. Given the slow global post-pandemic economic recovery, and the ongoing the impacts of the supply chain disruptions resulting from the conflict in Ukraine and the geopolitical tensions in the Middle East and elsewhere, the Sukuk market was affected in 2023.

The total Sukuk issuances in 2023 represented 60.84% (2022: 68.23%) of total bonds and Sukuk issuances whereas total Sukuk outstanding represented 63.20% (2022: 63.27%) of total bonds and Sukuk outstanding. The market was dominated by corporate Sukuk issuances which represented 77.25% (2022: 81.66%) of total corporate bonds and Sukuk issuances while corporate Sukuk outstanding accounted for 83.96% (2022: 82.82%) of total corporate bonds and sukuk outstanding.

The number of SRI Sukuk issued in 2023 increased to 15, bringing the total of SRI Sukuk issuers to 34 since 2015.

Corporate SRI sukuk issuances in 2023 amounted to RM8.68 bn (US$1.82 bn), which was 9.50% of total corporate Sukuk issuances, while corporate SRI Sukuk outstanding increased to RM26.32 bn (US$5.51 bn) at December 2023 (2022: RM17.93 bn), constituting 3.75% of total corporate Sukuk outstanding.

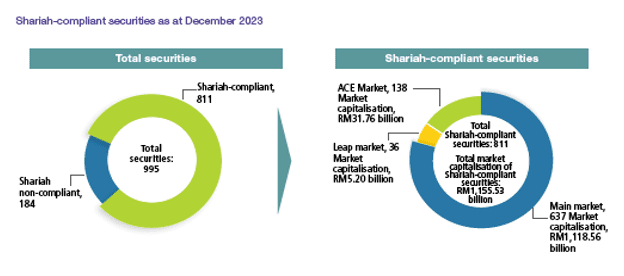

As of end 2023, the number of Shariah-compliant securities increased from 789 to 811, constituting 81.51% of the total 995 listed securities on Bursa Malaysia. The market capitalisation of Shariah-compliant securities registered an increase of 3.25% as compared to end 2022, standing at RM1,155.53 bn or 64.32% of the total market capitalisation by December 2023.

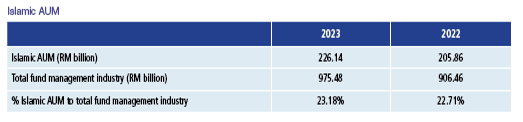

Similarly at December 2023, Islamic AUM stood at RM226.14 bn, a y-o-y increase of a.85% from RM205.86 bn as at end 2022. The total number of Islamic CIS (UTF, WF, PRS, REIT and ETF) amounts to 415 as of December 2023, which included 28 Islamic SRI funds. Additionally, there were a total of 59 fund management companies overseeing Islamic funds, comprising 24 full-fledged Islamic fund management companies and 35 conventional fund management companies with Islamic windows at December 2023.

The ICM remains a key component of the Malaysian capital market. The Securities Commission (SC) in fact celebrated its 30th Anniversary in 2023 and is gearing up towards assuming the Chair of the ASEAN Capital Markets Forum (ACMF) in 2025, while during the same year the country will also be subject to the Financial Action Task Force (FATF) Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) evaluation exercise in 2025.

“With this, we remain committed to ensuring the continued vitality of the capital market, enhancing its efficiency, competitiveness, and accessibility for all,” explained Dato’ Seri Dr Awang Adek Hussin, SC Chairman. The reality is that the SC in the words of Dr Hussin, is also “committed to Malaysia’s MADANI Economy Framework (Ekonomi MADANI) and the Capital Market Masterplan 3 (CMP3) to steer Malaysia’s capital market in a challenging global environment. Our focus on building a robust, inclusive, and sustainable ecosystem is reflected in the introduction of several reforms designed to enhance the efficiency, competitiveness, and accessibility of the capital market, thus ensuring its continued vitality.”

Ekonomi Madani is part of Prime Minister Anwar Ibrahim’s focussed strategy linking and aligning Islamic finance to sustainability and manifested through his Government’s Belanjawan MADANI vision on how Islamic finance can further leverage on the sustainability concept for the development of the sector. Its three pillars are: i) Inclusive and sustainable economic growth; ii) Institutional reforms and good governance to restore confidence; and iii) Combating inequality through social justice.

According to Adnan Zaylani Mohamad Zahid, Deputy Governor of Bank Negara Malaysia, the word MADANI has its roots in Arabic and means “being developed in terms of thinking, spirituality and mentality”. The Malaysia MADANI concept – or civil society, he emphasised, “envisions a country that looks beyond economic wellbeing and materialism to one which emphasises humanity and good values like fair, just and effective governance. MADANI is an acronym for a policy that embraces six core values – keMampanan (Sustainability), KesejAhteraan (Prosperity), Daya Cipta (Innovation), hormAt (Respect), keyakiNan (Trust) and Ihsan (Compassion).”

The SC has introduced several initiatives to develop a facilitative sustainable and responsible investment (SRI) ecosystem in Malaysia, including the SRI Sukuk Framework in 2014 and updated several times since then. Similarly, the SC’s Capital Market Masterplan (CMP3) identifies SRI as one of the key development thrusts for the capital market over the next five years. It highlights the importance of SRI towards shaping a more sustainable and socially inclusive stakeholder economy in Malaysia that facilitates long-term value creation beyond short-term profits that would cater to broader stakeholder needs.

In his speech to the 15th International Conference on Islamic Economics and Finance 0n 20th February 2024 in Kuala Lumpur, Prime Minister Anwar Ibrahim urged financial institutions to “integrate these (Ekonomi Madani) principles into core structures and decision-making processes, and ensure that their products are equitable and accessible,” and regulatory bodies to “create enabling frameworks for innovation that incentivises and reinforces ethical conduct and not mere legalistic compliance.”

Despite these setbacks in 2023, the Malaysian economy, according to Dr Awang Adek Hussin, is projected to remain on a steady growth trajectory in 2024, backed by firm domestic demand, primarily through continued expansion in private sector spending. The Ministry of Finance expects growth of the Malaysian economy to accelerate to 4-5% in 2024 from 3.7% in 2023. This is consistent with the IMF’s Spring 2024 Meetings World Economic Outlook projections for Malaysia of real GDP of 3.7% for 2023 and projected to rise to 4.4% in 2024 and in 2025; with inflation settling at 2.5% and unemployment at 3.5% over the next three years.

However, warns Dr Hussin, “risks to growth remain tilted to the downside given ongoing external challenges. In the domestic capital market, activity will continue to be influenced by momentum in the domestic economy and corporate developments, with volatility likely to be driven primarily by uncertainties surrounding the global economy, particularly the direction of global monetary policy and evolving geopolitical tensions.”

Nevertheless, favourable momentum in the latter part of 2023, he maintained, is expected to continue into 2024, underpinned by ongoing supportive policy actions under the Ekonomi MADANI framework, which includes the New Industrial Master Plan (NIMP) 2030 and the National Energy Transition Roadmap (NETR).

These national policies are expected to provide a tailwind in the short- to medium-term, amid greater policy clarity and a continued commitment by the government towards improving medium-term economic growth prospects.