Islamic Banks Gear Up to Promising EV and Hybrid Car Market with Innovative Green Vehicle Finance and Charging Hubs in Support of Sustainability and Transition to Clean Energy Net Zero Plans

The Islamic finance sector is playing an increasing development and facilitation role in the transport and evolving electric car sector through a spate of green finance incentive financing packages aimed at both retail, industrial and corporate clients.

While Abu Dhabi Islamic Bank (ADIB), Qatar International Islamic Bank (QIIB) and Masraf Al Rayan seem to be setting the pace, it is Saudi Arabia that is embarking on arguably one of the most ambitious electric vehicles (EV) transition programmes. Last year, the Kingdom’s sovereign wealth fund, Public Investment Fund (PIF) signed a JV agreement with Foxconn, with BMW as a component technology provider – with the aim of establishing an EV manufacturing hub in a country with no history nor experience of mass car production. Nevertheless, the JV launched CEER, the Kingdom’s first EV brand.

A few months ago, Saudi Electricity Company, the Kingdom’s power generation utility, acquired a 25% stake totalling SAR254.0mn in Electric Vehicle Infrastructure Company (EVIC), which is wholly owned by the PIF, for the sole purpose of “operating and creating partnerships to provide alternate current (AC) and direct current (DC) power charging infrastructure for EVs” in the Kingdom. In fact, part of the proceeds of SEC’s two tranche US$2.2bn senior unsecured Sukuk with sustainability features closed in February 2024 is “to fund a portfolio of Eligible Projects as set out in SEC’s Green Sukuk Framework,” which includes transition to EVs.

Saudi Arabia’s EV strategy is aimed at supporting the Kingdom’s target under Saudi Vision 2030 to reach net zero emissions by 2060, with EVs playing a key role in decarbonizing the transportation sector, both in the Kingdom and throughout the wider region. According to PIF, the first of the CEER EVs are targeted to be rolled out in 2025 and expected to contribute US$8bn to Saudi Arabia’s GDP by 2034.

Some of the first movers in Islamic EV finance include QIIB, which launched its Green Financing offer for electric and hybrid vehicles in partnership with Ooredoo’s Nojoom loyalty programme in 2022, Masraf Al Rayan’s The Green Vehicle Finance Campaign, and ADIB’s Volt green financing program for electric cars in 2023. The holy month of Ramadan is popular for launching what is perceived as ethical environmentally friendly products and offers. For instance, Qatar Islamic Bank, like other Islamic financial institutions in the region, heavily promotes its Green Car Financing for hybrid and EVs during Ramadan.

While Mr. Omar Abdulaziz Al-Meer, QIIB Green Finance Officer, at the time of the launch stressed that “this Green Finance offer for both electric and hybrid vehicles encourage the preserving of the environment and offers a route to sustainability, whilst contributing to promoting a culture of Green Economy, with a shift towards the use of renewable energy,” the reality is often different.

QIIB Green’s offer for instance was for a limited two-month period, albeit with a reduced annual profit rate with a “grace period of up to 12 months for Qataris and 3 months for Expatriates (from the financing period),” and only available to QIIB Customers and non-Customers who transfer their Salaries to the bank and who have sperate mandatory Comprehensive Vehicle Takaful.

ADIB’s Volt financing program for electric cars similarly reports “great demand from customers.” But the base is low – the percentage of financing for green cars exceed a mere 2% of the total car financing, which translates to 600 new such auto financings in six-month from September 2023. The Volt programme benefits from a competitive financing rate, which ADIB’s Global Head of Retail Banking, Amit Malhotra, says is the lowest in the UAE industry for new EVs.

“By continuing to promote sustainable options such as electric vehicle financing, ADIB reinforces its dedication to environmental responsibility and contributes to the broader goals of reducing carbon emissions. This aligns with ADIB’s overarching ESG strategy, ensuring a holistic approach to ethical banking practices that benefit both customers and the environment. The programme’s achievements underline ADIB’s ongoing efforts to integrate environmental considerations into its financing initiatives,” he added.

Similarly, Masraf Al Rayan’s Green Vehicle Finance Campaign (GVFC), is part of its Green Inclusion strategy which promotes choosing electric and hybrid vehicles as a step towards a greener future, and which aligns with the Bank’s commitment to sustainable practices and enables its customers to make eco-conscious decisions while enjoying exclusive benefits, including “a very special profit rate,” a grace repayment holiday period, and bonus points to loyalty schemes.

“As an Islamic banking institution that prioritizes ethical and sustainable financial solutions, Masraf Al Rayan is moving forward to promote a more environmentally mindful lifestyle. The Green Vehicle Finance Campaign marks an important step towards making green choices more accessible and rewarding,” explained Rana Al Asaad, General Manager, Retail & Private Banking, at Masraf Al Rayan.

According to International Energy Agency (IEA) Executive Director Fatih Birol, “transitioning to clean energy is crucial if the world wants to keep alive the Paris Agreement’s long-term goal of keeping warming “well below” 2 C ̊ and aiming to limit it to 1.5 C ̊. The clean transition revolution has started, and it is going fast. A new IEA report shows that thanks to expansion of technologies such as solar, wind and electric vehicles, global energy-related carbon dioxide (CO2) emissions rose less strongly in 2023 than the year before even as total energy demand growth accelerated.”

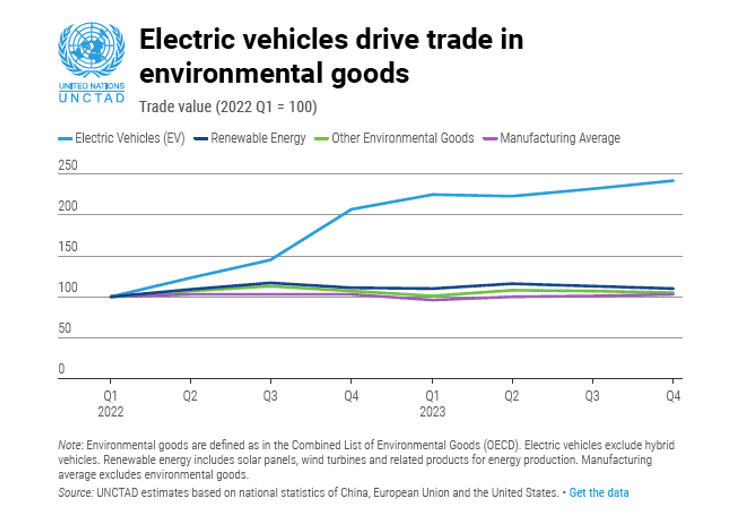

The trends are clear and present in other ways as well According to UNCTAD, The global surge in demand for electric vehicles is driving trade in environmental goods.

Hybrid technology and production are well established, and these products are almost as profitable as Internal Combustion Engines (ICE) vehicles for the companies. The Hybrid Electric Vehicles (HEVs) and EVs ecosystem are complex subject to vagaries of technologies, access to critical materials such as lithium, cobalt, graphite, manganese and iron ore – several of which are vital in the manufacturing of vehicle batteries.

In a recent report, Fitch Ratings highlighted the current realities for HEVs and EVs. Using the Japanese market, where car manufacturers have pioneered and dominated hybrid technology, Fitch concludes that “the profitability of HEVs is close to that for ICE vehicles for Japanese automakers, as hybrid technology and production are well established. Japanese automakers have strategically positioned hybrids as a key engine of growth for decades.”

HEVs have achieved high penetration and account for over 40% of new car sales, and sales are growing in other countries as well. Crucially this success is now funding investments in battery electric vehicles (BEVs). Range anxiety and underinvestment in charging infrastructure appear to be driving slower than expected growth in EV demand. As such, automakers are cutting net pricing on EVs and re-evaluating production strategies to try to stem near-term losses. Regulators, particularly in Europe, also appear to be reconsidering longer-term EV policies.

For this reason, Fitch expects “the global EV transition to continue but to take longer in North America, and perhaps Europe, while EV demand will remain strong in China. The automakers have now seen some success in HEVs and are accelerating investments in BEVs. They are increasingly investing in new technologies, such as new platforms dedicated to BEVs, all-solid-state batteries, advanced operating systems and autonomous driving. However, these new technologies for BEVs are untested, creating the risk that any delay in their commercial implementation will affect the introduction of BEVs.”

It remains to be seen all these technological and market dynamics align with initiatives such as the PIF’s EVIC hub and CEER production line.