Emirates Islamic Returns to International Sukuk Market in March 2025 with a 5-Year USD750mn Sukuk Murabaha Offering Supported by Robust Demand from a Large New Investor Cohort

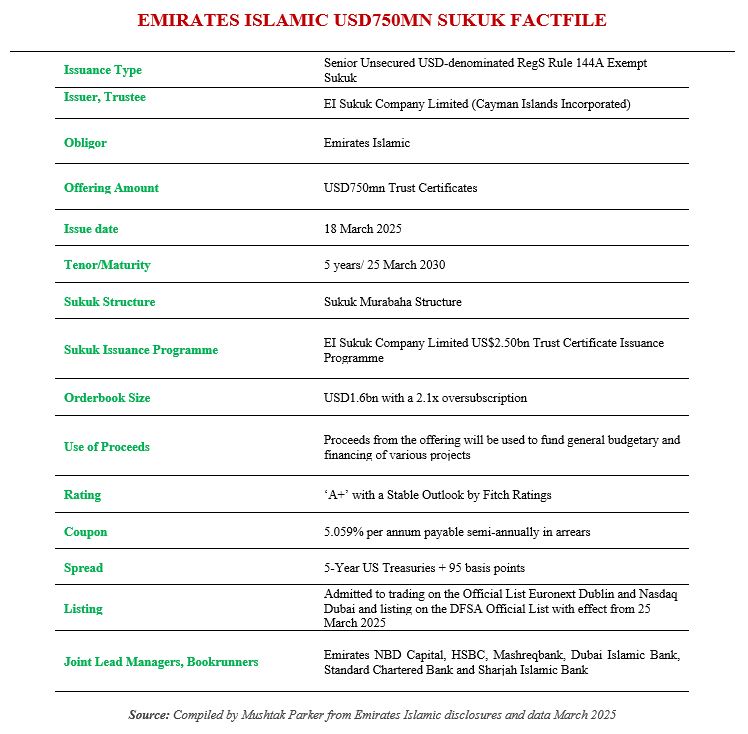

Emirates Islamic, one of the leading Islamic financial institutions in the UAE and the Islamic banking subsidiary of the Emirates NBD Group, successfully priced its latest Sukuk offering on 18 March 2025 – a 5-Year benchmark fixed rate USD750mn RegS Senior Unsecured Sukuk Murabaha.

Prior to this latest Sukuk offering, Emirates Islamic last year issued a 5-Year benchmark US$750mn RegS Senior Unsecured Sustainability Sukuk on 21 May 2024 – which was its maiden such issuance, in line with the UAE Government and Emirates NBD’s Sustainable Finance Framework. Similarly, stressed Emirates Islamic, this latest landmark issuance in March 2025 supports the Bank’s strategic growth journey as well as continued progress of the Islamic finance industry in the UAE and the MENA region.

The Sukuk certificates were issued on 18 March 2025 by EI Sukuk Company Limited, incorporated in the Cayman Islands, as Trustee on behalf of the Obligor and Service Agent, Emirates Islamic Bank, under the Company’s US$2.5bn Trust Certificates Issuance Programme. The 5-Year certificates have a maturity date of 25 March 2030. The Sukuk has a Murabaha structure.

Emirates Islamic mandated Emirates NBD Capital and Standard Chartered Bank on 16 March 2025 to act as Joint Global Coordinators of the transaction, and along with HSBC, Mashreqbank, Dubai Islamic Bank and Sharjah Islamic Bank to act as Joint Lead Managers and Bookrunners to the transaction. Emirates Islamic set the initial price guidance for the 5-Year Sukuk transaction at 125 basis points (bps) over 5-Year US Treasuries.

Due to the robust demand from investors across different regions, the order book exceeded US$1.6bn resulting in an oversubscription rate of 2.1 times. This strong investor demand, said Emirates Islamic, allowed the Bank to tighten the spread by 30 basis points from Initial Price Thoughts to 95 basis points over 5-Year US Treasuries, equating to a coupon of 5.059% per annum payable semi-annually in arrears. This in contrast to the pricing of a similar USD750mn offering in May 2024 which was priced at a spread of 100bps over 5-Year US Treasuries, translating into an expected profit rate to 5.431% per annum payable semi-annually in arrears.

The Issuance was well received by global investors with 80% of the Sukuk allocated to regional investors and the remaining 20% allocated to international investors. According to the Bank, there was demand from over 100 investors, including a considerable number of new investors, reflecting the increasing name recognition of Emirates Islamic among the global investor community.

Farid AlMulla, Chief Executive Officer commented: “Emirates Islamic is pleased to conclude the successful issuance of our most recent USD750mn Sukuk. This milestone emphasises the increasing recognition of Emirates Islamic among the global investor community. Islamic finance continues to see strong growth while delivering increasingly sophisticated products and structures. Emirates Islamic is committed to ensuring the proceeds are used to help growth the UAE economy.”

His Deputy CEO, Mohammad Kamran Wajid, added: “We are proud to conclude the next Sukuk in the growth journey of Emirates Islamic in line with our vision to be the most innovative Shariah compliant bank for our counterparties, customers, people, and communities. As the UAE’s preferred Islamic bank, Emirates Islamic remains committed to developing pioneering products and services to cater to the increasing demand for innovative Islamic finance solutions based on the highest standards of ethical banking.”

The market response to this latest Sukuk issuance, maintains Ebrahim Qayed, Head of Treasury and Markets, was phenomenal and augurs well for future Sukuk offerings. “Concluding two sizable deals of USD750 mn each in two consecutive years is a testimony of the global market’s growing appetite for investment opportunities from Emirates Islamic,” he added.

The Sukuk certificates like the Programme are rated ‘A+ by Fitch Ratings in line with the rating of the Obligor, Emirates Islamic. The proceeds from the offering will be used to fund general budgetary requirements and financing of various projects.

The Sukuk certificates were admitted to trading on the Regulated Market of Euronext Dublin and Nasdaq Dubai and listing on the Official List of Euronext Dublin but delisted from the DFSA Official List with effect from 25 March 2025.

Earlier this year Emirates Islamic reported a record profit before tax of AED3.1bn (USD840mn) in FY2024, “a remarkable 46% increase over the previous year.” This exceptional growth, said the Bank was driven by a positive trend in both funded and non-funded income, demonstrating a very strong business performance. Total income increased 13% to AED5.4bn (USD1.47bn) as assets grew 27% to AED111bn (USD30.22bn). Customer financing surged by an impressive 31% to AED71bn (USD19.33bn) and customer deposits increased by a very healthy 25% to AED77bn (USD20.96bn). “These outstanding results highlight the strength of the regional economy and showcase the Bank’s agility and expertise in identifying and responding to increased demand for Islamic banking,” observed CEO Farid AlMulla.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by EIB, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.