Big Ticket Murabaha Syndications Increasingly Match Attractiveness and Demand of Sukuk as Fund-raising Instrument as NEOM Enters Market with Maiden SAR10bn (US$2.67bn) Transaction at End April

The tried and tested, and often criticised Islamic corporate debt finance instrument, Murabaha (cost-plus financing) is increasingly re-establishing itself as a big-ticket fund-raising tool as an alternative to Sukuk (the Islamic capital debt market securities instrument). The development is important in that it represents an important diversification of sources of funding in the Islamic debt and credit finance space thus giving both sovereign, quasi-sovereign and corporate fund raisers alternative choices.

Criticised in the sense that over-exuberant proponents of Islamic finance tend to dismiss the so-called over-use of debt instruments such as Murabaha in favour of a reliance on equity-based instruments. The Sharia’a literature and ethos of course approves both debt and equity-based products within the given rules of both form and substance.

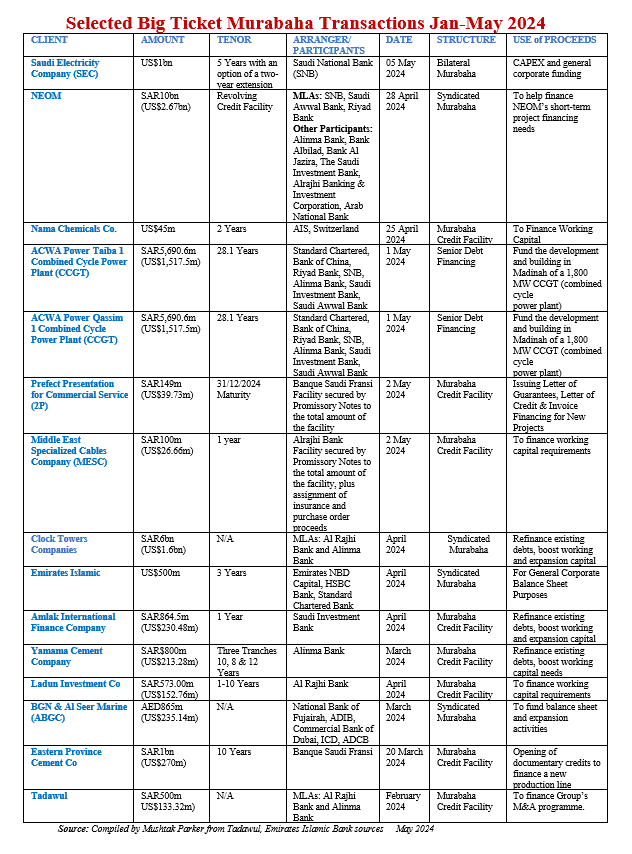

The big-ticket transactions in the last few weeks include a US$1 billion Bilateral Murabaha by Saudi Electricity Company (SEC) in May and the SAR6 billion (US$1.6 billion) Syndicated Murabaha by Clock Towers Companies in April 2024. But the entry of NEOM, the entity responsible for the NEOM giga projects in Saudi Arabia’s futuristic NEOM City, into the Islamic finance market could be a potential gamechanger. NEOM secured a SAR10 billion (US$2.67 billion) Syndicated Murabaha facility on a revolving basis on 28 April 2024 merely to help finance NEOM’s short-term project financing needs.

The revolving credit facility (RCF) is important not only for NEOM but also the Saudi Islamic corporate and project finance sector because it “reflects a continuation of NEOM’s strategy to diversify its sources of funding. The SAR10 billion facility, which follows a Murabaha structure, represents another milestone for NEOM as it progresses with the development of major projects and will be used to support NEOM’s short-term financing requirements.” The entry of NEOM, the Public Investment Fund (PIF), their numerous subsidiaries including ACWA Power, Saudi Real Estate Refinance Company (SRC), and augurs well for the future dramatic expansion of the Islamic finance in the Saudi debt capital market.

Nadhmi Al-Nasr, CEO of NEOM, emphasised that “as NEOM continues to gather pace, this new credit facility, backed by Saudi Arabia’s leading financial institutions, is a natural fit within our wider strategy for funding. We continue to explore a variety of funding sources as we deliver transformational infrastructure assets while supporting the wider Vision 2030 Programme. NEOM is among the largest projects in the world today, and we value the partnership we have with our relationship banks in facilitating access to a range of flexible financing options as we deliver on our ambition.”

The SAR10 billion RCF saw the participation of nine local banks. The mandated lead arrangers were Saudi National Bank, Riyad Bank, and Saudi Awwal Bank. The other participating banks comprised Al Rajhi Banking and Investment Corporation, Alinma Bank, Arab National Bank, Bank Albilad, The Saudi Investment Bank, and Bank AlJazira.

The new RCF follows on from the SAR23 billion agreement signed by NEOM and its partners to finance the NEOM Green Hydrogen Company. It also follows last year’s SAR3 billion debt financing arranged to partially fund NEOM’s development of Sindalah, the luxury island destination set to welcome visitors this year.

NEOM reportedly is also working on issuing its debut Sukuk – a SAR5 billion transaction – which planned for the second half of 2024. NEOM is already engaging with HSBC (Middle East), Alrajhi Bank and Saudi National Bank to act as advisers and lead managers to the transaction.

In contrast, SEC’s 5-Year US$1 billion bilateral Murabaha facility extended by Saudi National Bank gives a further fund-raising option to Saudi corporates for general corporate and capital expenditures.

The Ministry of Finance has in the near past urged Saudi corporates to raising expansion, working capital and refinancing requirements through Sukuk and Murabaha facilities, which are deemed less costly than conventional bank loans, and which would contribute to the diversification of their funding sources.

One aspect of the Saudi corporate transactional playbook which needs urgent review is the lack of disclosure on pricing and financial terms and conditions, which applies to both conventional and Sharia’a compliant modes of financing. This makes comparative analysis of the conventional and Islamic modes of financing more challenging.

ACWA Power, the renewables and energy transition subsidiary of PIF, was also in the act accessing an aggregate SAR11,381.2 million (US$3,035.0 million) of funding comprising two SAR5,690.6 million (US$1,517.5 million) senior debt facilities involving several Saudi Islamic banks, both with a 28.1year tenor.

Both transactions were jointly arranged and underwritten by Standard Chartered Bank, Bank of China, Riyad Bank, Saudi National Bank, Alinma Bank, Saudi Investment Bank, and Saudi Awwal Bank.

One facility will be used to fund the development and construction of an 1,800 MW CCGT (combined cycle power plant) – the ACWA Power Taiba 1 CCGT in Madinah, Saudi Arabia through Taiba 1 CCGT Project Co. (Sidra One for Electricity Company), in which ACWA Power has a shareholding of 40%; and the second one to fund the development and construction of a similar 1,800 MW CCGT (combined cycle power plant) – the ACWA Power Qassim 1 CCGT in Qassim, Saudi Arabia, through the Qassim 1 CCGT Project Co. (Qudra One for Electricity Company), in which ACWA Power has a similar shareholding of 40%.

Other smaller Murabaha transactions concluded in May 2024 involved Nama Chemicals Company, Prefect Presentation for Commercial Service (2P), and Middle East Specialized Cables Company (MESC). In the period January 2021- May 2024, a selection of big ticket Murabaha transactions mainly in Saudi Arabia and the GCC states monitored by DDCAP Research News totalled an aggregate of US dollar equivalent of US$10,151.37 million.

In a comment published in April 2024, Mohamed Damak, Global Head of Islamic Finance at S&P Global, observed that the funding profiles of Saudi banks are changing. “At the heart of the shift has been a rapid expansion in lending, notably driven by new mortgages and underpinned by a state-backed push to increase home ownership. That trend, coupled with the ongoing financing needs of the Vision 2030 economic initiative and relatively sluggish deposits growth, is likely to incentivize banks to seek alternative sources of funding, including external funding, with potential implications for banking sector credit quality. We expect Saudi banks’ foreign liabilities will continue to increase, from about US$19.2 billion at the end of 2023, to meet the funding requirements of strong lending growth and amid lower deposit expansion,” he added.