Malaysia’s Islamic Finance Market Share of the Overall Banking System Reaches 45.6% in 2023 Well on its Way to Achieving the Target of 50% Parity with the Conventional Sector by 2030

Steady as it goes! Malaysia’s Islamic banking and Takaful (IBT) system continued to grow in 2023 towards the long-cherished target of reaching 50% parity with the conventional counterpart by 2025.

The latest 2023 Annual Report of Bank Negara Malaysia (BNM), the central bank, shows how far the country, which first introduced Islamic banking in 1983, has come in its journey towards the holy grail of parity, driven by the ethos of a unique set of faith-based financial intermediation principles, the increasing needs of socio-financial inclusion, and giving Malaysians irrespective of creed, ethnicity and religious affiliation a choice in which system of financial management and products and services suite they wished to participating in.

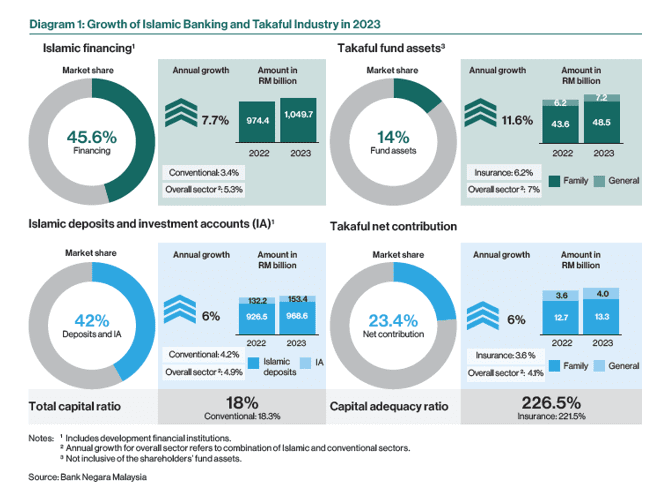

BNM’s data set is unequivocal. The Malaysian Islamic banking industry’s share of total financing in the financial system increased by 1.1% from 44.5% in 2022 to 45.6% in 2023 whilst the Takaful industry’s share of total net contribution increased from 23% in 2022 to 23.4% in 2023, but in terms of market size and depth the latter remained the ‘Cinderella’ of the IBT. Nevertheless, IBT institutions according to the regulator, remained resilient and well-capitalised.

For Malaysians and supporters of Islamic finance worldwide, this journey and trajectory has been a national sense of pride, a compelling achievement and policy empowerment, guided and nurtured by a proactive playbook over the last 41 years, which had assumed the soubriquet of the “Malaysian Model of Islamic Banking.”

For this, Malaysians and the wider Islamic finance fraternity owe a sense of gratitude to Tun Dr Mahathir Mohammed, the stalwart Barisan Nasional Coalition Prime Minister who ruled the southeast Asian country for decades.

They should also owe a great sense of gratitude to Tan Sri Jaafar Hussain, the late Governor of BNM who served at that time, whose mantra as espoused to me a rookie financial journalist in an interview with him in the early 1980s, was: “I have a dream that during my lifetime, there will be in Malaysia a dual banking system – an Islamic banking system operating side-by-side a conventional system, cooperating but not co-mingling.” The rest is history.

Championing Social and Financial Inclusion

But credit must also go to Ungku Zeti Akhtar Aziz, who served as Governor of BNM for 16 years, and who steadfastly supported the sentiments of her predecessor and others in between, adding her own touch to the development of Malaysian and global Islamic finance ecosystem, especially with the establishment of the Islamic Financial Services Board and the International Islamic Liquidity Management Corporation (IILM) to name a few.

While parity seems to be a stone’s throw away, several of the rubrics of the late governor’s and Ungku Aziz’s dreams probably have largely been realised. But even after four decades of operations, there are those who argue that Malaysia’s Islamic finance proposition needs a reset and perhaps with a healthy dose of fresh thinking and ideas.

The appointment of the seasoned central banker Datuk Abdul Rasheed Ghaffour as the new Governor of BNM in July 2023, replacing Tan Sri Nor Shamsiah Mohd Yunus, was widely welcomed as more industry-proactive, especially in a fluid national political climate and in a subdued post-pandemic global economic recovery dispensation.

Governor Ghaffour is a champion of Islamic social and financial inclusion, the UN SDG Agenda, and the Net Zero Paris Climate Agreement ambitions, which he sees as a natural synergy especially for the Global South.

“Efforts are underway to advance value-based intermediation and promote solutions by the Islamic finance industry in Malaysia to meet the growing demand for green and sustainable finance. This is an area with a lot of promise and potential, not just for Malaysia in its journey to meeting its Net Zero commitment, but for other economies in the region and the world at large,” he emphasised in the 2023 Annual Report.

The Financial Inclusion Framework 2023–26, which was launched during the year, he added, will further propel the inclusion agenda by setting out strategies to close the remaining gaps to meaningful access to quality and affordable financial services for all.

“One area with large potential is social finance. Being at the intersection of not just financial inclusion and sustainability but also with Islamic finance – areas which are all close to my heart – innovative social finance solutions can be developed at scale to make a meaningful impact in the lives and livelihoods of Malaysians. We expect this to gain further traction as more Islamic financial institutions progressively adopt innovative financial structures, such as blended finance and other alternative sources of funding, which integrate social finance into Islamic finance solutions,” he stressed.

The growth dynamics of the Malaysian Islamic banking system are encouraging. The market share for Islamic financing reached 45.6% of the total banking system financing. The annual growth rate however at 7.7% was more than double that of the 3.4% for the conventional financing and the 5.3% for the overall sector. This translated into RM1,049.7 bn (US$219.42 bn) of financing in 2023 bn compared to RM974.4 bn (US$203.68 bn) in 2022.

The trend for Islamic deposits and Investment Accounts was the same – a market share of 42% and an annual growth of 6%, compared with 4.2% for conventional deposits.

In both financing and deposits the annual growth rates was higher than the overall sector growth. In terms of total capital ratio, the two systems were more-or-less on parity – 18% for the Islamic sector and 18.3% for the conventional one.

In the Takaful sector while the growth dynamics appear to be sensational, with capital adequacy ratio totalling 226.5% compared to the insurance sector’s 221.5%, with a market share of Takaful fund assets of 14% and Takaful Net Contribution market share of 23.4%, and the Takaful sector annual growth trajectory at 11.6% outstripping that of the 6.2% of the insurance sector, the fundamental challenge is that the base of the Takaful industry is very low. For instance, Takaful fund assets reached a miniscule RM48.5 bn in 2023 up from the RM43.6 bn in 2022.

This means that growth figures and other data in absolute terms are heavily skewed and should be analysed with some caution. Whereas the performances in FY2023 were largely in line with the provisions of the Financial Sector Blueprint (2022-2026), the contributions of the Islamic finance sector to various national economic and development metrics cannot be ignored.

However, in 2023, there was only one metric that fared better than the figure for the previous year – RM262 billion were issued through Sukuk to fund real economic sectors (2022: RM185 billion).

In five other metrics, the sector’s contribution receded, perhaps suggesting the continued fall-out from the pandemic; the slow economic recovery partly due to perceptions, rightly or wrongly, of the policy direction of the stewardship of the economy by Prime Minister Anwar Ibrahim, who also doubles up as Finance Minister; and the cost-of-living crisis which has hit ordinary Malaysians hard. To be fair to the prime minister, several factors in the global economy especially commodity price volatility are beyond the control of any given government.

These metrics speak for themselves:

- The contribution of Islamic finance to GDP is down from 1.2% in 2022 to 1% in 2023.

- Islamic business financing growth to meet business demand across economic sectors, down from 11.9% in 2023 to 8.5% in 2023.

- Islamic household consumer financing growth to meet household demand down from 9.4.% in 2023 to 8.8% in 2023.

- Growth of financing disbursed to microenterprises and SMEs fell dramatically from 24.7% in 2022 to 12.5% in 2023.

- The penetration rate of Family Takaful was marginally down at 19.8% in 2023 compared with 20.1% in 2022.

Against this modest regression, there were some gains in 2023:

- A pilot project on impact-driven Investment Accounts (IA) was rolled out.

- myWakaf 2.0 was launched by AIBIM to effectively mobilise Cash Waqf towards community and economic empowerment.

- The CAKNA Scheme, a non-debt funding facility to assist the cashflow position of companies, specifically SME vendors, amounted to RM413.7 mn in 2023 benefiting 64 SME vendors across ten participating ministries.

- The roll out of a pilot project in 2023 by an Islamic bank to fund investments in SDG-aligned assets in areas such as renewable energy, clean transportation, and waste management. This pilot project included a social reinvestment feature where a portion of the investment returns would be channelled to social impact projects.

- In December 2023, the collateralised Murabahah, an Islamic funding instrument secured by collateral, was accorded statutory recognition for its close-out netting mechanism under the relevant laws. This recognition provides legal certainty on the applicability of the close-out netting mechanism, which is vital for managing risks in such transactions.

- The ongoing integration of BNM’s Value-based Intermediation (VBI) strategy, first introduced in 2017, into business strategies of Islamic banks. VBI, according to BNM, has contributed positively to individuals, households, and businesses, including micro-enterprises. Islamic banks intermediated RM433.8 bn (US$90.68 bn) in VBI-aligned initiatives between 2017-2022. VBI, says BNM, aims to strengthen the role and effectiveness of Islamic financial institutions in delivering the intended outcomes of Shariah, which is premised on balancing wealth creation and wealth circulation as well as promoting social justice, among others. This is achieved through practices, conduct and solutions that generate positive impact on the economy, community, and environment, while maintaining returns for the shareholders of the Islamic financial institutions. VBI is different from Corporate Social Responsibility (CSR) programmes as CSR is carried out separately from business operations.

Looking ahead, BNM’s near-to-medium-term strategy beyond 2023 includes:

- Strengthening the country’s Islamic finance Shariah Advisory Talent Ecosystem.

- The establishment of an integrated Islamic financer Shariah Advisory and Governance talent database.

- Nurturing Shariah Advisory scholars capable of advising on technical and complex Shariah issues related to economics, finance, trade, development, consumer finance, financial inclusion under the wider umbrella of Fiqh Al Muamalat.

- One observation in general relating to the global market is that Shariah advisories tend to look at products and innovations in a narrow and functionally compartmentalised way, which detracts from the wider associated issues such as the source of funds and asset formation and end use of these. A current case in point is the carbon credits market with Islamic financial institutions such as the Islamic Trade Finance Corporation (ITFC) investing in the carbon credits auctions of such institutions such as the Regional Voluntary Carbon Markets Company (RVCMC), a joint venture between the Public Investment Fund (PIF), the sovereign wealth fund of Saudi Arabia, and Tadawul, the Saudi Stock Exchange, following the obtaining of a fatwa (legal opinion) supporting such a transaction. The fatwa has not been publicly published, in contrast to Bursa Malaysia’s Fatwa Ruling 21 of on ‘Voluntary Carbon Market and Takyif Fiqhi of Carbon Credits.’

An interesting development in 2023 also was the finalisation of BNM’s Responsibility Mapping Policy, which establishes requirements for financial institutions to strengthen individual accountability at the senior level. This, says BNM, forms an integral part of broader efforts to ensure that financial institutions are managing their compliance and business risks effectively across the organisation.

“This policy,” maintained Governor Ghaffour, “emphasises the importance of the tone-from-the-top to drive good culture and decision-making in financial institutions. In Islamic finance, we pioneered the development of a policy for Islamic financial institutions on the application of Hajah and Darurah in navigating thought leadership. In addition, we continued to pursue strategies towards advancing Malaysia as an international gateway for Islamic finance. This includes deepening Malaysia’s Islamic financial markets and international linkages.”

The priorities for 2024 are to enhance Malaysia’s strong Islamic finance ecosystem by encouraging value-based innovation that embeds fundamental Maqasid Al-Sharia’a values thus optimising Islamic finance to support the funding and risk protection needs of the economy in its transition to a greener, more sustainable ecosystem; providing a more conducive regulatory and Sharia’a governance environment to accelerate market development; and continuously strengthening Malaysia’s proposition to tap global opportunities and deepen the domestic Islamic financial market.