Saudi State Electricity Utility SEC Returns to the International Market with a 2-Tranche Aggregate USD2.75bn Murabaha/Ijara Offering Including a USD1.25bn 10-Year Green Sukuk

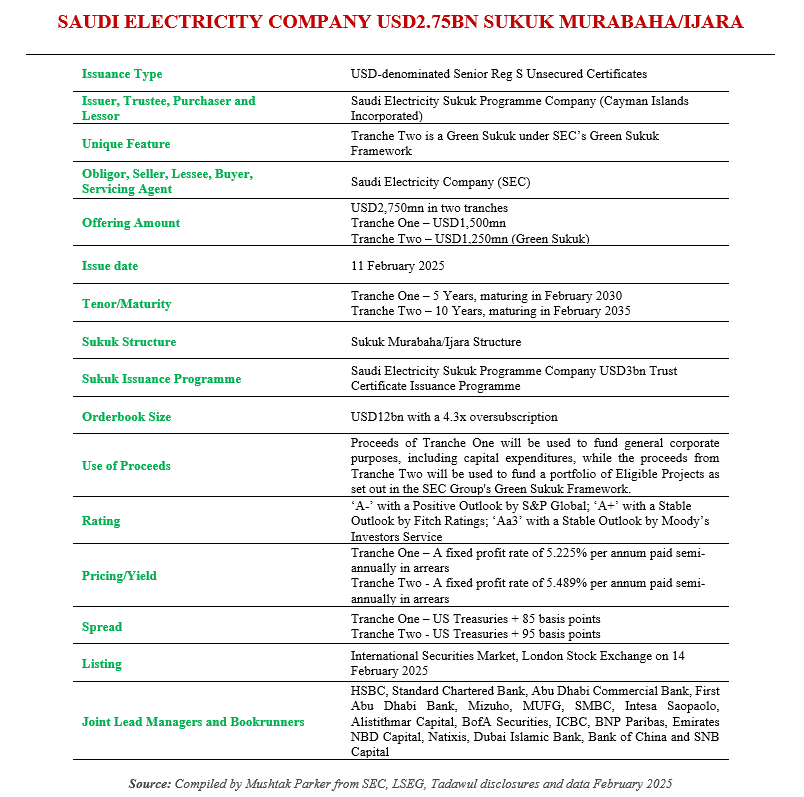

The state-owned Saudi Electricity Company (SEC) retuned to the international Sukuk market, successfully pricing a USD2.75bn dual-tranche senior unsecured Reg S Sukuk Murabaha/Ijara on 11 February 2025.

SEC, headquartered in Riyadh, is the main producer of electricity in Saudi Arabia, owning the largest distribution network and is the sole owner of transmission lines in the country. The company remains a top player in the electricity generation sector in the Middle East and North Africa, leading in production, transmission, and distribution. With a diverse power plant portfolio and an extensive transmission and distribution network, the company provides reliable and sustainable electricity to 11 million customers across the Kingdom, including the giga-projects of the futuristic NEOM City.

Its importance goes beyond its dominance of the power generation and distribution sectors. The ultimate controlling party of the SEC Group is the Government of Saudi Arabia which, through its ownership of the Saudi Public Investment Fund (PIF) (74.30%) and Saudi Aramco, the state oil company and one of the largest producers and exporters of crude oil in the world (6.93%), holds the largest shareholding in SEC, which drives the coordinated effort towards fulfilling the objectives of Saudi Arabia’s Vision 2030.

Equally important is the fact that SEC is the latest PIF-owned or linked company to access the debt market through a US dollar Sukuk issuance – a trend that has been gaining momentum over the last two years. PIF entities such as ACWA Power, SRC, Bahri, Riyadh Air, NEOM, GIB (Saudi Arabia), Saudi Tadawul Group, Alinma Bank, Ma’aden, Saudi Telecom Company, Riyad bank and Saudi National Bank – in addition to the PIF itself – have all accessed the Islamic finance market either through Sukuk issuances or Murabaha Syndicated Facilities, or both, in the last two years. No other country in which Islamic finance is of systemic importance has such an embedded and flourishing playbook in place.

This latest SEC offering was issued by the Saudi Electricity Sukuk Programme Company (Cayman Islands incorporated) under its USD3bn Trust Certificate Issuance Programme on behalf of its Obligor, Saudi Electricity Company.

The issuance comprises two tranches: a USD1.25bn 10-year Green Sukuk tranche maturing on 18 February 2035, and a USD1.5bn 5-year Sukuk tranche, maturing on 18 February 2030.

In fact, SEC is a pacesetter in Green Sukuk. The green tranche of this latest offering marks SEC’s fourth Green Sukuk tranche under its Green Sukuk Framework, with proceeds allocated to financing or refinancing eligible green projects in renewables and energy efficiency.

According to SEC, the company since 2020 has raised a total of USD3.75bn through Green Sukuk, “reinforcing its commitment to decarbonization and the continued expansion of its eligible green project portfolio. This supports SEC’s net-zero ambition by 2050 and aligns with its ESG strategic objective of advancing Saudi Arabia’s energy transition in line with Vision 2030.”

SEC mandated HSBC, Standard Chartered Bank, Abu Dhabi Commercial Bank, First Abu Dhabi Bank, Mizuho, MUFG, SMBC, Intesa Saopaolo, Alistithmar Capital, BofA Securities, ICBC, BNP Paribas, Emirates NBD Capital, Natixis, Dubai Islamic Bank, Bank of China and SNB Capital to act as Joint Lead Managers and Bookrunners to the transaction, and to arrange a series of investor calls and roadshows in London, Europe, the GCC, the Middle East, Asia and with Offshore US Accounts.

The transaction commenced on 10 February 2025 when SEC held a virtual investor roadshow, attracting strong investor interest from Asia, Europe, and the Middle East.

The initial price thoughts (IPTs) for the five-year USD benchmark sized Sukuk was in the area of US Treasuries + 120 basis points (bps), while for the10-year Green Sukuk the IPTs it was US Treasuries + 130 bps.

The issuance was successfully priced the following day in an intraday transaction, with the order book exceeding USD12bn, representing an oversubscription of 4.3 times. This allowed room for some price tightening with the 5-year certificates priced at a spread of US Treasuries + 85 bps and a profit rate 5.225% per annum and the 10-year papers priced at a spread of US Treasuries + 95 bps and a profit rate of 5.489% per annum – both paid semi-annually in arrears.

Eng. Khaled Al-Ghamdi, Acting CEO of SEC, commented on the closing of the transaction: “This issuance reaffirms the company’s ability to attract strong investor interest in international markets, supported by its robust credit standing and pivotal role in providing sustainable and highly reliable energy solutions.

“This contributes to the transformation of the energy sector toward greater sustainability in alignment with Saudi Vision 2030 targets…and represents a significant step toward realizing our ambitious growth and expansion plans by injecting further investments into the electricity grid infrastructure, integrating renewable energy sources, and accelerating our digitalization and automation initiatives. This ensures we continue delivering high-quality and reliable electricity services, meeting the expectations of our customers and shareholders”.

Indeed, the proceeds of Tranche One (the USD1.5bn tranche) will be used to fund general corporate purposes, including capital expenditures, while the proceeds from Tranche Two (the USD1.25bn Green Sukuk tranche) will be used to fund a portfolio of Eligible Projects as set out in the SEC Group’s Green Sukuk Framework.

SEC maintains high investment-grade credit ratings from leading international rating agencies: Aa3 (stable) from Moody’s, A+ (stable) from Fitch, and A (positive) from Standard & Poor’s. The Trust certificates are rated commensurate with the above ratings.

The certificates were admitted for listing and trading on the International Securities Market, of the London Stock Exchange on 14 February 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by SEC, with the Murabaha issuance for each tranche being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.