SRC Keeps Sukuk Issuance Momentum Going with Seventh and Eighth Mudaraba/Murabaha Fixed Rate Offerings in the Domestic Market Totalling SAR3.5bn (US$930m)

The Saudi Real Estate Refinance Company (SRC), the Sharia’a compliant mortgage finance and securitisation company owned by the Public Investment Fund (PIF), the Saudi sovereign wealth fund, successfully closed its latest Sukuk offering – a dual tranche Senior Unsecured SAR3.5 billion (US$930 million) Mudaraba/Murabaha Sukuk on 16 November 2023.

The Sukuk was issued under SRC’s SAR20 billion (US$5.33 billion) Trust Certificates Issuance Programme which is guaranteed by the Saudi Ministry of Finance on behalf of the Government. SRC, a regular issuer of Sukuk, mandated HSBC Saudi Arabia to act as lead coordinator on this latest offering, and as co-joint lead managers with Aljazira Capital, Al Rajhi Capital, and SNB Capital to the transaction. The transaction was distributed as a private placement to Saudi institutional and qualified investors.

The two tranches offered on 16th November 2023 which raised an aggregate SAR3.5 billion (US$930 million) comprised:

- A first tranche of SAR2.00 billion (US$530.00 million) with a 5-year tenor maturing on 16th November 2028 and priced at a fixed coupon rate of 5.20 % per annum to be paid semi-annually

- A second tranche of SAR1.5 billion (US$400.00 million) with a 7-year tenor maturing on 16th November 2030 and priced at a fixed coupon rate of 5.30% per annum to be paid semi-annually.

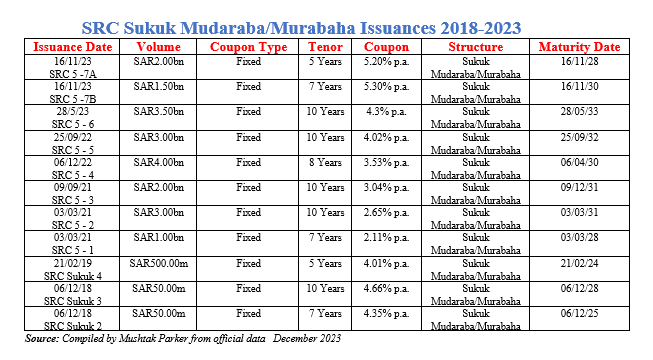

The drawdown marks the issuance of the seventh and eighth series under SRC’s domestic Sukuk programme and follows the SAR 3.5 billion guaranteed Sukuk issuance in May 2023.

According to Fabrice Susini, then outgoing CEO of SRC, “the issuance witnessed interest from the institutional investor community, reinforcing the confidence in the local market and in SRC’s operational framework. It also affirms SRC’s pivotal role in contributing to the Vision 2030 Housing Programme as well as to the Financial Sector Development Programme. SRC’s consistent Sukuk issuances reinforce our commitment to taking part in financial sector development in Saudi Arabia.

“Through these issuances, SRC is contributing to diversifying funding for the real estate sector and to driving growth. By providing banks and real estate finance companies with liquidity, SRC enables further development in the home financing sector increasing homeownership rates among Saudi citizens.”

Supporting the Saudi National Housing Agenda

The SRC Board of Directors in October 2023 appointed the seasoned Majeed Al Abduljabbar, a banker with 26 years of experience in both the public and private financial sectors, as the new Chief Executive Officer, effective 1st January 2024 to succeed Fabrice Susini after obtaining approval from the Saudi Central Bank (SAMA).

SRC was established in 2017 by PIF after obtaining a license from SAMA to operate in the market and as part of the government initiatives to support the national agenda of increasing home ownership amongst Saudi citizens and promoting the development of the Saudi housing finance market under a core pillar of Saudi Vision 2030 Housing Programme, and to act as a major catalyst for the growth and sustainability of housing finance in the Kingdom and establishing a secondary mortgage securitisation market.

Under its mandate, SRC aims to provide Sharia’a compliant refinancing and balance sheet management solutions to primary mortgage financiers, to increase the availability of affordable housing finance options for Saudis.

As such it also aims to facilitate the trading of real estate finance contracts and the flow of funds towards the housing sector to provide liquidity to the secondary market, better means to mortgage finance entities to fund residence ownership for borrowers, to provide stability and growth in the secondary market for real estate finance, and to act as an intermediary between the sector’s domestic and foreign finance sources.

In fact, in June 2023, SRC signed a technical cooperation agreement with Ginnie Mae, a government-owned corporation operating within the US Department of Housing and Urban Development, whereby the two entities would share policies and regulations in the housing finance sector. The collaboration is aimed at supporting affordable housing and the mortgage market for citizens in both the US and the Kingdom of Saudi Arabia.

Since its inception, SRC, assigned an (A+) stable rating from Fitch Ratings, an (A2) positive rating from Moody’s Investors Service, and an (A-) stable rating from S&P Global Ratings, has actively participated in the capital markets through the issuance of Sukuk and accessing Murabaha financing through syndications, contributing to the development of the financial sector and supporting the economic diversification outlined in Vision 2030.