Aldar Investment Properties Issues Second Benchmark US$500m Green Sukuk Wakala/Murabaha in May 2024 in Support of its Growth Agenda and Net Zero and Sustainability Commitments

Abu Dhabi-based Aldar Investment Properties, the largest real estate management company in Abu Dhabi and subsidiary of Aldar Properties (Aldar), returned to the international market in May 2024 with the issuance of its second Green Sukuk Wakala/Murabaha – a US$500 million Reg S senior unsecured benchmark Sustainable Green Sukuk offering. Aldar is 25%-owned by the Abu Dhabi sovereign wealth fund Mubadala and 26% owned by International Holding Company, part of a business empire overseen by Sheikh Tahnoon bin Zayed al- Nahyan, the UAE’s national security adviser and brother to the president.

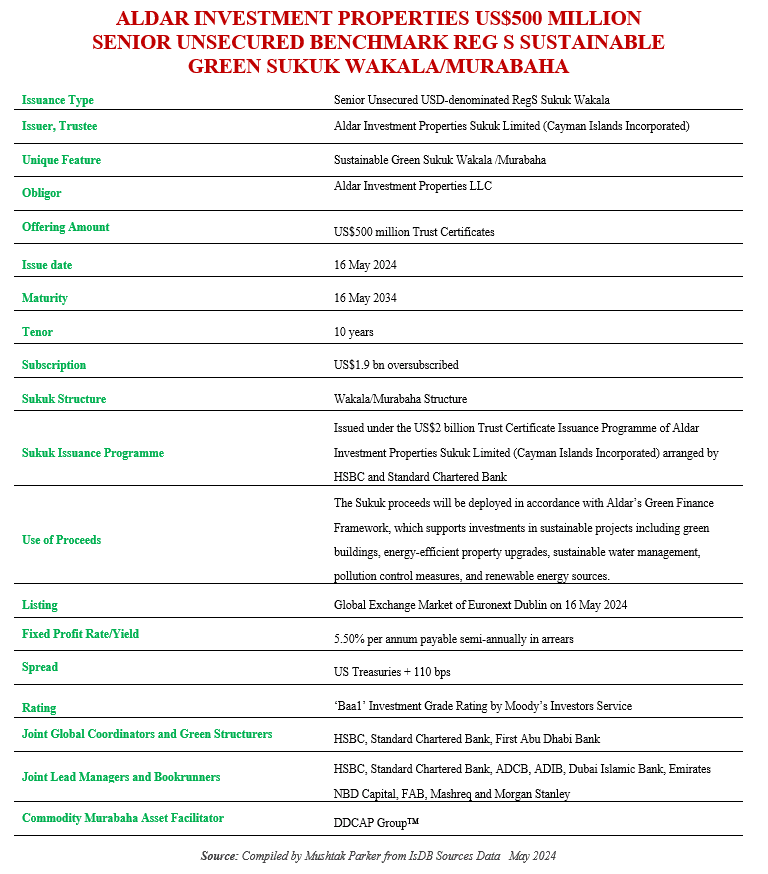

The Certificates were issued through Aldar Investment Properties Sukuk Limited (Cayman Islands Incorporated), which also acted as the Trustee on behalf of the Obligor, Aldar Investment Properties LLC (AIP). The issuance is the latest offering under Aldar Investment Properties Sukuk Limited’s US$2 billion Trust Certificates Issuance Programme to support its growth agenda and sustainability commitments, in line with the goals of the 2015 Paris Agreement, the UAE Net Zero by 2050 Strategic Initiative and Aldar’s plan to be a net zero carbon business by 2050.

Aldar had mandated HSBC and Standard Chartered Bank to act as joint Global Coordinators to the transaction, and together with Abu Dhabi Commercial Bank (ADCB), Abu Dhabi Islamic Bank (ADIB), Dubai Islamic Bank (DIB), Emirates NBD Capital, First Abu Dhabi Bank (FAB), Mashreq and Morgan Stanley to act as joint lead managers and joint bookrunners, and to arrange a series of investor calls and roadshows with accounts in the UK, EU, the MENA region, Asia and Offshore US for a benchmark Green Sukuk offering.

The fixed rate sustainable Green Sukuk was launched on 7 May 2024 with the initial price guidance at US Treasuries plus 140 basis points (bps), before tightening to 110 bps over US Treasuries following robust demand for the certificates with the order book reaching more than US$1.9 billion.

The Sukuk proceeds will be deployed in accordance with Aldar’s Green Finance Framework, which supports investments in sustainable projects including green buildings, energy-efficient property upgrades, sustainable water management, pollution control measures, and renewable energy sources. This issuance, added Aldar, reinforces the company’s commitment to its Net Zero Plan, through which it aims to achieve net zero carbon emissions across its operations by 2050.

The 10-year Sukuk attracted robust demand. The transaction was priced with a 5.50% coupon rate payable semi-annually in arrears, which according to AIP “achieved the tightest credit spread ever priced by Aldar and was 4 times oversubscribed by regional and international investors. The significant demand, along with the tight credit spread, reflects the strong fundamentals of the Aldar business and the market’s confidence in the company’s ability to deliver on its environmental, social, and governance (ESG) commitments.”

Prior to this offering, Aldar issued a similar inaugural fixed rate sustainable US$500 million Green Sukuk Wakala/Murabaha in May 2023, which was priced at a coupon rate of 4.875% per annum payable semi-annually in arrears, translating into a spread of 150 bps over US Treasuries. Prior to the above two Green Sukuk transactions, AIP’s last foray into the Sukuk market was in in October 2019 when it issued a fixed rate 10-year US$500 million Sukuk. That transaction was priced at a coupon rate of 3.875% per annum, the lowest rate ever achieved by Aldar at the time, following strong investor demand. The transaction, which marked the first 10-year public Sukuk offering by an Abu Dhabi-based issuer, was 6 times oversubscribed, with global investors accounting for 71% of the total transaction allocation.

AIP houses a diversified portfolio of income-generating real estate assets valued at over AED25 billion. “AIP enjoys a robust financial position underpinned by its Baa1 investment grade credit rating from Moody’s. This strong credit rating reflects AIP’s solid financial standing, favourable market conditions, and its ability to effectively manage its sizeable and growing portfolio across various sectors and geographies,” said the company. Over the past year, Aldar achieved 47 points on the Dow Jones Sustainability Index (DJSI), maintaining its top spot in the GCC, and within the top quartile of the 299 global real estate companies assessed. The company also maintained a low-risk score of 15.9 on Sustainalytics Risk Index and continued to hold its BBB rating in MSCI.

Additionally, the company says it continues to make significant progress towards becoming a net zero carbon business across its Scope 1, Scope 2, and Scope 3 greenhouse gas (GHG) emissions by 2050, in line with its Net Zero Plan.

Aldar has adopted a green financing framework, which aligns with the United Nations Sustainable Development Goals and is based on principles set out by the International Capital Markets Association (ICMA) and the Loan Market Association. The framework sets out criteria for use of proceeds and is governed by Aldar’s Sustainability Council, which comprises senior management and is chaired by Aldar’s Group Director of Sustainability and CSR. Aldar’s Net Zero Plan explains how it will achieve Net Zero in its direct emissions and the embodied carbon of all its developments and projects, as well as emissions associated with its supply chain and tenants.

In parallel, Aldar also tendered a buy-back of its Sukuk maturing in September 2025, providing existing investors with the opportunity to participate in the new issuance, with Aldar utilizing the proceeds to refinance existing debt and extend its debt maturity profile.