Regular Issuer Sharjah Islamic Bank Returns to International Market with Benchmark Senior Unsecured 5-Year US$500mn Sukuk Murabaha/Ijara Issuance to Successfully Close its 10th Sukuk Transaction to Date

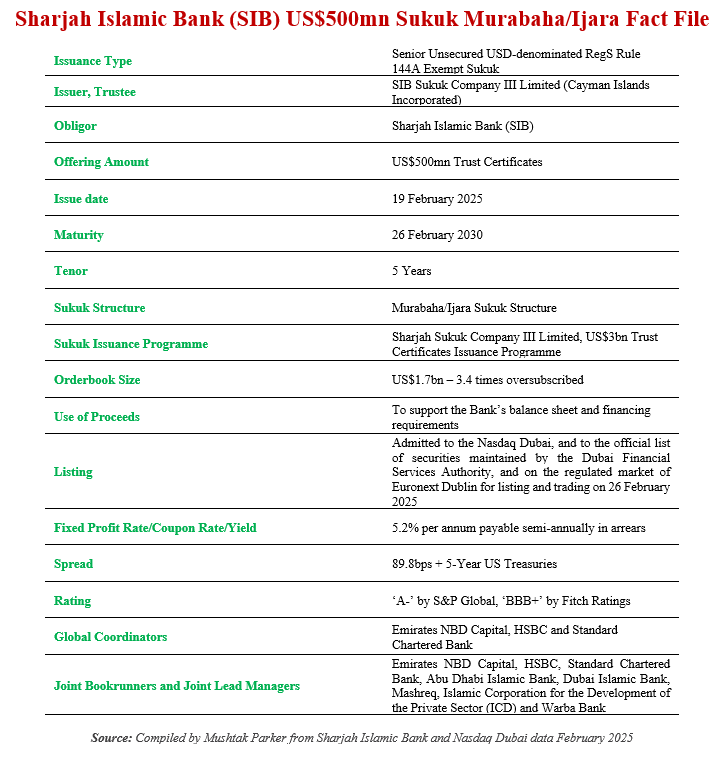

Sharjah Islamic Bank (SIB), one of the first mover banks to issue Sukuk in the international financial markets, successfully closed its latest foray into the global capital market – a 5-Year US$500mn Sukuk Murabaha/Ijara issuance on 19 February 2025, maturing on 26 February 2030.

The Sukuk certificates, which are Senior Unsecured USD-denominated Reg S Rule 144A Exempt Sukuk, were issued by Cayman Islands-incorporated SIB Sukuk Company III Limited as Trustee, on behalf of the Obligor and Service Agent SIB.

This latest transaction marks the seventh issuance under the Bank’s US$3.0bn Trust Certificate Issuance Programme which was established in 2013 and updated in July 2024 and arranged by Standard Chartered Bank. SIB last issued a Sukuk in July 2024, which was a similar USD500mn Sukuk Murabaha/Ijara.

SIB mandated Emirates NBD Capital, HSBC and Standard Chartered Bank on 24 June 2024 to act as Joint Global Coordinators to the transaction, and together with Abu Dhabi Islamic Bank, Dubai Islamic Bank, Mashreq, Islamic Corporation for the Development of the Private Sector (ICD), the private sector funding arm of the Islamic Development Bank (IsDB) Group, and Warba Bank to act as Joint Lead Managers and Bookrunners, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

The Bank had set the initial price guidance for the 5-year trust certificates at around 125 basis points (bps) over 5-Year US Treasuries. According to SIB, the issuance received a tremendous response from regional and international investors, attracting an order book that peaked at US$1.7bn resulting in a 3.4x oversubscription.

Due to the robust demand from investors, SIB was successfully able to tighten the pricing by around 25bps. The transaction was eventually priced at a closing spread of 89.8 bps + 5 years US Treasuries. This translates into a fixed profit rate/yield of 5.20% per annum payable semi-annually in arrears.

This compared with the pricing of the July 2024 Sukuk issuance which was priced at a closing spread of 105 bps + 5 years US Treasuries, which translated into a fixed profit rate/yield of 5.25% per annum payable semi-annually in arrears. The proceeds of the Sukuk will be used to support the Bank’s balance sheet and financing requirements.

Mohamed Abdalla, CEO of Sharjah Islamic Bank, thanked the investors for their vote of confidence in the bank and investing in the Sukuk. “This is our tenth foray in the international capital markets, having issued a Sukuk as early as 2006. The bank remains strong under prudent management and that reflects in the ratings and pricing of our transactions,” he added.

According to Ahmed Saad, Deputy CEO of SIB, “the Sukuk’s diverse geographical distribution was a key target of the issuance. We were able to allocate diversely with investor accounts in the Middle East, Asia and Europe.”

ICD, one of the Joint Lead Managers and Bookrunners, stressed that “with strong participation from investors across MENA, Europe, and Asia, this issuance reflects the global confidence in SIB’s credit strength and the growing resilience of Islamic finance. The Sukuk also achieved a re-offer spread inside the fair value level, demonstrating market strength and investor trust.

“This is just one of many Sukuk transactions ICD has successfully facilitated, raising a total of USD 4.85bn in the first two months of 2025 alone. As part of ICD’s ongoing mission to assist private sector companies and member countries in accessing the Islamic debt capital market, we continue to play a crucial role in supporting financial institutions with the right tools and expertise.”

The Sukuk certificates, rated ‘A-’ by S&P Global Ratings and ‘BBB+’ by Fitch Ratings, were admitted for listing on Nasdaq Dubai and to the official list of securities maintained by the Dubai Financial Services Authority on 26 February 2025, and on the regulated market of Euronext Dublin similarly on 26 February July 2025.

With this latest US$500mn issuance, the total listings by SIB, comprising of two senior unsecured Sukuk and one Additional Tier 1 Capital Sukuk on Nasdaq Dubai, stands at US$2 bn. Being one of the earliest issuers of Sukuk in the market, having issued its inaugural offering in 2006, this was SIB’s 10th public Sukuk issuance. The bank currently has a US$500mn Sukuk maturing in June 2025 and a call date of its US$500mn Additional Tier 1 Capital Sukuk in July 2025.