Sharjah Islamic Bank Returns to Global Market After an Absence of 4 Years with Benchmark US$500mn Sukuk Ijara/Murabaha Issuance

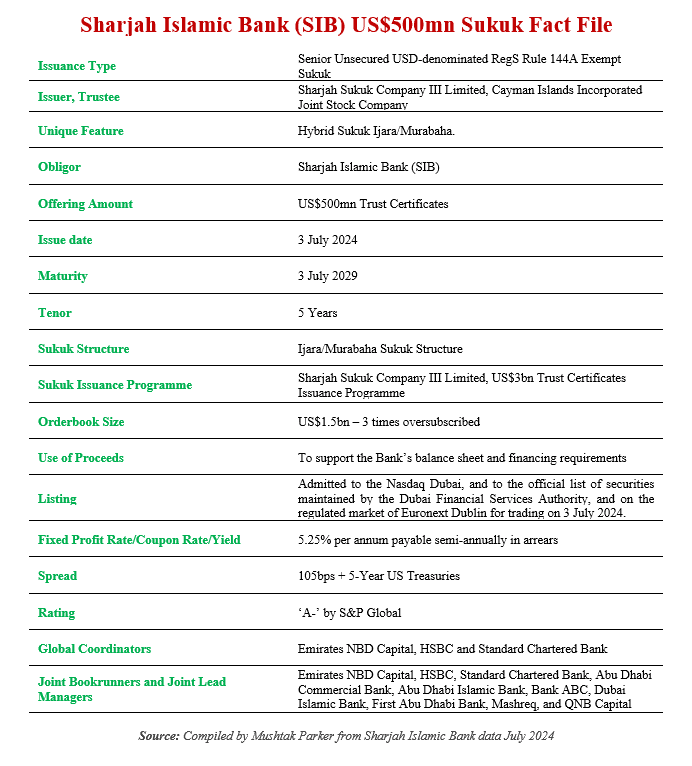

Sharjah Islamic Bank (SIB), one of the first mover banks to issue Sukuk in the international financial markets, successfully closed its latest foray into the global capital market – a 5-Year US$500mn Sukuk Ijara/Murabaha issuance on 3 July 2024, maturing on 3 July 2029.

The Sukuk certificates were issued by Cayman Islands-incorporated Sharjah Sukuk Company III Limited as Trustee, on behalf of the Obligor and Service Agent SIB. This latest transaction marks the sixth issuance under the Bank’s US$3.0bn Trust Certificate Issuance Programme which was established in 2013 and arranged by Standard Chartered Bank. SIB mandated Emirates NBD Capital, HSBC and Standard Chartered Bank on 24 June 2024 to act as Joint Global Coordinators to the transaction, and together with Abu Dhabi Commercial Bank, Abu Dhabi Islamic Bank, Bank ABC, Dubai Islamic Bank, First Abu Dhabi Bank, Mashreq, and QNB Capital to act as Bookrunners, and to arrange a series of investor calls and meetings in London, Europe, the Middle East, Asia and with Offshore US Accounts.

The Bank had set the initial price guidance for the 5-year trust certificates at around 140 basis points (bps) over 5-Year US Treasuries. According to SIB, the issuance received a tremendous response from regional and international investors, attracting and order book that peaked at US$1.5bn resulting in a 3x oversubscription. Due to the robust demand from investors, SIB was successfully able to tighten the pricing by around 35bps. The transaction was eventually priced at a closing spread of 105 bps + 5 years US Treasuries. This translates into a fixed profit rate/yield of 5.25% per annum payable semi-annually in arrears.

Mohamed Abdalla, CEO of Sharjah Islamic Bank, thanked the investors for their vote of confidence in the bank and investing in the Sukuk. “This is our ninth foray in the international capital markets, having issued a sukuk as early as 2006. The bank remains strong under prudent management and that reflects in the ratings and pricing of our transactions,” he added.

According to Ahmed Saad, Deputy CEO of SIB, “the Sukuk’s diverse geographical distribution was a key target of the issuance. We were able to allocate diversely with the Middle East getting 80% of the allocations, while Asia and Europe getting 13%, 7% respectively. The interest in Middle Eastern Credit story in general and Sharjah Islamic Bank in particular was very strong and heartening for us despite a volatile market background.”

The Sukuk certificates, rated ‘A-’ by S&P Global Ratings, were admitted for listing on Nasdaq Dubai and to the official list of securities maintained by the Dubai Financial Services Authority on 3 July 2024, and on the regulated market of Euronext Dublin similarly on 3 July 2024. With this latest US$500mn issuance, the total listings by SIB, comprising of two seniors unsecured Sukuk and one Additional Tier 1 Capital Sukuk on Nasdaq Dubai, stands at US$1.5bn.

The listing underscores Nasdaq Dubai’s role as a premier global market for debt listings (both bonds and Sukuk), totalling US$134.1bn. According to the Bourse, the total value of Sukuk listed on Nasdaq Dubai amounts to US$93.89bn, reinforcing its status as a leading global market for Sukuk issuances.

Being one of the earliest issuers of Sukuk in the market, having issued its inaugural offering in 2006, this was SIB’s 9th public Sukuk issuance and first since 2020. The bank currently has a US$500mn Sukuk maturing in June 2025 and a call date of its US$500mn Additional Tier 1 Capital Sukuk in July 2025.

Sharjah Islamic Bank earlier this year in April reported a 22.5% increase in its net profit before tax amounting to AED285.4mn (US$77.70mn) for the first quarter of 2024, compared to ARD233.1mn (US$63.46mn) for the same period in the previous year. Net profit after tax in Q1 2024 amounted to AED259.7mn (US$70.70mn), an increase of 11.4% on the same period in 2023.

Total assets similarly increased by 6.4% to AED70.1bn (US$19.09bn) from AED65.9bn (US$17.94bn). The Bank’s Islamic financing portfolio remained stable at AED33.4bn (US$9.09bn) and customer deposits amounted to AED45.1bn (US$12.28bn) at end Q1 2024. SIB, formerly known as the National Bank of Sharjah, has three major shareholders comprising Sharjah Asset Management, Kuwait Finance House and Sharjah Social Security Fund, who hold over 56% of the shareholding.