Saudi Investment Bank Debuts USD750mn Additional Tier 1 Capital Perpetual Sustainable Mudaraba Sukuk in the International Market in November as Such Offerings Flourish Among Islamic Banks in 2024

Saudi Investment Bank (SAIB) is the latest Saudi bank to successfully raise funds from the international market through a maiden USD750mn benchmark Mudaraba Sukuk offering on 21 November 2024. When you add the twin features of sustainability and an Additional Tier 1 (AT1) Capital Perpetual Sukuk, then the transaction assumes interesting proportions.

In fact, several Saudi banks including Riyad Bank in October with a similar volume have recently resorted to this fund-raising route.

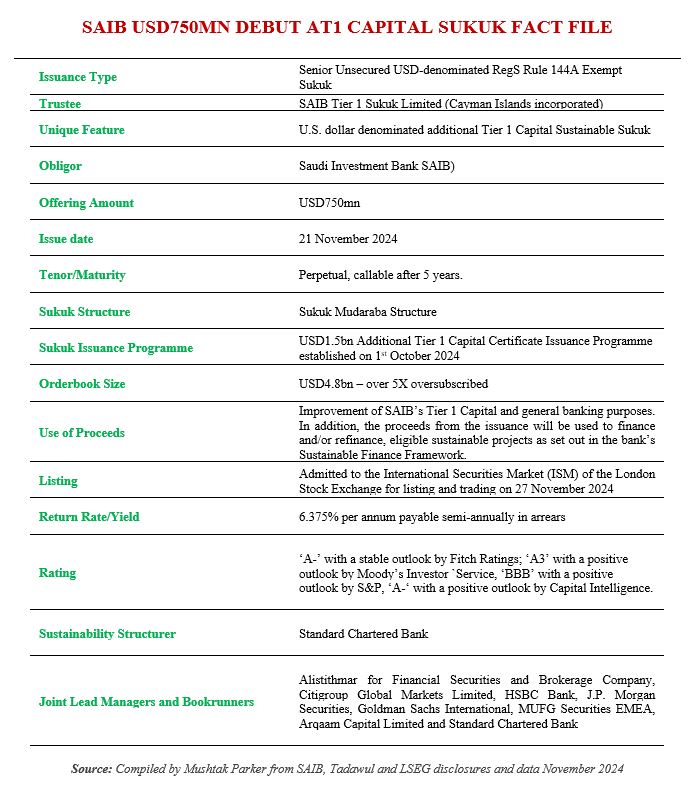

The Sukuk certificates were issued under USD1.5bn Saudi Investment Bank Additional Tier 1 Capital Certificate Issuance Programme established by the Trustee, SAIB Tier 1 Sukuk Limited, with SAIB acting as obligor, on 1st October 2024. The offering marks the first ever USD Tier 1 sustainable Sukuk offering by the Bank in the international capital markets.

The Bank mandated Alistithmar for Financial Securities and Brokerage Company, Citigroup Global Markets Limited, HSBC Bank, J.P. Morgan Securities, Goldman Sachs International, MUFG Securities EMEA, Arqaam Capital Limited and Standard Chartered Bank to as joint lead managers and bookrunners to the transaction and to arrange a series of investor calls and roadshows in London, EU, the MENA region, Asia and US Offshore Accounts.

The investor calls and meetings began in London on Monday, 18 November 2024. Saudi Investment Bank begun offering Additional Tier 1 capital sustainable 5-year perpetual non-call Mudaraba Sukuk to Saudi and global investors. The initial price thoughts (IPTs) were set in the 6.875% area, but it tightened with the final return and yield set at 6.375% pr annum, payable on a semi-annual basis in arrears.

The transaction attracted strong demand from both Saudi and international investors with the order book reaching over USD4.8bn. According to SAIB, the offering received significant interest from international, Saudi and GCC investors, resulting in one of the highest oversubscriptions of the order book. It also achieved one of the highest international distributions from Europe, Asia, US Offshore and the Middle East.

“This resounding success,” according to Mr. Salman Bader Al-Fughom, Deputy Chief Executive Officer of SAIB, “is a testament to the market’s confidence in the Bank’s credit worthiness and strategic direction. The funds raised will be used to enhance the bank’s liquidity and support the growth of its balance sheet and will be allocated to financing and refinancing eligible projects under the Bank’s Sustainable Finance Framework, and in line with the goals and vision of Saudi Arabia’s Vision 2030. This Sustainable Sukuk Issuance is a strategic step in enhancing our financial framework. It aligns with our commitment to sustainability and reinforces our position as a leader in responsible banking practices. This issuance not only broadens our investor based but also sets a benchmark for future bond issues in the region.”

The offering was settled on 27 November 2024, and the Sukuk certificates have been admitted for listing and trading on the London Stock Exchange’s International Securities Market (ISM). Perpetual AT1 Capital securities do not have a mandatory fixed redemption date but can be callable after an agreed number of years according to the provisions of the base prospectus and final terms. Such Sukuk structures seem to be the flavour of the year for debt paper offerings especially by Islamic banks. This especially when they are linked to sustainability metrics.

In the last two years Dubai Islamic Bank, Qatar International Islamic Bank, Abu Dhabi Islamic Bank, Bank Aljazira, Alinma Bank and Riyad Bank have tapped the market with similar USD750mn offerings.

There is also much debate on the effectiveness of Additional Tier 1 (AT1) Capital instruments in the international financial market. Some conventional banks have recently withdrawn from the AT1 issuance market. AT1 Capital is a component of Tier 1 Capital that is held by banks to shore up their financial resilience and can usually be converted into equity when a trigger occurs, such as when a bank’s capital falls below a certain threshold. After all, AT1 bonds, for instance, are the riskiest debt instruments banks can issue and are designed to be perpetual, but issuers can redeem them after a specified period.

The proceeds from the Sukuk will be used to strengthen the Bank’s capital base in accordance with the Basel III framework, improve its Tier 1 Capital and for general banking purposes. In addition, the proceeds from the issuance will be used to finance and/or refinance, eligible sustainable projects as set out in the bank’s Sustainable Finance Framework. The bank’s sustainability objectives are also aligned with Saudi Arabia’s Vision 2030 agenda, which targets expanding and diversifying the economy, enabling social responsibility, and increasing employment, among other goals.