Riyad Bank Returns to the International Market in September with a Repeat Perpetual USD750mn AT1 Capital Sustainable Mudaraba Sukuk as Such Offerings Flourish Among Islamic Banks in 2024

Riyad Bank is the latest Saudi bank to successfully raise funds from the international market through a USD750mn benchmark Mudaraba Sukuk offering on 26 September 2024. When you add the twin features of sustainability and an Additional Tier 1 (AT1) Capital Perpetual Sukuk, then the transaction assumes interesting proportions.

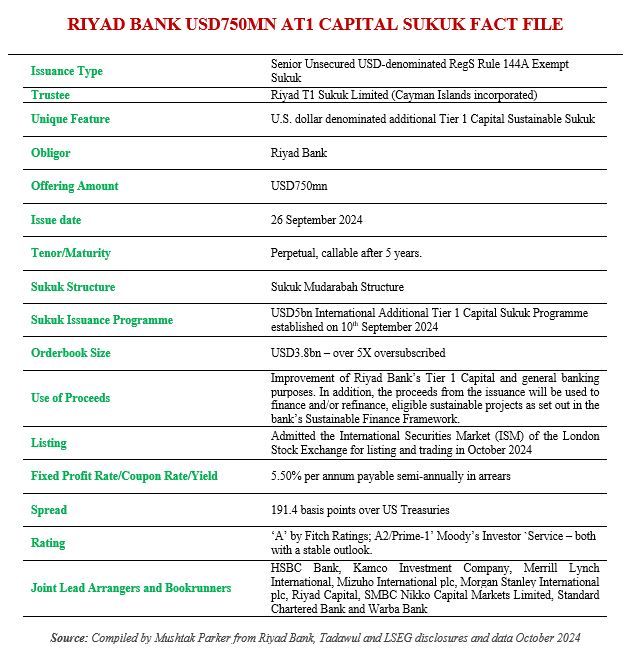

The Bank in a disclosure to Tadawul (the Saudi Exchange) on 3 October 2024, confirmed that it had completed the issuance of an USD750mn AT1 Capital Sustainable Sukuk. The offering as a Senior Unsecured USD-denominated RegS Rule 144A Exempt transaction, was issued by its special purpose vehicle Riyad T1 Sukuk Limited (Cayman Islands incorporated) under the bank’s USD5bn International Additional Tier 1 Capital Sukuk Programme established on 10th September 2024. The Sukuk is a perpetual issuance callable after 5 years.

The issuance is pursuant to the approval from its Board of Directors and the Saudi Capital Market Authority to tap the international Sukuk market through a US dollar denominated AT1 Capital Perpetual Sustainable Sukuk. Perpetual AT1 Capital securities which accordingly do not have a mandatory fixed redemption date but can be callable after an agreed number of years according to the provisions of the base prospectus and final terms, seem to be the flavour of the year for Sukuk offerings especially by Islamic banks. This especially when they are linked to sustainability metrics.

In this issue of DDCAP Research News, Dubai Islamic Bank and Qatar International Islamic Bank have similarly tapped the international market for AT1 offerings. These have been preceded by similar such issuances by Abu Dhabi Islamic Bank, Bank Aljazira and Alinma Bank. Prior to this latest AT1 issuance, Riyad Bank issued a similar USD750mn offering in February 2022.

There is also much debate on the effectiveness of Additional Tier 1 (AT1) Capital instruments in the international financial market. Some conventional banks have recently withdrawn from the AT1 issuance market. AT1 Capital is a component of Tier 1 Capital that is held by banks to shore up their financial resilience and can usually be converted into equity when a trigger occurs, such as when a bank’s capital falls below a certain threshold. After all, AT1 bonds, for instance, are considered to be the riskiest debt instruments banks can issue and are designed to be perpetual but issuers can redeem them after a specified period.

The Bank mandated HSBC Bank, Kamco Investment Company, Merrill Lynch International, Mizuho International plc, Morgan Stanley International plc, Riyad Capital, SMBC Nikko Capital Markets Limited, Standard Chartered Bank and Warba Bank to act as Joint Lead Managers and Bookrunners to the transaction and to arrange a series of investor calls and meetings with accounts in the UK, EU, the Middle East and Asia. Initial price thoughts were set in the 6% area, with a further price guidance at 5.625% to 5.75%. The robust demand from eligible investors in Saudi Arabia and internationally with the orderbook peaking at USD3.8bn and the issuance being oversubscribed by 5 times allowed the pricing to be tightened further with the yield set at a final 5.50% per annum payable semi-annually in arrears. This coincided with a concomitant tightening of the spread by 55 bps, closing at 191.4 bps over US Treasuries.

The proceeds from the Sukuk will be used to strengthen the Bank’s capital base in accordance with the Basel III framework, improve its Tier 1 Capital and for general banking purposes. In addition, the proceeds from the issuance will be used to finance and/or refinance, eligible sustainable projects as set out in the bank’s Sustainable Finance Framework, launched in February 2022, which S&P Global says is aligned to ICMA’s Sustainability Bond Guidelines, Social Bond Principles and its Green Bond Principles 2021; LMA/LSTA/APLMA’s Social Loans Principles and its Green Loan Principles 2021. The bank’s sustainability objectives are also aligned with Saudi Arabia’s Vision 2030 agenda, which targets expanding and diversifying the economy, enabling social responsibility, and increasing employment, among other goals. The bank plans to achieve these objectives through its Bukra strategy, which is defined through four key pillars: environment, community, economy, and knowledge.

According to S&P Global, Riyad Bank’s Sustainable Finance Framework “will help achieve these goals through the targeted financing of relevant green and social initiatives. These initiatives include social projects that target small businesses and parts of the population that lack access to basic infrastructure and essential services among others, as well as green projects that support the energy transition in Saudi Arabia.”

The Sukuk certificates, which were assigned an ‘A’ rating by Fitch Ratings; and an A2/Prime-1’ rating by Moody’s Investor `Service – both with a stable outlook, were admitted to the International Securities Market (ISM) of the London Stock Exchange for listing and trading in October 2024.