QIIB Returns to the International Financial Market in September with its Third Offering in 2024 of a USD300mn AT1 Capital Sukuk Bringing the Total Volume to USD1.05bn

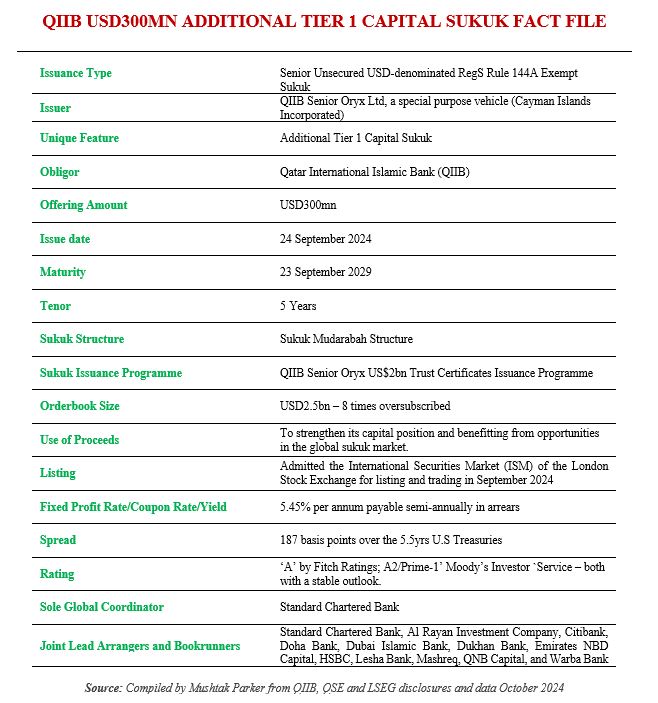

Qatar International Islamic Bank (QIIB), one of the oldest Islamic banks in Qatar and a regular issuer of Sukuk in the international market since 2012, successfully closed a 5-Year USD300mn Tier 1 Capital Sukuk on 24 September 2024 aimed at strengthening the Bank’s capital position and benefitting from opportunities in the global Sukuk market.

QIIB had mandated Standard Chartered Bank as the sole global coordinator, and along with Al Rayan Investment Company, Citibank, Doha Bank, Dubai Islamic Bank, Dukhan Bank, Emirates NBD Capital, HSBC, Lesha Bank, Mashreq, QNB Capital, and Warba Bank as joint lead managers and book runners, and to arrange a series of investor calls and meetings with accounts in the Middle East, UK, Europe and Asia.

The Sukuk, according to Dr Abdulbasit Ahmed al-Shaibei, Chief Executive Officer of QIIB, witnessed robust demand from investors, with the total order book reaching more than eight times the issuance size, which confirms the confidence of international and regional investors in QIIB and the Qatari economy. The subscription to this latest QIIB Sukuk came from 115 investors around the world, with the total order book exceeding USD2.5bn.

The issue was priced at a profit margin of 187 basis points over 5.5yrs U.S Treasuries, with a final return of 5.45% per annum payable semi-annually in arrears.

This is the third foray into the international Sukuk market for QIIB in 2024 to date. In January QIIB issued its maiden benchmark 5-year USD500mn QIIB Sustainable Oryx Sukuk, which was followed by a tap USD250mn Sustainability Oryx Sukuk issuance on 31 July 2024. This brought the aggregate amount of the Sustainability Oryx Sukuk to US$750mn. This brings the aggregate volume raised by QIIB through international Sukuk issuances to date in 2024 to USD1.05bn.

QIIB is the first Qatari bank to issue sustainable Sukuk as part of its engagement in aligning with the third strategy for the financial sector launched by the Qatar Central Bank, and as part of keeping up with government policies that pay special attention to sustainability issues.

QIIB listed the original 5-year US$500mn issuance on the London Stock Exchange in January 2024. These tap trust certificates share the same maturity date, face value, and profit rate as the original offering but were sold at the prevailing market price rather than the original issue price.

To contrast with the pricing of the AT1 Sukuk, the USD500mn QIIB Sustainable Oryx Sukuk in January 2024 was priced at a spread of 120 basis points (bps) above the five-year U.S. Treasury rate, with a profit rate of 5.247% annually. Similarly, the USD250mn tap issuance in July was priced at 100 bps over US Treasuries, with an annual profit rate of 5.247% and an issue price of 100.431%.

According to QIIB CEO Dr Abdulbasit Ahmed al-Shaibei, “this is our second Sukuk issuance this year, that has attracted strong demand from investors worldwide. The favourable pricing of these Sukuk reinforces the global appeal and strength of the Qatari economy, which continues to enjoy exceptional investment attractiveness. Qatar’s strong and attractive economy plays a pivotal role in supporting the country’s institutions, especially its banks.

“The significant demand for our Sukuk reflects the financial strength and credit worthiness of QIIB, which is backed by the asset quality, strong liquidity, robust capitalisation, and high efficiency in the banking sector. Reports from international credit rating agencies confirm our strong profitability and stable outlook, ensuring our long-term growth prospects.”

Issuing the Sukuk within the Tier 1 Capital Framework, he explained, is a strategic move to bolster QIIB’s financial strength and meet its growth ambitions. This also enhances the Bank’s presence in international markets and strengthens relationships with global investors and financial institutions.

“Earlier this year,” he added, “QIIB issued a USD500mn sustainable Sukuk, listed on the London Stock Exchange. As Qatar’s first institution to issue sustainable Sukuk, we received a phenomenal response from investors across the globe. This issuance underscores our commitment to sustainability and aligns with Qatar National Vision 2030, as well as the Third Financial Sector Strategy launched by the Qatar Central Bank, which prioritises environmental, social, and governance (ESG) principles. Our efforts contribute to the continued development and prosperity of the financial sector from multiple dimensions.”

Dr Abdulbasit Ahmed al-Shaibei, a seasoned Islamic banker with over 40 years’ experience, remains confident in QIIB’s ability to strengthen its financial standing and achieve growth in line with the interim and strategic plans approved by the Bank’s Board of Directors.