QIIB Returns to Global Market in July with US$250mn Tap Sukuk Offering Boosting Original Issuance to US$750mn as Sustainability Sukuk Continues to Gain Market Momentum

Qatar International Islamic Bank (QIIB), a regular issuer of Sukuk in the international market since 2012, successfully closed a tap US$250mn Sustainability Oryx Sukuk issuance on 31 July 2024. This tap issuance is linked to the original maiden benchmark 5-year US$500mn QIIB Sustainable Oryx Sukuk offering in January 2024. This brings the aggregate amount of the Sustainability Oryx Sukuk to US$750mn, with a further tap issuance also a possibility.

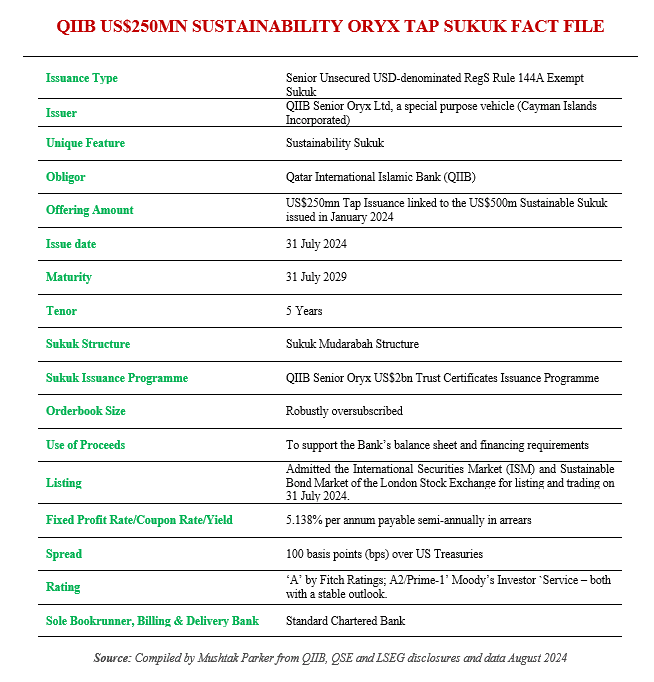

The tap issuance has a 5-year tenor maturing in July 2029 and was issued by QIIB Senior Oryx Ltd, a special purpose vehicle issuer incorporated in the Cayman Islands, on behalf of the Obligor, QIIB. The transaction was completed on 31 July 2024 and similarly issued under Qatar International Islamic Bank’s US$2bn Trust Certificate Issuance Programme, which was updated in July 2024.

QIIB is the first Qatari bank to issue sustainable Sukuk as part of its engagement in aligning with the third strategy for the financial sector launched by the Qatar Central Bank, and as part of keeping up with government policies that pay special attention to sustainability issues. QIIB listed the original 5-year US$500mn issuance on the London Stock Exchange in January 2024. These new trust certificates share the same maturity date, face value, and profit rate as the original offering but are sold at the current market price rather than the original issue price.

As such, the tap issuance was priced at 100 basis points (bps) over US Treasuries, with an annual profit rate of 5.247% and an issue price of 100.431%. Like the original issuance, the tap issuance was offered to sophisticated investors, outside the US, in reliance on Regulation S under the US Securities Act of 1933. It was admitted to trading on the London Stock Exchange’s International Securities Market and was listed on the London Stock Exchange’s Sustainable Bond Market on 31 July 2024.

This contrasts with the January 2024 transaction which was priced at a spread of 120 basis points (bps) above the five-year U.S. Treasury rate, with a profit rate of 5.247% annually. QIIB had appointed Standard Chartered Bank as the Global Coordinator for the transaction, along with Al Rayan Investment (the capital markets division of Masraf Alrayan Group), Dukhan Bank, Emirates NBD Capital, KFH Capital, Mashreqbank, The Islamic Corporation for the Development of the Private Sector (ICD) (the private sector funding arm of the Islamic Development Bank (IsDB) Group), and QNB Capital as Joint Lead managers and Bookrunners for the issuance. A series of virtual investor calls followed with interested parties in the UK, Europe, GCC, MENA region, Asia and Offshore US Accounts.

QIIB mandated Standard Chartered Bank as sole bookrunner and billing and delivery bank for the July tap. The demand for the issuance was robust with the issuance well oversubscribed, allowing tighter pricing. The issuance garnered support from over investors from across MENA, Asia, EU, and Offshore American markets.

Qatar surprisingly is one of the smaller Sukuk markets in terms of number of issuers, market depth and sovereign domestic Sukuk issuances at the Qatar Central Bank for reserve and liquidity management purposes. There is accordingly a dearth of A-rated Islamic debt papers in the local market, hence the robust demand for such papers from local and overseas investors for such offerings. In general, the Sukuk pipeline in the six-member Gulf Cooperation Council (GCC) states according to the Big Three rating agencies however remains robust in the near-to-medium term as sovereigns, government-related entities, corporates and financial intuitions continue to tap the international debt capital markets, especially for A-rated papers.

QIIB, one of the medium-sized Qatari Islamic banks in terms of total assets, has a rich experience in Sukuk issuance since its successful foray into the market with its debut US$700mn Sukuk in 2012 and followed by two issuances in 2019 of US$300mn and US$500mn, which were both listed on the London Stock Exchange.

In July 2024, the Bank reported interim financial results (FH 2024) of QR655.1mn (US$179.69mn) in net profit – up 6.5% on the same period in 2023; total income of QR1.7bn (US$470mn) – up 20.6%; total assets of QR59.3bn (US$16.27bn) – up 7.6%; and customer deposits totalling QR40.4bn (US$11.08bn) compared to QR36.3bn (US$9.96bn) at the end of the same period in 2023. The results are partly reflected in the ratings of QIIB. On 22 July 2024, Moody’s Investor Service affirmed QIIB rating at ‘A2/Prime-1’ with a stable outlook. “The bank has a strong profitability underpinned by its well-established Islamic assets with banking privilege, strong liquidity reserves, sound capital and good operational efficiency. The stable outlook of the bank rating on the long-term balances our expectations that the bank will maintain its strong profitability”, stressed Moody’s in its rating rationale. Later on 23 July, agency Fitch Ratings similarly affirmed QIIB’s rating at ‘A’ with a stable outlook, echoing the same sentiments on the Bank’s future profitability and stable asset quality.

Dr Abdulbasit Ahmed Al-Shaibei, the seasoned QIIB Chief Executive Officer, is confident about the success of the Bank’s forays into sustainable Sukuk issuance and favourable pricing following the establishment of a dedicated framework for sustainable financing in January 2024, which aims to fund projects that contribute to environmental and social benefits. “The sustainable Sukuk we have issued is part of our active engagement in aligning with the Third Financial Sector Strategy recently approved by the Qatar Central Bank, encompassing principles, particularly with regard to sustainability, aiming further development and prosperity in the financial sector from various perspectives.”

The Sukuk was issued under QIIB’s Sustainable Finance Framework under which “QIIB will allocate an amount at least equivalent to the net proceeds of the Sustainable Financing Instruments issued under this Framework to finance and/or re-finance, in whole or in part, sustainable projects which meet the eligibility criteria of the following Eligible Sustainable Project categories.”

In a Second Party Opinion, Sustainable Fitch affirmed QIIB’s Sustainable Finance Framework’s Pillar Alignment Key Drivers, namely Use of Proceeds, Green Projects and Additional Information as ‘Good’. Similarly, QIIB also has an exclusion list that means it will not finance non-Sharia’a compliant activities or activities that the market considers environmentally or socially harmful. The focus is to finance renewable energy projects, clean transportation, primary healthcare and education as well as those related to employment generation.

The Tap Sukuk certificates were also admitted to trading on the London Stock Exchange (LSEG’s) International Securities Market and were listed on the LSEG’s Sustainable Bond Market on 31 July 2024.