GFH Financial Group Returns to the International Market with a Benchmark Fixed Rate USD500mn Sukuk Murabaha/Ijara Offering Amid Strong Overseas Investor Demand

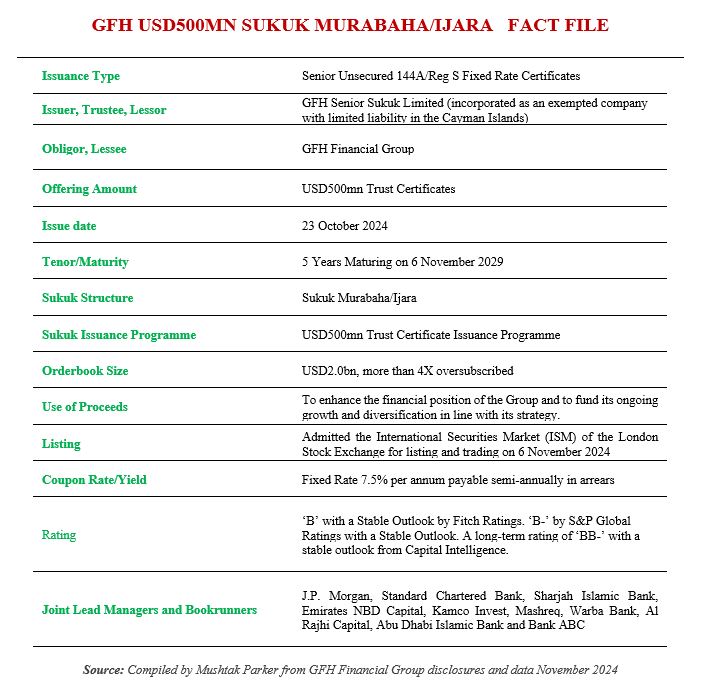

GFH Financial Group, the Bahrain-based diversified financial group, successfully priced its latest Sukuk offering, a benchmark 5-Year US500mn Sukuk Murabaha/Ijara offering on 23 October 2024.

This follows approval from its Ordinary General Meeting in Manama on 9 October 2024. GFH had mandated J.P. Morgan, Standard Chartered Bank, Sharjah Islamic Bank, Emirates NBD Capital, Kamco Invest, Mashreq, Warba Bank, Al Rajhi Capital, Abu Dhabi Islamic Bank and Bank ABC to act as Joint Lead Managers and Joint Bookrunners to the transaction, and to arrange a series of fixed income investor calls and roadshows with accounts in London, EU, the GCC, Asia and with Offshore US accounts.

A USD-denominated, fixed rate, 5-year, benchmark, Regulation S, senior, unsecured, Sukuk offering by GFH Senior Sukuk Limited, under its USD500mn Trust Certificate Issuance Programme, would follow. A benchmark USD500mn Sukuk Murabaha/Ijara followed on 23 October 2024 with a maturity on 6 November 2029 followed.

The transaction, said GFH in a disclosure, saw strong demand from international investors with the final order book exceeding USD2bn, representing an oversubscription of more than 4X. This transaction was priced at around 240 basis points tighter than GFH’s previous issuance in 2020 (relative to the US Treasury benchmark). The initial price thoughts were set at around 8% but due to the strong demand from investors, the price tightened to a final coupon rate/yield to maturity of 7.5% per annum payable semi-annually in arrears.

The international investors were allocated more than 50% of the issuance with the remaining allocated to regional and local investors. Included among them were a diverse mix comprising fund managers, private banks and financial institutions.

The proceeds of the Sukuk will be used to enhance the financial position of the Group and to fund its ongoing growth and diversification in line with its strategy.

Mr. Hisham Alrayes, Group CEO of GFH, commented: “We are delighted to mark another successful issuance further expanding GFH’s presence in the international debt capital markets and diversifying our global investor base. Strong demand for the issuance from a diverse group of international and regional institutional investors underscores the strength of our franchise and the reputation that GFH has built.

“It is also testament to the confidence we enjoy in our strategy, robust business model, and prospects as we expand our investments and global presence across priority sectors and markets including the GCC, US and Europe. We look forward to another chapter of growth where we will continue to build and deliver even greater value for our investors and shareholders.”

Today, GFH has more than US$21bn of assets and assets under management including a global portfolio of investments in logistics, healthcare, education and technology in the MENA region, Europe and North America. The Group’s shares are actively traded on four regional exchanges including the Abu Dhabi Securities Exchange, Bahrain Bourse, Boursa Kuwait, and Dubai Financial Market.