Dubai Islamic Bank (DIB) Closes Second Sukuk Transaction of 2024, a USD500mn Benchmark Perpetual AT1 Sukuk Mudarabah at the Lowest Yield by an EM Bank Since 2022

If accolades are to be awarded for Sukuk issuance consistency, then Dubai Islamic Bank (DIB), the oldest commercial Islamic bank in the world and one of the largest Islamic banks in the UAE in terms of assets, must take credit for its second international Sukuk offering in 2024 to date, reinforcing its reputation as one of the most prolific and regular financial institution issuers of Sukuk.

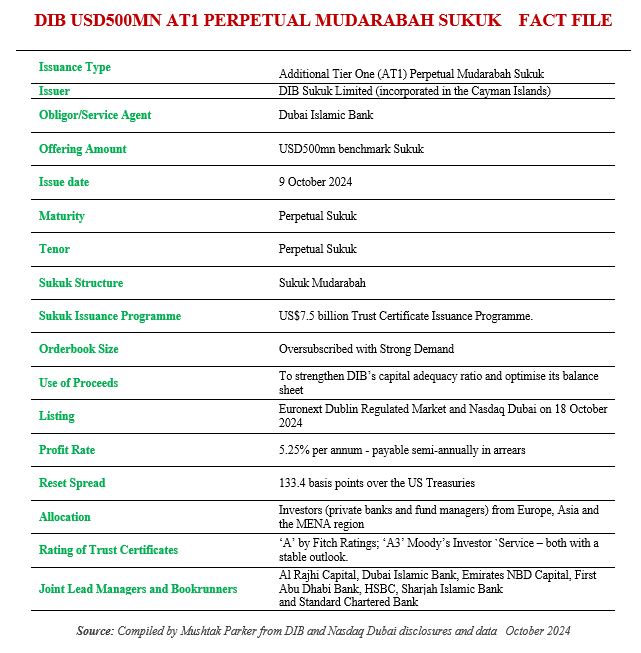

DIB successfully issued a USD500 million Additional Tier 1 Basel III-compliant Perpetual Mudarabah Sukuk on 9th October 2024, which the Bank stresses will strengthen DIB’s capital adequacy ratio and optimise its balance sheet. This latest Sukuk was issued by DIB Sukuk Limited, its Cayman Island incorporated special purpose vehicle, on behalf of the Obligor, Dubai Islamic Bank.

The Bank had mandated Al Rajhi Capital, Dubai Islamic Bank, Emirates NBD Capital, First Abu Dhabi Bank, HSBC, Sharjah Islamic Bank and Standard Chartered Bank to act as Joint Lead Managers and Joint Bookrunners to the transaction and to arrange a series of investor calls to accounts in the UK/Europe, Asia and the MENA region.

DIB’s robust credit fundamentals and the UAE’s positive credit story, says the Bank, generated high interest from investors. The transaction, as such, was well received by its loyal investor base comprising banks, private banks and fund managers from Europe, Asia and the Middle East and North Africa (MENA) region.

The strong orderbook allowed DIB to tighten the pricing to 5.25% from Initial Price Thoughts of 5.75% that were released earlier in the morning. The transaction, which was executed intraday, managed to achieve a reset spread of 133.4 basis points over the US Treasury rate, which says DIB is the lowest for an AT1 instrument globally since the 2009 financial crisis.

Prior to this issuance, DIB, rated ‘A3’ by Moody’s Investors Service and ‘A’ by Fitch Ratings, successfully priced its third Sustainability Sukuk in February 2024 – a landmark USD1bn 5-year benchmark senior issue with a profit rate of 5.243% per annum payable semi-annually in arrears and representing a spread of 95 basis points (bps) over 5-Year US Treasuries.

Dr Adnan Chilwan, Group Chief Executive Officer, on closing this latest transaction commented: “DIB is very pleased with this successful execution in the international capital markets space. The transaction represents the lowest yield achieved by an Emerging Markets Bank since April 2022. The deal highlights the confidence placed by international and regional investors in the bank’s strategy and credit story and showcases the large investor following that the UAE enjoys. I am grateful to both our regular and new investors for their continuous support and remain steadfast in delivering on our commitments to the market.”

The Sukuk certificates issued under DIB Sukuk Limited were admitted for listing and trading on the Regulated Market of Euronext Dublin and NASDAQ Dubai in October 2024.