BSF 5-Year USD750mn Sukuk Wakala/Murabaha Secures Huge Investor Demand With a 5x Oversubscription and ‘the Tightest Credit Spread for a Saudi Bank Issuer Ever’

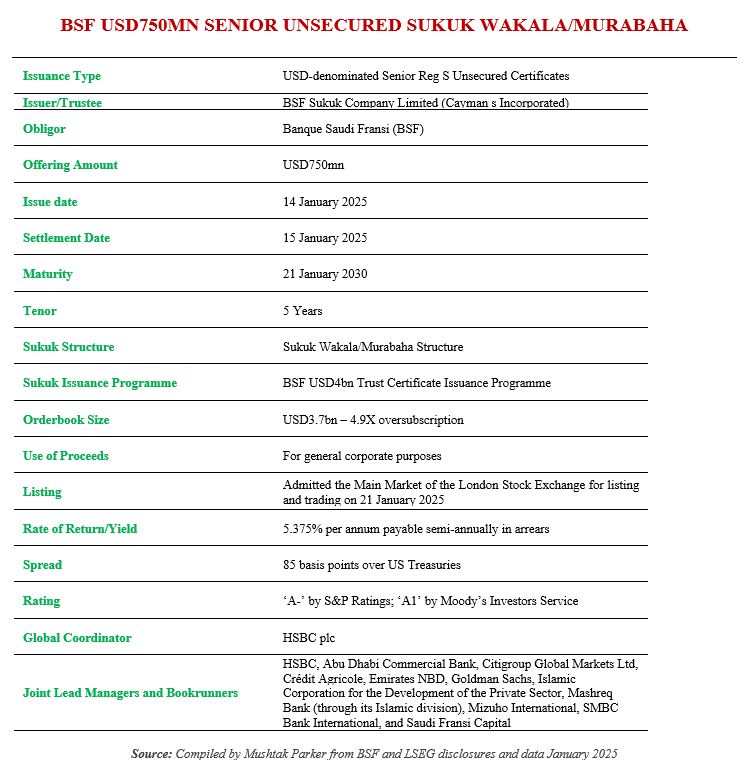

Banque Saudi Fransi (BSF), a regular issuer of Sukuk both in the Saudi domestic market and in the international market, returned to the market with a benchmark USD750mn Sukuk Wakala/Murabaha offering on 14 January 2025.

The Sukuk certificates were issued by BSF Sukuk Company Limited (Cayman Islands Incorporated) under the Bank’s USD4bn Trust Certificate Issuance Programme. BSF announced the commencement of the offer on 14 January 2025.

BSF mandated HSBC to act as global coordinator and together with Abu Dhabi Commercial Bank, Citigroup Global Markets Ltd, Crédit Agricole, Emirates NBD, Goldman Sachs, Islamic Corporation for the Development of the Private Sector, Mashreq Bank (through its Islamic division), Mizuho International, SMBC Bank International, and Saudi Fransi Capital to be the Joint Arrangers and Bookrunners to the transaction. They were also mandated to arrange a series of investors meetings and calls in the UK, GCC, Europe, Asia and with Offshore US Accounts for the issuance.

According to BSF, the USD750mn Sukuk issuance “achieved several record-setting milestones that reinforce its position as a leader in Shariah-compliant finance and align with Saudi Arabia’s Vision 2030.” The Sukuk has a tenor of 5 years and a matures on 21 January 2030. The issuance saw significant investor demand, with the orderbook peaking at USD3.7bn, representing a 4.9x oversubscription. This level of demand, said BSF, highlights the market’s strong confidence in BSF’s robust credit profile and strategic direction.

In a significant achievement, the Sukuk was priced flat to the Saudi sovereign secondary Sukuk curve, and offered an annual yield of 5.375% per annum, payable semi-annually in arears. This added BSF reflected the Bank’s ability to issue at levels that are typically out of reach for most regional financial institutions, highlighting its strong credit standing and investor trust.

At a re-offer spread of US Treasuries + 85 basis points (bps), the Sukuk, stressed BSF, achieved the tightest credit spread for a Saudi bank issuer ever. This also represents the second-tightest Treasury spread for a fixed-income capital market issuance by any GCC financial institution. Furthermore, BSF priced the Sukuk with no new issue concession, as the re-offer spread aligned with the fair value level.

The issuance also marks the largest oversubscription level for BSF to date. The bank’s proactive global marketing strategy, including a recent non-deal roadshow in Asia, contributed to a highly diversified orderbook with over 110 unique investors from across the GCC, UK, Europe, and Asia. The strong participation from global investors reflects the success of BSF’s targeted investor engagement efforts, added the bank.

Bader Alsalloom, CEO of BSF, commented: “This Sukuk issuance marks a significant milestone in BSF’s ongoing efforts to optimize funding activities and expand our global investor base. The strong demand and record-breaking metrics demonstrate the market’s trust in our financial stability and strategic vision. We remain committed to supporting Saudi Arabia’s economic transformation by providing innovative financial solutions while maintaining our leadership in Shariah-compliant finance. This successful transaction underscores BSF’s pivotal role in Saudi Arabia’s financial sector, strengthening its liquidity profile, expanding its presence in international capital markets, and contributing to the broader objectives of Vision 2030.”

The certificates, rated ‘A-’ by S&P Ratings and ‘A1’ by Moody’s Investors Service, were Admitted to International Securities Market of the London Stock Exchange for listing and trading on 21 January 2025.

Note to Newsletter readers from DDCAP Group™: In addition to the above details, we were pleased that the Group was involved in the new issuance by BSF, with the Murabaha issuance being facilitated by DD&Co Limited and utilisation of its multiple award-winning platform ETHOS AFP™.